Delving into can you go to jail for not paying student loans, this introduction immerses readers in a unique and compelling narrative. It is essential to understand the legal ramifications associated with defaulting on student loan obligations, distinguishing between federal and private loan agreements and the distinct enforcement mechanisms employed by each. This exploration will illuminate the specific circumstances under which legal actions, potentially leading to incarceration, might be initiated.

Beyond the immediate legal consequences, defaulting on student loans carries a spectrum of significant repercussions. These include a detrimental impact on credit scores, the potential for wage garnishment, and the interception of tax refunds for federal loans. Understanding these broader implications is crucial for borrowers facing repayment challenges.

Understanding the Core Question

The question of whether one can go to jail for not paying student loans is a significant concern for many individuals navigating their financial journeys. While the immediate thought might lean towards incarceration, the reality is nuanced and depends heavily on the type of loan, the borrower’s actions, and the specific legal processes involved. Understanding these distinctions is key to demystifying the potential consequences of student loan default.The legal ramifications for student loan non-payment are not a one-size-fits-all scenario.

They vary considerably between federal and private loans, each carrying its own set of enforcement mechanisms and potential outcomes. This exploration will delve into these differences, shedding light on the specific circumstances that could lead to more severe legal actions.

Legal Ramifications of Defaulting on Federal Student Loans

Defaulting on federal student loans triggers a series of actions initiated by the U.S. Department of Education or its contracted agencies. These consequences are designed to recover the outstanding debt and can significantly impact a borrower’s financial well-being and creditworthiness.When a borrower defaults on federal student loans, typically after 270 days of missed payments, several enforcement actions can be taken without a court order in many cases.

These include:

- Wage Garnishment: The government can garnish up to 15% of your disposable pay without a court judgment.

- Tax Refund Offset: Your federal and state tax refunds can be intercepted to pay down your loan debt.

- Social Security Benefit Offset: A portion of your Social Security benefits can be withheld.

- Denial of Future Federal Student Aid: You will not be eligible for further federal student loans or grants until the default is resolved.

- Damage to Credit Score: Defaulting severely damages your credit score, making it difficult to obtain loans, rent an apartment, or even secure certain jobs.

It is crucial to understand that while these are serious financial penalties, they do not directly involve jail time. The federal government has robust administrative tools to recover debt, making legal intervention for the sole purpose of imprisonment for non-payment of federal student loans exceedingly rare, if not practically non-existent.

Legal Ramifications of Defaulting on Private Student Loans

Private student loans are issued by banks, credit unions, and other private lenders. The default process and subsequent legal actions for these loans differ significantly from federal loans, as they are governed by contract law and require court intervention for many enforcement actions.When a borrower defaults on a private student loan, the lender can pursue a range of legal remedies.

These typically involve:

- Lawsuits and Court Judgments: The lender must file a lawsuit against the borrower. If the lender wins, they obtain a court judgment.

- Wage Garnishment (Court-Ordered): With a court judgment, lenders can seek an order to garnish wages, often a higher percentage than with federal loans, depending on state laws.

- Bank Account Levy: A lender with a judgment can seize funds from your bank accounts.

- Property Liens: In some cases, a lender can place a lien on your property.

- Credit Score Damage: Similar to federal loans, default will severely impact your credit score.

The key distinction here is the necessity of a court judgment for many of these actions. While jail time is not a direct consequence of defaulting on private student loans, the legal process can become extensive and lead to significant financial hardship.

Comparison of Enforcement Mechanisms for Federal Versus Private Student Loan Debt

The enforcement mechanisms for federal and private student loan debt present a clear contrast in their approach and the level of judicial involvement required. Understanding these differences is vital for borrowers to anticipate the potential pathways of debt recovery.Federal student loans benefit from streamlined administrative powers, allowing for debt collection without immediate court action in many instances. This includes direct garnishment of wages and benefits, and interception of tax refunds.

