how to delete bank account in quickbooks online is a critical task that many users encounter as their financial management evolves. This comprehensive guide delves into the intricacies of removing a bank account, ensuring you navigate the process with confidence and clarity.

We’ll explore the fundamental reasons why you might need to make this change, the crucial preparatory steps, and a detailed walkthrough of the deletion procedure itself. Understanding the implications for your historical data and learning how to manage connected bank feeds are paramount to a smooth transition. This exploration aims to equip you with all the necessary knowledge to effectively manage your QuickBooks Online accounts.

Understanding the Need to Delete a Bank Account in QuickBooks Online

Deleting a bank account from QuickBooks Online is a procedural step that users may need to undertake for various reasons related to financial management, data accuracy, and system organization. This action is not to be confused with simply disconnecting a bank feed; it involves the permanent removal of the account and its associated transactions from the accounting software. Understanding the implications and common drivers for this action is crucial before proceeding.The decision to delete a bank account often stems from scenarios where an account is no longer active, was erroneously added, or needs to be removed due to a change in business structure or banking relationships.

It is essential to recognize that deleting an account has significant ramifications for the historical financial data within QuickBooks Online. This means that all transactions, reconciliations, and reports tied to that specific bank account will also be removed. Therefore, careful consideration and proper preparation are paramount to avoid data loss or inaccuracies in financial reporting.

Reasons for Deleting a Bank Account

Several common scenarios prompt users to remove a bank account from their QuickBooks Online. These reasons are typically driven by the need to maintain a clean and accurate financial record, especially as business operations evolve.

- Closed or Inactive Accounts: When a business closes a bank account, whether it’s a primary operating account or a secondary one used for specific purposes, it should be removed from QuickBooks Online to prevent confusion and ensure that only active financial instruments are tracked.

- Duplicate Accounts: Occasionally, a bank account might be accidentally entered into QuickBooks Online twice, leading to duplicate entries and potentially skewed financial data. Deleting the duplicate entry is necessary for accuracy.

- Mistakenly Added Accounts: Users might add an account by mistake, perhaps during initial setup or when exploring features. If the account is not intended to be part of the company’s financial tracking, it should be removed.

- Restructuring of Banking Relationships: If a business consolidates its banking with a new institution or significantly changes its banking structure, old accounts that are no longer in use should be purged from the system.

- Testing or Sandbox Environments: In situations where QuickBooks Online is used for training or testing purposes, dummy bank accounts might be created and later need to be deleted to keep the environment clean.

Implications of Deleting a Bank Account

The act of deleting a bank account in QuickBooks Online is a definitive action with several important consequences for the integrity and accessibility of financial data. It is imperative to understand these implications before undertaking the deletion process.The primary implication is the irreversible removal of the bank account and all its associated transactions from the QuickBooks Online ledger. This means that any historical data, including deposits, withdrawals, expenses, income, and reconciliation records pertaining to that account, will no longer be accessible within the software.

This can impact historical analysis, audit trails, and the ability to generate reports that include data from the deleted account.

Deleting a bank account permanently removes all associated transactions and reconciliation data from QuickBooks Online.

Furthermore, if the deleted bank account was used in the creation of any custom reports or was part of a historical analysis, those elements may become incomplete or erroneous after the deletion. The accounting software relies on a complete dataset for accurate financial reporting.

Scenarios Requiring Bank Account Deletion

Certain typical situations necessitate the deletion of a bank account to maintain sound financial management practices within QuickBooks Online. These scenarios often involve a clear distinction between active and inactive financial components of a business.A common scenario involves a business transitioning from one accounting system to another. If a bank account was meticulously managed in a previous system and is no longer being actively used or reconciled within QuickBooks Online, it might be deleted to streamline the QuickBooks Online data.

Another instance is when a specific project or subsidiary is being wound down, and its associated bank account is being closed. In such cases, removing the account from the main QuickBooks Online file prevents it from cluttering current financial views and reports.Consider a business that operated a temporary promotional account for a specific event. Once the event concludes and the account is closed, its presence in QuickBooks Online serves no further purpose and can be a source of confusion.

Deleting it ensures that the active financial accounts accurately reflect the current operational landscape.

Prerequisites and Preparations Before Deleting: How To Delete Bank Account In Quickbooks Online

Before embarking on the process of deleting a bank account in QuickBooks Online, a series of crucial preparatory steps must be meticulously executed. This ensures data integrity, prevents potential financial discrepancies, and maintains the overall accuracy of your accounting records. Neglecting these prerequisites can lead to complex reconciliation issues and a distorted financial picture, making the deletion process more arduous and prone to errors.

Therefore, a systematic approach to preparation is paramount.The deletion of a bank account is not a trivial action; it involves removing a significant financial entity from your accounting system. This action has implications for historical data, transaction reporting, and future financial analysis. Consequently, a thorough understanding of the necessary safeguards and preparatory actions is essential to mitigate any adverse effects.

Reconciling All Transactions, How to delete bank account in quickbooks online

The absolute necessity of reconciling all transactions associated with the bank account slated for deletion cannot be overstated. Reconciliation is the process of comparing your QuickBooks Online records against the bank’s official statements. This ensures that every deposit, withdrawal, fee, and adjustment has been accurately recorded and accounted for within your system.When a bank account is deleted, all associated transactions are also removed.

