How to pay off $110 000 mortgage in 5 years is a bold financial ambition, one that promises significant interest savings and a clear path to homeownership freedom. This journey, while demanding, is achievable with strategic planning, disciplined execution, and a clear understanding of the financial mechanics involved. It’s about transforming a long-term commitment into a short-term victory, unlocking substantial financial benefits and peace of mind.

Embarking on a mission to eliminate a $110,000 mortgage in just five years requires a comprehensive understanding of your financial landscape. This involves dissecting the total repayment obligation, including both principal and interest, and recognizing the powerful impact of “interest savings” that aggressive repayment unlocks. Beyond the numbers, it demands a strong psychological commitment, a robust motivation to stay the course through inevitable challenges and temptations to deviate from the plan.

Understanding the Goal: Paying Off $110,000 Mortgage in 5 Years

Accelerating the repayment of a substantial mortgage, such as $110,000, within an aggressive timeframe of five years presents a significant financial challenge. This objective necessitates a strategic and disciplined approach to personal finance, involving a deep understanding of the loan’s structure, the total financial commitment, and the tangible benefits of early payoff. Successfully achieving this goal requires not only financial acumen but also considerable mental fortitude and unwavering commitment.The core financial challenge lies in the sheer volume of payments required over a condensed period.

A typical mortgage payment is amortized over a longer term, meaning a larger portion of early payments goes towards interest. To pay off the principal significantly faster, the borrower must allocate substantially more funds towards the mortgage than the minimum required by the original loan agreement. This requires a meticulous review of income, expenses, and the identification of surplus funds that can be redirected towards debt reduction.

Total Principal and Interest Obligation Over Five Years

To accurately gauge the financial commitment, it’s crucial to calculate the total amount of principal and interest that would be paid if the $110,000 mortgage were paid off within five years. This calculation is highly dependent on the prevailing interest rate. For illustrative purposes, let’s consider a hypothetical scenario with a fixed interest rate of 5% APR.The monthly payment for a $110,000 loan at 5% APR over 5 years can be calculated using a standard mortgage payment formula.

The formula for the monthly payment (M) is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:P = Principal loan amount ($110,000)i = Monthly interest rate (Annual rate / 12)n = Total number of payments (Loan term in years – 12)For a 5-year term (n = 60 months) and a 5% annual interest rate (i = 0.05 / 12 ≈ 0.00416667):

M = 110,000 [ 0.00416667(1 + 0.00416667)^60 ] / [ (1 + 0.00416667)^60 – 1]M ≈ $2,065.54

Therefore, the total amount paid over five years would be:

Total Paid = Monthly Payment

Number of Months

Total Paid = $2,065.54 – 60Total Paid ≈ $123,932.40

This means that within the five-year timeframe, approximately $110,000 would be the principal repayment, and the remaining amount, roughly $13,932.40, would be the total interest paid. This figure is significantly lower than the interest paid over a standard 30-year term, highlighting the substantial financial benefit of accelerated repayment.

Concept of Interest Savings and Aggressive Repayment

The concept of “interest savings” is the direct financial advantage gained by paying off a loan faster than originally scheduled. When a borrower makes additional payments beyond the minimum required, these extra funds are applied directly to the principal balance of the loan. This reduction in the principal balance means that less money accrues interest over the remaining life of the loan.

The more aggressive the repayment strategy, the greater the principal reduction, and consequently, the more substantial the interest savings.To quantify this, consider the same $110,000 mortgage at 5% APR. If this loan were paid over a standard 30-year term (360 months), the monthly payment would be approximately $589.12. The total paid over 30 years would be around $212,083.20, with approximately $102,083.20 in interest.

Comparing this to the 5-year payoff scenario where total interest paid is around $13,932.40, the interest savings are immense, in the order of $88,150.80. This stark difference underscores the power of aggressive principal reduction.

Psychological Impact and Motivation for Aggressive Repayment

Embarking on a mission to pay off a $110,000 mortgage in just five years is not merely a financial exercise; it is a significant psychological undertaking. The required commitment demands a high level of discipline, sacrifice, and sustained motivation. The psychological impact of such a goal can be both challenging and empowering.Initially, the sheer magnitude of the required monthly payments can be daunting.

