how to pay off 15 year mortgage in 7 years sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with entertaining interactive style and brimming with originality from the outset.

Ever dreamed of ditching that mortgage debt years ahead of schedule? We’re diving headfirst into the thrilling challenge of how to pay off a 15-year mortgage in a lightning-fast 7 years! Imagine slashing your mortgage term in more than half – that’s not just about saving a boatload of cash on interest; it’s about unlocking a future of financial freedom sooner than you ever thought possible.

Get ready to explore the smart strategies, the psychological boosts, and the nitty-gritty financial maneuvers that can turn this ambitious goal into your reality. Let’s get this party started!

Understanding the Goal: Paying Off a 15-Year Mortgage Faster: How To Pay Off 15 Year Mortgage In 7 Years

Hoo! My brothers and sisters, gather ’round, for we speak of a dream that can be made real, a testament to our hard work and wisdom. We aim to conquer our 15-year mortgage, not in its appointed time, but in a mere 7 years. This is not a flight of fancy, but a strategic maneuver, a way to seize our financial future with both hands, much like a skilled farmer harvests his bounty ahead of the season.Accelerating mortgage payoff means making payments that exceed the minimum required amount.

These extra payments are applied directly to the principal balance of the loan. By diligently chipping away at the principal, we shorten the lifespan of the debt, thereby reducing the total interest paid over the life of the loan. It’s like finding a shortcut on a long journey; you arrive at your destination sooner and with less wear and tear.

Financial Benefits of Reducing Mortgage Term

The advantages of transforming a 15-year commitment into a 7-year accomplishment are as abundant as the harvest after a good rain. The most immediate and tangible benefit is the significant reduction in the total interest paid. This saved money can then be redirected to other pursuits, be it investing, saving for retirement, or enjoying the fruits of our labor. Furthermore, achieving mortgage freedom means no more monthly debt obligations, freeing up substantial cash flow for other financial goals.Let us consider the stark reality of interest.

Over a 15-year term, even with a modest interest rate, the total interest paid can amount to a considerable sum. For example, a $200,000 mortgage at 4% interest over 15 years would accrue approximately $66,767 in interest. By paying it off in 7 years, the total interest paid would be drastically reduced, often by more than half. This substantial saving is a direct consequence of reducing the principal faster and thus reducing the base on which interest is calculated.The formula for calculating the total interest paid on a mortgage is complex, but the principle of reducing principal is simple.

The earlier you reduce the principal, the less interest accrues. This is often visualized by amortization schedules, which show how much of each payment goes towards interest versus principal. In accelerated payoff, the proportion going to principal increases much faster.Consider this scenario: a $200,000 loan at 4% interest.

- Standard 15-year payoff: Monthly payment approximately $1,

497. Total interest paid: ~$66,767. - Accelerated 7-year payoff: To achieve this, the monthly payment would need to be significantly higher, approximately $2,

782. Total interest paid: ~$37,573.

The difference in interest saved is a staggering $29,194. This is a powerful illustration of the financial gains from early payoff.

Psychological Advantages of Mortgage Freedom

Beyond the tangible financial gains, the prospect of achieving mortgage freedom in 7 years offers profound psychological benefits. It is a liberation from a significant financial burden, a weight lifted from one’s shoulders. This newfound freedom can lead to reduced stress, increased peace of mind, and a greater sense of accomplishment and security. Imagine the feeling of owning your home outright, free from the constant pressure of monthly mortgage payments.

This psychological uplift can empower individuals to take on new challenges, pursue passions, and enjoy life with a lighter heart. It fosters a sense of control over one’s destiny and can be a powerful motivator for continued financial discipline.

Initial Assessment and Financial Readiness

Before embarking on the ambitious journey of conquering your 15-year mortgage in just 7 years, a clear-eyed assessment of your current financial standing is paramount. This is not a time for wishful thinking, but for rigorous examination, much like a wise farmer surveys their fields before planting. Understanding precisely where you stand financially is the bedrock upon which your accelerated payment strategy will be built.This initial phase involves meticulously gathering all pertinent information about your mortgage and then honestly evaluating your household’s financial capacity.

It requires a disciplined approach to uncover potential avenues for extra payments without jeopardizing your essential needs or long-term financial health.

Current Mortgage Balance and Remaining Term

To effectively plan for early mortgage payoff, one must first establish the exact parameters of the existing debt. This involves identifying the principal amount still owed and the original duration of the loan.

To ascertain these figures, consult your most recent mortgage statement. This document typically details:

- The outstanding principal balance.

- The original loan term (in this case, 15 years).

- The remaining term, calculated from the loan’s origination date to the present.

For instance, if you took out a 15-year mortgage 3 years ago, your remaining term is 12 years. Knowing your current principal balance is the critical number for all subsequent calculations regarding interest savings and payment acceleration.

Calculating Total Interest Saved

The allure of paying off a mortgage early lies significantly in the substantial interest savings. By reducing the loan’s life, you curtail the period during which interest accrues, leading to considerable financial gains over time.The total interest saved can be estimated by comparing the total interest paid on the original 15-year schedule versus the total interest paid under your accelerated 7-year payoff plan.

A common method involves using an amortization schedule calculator.