If these transactions are not reconciled, you risk losing the accurate record of these financial movements. This can create gaps in your historical data, making it impossible to accurately trace past financial activities or generate reliable reports. A fully reconciled account guarantees that all financial data pertaining to that account is accounted for before its removal, preserving the integrity of your overall financial records.

“Reconciliation is the bedrock of accurate financial reporting. Before deleting any financial account, ensure every transaction has been accounted for and verified against its source.”

Backing Up QuickBooks Online Data

Prior to undertaking any significant data modification, such as the deletion of a bank account, a comprehensive backup of your QuickBooks Online data is an indispensable safeguard. While QuickBooks Online is a cloud-based platform, it does not offer a direct “downloadable backup” feature in the traditional sense that desktop software does. However, robust data export functionalities exist that can serve a similar purpose, allowing you to preserve a snapshot of your financial information.This backup acts as a critical safety net.

In the unlikely event that the deletion process encounters an unforeseen issue, or if you later realize that certain historical data was inadvertently required, having a backup allows for restoration or reference. This is particularly important for audit purposes or for maintaining a complete historical ledger of your business’s financial journey. Exporting your data to a secure location ensures that you retain a copy of your financial information independent of the QuickBooks Online platform.

Verification Checklist Before Deletion

To ensure a smooth and error-free deletion process, it is highly advisable to create and follow a comprehensive checklist. This structured approach helps to systematically confirm that all necessary steps have been completed, minimizing the risk of oversight.The following checklist Artikels the essential items to verify before proceeding with the removal of a bank account from QuickBooks Online:

- Account Balance Verification: Confirm that the ending balance of the bank account in QuickBooks Online matches the final statement balance from the financial institution. This ensures no outstanding discrepancies exist.

- Transaction Review: Scrutinize all open transactions, such as uncleared checks or outstanding deposits, to ensure they are either posted correctly or have been resolved through other means.

- Transaction Categorization: Verify that all historical transactions have been appropriately categorized. This is crucial for accurate historical reporting and tax preparation, even after the account is deleted.

- Linked Accounts and Rules: Identify and address any rules or automatic transaction categorizations that are specifically tied to the bank account being deleted. These may need to be deactivated or reconfigured.

- Integration Checks: If the bank account is linked to any third-party applications or services (e.g., payment processors, payroll services), ensure these integrations are either disconnected or reconfigured to use an alternative account.

- Reporting Impact Assessment: Consider how the deletion of this account will affect existing reports. For example, if this was a primary operating account, reports like Profit and Loss or Balance Sheet might require adjustments in their presentation of historical data.

- Data Export Completion: Ensure that a complete export of your QuickBooks Online data, or at least the relevant historical data from the account in question, has been successfully performed and securely stored.

- Confirmation of No Pending Transactions: Double-check that no new transactions are expected to be imported or manually entered for this account before proceeding with deletion.

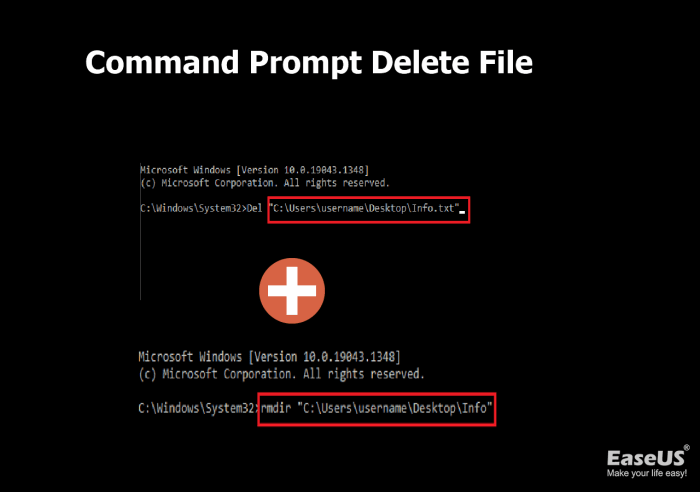

Step-by-Step Procedure for Deleting a Bank Account

Deleting a bank account in QuickBooks Online is a process that requires careful execution to ensure data integrity. This procedure involves making the account inactive as a preliminary step before its final removal, preventing unintended data loss or disruption to existing financial records. Understanding each step is crucial for a clean and accurate accounting ledger.The sequence of actions is designed to first isolate the account from active use and then remove it from the primary view, thereby decluttering the Chart of Accounts.

This methodical approach is vital for maintaining the accuracy and efficiency of your financial reporting within QuickBooks Online.

Navigating to the Chart of Accounts

The Chart of Accounts serves as the foundational structure for all financial transactions in QuickBooks Online. Locating the specific bank account within this comprehensive list is the initial and most critical step in the deletion process. A precise navigation path ensures that the correct account is targeted for inactivation and subsequent removal.To access the Chart of Accounts:

- Navigate to the Gear icon in the upper right corner of your QuickBooks Online dashboard.

- From the dropdown menu, select Chart of Accounts under the “Your Company” section.

This action will display a list of all accounts configured within your QuickBooks Online company file, organized by account type.