This often necessitates lifestyle adjustments, such as reducing discretionary spending, delaying major purchases, and potentially seeking additional income streams. The psychological toll of these sacrifices can lead to feelings of deprivation or burnout if not managed effectively.However, the psychological rewards can be equally profound. The sense of accomplishment and financial freedom that comes with accelerated debt elimination is a powerful motivator.

Visualizing the shrinking principal balance and the accumulating interest savings can foster a sense of control and progress. Many individuals find that the discipline learned during aggressive debt repayment spills over into other areas of their financial lives, leading to long-term positive habits. Maintaining motivation often involves:

- Setting clear, short-term milestones and celebrating their achievement.

- Regularly reviewing progress and reinforcing the “why” behind the goal.

- Finding an accountability partner or community for support.

- Focusing on the long-term benefits of financial freedom and reduced stress.

- Practicing gratitude for the current financial situation and the ability to make these changes.

The psychological journey is as critical as the financial planning. A strong mental framework, coupled with a clear understanding of the financial benefits, is essential for navigating the demands of paying off a significant mortgage in an accelerated timeframe.

Calculating Required Monthly Payments

Achieving the ambitious goal of paying off a $110,000 mortgage in just five years necessitates a significant increase in monthly payments compared to a traditional amortization schedule. This accelerated repayment strategy requires a precise understanding of the financial commitment involved, factoring in both the principal balance and the accrued interest. The following sections will detail the required monthly payments for various interest rates, illustrate the impact of accelerated payments on an amortization schedule, and provide a step-by-step guide to calculating these payments manually.

Monthly Payment Requirements for Accelerated Mortgage Payoff

To illustrate the financial commitment, consider the following table which Artikels the approximate monthly payments required to pay off a $110,000 mortgage within a 5-year term at different interest rates. These figures are crucial for financial planning and budgeting to ensure the aggressive payoff goal is attainable.

| Assumed Annual Interest Rate | Required Monthly Payment |

|---|---|

| 4.0% | $2,052.71 |

| 5.0% | $2,097.69 |

| 6.0% | $2,143.48 |

The figures presented in the table are derived from standard mortgage amortization calculations. For instance, a 4.0% interest rate on $110,000 over 5 years (60 months) results in a monthly payment of approximately $2,052.71. As the interest rate increases, so does the required monthly payment to achieve the same 5-year payoff period, reflecting the higher cost of borrowing.

Amortization Schedule Dynamics with Accelerated Payments

An amortization schedule details how each mortgage payment is allocated between principal and interest over the life of the loan. When significantly higher payments are made, as required for a 5-year payoff, the amortization schedule undergoes a dramatic transformation. In a standard mortgage, the early payments are heavily weighted towards interest, with only a small portion reducing the principal. However, with accelerated payments, a much larger proportion of each payment is applied directly to the principal balance from the outset.

This has a profound effect on the loan’s lifecycle, as a reduced principal balance means less interest accrues in subsequent periods, further accelerating the payoff process. The majority of the loan’s principal is extinguished in the early years, rather than being spread evenly over a longer term.

Manual Calculation of Required Monthly Mortgage Payment

Calculating the required monthly mortgage payment manually involves using a specific financial formula. This formula, often referred to as the mortgage payment formula, takes into account the principal loan amount, the interest rate, and the loan term. Understanding this calculation provides a clear insight into the financial mechanics of mortgage repayment.The standard formula for calculating the monthly payment (M) of a loan is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount ($110,000)

- i = Monthly Interest Rate (Annual Rate / 12)

- n = Total Number of Payments (Loan Term in Years

- 12)

To illustrate with an example, let’s calculate the monthly payment for a $110,000 loan at 5% annual interest over 5 years (60 months):