The formula for calculating total interest paid over the life of a loan is:Total Interest = (Total Payments)

So, you’re looking to crush that 15-year mortgage in half the time? That’s awesome! It makes you wonder, though, how much dough you’d even need for a mortgage in the first place, like how much income is needed for a 300k mortgage. Knowing that helps set the stage for figuring out how to slash those payments and become mortgage-free way ahead of schedule.

(Principal Borrowed)

To calculate savings, you would first determine the total interest paid if you continue with the original 15-year payment schedule. Then, you would calculate the total interest paid if you consistently make extra payments to achieve the 7-year payoff. The difference between these two amounts represents your total interest savings.For example, on a $200,000 mortgage at 4% interest with a 15-year term, the total interest paid would be approximately $65,744.

If you were to pay this off in 7 years with significantly higher monthly payments, the total interest paid could be reduced to around $30,000-$35,000, resulting in savings of over $30,000. Online mortgage payoff calculators are invaluable tools for generating these precise figures.

Assessing Personal Financial Capacity for Extra Payments

Determining your ability to make additional payments requires an honest appraisal of your income, expenses, and financial reserves. This is akin to a seasoned sailor checking the winds and currents before setting sail.A structured approach is necessary to identify funds that can be redirected towards accelerated mortgage payments without creating undue financial strain.

- Analyze Income Streams: Document all sources of household income, including salaries, bonuses, freelance earnings, and any other regular financial inflows.

- Track Expenses Meticulously: Categorize and record every expenditure for at least one to two months. This includes fixed costs (rent, mortgage, insurance) and variable costs (groceries, utilities, entertainment).

- Identify Discretionary Spending: Pinpoint areas where spending can be reduced or eliminated. This might involve dining out less, cutting back on subscriptions, or finding more affordable alternatives for certain goods and services.

- Evaluate Savings and Investments: Assess your current savings accounts, emergency funds, and investment portfolios. Determine if any portion can be safely reallocated without compromising your financial security or future goals. It is crucial to maintain an adequate emergency fund, typically 3-6 months of living expenses, before aggressively paying down debt.

Organizing a Personal Budget for Accelerated Payments

A well-organized budget is the compass that guides your financial journey. It transforms raw financial data into actionable steps, illuminating the path to accelerated mortgage payoff.The goal of this budget is to systematically uncover surplus funds that can be allocated to your mortgage.

Begin by creating a detailed monthly budget that Artikels all income and expenses. Use a spreadsheet, budgeting app, or even a notebook. The key is consistency and accuracy.

- List all Income: Sum up all expected income for the month after taxes.

- Categorize Expenses: Group your expenses into essential (housing, food, utilities, transportation, debt payments) and non-essential (entertainment, dining out, hobbies, travel).

- Subtract Expenses from Income: Calculate the difference between your total income and total essential expenses. This initial figure represents your potential surplus.

- Identify Reductions in Non-Essential Spending: Review your non-essential spending categories. Determine specific, achievable reductions you can make in each. For example, instead of spending $200 on dining out, aim for $100.

- Allocate Surplus Funds: The sum of your initial surplus and any identified reductions in non-essential spending becomes the amount available for extra mortgage payments.

For instance, if your monthly income is $5,000 and essential expenses are $3,000, you have a $2,000 surplus. If you identify $500 in potential savings from non-essential spending (e.g., $200 less on entertainment, $100 less on shopping, $200 less on dining out), you can allocate $2,500 towards your mortgage each month. This systematic approach ensures that every dollar is accounted for and strategically directed towards your goal.

Strategies for Making Extra Mortgage Payments

Now that we have understood our goal and assessed our readiness, it is time to discuss the very heart of accelerating our mortgage payoff: the strategies for making extra payments. These are not mere suggestions; they are the powerful tools that will help us conquer that 15-year debt in just 7 years. Think of these strategies as the sharpened spears and sturdy shields in our battle against interest.Making extra payments is the most direct way to reduce the principal balance of your mortgage faster than the original schedule.

By paying down the principal, you reduce the amount of interest that accrues over the life of the loan. This section will delve into the most effective methods for achieving this, ensuring every extra coin works diligently for you.

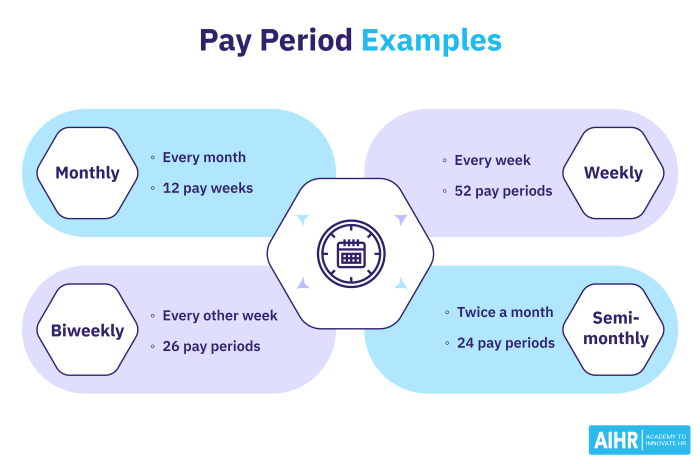

Bi-Weekly Payment Method

The bi-weekly payment method is a popular strategy that, when implemented correctly, can shave years off your mortgage. It involves paying half of your monthly mortgage payment every two weeks. Since there are 52 weeks in a year, this results in 26 half-payments, which equates to 13 full monthly payments annually instead of the standard 12.This extra payment goes directly towards your principal balance, accelerating your payoff timeline.