Making an Account Inactive

Before a bank account can be permanently deleted, QuickBooks Online requires it to be marked as inactive. This intermediate step is a safeguard that prevents immediate deletion of historical data associated with the account. Inactivating an account effectively removes it from active use and reporting, but preserves its transactional history, which can be crucial for audits or future reference.The process for inactivating a bank account is as follows:

- In the Chart of Accounts, locate the specific bank account you wish to delete.

- Click the dropdown arrow next to the “Action” column for that account.

- Select Make inactive from the options presented.

- A confirmation message may appear. Review it and click Yes to confirm the inactivation.

Once inactivated, the account will typically be moved to a separate section within the Chart of Accounts, often labeled “Inactive Accounts,” and will no longer appear in dropdown menus for transaction entries.

Removing an Inactive Bank Account

After an account has been successfully marked as inactive, QuickBooks Online provides the option to permanently remove it. This step is irreversible and should only be performed after ensuring that no future transactions will be linked to this account and that its historical data is no longer required for active reporting or immediate reference. The permanent removal cleans up the Chart of Accounts, enhancing its clarity and manageability.To permanently remove an inactive bank account:

- Return to the Chart of Accounts.

- Click the Gear icon in the upper right corner and select Chart of Accounts.

- Ensure that the “Include inactive” checkbox is ticked in the upper right section of the Chart of Accounts list. This will display previously inactivated accounts.

- Locate the inactive bank account you wish to delete.

- Click the dropdown arrow next to the “Action” column for that inactive account.

- Select Delete from the options.

- A final confirmation prompt will appear, warning that this action is permanent. Review the prompt and click Yes to confirm the deletion.

It is important to note that if an inactive account has associated transactions, QuickBooks Online may prevent its deletion. In such cases, it is advisable to first clear any outstanding transactions or reclassify them before attempting deletion again. For accounts with historical data that might be needed, keeping them inactive rather than deleting them permanently is a more prudent approach.

Handling Reconciled and Unreconciled Transactions

The decision to delete a bank account in QuickBooks Online necessitates a thorough understanding of how existing transactions, both reconciled and unreconciled, will be managed. This process is critical to maintaining the integrity of your financial data and avoiding potential reporting errors or data discrepancies. QuickBooks Online has specific protocols for handling these transactions, and proactive management before deletion is paramount.When a bank account is deleted, QuickBooks Online does not permanently erase the associated transactions.

Instead, it reclassifies them. Reconciled transactions are typically moved to a suspense account or a designated clearing account. This is a crucial safeguard to preserve the audit trail and ensure that past financial periods, which have already been verified, remain intact for reporting purposes. Unreconciled transactions, on the other hand, present a different set of challenges and require careful attention before the account can be safely removed.

Management of Reconciled Transactions Upon Deletion

QuickBooks Online employs a robust mechanism to handle reconciled transactions when a bank account is deleted. The system intelligently reassigns these transactions to a suspense or clearing account. This ensures that the historical accuracy of your financial statements is not compromised. For instance, if you had a reconciled transaction in January that you are now deleting the bank account for in June, that January transaction will still exist in your QuickBooks data, but it will no longer be linked to the deleted bank account.

Instead, it will reside in a holding account, allowing you to trace its original entry and purpose without affecting the reconciled status of prior periods. This feature is vital for audit purposes and for maintaining a clear financial history.

Challenges with Unreconciled Transactions

The presence of unreconciled transactions poses a significant hurdle when attempting to delete a bank account. QuickBooks Online generally prevents the deletion of an account that still contains open, unreconciled items. This is because unreconciled transactions represent discrepancies between your QuickBooks records and the actual bank statements, and their deletion without resolution would lead to inaccurate financial reporting and a broken audit trail.

If an account with unreconciled items were to be deleted, these transactions would effectively disappear from the context of their originating bank account, making it impossible to identify and correct the errors. This could result in understated or overstated balances, incorrect profit and loss statements, and difficulties in future financial analysis.

Addressing Outstanding Transactions Before Deletion

To ensure a smooth deletion process and maintain data integrity, it is imperative to address all outstanding unreconciled transactions before proceeding. This involves a meticulous review of the bank register for the account slated for deletion. The primary goal is to either match these transactions to their corresponding entries in QuickBooks or to investigate and correct any discrepancies. This proactive approach prevents the loss of critical financial data and ensures that your QuickBooks file accurately reflects your business’s financial standing.The best practice is to reconcile the bank account up to the most recent statement date.

If this is not feasible, then every transaction in the account’s register must be accounted for. This might involve adding missing transactions, editing existing ones to reflect correct amounts or dates, or categorizing them appropriately.

Procedure for Reviewing and Resolving Transaction Discrepancies

A systematic approach to reviewing and resolving transaction discrepancies is essential. This procedure ensures that all items are accounted for and that the deletion process can proceed without errors.

- Access the Bank Register: Navigate to the Chart of Accounts, select the bank account intended for deletion, and click on its register.

- Filter by Reconciliation Status: Look for options to filter transactions by their reconciliation status. Identify all transactions that are marked as “Not Reconciled” or have no reconciliation status indicated.

- Investigate Each Unreconciled Transaction: For each unreconciled transaction, meticulously compare it against your physical bank statements or online banking portal records. Pay close attention to the date, payee/payer, description, and amount.

- Identify the Nature of Discrepancy:

- Missing Transactions: If a transaction appears on your bank statement but not in QuickBooks, it needs to be added.