Private lenders, on the other hand, generally must navigate the court system to enforce repayment.Here’s a breakdown of the key differences:

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Initial Default Action | Administrative (e.g., wage garnishment, tax refund offset) | Requires lender to file lawsuit and obtain court judgment |

| Wage Garnishment | Up to 15% of disposable pay, administrative | Court-ordered, percentage varies by state, often higher |

| Tax Refund Offset | Yes, federal and state | No, unless specific state laws apply or a court order is obtained |

| Social Security Offset | Yes, a portion can be withheld | Generally no, unless through a court order |

| Statute of Limitations | Generally none for collection of federal debt | Varies by state, but generally exists |

The federal system’s administrative powers provide a more direct route to debt recovery, while the private system’s reliance on the courts introduces a more formal, albeit potentially slower, legal process.

Circumstances Leading to Legal Action for Student Loan Non-Payment

While direct imprisonment for simply failing to pay student loans is exceptionally rare, legal action that could indirectly lead to severe consequences, including potential contempt of court charges, can arise in very specific, often egregious, circumstances. These situations typically involve deliberate evasion of legal obligations or fraudulent activity, rather than mere inability to pay.The legal system generally aims to facilitate debt recovery and not to incarcerate individuals for financial hardship.

However, certain actions can cross a line into contempt of court or other offenses:

- Failure to Comply with Court Orders: If a court orders you to appear for a hearing related to your student loan debt, or to provide financial information, and you deliberately ignore these orders, you could be held in contempt of court. This can result in fines or, in extreme cases, jail time until you comply.

- Fraudulent Activity: If it is proven that you engaged in fraud to obtain the student loans (e.g., providing false information on applications) or to evade repayment (e.g., hiding assets illegally), criminal charges could be pursued. This is distinct from simply being unable to pay.

- Willful Evasion of Legal Process: Repeatedly and intentionally evading service of process or refusing to participate in legal proceedings initiated by the lender, despite knowing about them, can lead to sanctions from the court.

It is important to emphasize that these scenarios are not about the debt itself leading to jail, but about the borrower’s actions in defiance of the legal system or through dishonest means. The focus shifts from debt collection to the enforcement of legal procedures and the prosecution of criminal behavior.

Consequences Beyond Default: Can You Go To Jail For Not Paying Student Loans

Navigating student loan repayment can feel like a complex journey, and while the immediate concern might be avoiding legal action, it’s crucial to understand the ripple effects of default that extend far beyond the courtroom. These consequences can significantly impact your financial well-being and future opportunities, but with knowledge and proactive steps, you can mitigate their severity and work towards a brighter financial future.Understanding these potential outcomes empowers you to make informed decisions and take control of your financial path.

It’s about seeing the bigger picture and recognizing that responsible management of your student loans is an investment in your long-term stability and peace of mind.

Credit Score Impact

When student loans go into default, it sends a strong negative signal to credit bureaus, significantly impacting your credit score. This score is a vital component of your financial health, influencing your ability to secure future loans, rent an apartment, and even obtain certain job opportunities. A lower credit score means lenders perceive you as a higher risk, leading to less favorable terms and higher interest rates on any credit you might seek.The default will be reported to the major credit bureaus, typically remaining on your credit report for up to seven years.

This prolonged negative mark can make it challenging to rebuild your creditworthiness, but consistent positive financial behavior over time can help to gradually improve your score.

Wage Garnishment

One of the more direct and impactful consequences of defaulting on federal student loans is the possibility of wage garnishment. This means that a portion of your paycheck can be legally withheld by your employer and sent directly to the Department of Education to repay your debt. This process can occur without a court order for federal loans, making it a swift and significant financial strain.

While the specter of jail for unpaid student loans is largely a myth, financial distress can lead to serious consequences, impacting your ability to manage other debts. Understanding options like can you have two va home loans might offer perspective on financial flexibility. However, ignoring student loan obligations can still result in wage garnishment and other legal actions, though not typically jail time.

For federal student loans in default, the government can garnish up to 15% of your disposable pay, or the amount by which your weekly disposable pay exceeds 30 times the minimum wage, whichever is less.

This garnishment can create considerable hardship, reducing your disposable income and making it difficult to cover essential living expenses. It underscores the importance of addressing your loan obligations before they reach this stage.