For instance, on a $200,000 mortgage with a 4% interest rate over 15 years, the monthly payment is approximately $1,477. By paying $738.50 every two weeks, you would effectively make one extra monthly payment per year. This seemingly small adjustment can lead to paying off the mortgage several years earlier and saving tens of thousands in interest. It is crucial to ensure your lender applies these extra payments to the principal and not as an advance on future payments.

Lump Sum Payment Strategy

A lump sum payment is a significant, one-time payment made towards your mortgage principal. This strategy is particularly effective when you have received a windfall, such as a tax refund, a bonus at work, an inheritance, or proceeds from selling an asset. The key to its effectiveness lies in the size of the payment and its direct application to the principal.To implement this strategy, identify a period when you will have a substantial amount of extra cash.

This could be annually, after receiving a tax refund, or whenever a bonus is disbursed. The timing is less critical than the action itself. When you make the payment, clearly communicate to your lender that the entire amount is to be applied directly to the principal balance. A simple letter or specific instructions during the payment process will suffice. For example, if you have a $300,000 mortgage and receive a $10,000 bonus, applying that entire $10,000 directly to the principal can significantly reduce your loan term and interest paid.

Extra Principal Payments Versus Increased Regular Payment Amounts

While both methods involve paying more than the minimum required, there’s a nuanced difference in how they are applied and their impact. Making extra principal payments means sending in an amount specifically designated to reduce the principal balance, often in addition to your regular monthly payment. This can be done through bi-weekly payments, lump sums, or simply adding an extra amount to your regular monthly payment and specifying it’s for principal.Increasing your regular payment amount, on the other hand, means adjusting your standard monthly payment to a higher figure.

If your lender allows, you can simply pay, for example, $1,600 instead of $1,477. However, it is imperative to confirm with your lender that this increased amount is being applied directly to the principal and not just held as an advance on future payments.The primary advantage of clearly designating extra payments as principal payments is the direct reduction of the loan’s principal balance, which in turn lowers the amount of interest you will owe over time.

If your lender simply applies an increased regular payment as an advance, you might not see the full benefit of interest savings until much later in the loan term. Therefore, direct principal payments are generally more effective for accelerated payoff.

Ensuring Extra Payments Are Applied Directly to the Principal

This is a critical step that many homeowners overlook, leading to missed opportunities for accelerated debt reduction. To ensure your extra payments are applied correctly, follow these practices:

- Communicate Clearly with Your Lender: Before making any extra payment, contact your mortgage servicer. Understand their specific procedures for applying extra payments to the principal. Some lenders have online portals where you can designate this, while others require a written request.

- Specify in Writing: When sending a check or making an online payment, include a clear, unambiguous statement. For example, write “Apply this payment to principal only” on the memo line of your check or in the payment notes section online.

- Document Everything: Keep records of all extra payments made and the correspondence with your lender regarding their application. This documentation serves as proof and can be referenced if any discrepancies arise.

- Review Your Statements Regularly: After making an extra payment, carefully review your next mortgage statement. Verify that the payment was applied as principal and that your principal balance has decreased accordingly. If it was applied as an advance payment, contact your lender immediately to rectify the situation.

“A small stream, if constantly flowing, can carve a mighty canyon.”

This proverb aptly describes the power of consistent extra payments. Even small, regular additional payments, when directed to the principal, accumulate significantly over time, leading to substantial interest savings and a faster path to homeownership.

Leveraging Windfalls and Unexpected Income

Just as the swift currents of the Batak rivers can carve through stone, so too can unexpected financial windfalls accelerate your journey to a debt-free home. These are not mere bonuses to be spent; they are powerful tools, like a sharp machete, that can efficiently clear the path to paying off your 15-year mortgage in a shorter span. Embracing these opportunities with a clear plan will significantly shorten your repayment period.When unexpected funds arrive, it’s natural to feel a sense of freedom.

However, the wise course, echoing the foresight of our ancestors who always planned for lean times, is to channel these resources directly towards your mortgage principal. This proactive approach ensures that your money works harder for you, reducing the total interest paid and bringing you closer to the day you hold the title deed free and clear.

Strategic Use of Tax Refunds for Mortgage Acceleration

The annual tax refund, often viewed as a welcome surprise, can be a significant contributor to your mortgage payoff strategy. Instead of letting this money sit in a checking account or being spent on immediate desires, it can be strategically deployed to make a substantial dent in your outstanding loan balance.Consider the impact of a typical tax refund, which for many households can range from a few hundred to several thousand dollars.

Applying this lump sum directly to the principal means that a larger portion of your subsequent payments will also go towards reducing the principal, creating a snowball effect. This is akin to adding extra logs to a fire; it burns hotter and faster, reaching its goal sooner. For instance, if your refund is $3,000, and you apply it directly to your principal, you immediately reduce the amount on which interest is calculated, saving you money over the life of the loan.