- Incorrect Entries: If a transaction exists in QuickBooks but the details (amount, date, payee) do not match the bank statement, it requires editing.

- Duplicate Entries: If a transaction appears twice in QuickBooks, one of the entries should be deleted.

- Unapplied Payments/Deposits: Ensure all customer payments and vendor payments are correctly applied to invoices or bills.

- Reconcile or Adjust:

- For missing transactions, create a new entry in QuickBooks with the correct details.

- For incorrect entries, edit the existing transaction in QuickBooks to match the bank statement.

- For duplicate entries, delete the erroneous transaction.

- If a transaction represents a bank fee or interest not yet recorded, add it to the appropriate expense or income account.

- Re-run Reconciliation (if applicable): If you are able to perform a partial reconciliation or if the goal is to clear the balance to zero, re-run the reconciliation process to confirm that all discrepancies are resolved.

- Confirm Zero Balance (for deletion): Before deleting the account, ensure that the ending balance in the QuickBooks register for that account is zero, or that any remaining balance can be appropriately transferred to another account if the intention is not a complete closure of financial activity. If the account is being closed due to cessation of activity, the balance should ideally be zero.

“Proactive management of unreconciled transactions is not merely a procedural step; it is a fundamental requirement for maintaining the integrity and accuracy of your financial records when deleting a bank account.”

Alternative Actions to Deleting a Bank Account

While deleting a bank account in QuickBooks Online offers a clean slate, it is a permanent action that removes all associated transaction history. In many scenarios, alternative methods provide a more appropriate way to manage accounts that are no longer in active use without compromising historical data. Understanding these alternatives is crucial for maintaining an accurate and functional accounting system.This section explores the primary alternative to outright deletion: marking an account as inactive.

We will delve into the nuances of this process, compare it directly with deletion, and Artikel specific situations where inactivation is the superior choice. Furthermore, a decision-making framework will be presented to guide users in selecting the most suitable course of action.

Comparing Account Deletion and Inactivation in QuickBooks Online

The fundamental difference between deleting a bank account and marking it as inactive lies in the permanence and data retention. Deletion permanently removes the account and all its associated transactions from your QuickBooks Online company file. This means that any reports or historical data referencing this account will no longer be accessible or calculable. In contrast, inactivating an account hides it from your active chart of accounts and prevents new transactions from being posted to it.

However, all historical data remains intact and accessible for reporting purposes. This distinction is critical for audit trails, historical analysis, and maintaining a complete financial record.

Managing Unused Bank Accounts with Historical Data

For bank accounts that are no longer actively used but still contain valuable historical transaction data, inactivation is the recommended approach. This ensures that past financial activities, such as previous year’s tax returns or comparative financial analysis, can still be referenced. QuickBooks Online allows users to filter their chart of accounts to view inactive accounts, ensuring that this historical data is not lost.

This is particularly important for accounts that may have been used for specific projects, temporary funding, or as holding accounts that are now closed but whose records are still relevant for compliance or analysis.

Scenarios Favoring Account Inactivation Over Deletion

There are several key scenarios where marking a bank account as inactive is a more appropriate solution than permanent deletion. These situations primarily revolve around the need to preserve historical financial data.

- Accounts with Reconciled Transactions: If a bank account has been reconciled in the past, deleting it would break the reconciliation history and potentially create discrepancies in your financial statements. Inactivating the account preserves the reconciled status.

- Accounts Used for Past Projects or Audits: Historical projects, or accounts used for specific periods that may be subject to future audits or reviews, require the retention of their transaction data. Inactivation ensures this data remains available.

- Accounts with Outstanding Balances (Closed Accounts): Even if a bank account is officially closed by the financial institution, if there are still outstanding transactions or pending settlements within QuickBooks Online, inactivating the account prevents further entries while keeping the historical context.

- Accounts Used for Comparative Reporting: When performing year-over-year comparisons or analyzing trends, having access to historical account data, even from inactive accounts, is essential for accurate reporting.

- Accounts Subject to Regulatory Requirements: Certain industries or jurisdictions may have specific record-keeping requirements that mandate the retention of financial data for a defined period. Deleting accounts would violate these regulations.

Decision Tree for Bank Account Management

To assist users in making an informed decision between deleting and inactivating a bank account, the following decision tree can be utilized. This framework guides the user through a series of questions to determine the most suitable action based on their specific circumstances.

| Question | Decision Path | Outcome |

|---|---|---|

| Is the bank account still actively used for transactions? | Yes | Do not delete or inactivate. Continue using the account. |

| No | Proceed to the next question. | |

| Is there any historical transaction data in this account that might be needed for future reference, audits, or reporting? | Yes | Mark the account as inactive. |

| No | Proceed to the next question. | |

| Has the account ever been reconciled within QuickBooks Online? | Yes | Mark the account as inactive to preserve reconciliation history. |

| No | Proceed to the next question. | |

| Are there any regulatory or compliance requirements that necessitate retaining the historical data of this account? | Yes | Mark the account as inactive. |

| No | If no historical data is needed and the account has never been reconciled, and there are no compliance reasons, then deletion is an option. However, caution is advised due to the permanent nature of deletion. |

Consequences and Best Practices Post-Deletion

Deleting a bank account in QuickBooks Online, while sometimes necessary, carries implications that extend beyond the immediate removal of data. Understanding these consequences is crucial for maintaining the integrity of your financial records and ensuring smooth future operations, particularly during audits or when generating comprehensive financial reports. Proactive planning and adherence to best practices can mitigate potential issues and safeguard your financial data.The ramifications of deleting a bank account are multifaceted, impacting historical data, reconciliation processes, and the overall accuracy of your financial statements.