Tax Refund Interception, Can you go to jail for not paying student loans

Another significant consequence for defaulted federal student loans is the interception of your tax refunds. If you are due a refund from the IRS, it can be withheld and applied to your outstanding student loan debt. This measure is designed to recover delinquent federal debts and can come as an unwelcome surprise when you are expecting to receive funds.This interception can disrupt your financial planning, especially if you rely on your tax refund for important expenses or savings goals.

It highlights the pervasive reach of federal loan collection efforts.

Loan Rehabilitation

Fortunately, for those facing default on federal student loans, there are pathways to recovery and rebuilding. Loan rehabilitation is a structured process designed to help borrowers regain good standing with their loans. By successfully completing a rehabilitation program, you can remove the default status from your credit report and restore access to federal student aid for future educational pursuits.The process typically involves making a series of on-time, voluntary payments for a specified period.

The exact number of payments can vary, but it’s a manageable commitment aimed at demonstrating your renewed ability to repay your debts.Benefits of loan rehabilitation include:

- Removal of the default status from your credit report, which can help improve your credit score over time.

- Restoration of eligibility for federal student aid, such as Pell Grants and federal student loans, for future education.

- The ability to consolidate your loans again, potentially leading to a more manageable repayment plan.

- Protection from further collection actions, including wage garnishment and tax refund interception.

This process offers a hopeful and practical solution for borrowers seeking to overcome the challenges of student loan default and regain control of their financial future. It’s a testament to the fact that with commitment and the right approach, recovery is always possible.

Legal Avenues and Protections

Navigating the complexities of student loan debt can feel daunting, but it’s crucial to remember that a landscape of legal avenues and protections exists to empower you. Understanding these options can transform a feeling of being trapped into one of proactive management and hopeful resolution. This section illuminates the pathways available to help you regain control and find peace of mind.

Statutes of Limitations for Student Loan Debt Collection

Every state has laws that set a time limit within which creditors, including student loan lenders, can legally pursue repayment through the courts. This is known as the statute of limitations. Once this period expires, the lender generally loses the right to sue you for the debt. However, it’s vital to understand that this does not erase the debt itself, nor does it prevent lenders from continuing collection efforts like contacting you or reporting to credit bureaus, depending on the loan type and state laws.

The clock on the statute of limitations can also be reset under certain circumstances, such as making a payment or acknowledging the debt in writing, so vigilance is key.

Student Loan Forgiveness Programs

A beacon of hope for many borrowers, student loan forgiveness programs offer a way to have some or all of your student loan debt canceled. These programs are designed to support individuals in public service, those with disabilities, or those who have been defrauded by their educational institutions. Eligibility criteria vary significantly, often requiring specific employment in qualifying public service roles for a set number of years, income-driven repayment plans, or proof of severe and permanent disability.

Exploring these programs can be a game-changer for your financial future.

- Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance on Direct Loans after 120 qualifying monthly payments have been made while working full-time for a qualifying employer.

- Teacher Loan Forgiveness Program: Teachers who have worked full-time for five complete and consecutive academic years in a low-income school or educational service agency may be eligible for forgiveness.

- Income-Driven Repayment (IDR) Plans: While not strictly forgiveness programs, IDR plans like PAYE, REPAYE, IBR, and ICR can lead to forgiveness of the remaining balance after 20-25 years of qualifying payments.

- Total and Permanent Disability (TPD) Discharge: Borrowers who are totally and permanently disabled may be eligible to have their federal student loans discharged.

Bankruptcy and Student Loan Debt Discharge

The possibility of discharging student loan debt through bankruptcy is a complex but important consideration. Historically, federal and most private student loans were difficult to discharge in bankruptcy, requiring borrowers to prove “undue hardship.” This is a high legal standard that often involves demonstrating that you cannot maintain a minimal standard of living for yourself and your dependents if forced to repay the loans.

However, recent legal interpretations and changes in some jurisdictions have made it slightly more accessible, particularly for private loans, and there’s ongoing advocacy to make federal loans more dischargeable.