Allocating Bonuses and Other One-Time Income Towards the Mortgage Principal

Work bonuses, inheritances, or any other form of one-time income represent a golden opportunity to make a significant leap towards your mortgage payoff goal. These sums are often substantial and, when directed wisely, can shave years off your repayment timeline.The benefit of allocating bonuses to your mortgage principal is manifold. Firstly, it directly reduces the amount of interest you will pay over the remaining loan term.

Secondly, it shortens the loan’s life, meaning you’ll be free of mortgage payments sooner, allowing you to redirect those funds to other financial goals or enjoy your hard-earned freedom. For example, a $10,000 bonus applied to a $200,000 mortgage balance could effectively reduce the loan term by several months, depending on the interest rate and amortization schedule. It’s a direct and impactful way to accelerate your financial liberation.

Identifying Other Common Sources of Unexpected Income

Beyond tax refunds and bonuses, various other unexpected income streams can be harnessed for mortgage acceleration. These opportunities, though perhaps smaller in individual amounts, can collectively contribute to a substantial reduction in your loan principal over time.Common sources include:

- Rebates from purchases or promotions.

- Gift money received for special occasions.

- Proceeds from selling unused items or assets.

- Interest earned on savings accounts or investments that you decide to redirect.

- Any reimbursements or refunds from overpaid bills or services.

By consistently identifying and earmarking these funds, you create a steady stream of extra payments that, like the persistent flow of a river, gradually wears down the obstacles to your financial freedom.

Organizing a Plan for Consistently Applying Windfalls to the Mortgage

To maximize the impact of these unexpected financial gifts, a structured plan is essential. Without a clear strategy, windfalls can easily be absorbed into everyday spending, losing their potential to accelerate your mortgage payoff.A well-defined plan ensures that these funds are consistently directed towards your principal. This involves:

- Immediate Allocation: As soon as a windfall is received, earmark it specifically for your mortgage. Do not let it mingle with your regular income.

- Dedicated Account (Optional but Recommended): Consider setting up a separate savings account to temporarily hold windfalls before they are applied to the mortgage. This provides a visual reminder of your progress and prevents accidental spending.

- Direct Payment Method: When making the extra payment, ensure it is clearly designated as a principal-only payment. Contact your lender if necessary to confirm their process for applying extra payments to the principal.

- Regular Review: Periodically review your mortgage statement to track the impact of these extra payments. This can be a powerful motivator.

By following such a plan, you transform random windfalls into a predictable and powerful force for achieving your goal of paying off your 15-year mortgage in 7 years.

Optimizing Your Mortgage for Faster Payoff

Hoo, my kin! We have journeyed through the understanding of our goal and the readiness of our spirits and coffers. Now, let us speak of how to make our mortgage, that burden of years, a swifter journey, like a swift river flowing to the sea. This is about sharpening our tools, my brothers and sisters, making our mortgage work for us, not the other way around.The path to a faster payoff is not always a straight line.

Sometimes, it requires a strategic shift, a clever adjustment to the very contract that binds us to our homes. This section is about understanding these strategic moves, the nuances of changing our mortgage landscape to accelerate our freedom.

Refinancing for Accelerated Payoff

Refinancing is like finding a new, faster boat for our journey. It can dramatically alter the time it takes to reach our destination. By securing a new loan, we can either shorten the term of our repayment or reduce the interest we pay, or ideally, both. A shorter term means more of our monthly payment goes towards the principal, shaving years off the loan.

A lower interest rate means less money spent on interest over the life of the loan, freeing up funds that can be redirected to principal payments.The implications are significant. Imagine a 15-year mortgage at 6% interest. By refinancing to a 10-year term at 5%, even with a slightly higher monthly payment, the total interest paid over the life of the loan can be substantially less, and the payoff date arrives much sooner.

It’s a trade-off, often requiring a careful calculation of closing costs versus long-term savings.

Comparing Mortgage Products for Acceleration

When considering a refinance, the market offers a sea of options, like different paths through the forest. Not all paths lead to the same destination. We must be discerning, comparing not just the interest rate, but the term, the type of loan (fixed vs. adjustable), and any associated fees.Consider these aspects when comparing:

- Interest Rate: The percentage charged on the principal. A lower rate is always beneficial for faster payoff.

- Loan Term: The duration over which the loan is to be repaid. Shorter terms inherently accelerate payoff.

- Closing Costs: Fees associated with originating a new loan. These must be factored into the overall savings.

- Loan Type: Fixed-rate mortgages offer predictable payments, while adjustable-rate mortgages can fluctuate, potentially offering lower initial rates but carrying risk.