It is imperative to approach this action with a thorough understanding of its long-term effects and to implement strategies that preserve data integrity.

Long-Term Effects on Financial Reporting and Audits

The deletion of a bank account fundamentally alters the historical financial data available within QuickBooks Online. This can create significant challenges when attempting to generate accurate financial reports that rely on complete historical transaction data, such as comparative income statements or balance sheets spanning multiple periods. For auditors, the absence of specific bank account records can raise red flags, necessitating extensive supplementary documentation to reconstruct the financial activity.

The inability to directly access deleted account transactions means that any analysis or verification requiring that specific data becomes more complex and time-consuming. This can lead to increased audit fees and potential scrutiny if the rationale for deletion is not adequately documented.

When tidying up your financial records in QuickBooks Online, deleting a bank account is straightforward. If you’re considering closing accounts elsewhere, like learning how to close your td bank account , remember to then return to QuickBooks to properly remove any linked digital breadcrumbs for a clean financial slate.

Importance of Maintaining Clear Records of Deletion Rationale

Documenting the precise reasons for deleting a bank account is paramount. This documentation serves as an irrefutable audit trail, explaining the absence of specific financial data. Without a clear record, auditors or internal stakeholders may question the completeness or accuracy of financial records, potentially leading to investigations or requests for extensive explanations. A well-maintained record should include the date of deletion, the specific bank account details, the user who performed the deletion, and a concise yet comprehensive explanation of why the account was removed.

This could range from account closure by the financial institution to the consolidation of accounts or the correction of a duplicate entry.

Recommendations for Ensuring Data Integrity Post-Deletion

To maintain data integrity after deleting a bank account, several key practices should be adopted. The primary objective is to ensure that all essential financial information is preserved and accessible, even if not directly within the deleted account’s ledger.

- Backup Critical Data: Before proceeding with deletion, perform a comprehensive backup of your QuickBooks Online company file. This backup serves as a safety net, allowing you to restore historical data if unforeseen issues arise or if specific transaction details are needed later.

- Export Transaction Reports: Generate and save detailed transaction reports for the deleted bank account for at least the past several fiscal years. These reports should include all relevant details such as dates, payees, amounts, and categories.

- Create a Manual Summary Account: Consider creating a manual journal entry to represent the net balance of the deleted account at the time of deletion. This summary can be posted to a permanent equity or other income/expense account, providing a high-level representation of the account’s historical financial impact without retaining individual transactions.

- Document Reconciliation Status: Clearly note the reconciliation status of the bank account at the time of deletion. If it was reconciled, retain the final reconciliation reports. If it was unreconciled, document the outstanding items and the plan for addressing them.

- Update Financial Models: Review and update any financial models, forecasts, or budgets that may have referenced the deleted bank account. Ensure these are adjusted to reflect the absence of the account and its associated cash flows.

Summary of Do’s and Don’ts for Managing Bank Accounts in QuickBooks Online

Effective management of bank accounts within QuickBooks Online requires a balance of operational efficiency and financial diligence. Adhering to a set of clear do’s and don’ts can prevent common pitfalls and ensure the long-term health of your financial records.

| Do’s | Don’ts |

|---|---|

| Do connect all active bank and credit card accounts to QuickBooks Online for automated transaction feeds. | Don’t delete bank accounts that have historical transactions without thoroughly understanding the implications and performing necessary data preservation steps. |

| Do reconcile all bank accounts regularly, ideally monthly, to ensure accuracy. | Don’t ignore unreconciled transactions; address them promptly to avoid discrepancies. |

| Do review and categorize transactions promptly to maintain up-to-date financial reporting. | Don’t assume that deleting an account erases all financial impact; historical data and reporting may still be affected. |

| Do create manual journal entries to reflect the closure of a bank account if it’s no longer active but needs historical representation. | Don’t rely solely on QuickBooks Online for all record-keeping; maintain external backups and documentation for critical financial data. |

| Do document the rationale and process for any bank account deletion for audit and reference purposes. | Don’t delete an account if there’s any doubt about its necessity; explore alternative solutions like deactivating or archiving first. |

Visualizing the Deletion Process (Conceptual Description)

Understanding the visual cues and the user journey within QuickBooks Online is crucial for executing the deletion of a bank account accurately and with confidence. This section dissects the interface elements and the typical interaction flow, demystifying the process from initial identification to final removal.The process of removing a bank account from QuickBooks Online is designed to be intuitive, guiding users through a series of clear steps.

By visualizing this journey, users can anticipate the interface elements they will encounter and the confirmations required, thereby minimizing potential errors and ensuring a smooth operation.