The “undue hardship” standard in bankruptcy for student loans typically involves a three-part test: (1) that you cannot maintain, based on your present and future financial resources, a minimal standard of living for yourself and your dependents; (2) that this situation is likely to continue for a significant portion of the loan repayment period; and (3) that you have made good faith efforts to repay your loans.

Negotiating a Settlement with Lenders

For those facing overwhelming balances, negotiating a settlement with your student loan lender can be a viable strategy to resolve your debt for less than the full amount owed. This process involves offering a lump sum payment that is less than the total outstanding balance in exchange for the lender agreeing to consider the debt settled. It’s a negotiation, so preparation is key.

Understanding your financial situation thoroughly and having a realistic offer in mind are crucial steps. While lenders may be hesitant, especially for federal loans, they may be more open to settlements for private loans, particularly if they perceive the debt as difficult to collect.

When considering a settlement, remember that it can have implications for your credit score. However, if managed correctly, it can provide a definitive end to collection efforts and a clear path forward. It’s often advisable to seek professional guidance from a financial advisor or a debt relief specialist to navigate this process effectively and ensure you are protected.

Scenarios and Nuances

Navigating student loan repayment can sometimes feel complex, but understanding the potential paths and common misconceptions empowers you to make informed decisions. This section delves into real-world scenarios and clarifies crucial aspects of student loan delinquency.

Illustrative Scenario of Legal Proceedings for Delinquency

Imagine Sarah, who graduated with significant federal student loan debt and has been struggling to find stable employment in her field. For over two years, she has been unable to make any payments, and her loan servicer has exhausted standard collection efforts. The U.S. Department of Education, holding her loans, initiates legal action. This could involve the government filing a lawsuit to obtain a judgment.

If a judgment is granted, the government can then pursue further enforcement actions. For instance, they might seek to garnish Sarah’s wages directly from her employer, a process that doesn’t require a court order in many cases for federal debts. Additionally, if Sarah is due to receive a tax refund, that refund could be intercepted and applied to her outstanding loan balance.

This scenario highlights that while jail time is exceptionally rare, legal proceedings that impact income and assets are a tangible consequence of prolonged delinquency.

Comparative Table of Student Loan Default Consequences

It’s essential to recognize that not all student loans are created equal, and the consequences of defaulting can vary significantly. Understanding these differences empowers you to prioritize and seek appropriate solutions.

| Loan Type | Federal Default Consequences | Private Default Consequences |

|---|---|---|

| Federal Direct Subsidized/Unsubsidized | – Default Status – Wage Garnishment – Tax Refund Interception – Social Security Benefit Offset – Denial of Further Federal Aid – Collection Fees and Accrued Interest |

N/A |

| Federal PLUS Loans | – Default Status – Wage Garnishment – Tax Refund Interception – Social Security Benefit Offset – Denial of Further Federal Aid – Collection Fees and Accrued Interest |

N/A |

| Private Loans | N/A | – Lawsuit – Judgment Lien on Assets – Wage Garnishment (court order required) – Potential Seizure of Assets (in some states) – Significant Damage to Credit Score |