New Shorter-Term Mortgage Versus Accelerating Existing Loan

The decision between a new shorter-term mortgage and accelerating payments on our current loan is a crucial one, like choosing between building a new bridge or reinforcing the old one. Each has its merits. A new shorter-term mortgage, like a 10-year loan, forces a faster repayment schedule from the outset. Accelerating an existing loan, on the other hand, allows us to maintain our current payment structure while strategically adding extra principal payments.Here’s a comparison:

| Feature | New Shorter-Term Mortgage | Accelerating Existing Loan |

|---|---|---|

| Initial Payment | Potentially higher to accommodate shorter term. | Remains the same, with added principal payments. |

| Interest Savings | Significant due to shorter term and potentially lower rate. | Significant if consistent extra payments are made. |

| Flexibility | Less flexible once the new loan is secured. | More flexible; extra payments can be adjusted as needed. |

| Closing Costs | Incurred during refinance. | Typically none, unless specific features are added. |

Mortgage Assumptions and Transfers

In some rare instances, a mortgage assumption or transfer might present an opportunity for accelerated payoff, though this is less common in today’s market. A mortgage assumption allows a new buyer to take over the existing mortgage on a property. If the existing mortgage has favorable terms, such as a low interest rate or a shorter remaining term, this could, in theory, benefit the assuming party.

However, lenders often require strict qualification, and such provisions are not always permitted or advantageous for accelerating one’s own payoff unless it’s part of a strategic sale and repurchase. It’s a complex maneuver, akin to finding a hidden path that might not be well-trodden.

Advanced Techniques and Financial Planning

Having laid the groundwork and explored various strategies for accelerating your mortgage payoff, it is now time to delve into more sophisticated methods and meticulous planning. This section will equip you with advanced techniques that, when combined with a robust financial roadmap, will solidify your path to becoming mortgage-free within seven years, a feat worthy of a proud Batak warrior conquering a formidable challenge.

We will explore how to strategically manage multiple debts and harness the power of increased earnings to achieve your ambitious goal, ensuring your financial future is as secure as the ancestral lands of your forefathers.

Debt Snowball and Debt Avalanche Methods for Mortgage Payoff

When aiming to conquer multiple debts, including your primary mortgage, two popular, yet distinct, strategic approaches can be employed: the debt snowball and the debt avalanche. Both methods involve making minimum payments on all debts except one, on which you focus extra payments. The difference lies in the order of attack.The debt snowball method prioritizes paying off debts with the smallest balances first, regardless of interest rate.

This psychological approach provides quick wins and builds momentum as smaller debts are eliminated rapidly. Once a small debt is paid off, the payment amount from that debt is added to the minimum payment of the next smallest debt, creating a “snowball” effect.Conversely, the debt avalanche method prioritizes paying off debts with the highest interest rates first, regardless of balance.

This financially sound approach saves the most money on interest over time. Once the highest-interest debt is paid off, its payment amount is added to the minimum payment of the next highest-interest debt.For mortgage payoff, applying these methods can be nuanced. While the mortgage is often the largest debt, if you have other high-interest debts like credit cards or personal loans, it might be more financially prudent to tackle those first using the debt avalanche method before dedicating all extra funds to the mortgage.

However, if the mortgage interest rate is significantly higher than other debts, or if psychological motivation is paramount, the debt snowball can still be effective.

“The fastest way to reach the summit is not always the easiest, but it is always the most rewarding.”

Impact of Increasing Income Through Side Hustles or Career Advancement

A significant accelerant for any ambitious financial goal, including rapid mortgage payoff, is the strategic increase of your income. Pursuing side hustles or actively seeking career advancement can inject substantial funds into your payoff plan, dramatically shortening the timeline.Consider the power of a side hustle: imagine a skilled craftsman offering their services on weekends, a tech-savvy individual providing freelance IT support, or a culinary enthusiast selling homemade delicacies.

Even a few extra hundred dollars a month, consistently applied to your mortgage principal, can shave years off your loan. For example, an extra $500 per month on a $200,000, 15-year mortgage at 4% interest can reduce the payoff time by approximately 3 years and save over $20,000 in interest.Career advancement, through promotions, salary negotiations, or acquiring new, in-demand skills, offers a more substantial income boost.

A salary increase of 10-20% can translate into thousands of extra dollars annually. If you receive a promotion that adds $10,000 to your annual income, and you dedicate half of that ($5,000 annually, or about $417 per month) to your mortgage, the impact on a 15-year loan can be significant. For instance, on the same $200,000 mortgage at 4%, an additional $417 per month could reduce the payoff by nearly 2 years and save approximately $17,000 in interest.

Creating a Personalized Financial Roadmap for Achieving the 7-Year Payoff Goal

To navigate the journey towards a 7-year mortgage payoff, a well-defined and personalized financial roadmap is indispensable. This roadmap acts as your compass, ensuring every financial decision aligns with your ultimate objective.The first step is a thorough review of your current financial standing. This involves understanding your income, expenses, assets, and liabilities in detail. A budget is crucial here, not just for tracking spending, but for identifying areas where funds can be redirected towards extra mortgage payments.Next, set a clear, quantifiable goal.

For instance, if your mortgage balance is $250,000 with 15 years remaining at a 4% interest rate, your target is to pay it off in 7 years. This translates to a required monthly payment significantly higher than your current minimum. Using a mortgage payoff calculator, you can determine this exact figure. For this example, the minimum payment would be around $1,709.

To pay it off in 7 years, the required monthly payment would be approximately $3,255, meaning an additional $1,546 needs to be paid each month.Your roadmap should then detail the strategies you will employ to generate these extra funds. This might include:

- Identifying and cutting non-essential expenses.

- Allocating a specific portion of each paycheck to extra principal payments.

- Planning for and integrating income from side hustles or anticipated raises.

- Setting aside a small emergency fund to avoid derailing your payoff plan with unexpected costs.