Navigating to Bank Accounts

The initial step in managing bank accounts within QuickBooks Online involves locating them within the application’s dashboard. This is typically achieved through a clear and accessible navigation structure.The primary pathway to access bank accounts begins with the main navigation menu, usually found on the left-hand side of the screen. Within this menu, users will typically find an option labeled “Accounting” or “Transactions.” Expanding or clicking on this section will reveal a sub-menu, which commonly includes “Chart of Accounts.” The Chart of Accounts serves as a comprehensive list of all financial accounts used by the business, including bank accounts, credit cards, loans, and other assets, liabilities, and equity accounts.

Selecting “Chart of Accounts” presents a table or list displaying each account, its type, and its current balance. Bank accounts are readily identifiable by their account type, such as “Bank” or “Checking.”

Identifying and Deactivating the Account

Once the specific bank account is located in the Chart of Accounts, the interface provides clear indicators for managing its status, including the option to deactivate it, which is a prerequisite for deletion.Within the Chart of Accounts, each account row typically features an “Action” column or a set of icons. To initiate the process of removing a bank account, users must first make it inactive.

This is achieved by clicking on the dropdown arrow or the “Action” button associated with the target bank account. A context menu will appear, offering several options. The pertinent option here is “Make Inactive.” This action does not immediately delete the account but rather hides it from active view in most reports and transaction entries, preventing new transactions from being associated with it.

The “Make Inactive” option is visually distinct, often appearing as a clear text link or a button, signifying a deliberate action to remove the account from regular use.

The Deletion Confirmation and Warnings

Following the deactivation step, QuickBooks Online implements a robust confirmation process to prevent accidental deletion and to inform users of the implications.After selecting “Make Inactive,” QuickBooks Online will present a confirmation dialog box. This dialog serves as a critical safeguard. It typically states that the account will be made inactive and will no longer appear in most transaction lists or reports.

For bank accounts that have associated transactions, especially reconciled ones, the system will often display a more specific warning. This warning might elaborate on the implications for historical data and reporting. The interface then prompts the user to confirm their decision, usually with buttons like “Yes” or “OK.” For accounts with a history of transactions, a further step might be required, potentially involving a direct “Delete” option that appears after the initial deactivation, accompanied by a more explicit warning about the permanence of the action and its impact on historical financial records.

User Experience Flow: From Discovery to Removal

The user experience is designed to be sequential and guided, ensuring that users are aware of each stage of the account removal process.The user’s journey begins with logging into QuickBooks Online and navigating to the “Accounting” or “Transactions” section of the main menu. From there, they select “Chart of Accounts.” Upon viewing the list of accounts, they locate the specific bank account they wish to remove.

A click on the “Action” button or dropdown menu next to the account reveals the options. The user selects “Make Inactive.” A confirmation pop-up appears, explaining that the account will be hidden. If the account has associated transactions, a more detailed warning may be displayed, possibly outlining the consequences for historical data. If the account has been reconciled, the system might explicitly state that the account cannot be deleted until all associated transactions are handled.

In some scenarios, after making an account inactive, a distinct “Delete” option might become available, accompanied by a final, prominent warning message emphasizing that this action is irreversible and will permanently remove the account and its associated data from the system, urging the user to proceed only if they are absolutely certain.

Managing Connected Bank Feeds and Integrations

Deleting a bank account within QuickBooks Online necessitates a careful review and management of any associated bank feeds and third-party integrations. This process ensures that the integrity of your financial data remains intact and that your workflows are not disrupted by the removal of an account. Failure to address these connections can lead to data inconsistencies, errors in transaction imports, and potential disruptions in services that rely on QuickBooks Online data.The impact of deleting a bank account extends beyond the QuickBooks Online platform itself.

Any external applications or services that were configured to pull or push data from or to that specific bank account within QuickBooks Online will likely encounter errors or cease to function correctly. This necessitates a proactive approach to identify and manage these dependencies before or immediately after the account deletion.

Impact on Connected Bank Feeds

When a bank account is deleted in QuickBooks Online, any direct bank feeds that were previously established for that account are automatically terminated. QuickBooks Online severs the connection to the financial institution for that specific account. This means that new transactions will no longer be automatically downloaded and categorized from that bank. The system essentially treats the connection as if it never existed for the deleted account.

Disconnecting or Reconfiguring Bank Feeds

To manage bank feeds associated with a deleted account, it is crucial to ensure they are properly disconnected within QuickBooks Online. If you have other bank accounts still active, you will want to verify that their feeds remain functional.The steps to disconnect or reconfigure bank feeds are as follows:

- Navigate to the Banking section in QuickBooks Online.

- Locate the list of connected accounts.

- For the deleted account, if it still appears (which is unlikely after a successful deletion but good to verify), you would typically find an option to “Edit Info” or a similar setting. Within these settings, there is usually a “Disconnect this bank account” or “Deactivate” option.

- If you are reconfiguring feeds for other accounts, you would follow a similar process, ensuring the correct accounts are selected and the connection is active.

- If you are adding a new account to replace the deleted one, you will initiate a new bank feed connection process for that new account.

Potential Issues with Third-Party Applications

Third-party applications integrated with QuickBooks Online that relied on data from the deleted bank account can experience significant disruptions. These applications might include accounting software add-ons, expense management tools, payroll services, or reporting platforms. If these applications were configured to specifically access or process data related to the deleted bank account, they may:

- Fail to sync data, leading to outdated information in the third-party application.

- Generate error messages indicating a missing or inaccessible account.

- Cause reporting inaccuracies if the deleted account was part of the data set used for calculations.