Common Misconceptions Regarding Jail Time for Student Loan Non-Payment

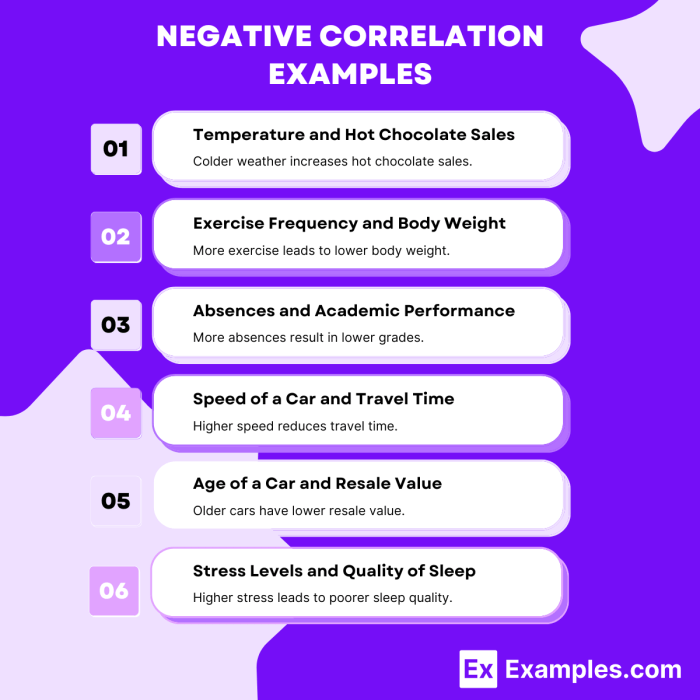

A prevalent and persistent myth is that one can go to jail for not paying student loans. This is overwhelmingly false for the vast majority of student loan borrowers, particularly those with federal loans. Criminal charges and incarceration are reserved for cases of intentional fraud or evasion of legal obligations, such as contempt of court after being ordered to pay.

For typical delinquency, the consequences are civil, not criminal. These civil actions aim to recover the debt through means like wage garnishment or asset seizure, rather than imprisonment. Focusing on the reality of civil penalties helps alleviate undue fear and encourages borrowers to address their financial situation proactively.

The Importance of Proactive Communication with Lenders

When facing financial difficulties, the single most empowering action a borrower can take is to communicate openly and honestly with their student loan lender or servicer. Ignoring the problem only allows it to escalate. Lenders are often willing to work with borrowers experiencing temporary hardships. They may offer options such as:

- Income-Driven Repayment (IDR) Plans: These plans adjust your monthly payment based on your income and family size, making payments more manageable.

- Deferment or Forbearance: These options can temporarily pause or reduce your payments, providing much-needed breathing room.

- Loan Consolidation: This can simplify your repayment by combining multiple loans into one, potentially with a new interest rate and repayment term.

Proactive communication not only helps you explore these beneficial options but also demonstrates your commitment to resolving the debt, which can positively influence how lenders approach your situation. It transforms a potentially adversarial relationship into a collaborative effort towards a solution.

Final Summary

In conclusion, while the direct prospect of jail time for simply not paying student loans is exceedingly rare and often misunderstood, the legal and financial consequences of default are substantial and far-reaching. Navigating the complexities of student loan debt requires a proactive approach, including understanding available legal avenues, exploring forgiveness programs, and engaging in open communication with lenders to mitigate potential adverse outcomes.

Questions Often Asked

What is the primary difference in how federal and private student loans are collected?

Federal student loans are managed by the U.S. Department of Education and have specific collection processes, including administrative wage garnishment and tax refund interception without a court order. Private student loans are collected by private lenders, who must typically file a lawsuit and obtain a court judgment to enforce collection actions like wage garnishment.

Under what specific circumstances might legal action leading to potential jail time occur for student loan non-payment?

Jail time for student loan non-payment is extremely uncommon and typically arises not from the debt itself, but from associated criminal acts. This could include charges like fraud (e.g., falsifying information on loan applications), perjury, or contempt of court if a borrower willfully disobeys a court order related to debt repayment or financial disclosure.

Can a lender seize my assets if I default on a private student loan?

Yes, if a private lender obtains a court judgment against you for an unpaid student loan, they can pursue legal means to seize assets such as bank accounts, property, or other valuables to satisfy the debt, depending on state laws and the specifics of the judgment.

What is the statute of limitations for collecting student loan debt?

For federal student loans, there is generally no statute of limitations for collection. For private student loans, the statute of limitations varies significantly by state, typically ranging from three to ten years, after which a lender may no longer be able to sue for repayment.

Is it possible to discharge student loan debt through bankruptcy?

Discharging student loan debt through bankruptcy is possible but is considered an “undue hardship” discharge and is difficult to obtain. Borrowers must typically prove that they cannot maintain a minimal standard of living for themselves and their dependents, that this situation is likely to persist, and that they have made good-faith efforts to repay the loans.