A visual representation of this roadmap, perhaps a chart or spreadsheet, can serve as a constant reminder and motivator. Regularly review and adjust your roadmap as your financial situation evolves, ensuring you remain on track.

Organizing a Long-Term Financial Plan Integrating Accelerated Mortgage Payoff with Other Savings and Investment Goals

Achieving rapid mortgage payoff is a significant financial accomplishment, but it should not exist in isolation from your broader long-term financial aspirations. A comprehensive plan integrates accelerated mortgage payoff with other vital savings and investment goals, creating a robust financial future.Consider your retirement. While aggressively paying down your mortgage is commendable, neglecting retirement savings can have long-term consequences. The key is balance.

A common approach is to contribute enough to your employer-sponsored retirement plan (like a 401(k)) to receive the full employer match. This is essentially free money and should not be overlooked. Beyond the match, you can strategically allocate additional funds.Here’s a framework for integration:

- Prioritize the Employer Match: Always contribute enough to capture any employer match in your retirement accounts.

- Aggressive Mortgage Payments: Dedicate a significant portion of your extra income towards your mortgage principal to meet your 7-year goal.

- Balanced Retirement Contributions: Once the mortgage is on track, or if your income allows, increase retirement contributions beyond the match, especially if you are behind on retirement savings. Consider the tax advantages of retirement accounts.

- Other Savings Goals: Allocate funds for other important goals such as education for children, a down payment on a future investment property, or a substantial emergency fund (beyond what’s needed to protect your mortgage payoff).

A potential scenario might involve dedicating 60% of extra income to mortgage principal, 30% to retirement savings, and 10% to other short-term savings goals. As your income grows or your mortgage balance decreases, these percentages can be adjusted. For example, once the mortgage is paid off, the entire amount previously allocated to mortgage payments can be redirected towards retirement or other investment opportunities, significantly accelerating wealth accumulation.

This holistic approach ensures that while you are conquering your mortgage debt, you are also building a secure and prosperous future, a testament to wise financial stewardship.

Potential Pitfalls and Considerations

Batak elders have always taught us to look before we leap, especially when dealing with matters as significant as our homes. While the spirit to conquer debt swiftly is admirable, haste without foresight can lead to troubles as formidable as the debt itself. Therefore, understanding the hidden rocks and treacherous currents in this journey is as crucial as charting the course.The path to accelerated mortgage payoff is not a smooth, paved road for everyone.

Many a brave soul has stumbled due to common oversights. These can range from neglecting essential financial buffers to overextending one’s cash flow, creating a precarious situation. It is wise to learn from the experiences of others and fortify our approach against these potential challenges.

Common Mistakes to Avoid

The pursuit of rapid debt reduction can sometimes blind us to fundamental financial prudence. Many fall into traps that, while seemingly minor at first, can have significant repercussions down the line. Recognizing these pitfalls beforehand allows us to steer clear of them, ensuring our journey is not only swift but also secure.Here are some common missteps that can hinder your accelerated mortgage payoff plan:

- Underestimating the importance of a robust emergency fund. Some borrowers deplete their savings to make extra payments, leaving them vulnerable to unexpected expenses like job loss or medical emergencies.

- Neglecting essential living expenses and discretionary spending. Sacrificing too much can lead to burnout and a feeling of deprivation, making it difficult to sustain the payoff plan long-term.

- Failing to account for property taxes and homeowner’s insurance in the accelerated payment strategy. These are critical expenses that must be managed alongside the principal reduction.

- Not verifying that extra payments are applied directly to the principal balance. Some lenders may misapply these payments, leading to unintended consequences and slower payoff.

- Ignoring the impact of interest rate fluctuations on variable-rate mortgages when making extra payments. This can complicate payoff calculations and strategies.

Maintaining an Emergency Fund

Just as a strong house needs a solid foundation, a secure financial life requires a buffer against unforeseen storms. An emergency fund acts as this crucial safety net. While the allure of a debt-free home is strong, sacrificing your emergency savings to achieve it is akin to building a beautiful house on sand.The purpose of an emergency fund is to cover unexpected expenses without derailing your primary financial goals, including your mortgage payoff.

This fund should ideally cover three to six months of essential living expenses. Without it, any significant disruption, such as a medical bill or a period of unemployment, could force you to pause your extra mortgage payments or even take on new debt, thus setting back your progress.

Managing Cash Flow During Payoff

The rhythm of your finances, your cash flow, is the heartbeat of your household. When you commit to making extra mortgage payments, you are intentionally altering this rhythm. It is vital to ensure this new tempo is sustainable and does not strain your household to the breaking point.A careful examination of your income and expenses is paramount. This involves tracking every coin and note to understand where your money goes.

Once you have a clear picture, you can identify areas where spending can be reduced without causing undue hardship. This freed-up cash can then be strategically directed towards your mortgage.Here are key aspects of managing cash flow for accelerated payoff:

- Budgeting with Precision: Create a detailed budget that allocates funds for all essential expenses, savings, and your extra mortgage payment.

- Identifying Non-Essential Spending: Review discretionary spending habits, such as dining out, entertainment, and subscriptions, and determine where cuts can be made.