- Potentially lead to duplicate entries or data corruption if not handled carefully during the re-integration phase.

For instance, an expense management tool that automatically pulled transactions from a business checking account for reimbursement processing would stop receiving data for that account after deletion, halting the reimbursement workflow for expenses tied to that account.

Updating Integration Settings After Account Removal

After deleting a bank account, it is imperative to update the settings of any integrated third-party applications. This ensures continued functionality and data accuracy.The procedure for updating integration settings typically involves:

- Identify all integrated applications: Review your QuickBooks Online settings and any external application dashboards to identify all services connected to your QuickBooks Online account.

- Access application settings: Log in to each third-party application and navigate to its integration or QuickBooks Online connection settings.

- Remove or update the reference to the deleted account: Within the application’s settings, locate where the deleted QuickBooks Online bank account was specified. This might be in account mapping, data source selection, or reporting filters.

- Reconfigure or establish new connections: If a replacement account has been added in QuickBooks Online, you will need to update the integration settings to point to this new account. This may involve re-authenticating the connection or selecting the new account from a dropdown list.

- Test the integration: After updating the settings, perform a test sync or run a report within the third-party application to confirm that data is flowing correctly and that no errors are present.

- Consult application support: If you encounter persistent issues or are unsure about the specific steps required for a particular application, consult the support documentation or contact the support team for that third-party service.

For example, if a CRM system was configured to link customer payments directly to a specific QuickBooks Online bank deposit account, upon deletion of that account, the CRM integration would need to be updated to point to a different, active bank account for future payment allocations. This prevents orphaned payment records and ensures accurate customer account balances.

Troubleshooting Common Deletion Issues

While the process of deleting a bank account in QuickBooks Online is generally straightforward, users may encounter specific obstacles. These issues often stem from QuickBooks’ built-in safeguards designed to protect data integrity. Understanding these common problems and their resolutions is crucial for a smooth administrative experience. This section will dissect the most frequent deletion errors and provide actionable solutions, ensuring users can navigate these challenges effectively.The QuickBooks Online platform employs robust mechanisms to prevent accidental data loss.

Consequently, certain conditions must be met before an account can be removed. When these conditions are not satisfied, QuickBooks will present an error message, indicating that the account cannot be deleted. Recognizing these error messages and understanding their underlying causes is the first step toward resolving them.

Restricted Deletion Due to Existing Transactions

One of the most prevalent reasons for being unable to delete a bank account is the presence of associated transactions. QuickBooks Online mandates that all financial data linked to an account must be properly handled before the account itself can be removed. This includes both reconciled and unreconciled transactions. Attempting to delete an account with outstanding financial records will result in an error message, typically stating that the account cannot be deleted because it contains transactions.To resolve this issue, users must systematically address all transactions associated with the bank account.

This process requires careful attention to detail and a thorough review of the account’s transaction history.

- Review Transaction History: Navigate to the bank account in question within QuickBooks Online. Access the transaction list and meticulously examine all entries, paying close attention to the dates and amounts.

- Reconcile Unreconciled Transactions: If there are unreconciled transactions, they must be reconciled or adjusted. For unreconciled transactions that should not have been recorded, they can be deleted. If they are valid, they need to be properly categorized and reconciled.

- Address Reconciled Transactions: While reconciled transactions are generally not the primary blocker for deletion, in some edge cases, if a reconciled transaction is directly linked to an account that is being deleted without proper accounting adjustments, it might cause an issue. However, the typical QuickBooks safeguard focuses onunreconciled* items. If a reconciled transaction is problematic, it often points to a deeper accounting error that needs correction before deletion.

- Transfer Balances: If the bank account has a balance (either positive or negative), this balance needs to be transferred to another existing account before deletion. This is often done by creating a journal entry or a transfer transaction. For instance, if the account has a positive balance, you might transfer it to your main operating account. If it has a negative balance (like an overdraft), you might transfer it to a relevant expense or liability account.

- Delete or Reclassify Other Related Entries: Beyond standard transactions, check for any other entries tied to the account, such as recurring transactions, memorized transactions, or specific journal entries that might be referencing the account. These may need to be deleted or modified.

“All financial data must be accounted for and properly settled before an account can be removed from the QuickBooks Online ledger.”

Restricted Deletion Due to Account Settings or Integrations

Beyond transactional data, certain account settings or active integrations can also prevent the deletion of a bank account. These restrictions are in place to maintain the integrity of financial reporting and the continuity of integrated services. For example, if a bank account is actively linked to a payroll service, a payment processor, or another third-party application, QuickBooks will typically block its deletion until the integration is deactivated.Resolving deletion restrictions related to settings or integrations requires understanding the interconnectedness of QuickBooks Online with other financial tools.

- Deactivate Linked Services: Identify any services or applications that are currently connected to the bank account you intend to delete. This could include payroll providers, payment gateways, or other financial tools. Access the settings within QuickBooks Online or the respective third-party application to disconnect or deactivate these integrations.

- Review Account Configuration: Examine the account’s configuration within QuickBooks Online. Ensure that it is not set as a primary account for any critical functions, such as a default payment account for specific recurring transactions or a designated account for tax payments. If it is, reconfigure these settings to use a different account.