- Automating Savings and Payments: Set up automatic transfers for your emergency fund contributions and extra mortgage payments to ensure consistency.

- Regular Review and Adjustment: Periodically review your budget and cash flow to make necessary adjustments as your income or expenses change.

Communicating with Your Mortgage Lender, How to pay off 15 year mortgage in 7 years

Your mortgage lender is not an adversary but a partner in your homeownership journey. Open and clear communication with them is essential, especially when you plan to make extra payments. This ensures your intentions are understood and executed correctly.When making extra payments, it is crucial to specify that the additional amount should be applied directly to the principal balance. Some lenders may automatically apply extra payments to the next scheduled payment, which does not accelerate your payoff.

Always confirm this with your lender.Here’s how to effectively communicate with your mortgage lender:

- Read Your Mortgage Agreement Carefully: Understand the terms and conditions regarding extra payments and any associated fees.

- Contact Your Lender Directly: Before making your first extra payment, call or write to your lender to inform them of your intention.

- Specify Principal Application: Clearly state that any additional funds should be applied to the principal balance and not towards future interest or payments.

- Request Written Confirmation: Ask for written confirmation from your lender that your extra payments are being applied correctly to the principal.

- Regularly Review Statements: Scrutinize your monthly mortgage statements to ensure that extra payments are accurately reflected and applied as intended.

Visualizing Progress and Motivation

Tarlangon do hita, ale dongan, ia da hita mambahen langka na gok gogo asa sahat hita di pitu taon jala ndang na sampulu lima taon dope di hutanta i. Na laho manatap hamajuon i, ima na gabe sangap dohot parohon ni rohanta, asa unang gabe tarhatop hita. Hita ma mambahen angka gambaran na boi tapangan roha, asa gabe margogo hita di parjalanan na gok ngolu on.Angka cara na laho mambahen hita gabe marsigogo di parjalanan on, ima na laho manatap hamajuon dohot mambahen angka horbo na laho patolhas hita di parjalanan on.

Ima na gabe sangap dohot parohon ni rohanta, asa unang gabe tarhatop hita. Hita ma mambahen angka gambaran na boi tapangan roha, asa gabe margogo hita di parjalanan na gok ngolu on.

Progress Tracker Design

Angka gambaran hamajuon na laho patolhas hita di parjalanan on, ima na gabe sangap dohot parohon ni rohanta, asa unang gabe tarhatop hita. Hita ma mambahen angka gambaran na boi tapangan roha, asa gabe margogo hita di parjalanan na gok ngolu on. Dibagasan tabel on, tapindangi do angka naung taulahon dohot angka na laho taparade.

| Bulan/Taon | Jumlah Pokok Hutang | Jumlah Bunga | Total Pembayaran | Sisa Pokok Hutang |

|---|---|---|---|---|

| Bulan 1 / Taon 1 | Rp X.XXX.XXX | Rp XXX.XXX | Rp X.XXX.XXX | Rp XX.XXX.XXX |

| Bulan 12 / Taon 1 | Rp X.XXX.XXX | Rp XXX.XXX | Rp X.XXX.XXX | Rp XX.XXX.XXX |

| Bulan 12 / Taon 7 | Rp 0 | Rp 0 | Rp X.XXX.XXX | Rp 0 |

Tapukka ma dohot gambaran na boi tapangan roha, songon gambaran ni bagas naung maradian jala tois jala tois dohot hita. Songon i do dohot di parjalanan ni hutanta, tapukka ma dohot angka gambaran na boi tapangan roha, asa unang gabe tarhatop hita.

Motivational Techniques for Accelerated Payments

Angka cara na laho mambahen hita gabe marsigogo di parjalanan on, ima na laho manatap hamajuon dohot mambahen angka horbo na laho patolhas hita di parjalanan on. Ima na gabe sangap dohot parohon ni rohanta, asa unang gabe tarhatop hita. Hita ma mambahen angka gambaran na boi tapangan roha, asa gabe margogo hita di parjalanan na gok ngolu on.

- Visualisasi Kebebasan Finansial: Bayangkan perasaan lega dan bangga saat rumah Anda benar-benar menjadi milik Anda sepenuhnya, jauh sebelum waktunya. Gambarkan bagaimana Anda bisa menggunakan dana yang sebelumnya dialokasikan untuk cicilan KPR untuk tujuan lain yang lebih memberdayakan, seperti investasi, liburan keluarga, atau membantu orang tua.

- Perayaan Pencapaian Kecil: Tetapkan target-target kecil yang dapat dicapai di sepanjang jalan. Misalnya, ketika Anda berhasil membayar sejumlah tertentu dari pokok hutang atau mencapai setengah jalan dari target 7 tahun Anda. Rayakan pencapaian ini dengan cara yang sederhana namun bermakna, seperti makan malam bersama keluarga atau membeli sesuatu yang Anda inginkan sebagai apresiasi atas kerja keras Anda.

- Dukungan Komunitas: Bagikan tujuan Anda dengan pasangan, keluarga, atau teman dekat yang dapat memberikan dukungan moral. Terkadang, sekadar mengetahui ada orang lain yang mendukung dan percaya pada kemampuan Anda dapat menjadi motivasi yang luar biasa. Pertimbangkan juga untuk bergabung dengan forum online atau grup keuangan yang memiliki tujuan serupa.