- Check for Linked Budgets or Reports: While less common, ensure the account is not a sole component of a critical budget or a custom report that would break upon its deletion. If it is, adjust the budget or report to accommodate the account’s removal.

- Verify Primary Bank Account Status: In some QuickBooks Online setups, a “primary” bank account might have certain restrictions. Confirm if the account is designated as primary and, if so, change this designation to another account before attempting deletion.

Seeking Support for Persistent Problems

In instances where users have diligently followed troubleshooting steps but still encounter difficulties deleting a bank account, seeking professional assistance is the recommended course of action. QuickBooks Online offers various support channels designed to help users overcome complex issues. Persistent problems may indicate a more intricate system conflict or a rare software anomaly that requires expert intervention.When seeking support, it is beneficial to have detailed information readily available to expedite the resolution process.

- Contact QuickBooks Support: The primary avenue for assistance is directly through QuickBooks Support. They offer phone, chat, and email support options. When contacting them, be prepared to describe the issue in detail, including any error messages received, and the troubleshooting steps already taken.

- Consult a QuickBooks ProAdvisor: For more complex or recurring issues, engaging a QuickBooks ProAdvisor can be highly beneficial. These certified professionals have extensive knowledge of QuickBooks Online and can offer personalized guidance, advanced troubleshooting, and accounting advice to resolve persistent deletion problems.

- Utilize QuickBooks Community Forums: The QuickBooks Community is a valuable resource where users can ask questions and receive answers from other QuickBooks users and Intuit employees. Searching existing discussions or posting a new question might provide a solution from someone who has encountered a similar problem.

Frequently Asked Questions (FAQ) on Deleting Bank Accounts

This section addresses common queries users may have regarding the deletion of bank accounts in QuickBooks Online, providing concise answers to recurring concerns.

Can I delete a bank account if it has a zero balance?

Yes, generally, you can delete a bank account with a zero balance, provided it has no outstanding transactions or active integrations preventing its removal. However, if it has a history of transactions, even if the current balance is zero, those historical transactions need to be addressed as Artikeld in the troubleshooting steps.

What happens to historical data when a bank account is deleted?

When a bank account is deleted, its transaction history is removed from QuickBooks Online. This is why it is crucial to ensure all necessary historical data has been reconciled, reported on, or archived before deletion, as it cannot be recovered once the account is removed.

Is it possible to undelete a bank account?

No, once a bank account is deleted from QuickBooks Online, it cannot be undeleted. The deletion is a permanent action. Therefore, it is imperative to be absolutely certain that an account should be deleted before proceeding.

What is the difference between deleting and closing a bank account in QuickBooks?

Deleting an account permanently removes it and its associated transaction history from your QuickBooks file. Closing an account, on the other hand, typically means marking it as inactive so it no longer appears in active lists but its historical data remains accessible for reporting purposes. QuickBooks Online primarily offers the “delete” function for bank accounts that are no longer in use and have no historical significance to be retained.

Can I delete a bank account that has been reconciled?

Generally, QuickBooks prevents the deletion of accounts with reconciled transactions if those transactions are not properly accounted for through adjustments or transfers. The system prioritizes data integrity. If you have reconciled transactions, ensure that any discrepancies or balance adjustments have been made before attempting deletion. If the account is truly no longer needed and all reconciliations are accurate, you might need to make a final adjustment to zero out the balance and then proceed with deletion.

Final Conclusion

Successfully navigating the process of how to delete bank account in quickbooks online involves careful planning and execution. By understanding the implications, preparing adequately, and following the Artikeld steps, you can ensure a clean removal that preserves the integrity of your financial records. Remember that while deletion is an option, marking an account as inactive often serves as a more suitable alternative for retaining historical data.

This guide has provided the tools and insights to make informed decisions about your QuickBooks Online account management, ensuring your financial data remains accurate and accessible for future reference and analysis.

User Queries

What happens to historical transactions when a bank account is deleted?

When a bank account is deleted in QuickBooks Online, its associated historical transactions are also removed. This means they will no longer appear in your reports or be accessible within the system. It is crucial to back up your data or ensure you have separate records if you anticipate needing this information later.

Can I delete a bank account if it has unreconciled transactions?

QuickBooks Online typically prevents the deletion of a bank account if it contains unreconciled transactions. You must reconcile all outstanding transactions or address them appropriately before proceeding with the deletion. This ensures data accuracy and prevents potential errors in your financial statements.

What is the difference between deleting an account and making it inactive?

Making an account inactive hides it from your active Chart of Accounts and prevents new transactions from being entered into it, but it retains the historical data. Deleting an account permanently removes the account and all its associated transactions from QuickBooks Online. Inactivation is generally preferred if you might need to refer to historical data in the future.

How do I disconnect a bank feed after deleting the associated account?

After deleting a bank account, you will need to manually disconnect any associated bank feeds from the Bank Feeds section of QuickBooks Online. Navigate to the Banking tab, find the disconnected account, and follow the prompts to sever the connection. This prevents further attempts to sync data from the now-deleted account.

Will deleting a bank account affect my tax filings?

If the deleted bank account’s transactions were included in past tax filings, their removal from QuickBooks Online could create discrepancies if not properly accounted for. It’s essential to maintain separate records of all financial activity, especially for tax purposes, before deleting any account. Consulting with a tax professional is advisable.