- Edukasi Berkelanjutan: Teruslah belajar tentang strategi pengelolaan keuangan yang lebih baik. Semakin Anda memahami bagaimana uang bekerja dan bagaimana mengoptimalkan pendapatan serta pengeluaran Anda, semakin besar motivasi Anda untuk terus maju. Baca buku, ikuti seminar, atau dengarkan podcast tentang keuangan pribadi.

The Feeling of Mortgage Freedom

Nunga sahat ma hita di parhepengon na tois, ima na laho manatap hamajuon dohot mambahen angka horbo na laho patolhas hita di parjalanan on. Ima na gabe sangap dohot parohon ni rohanta, asa unang gabe tarhatop hita. Hita ma mambahen angka gambaran na boi tapangan roha, asa gabe margogo hita di parjalanan na gok ngolu on.Bayangkan hari di mana Anda melakukan pembayaran KPR terakhir Anda, bukan setelah 15 tahun, tetapi setelah 7 tahun.

Rasanya seperti beban berat terangkat dari pundak Anda. Ada kelegaan yang mendalam, rasa pencapaian yang luar biasa, dan kebebasan finansial yang belum pernah Anda rasakan sebelumnya. Rumah Anda sepenuhnya milik Anda, bebas dari hutang. Anda bisa tidur nyenyak di malam hari, mengetahui bahwa Anda telah mencapai tujuan besar ini melalui disiplin dan kerja keras. Perasaan ini adalah buah manis dari perencanaan yang matang dan eksekusi yang gigih.

Celebrating Milestones

Angka cara na laho mambahen hita gabe marsigogo di parjalanan on, ima na laho manatap hamajuon dohot mambahen angka horbo na laho patolhas hita di parjalanan on. Ima na gabe sangap dohot parohon ni rohanta, asa unang gabe tarhatop hita. Hita ma mambahen angka gambaran na boi tapangan roha, asa gabe margogo hita di parjalanan na gok ngolu on.Merayakan setiap tonggak pencapaian adalah kunci untuk menjaga momentum dan semangat.

Ketika Anda berhasil mengurangi pokok hutang KPR Anda hingga setengahnya, atau ketika Anda mencapai akhir tahun pertama dengan pembayaran ekstra yang signifikan, itu adalah momen yang patut dirayakan.

- Perayaan Kecil di Rumah: Siapkan makan malam spesial bersama keluarga, nikmati hidangan penutup favorit Anda, atau adakan malam permainan yang menyenangkan.

- Investasi dalam Diri Sendiri: Gunakan sebagian kecil dari dana yang Anda hemat dari pembayaran KPR ekstra untuk membeli buku yang sudah lama Anda inginkan, mengikuti kursus singkat yang menarik minat Anda, atau membeli perlengkapan hobi baru.

- Liburan Singkat: Jika anggaran memungkinkan, rencanakan liburan akhir pekan singkat ke tempat yang belum pernah Anda kunjungi. Ini bisa menjadi penyegaran yang sangat dibutuhkan dan pengingat akan kebebasan yang Anda perjuangkan.

- Berbagi Kebahagiaan: Bagikan kabar baik dan pencapaian Anda dengan orang-orang terdekat. Ini tidak hanya akan membuat mereka ikut senang, tetapi juga bisa menginspirasi orang lain untuk mengambil langkah serupa.

End of Discussion

So there you have it – a comprehensive guide to conquering your 15-year mortgage in a mere 7 years! We’ve journeyed from understanding the sheer awesomeness of mortgage freedom to dissecting practical payment strategies, leveraging those unexpected windfalls, and even optimizing your loan itself. Remember, this isn’t just about crunching numbers; it’s about building momentum, staying motivated, and ultimately, achieving a monumental financial victory.

Go forth, implement these tactics, and get ready to celebrate that sweet, sweet mortgage-free life years ahead of schedule!

FAQ Overview

What’s the biggest financial benefit of paying off a 15-year mortgage in 7 years?

The biggest financial perk is the colossal amount of interest you’ll save. By cutting your loan term in half, you dramatically reduce the total interest paid over the life of the loan, putting that money back into your pocket or towards other financial goals.

How can I be sure my extra payments are going to the principal?

Always specify with your lender that extra payments are to be applied directly to the principal. You can often do this by writing a note on your check or through your online payment portal. It’s crucial to get this in writing and confirm it.

Is it always a good idea to refinance to a shorter term to pay off my mortgage faster?

Refinancing to a shorter term can accelerate payoff, but it often comes with higher monthly payments. You’ll need to weigh this against your budget and compare the new interest rate and fees to your current mortgage to ensure it’s truly beneficial.

What’s the difference between the debt snowball and debt avalanche methods for mortgage payoff?

The debt snowball method focuses on paying off smaller debts first for psychological wins, while the debt avalanche method prioritizes debts with the highest interest rates to save the most money over time. For mortgages, the avalanche method is generally more financially efficient.

How important is an emergency fund when making extra mortgage payments?

Maintaining a healthy emergency fund is absolutely critical. You don’t want to be forced to dip back into your mortgage or take on high-interest debt if an unexpected expense arises. Aim for 3-6 months of living expenses.