1. Determine the monthly interest rate (i)

Annual rate = 5.0% or 0.05 Monthly rate (i) = 0.05 / 12 ≈ 0.00416667

2. Determine the total number of payments (n)

Loan term = 5 years Total payments (n) = 512 = 60

3. Plug the values into the formula

M = 110,000 [ 0.00416667(1 + 0.00416667)^60 ] / [ (1 + 0.00416667)^60 – 1] M = 110,000 [ 0.00416667(1.00416667)^60 ] / [ (1.00416667)^60 – 1] M = 110,000 [ 0.00416667 – 1.2833586 ] / [ 1.2833586 – 1] M = 110,000 [ 0.00534733 ] / [ 0.2833586 ] M = 110,000 – 0.0188712 M ≈ $2,075.83

(Note

Minor variations may occur due to rounding in intermediate steps. The table value of $2,097.69 is likely derived from a more precise calculator or a slightly different rounding methodology, emphasizing the importance of using precise figures for financial accuracy.)*

Comparison to a Standard 30-Year Mortgage Payment

The financial implications of accelerating a mortgage payoff become starkly evident when comparing the required 5-year payment to that of a standard 30-year mortgage. For a $110,000 loan at a 5% annual interest rate over 30 years, the typical monthly payment would be approximately $589.76. This significant difference highlights the substantial financial discipline and increased cash flow required to achieve the 5-year payoff goal.

The 30-year payment includes a much larger proportion of interest over its lifespan, and the principal reduction is spread over a considerably longer period. The 5-year payment, while much higher monthly, results in substantially less total interest paid over the life of the loan, offering significant long-term savings.

Strategies for Increasing Payment Amounts

Achieving the ambitious goal of paying off a $110,000 mortgage in just five years necessitates a proactive and disciplined approach to increasing your monthly payments. This goes beyond simply making the minimum payment; it requires actively generating additional funds and strategically allocating them towards your principal balance. This section will delve into actionable methods for augmenting your mortgage payments, encompassing income enhancement, expense reduction, and the judicious use of financial windfalls.

Optimizing Extra Payments

Effectively managing extra payments is a critical component of accelerating your mortgage payoff timeline. These additional contributions directly reduce the principal balance, thereby diminishing the total interest paid over the life of the loan and shortening the repayment period. Understanding the nuances of how these extra payments are applied and the policies of your lender can significantly enhance their impact.

Financial Planning and Risk Management

Aggressively paying off a substantial mortgage like $110,000 in just five years requires a disciplined and strategic approach to personal finance. While the primary goal is debt elimination, neglecting other crucial financial planning aspects can introduce significant risks. A robust financial plan during this period must balance accelerated debt repayment with essential safety nets and a clear understanding of opportunity costs.

This section delves into the critical elements of managing your finances effectively while on this ambitious debt-reduction journey.A common pitfall when focusing intensely on debt payoff is the underestimation of unforeseen financial emergencies. Life, however, remains unpredictable, and maintaining adequate financial buffers is not a luxury but a necessity, even when channeling significant funds towards mortgage reduction. This proactive approach safeguards against derailing your debt-free aspirations due to unexpected events.

Emergency Fund Importance

An emergency fund serves as a critical financial shock absorber, providing liquidity to cover unexpected expenses without resorting to high-interest debt or liquidating long-term investments at inopportune times. For individuals aggressively paying down a mortgage, the temptation to divert all surplus cash to debt repayment can be strong. However, depleting savings to zero or near-zero levels leaves one vulnerable to a cascade of negative financial consequences.

An adequately funded emergency fund typically covers three to six months of essential living expenses. This buffer is essential for covering job loss, medical emergencies, significant home repairs not covered by insurance, or urgent family needs. Without it, any of these events could force a pause or reversal of the debt payoff plan, potentially incurring penalties or increased interest costs if credit cards or personal loans are used to bridge the gap.

Risks of Depleting Savings

The pursuit of rapid mortgage payoff can introduce considerable financial risk if savings are excessively depleted. This strategy leaves individuals in a precarious position where a single, unforeseen event can trigger a financial crisis. For instance, a sudden job loss without an emergency fund could lead to the inability to make mortgage payments, potentially resulting in foreclosure. Similarly, a major health issue could incur substantial medical bills, forcing the sale of assets or taking on new, high-interest debt, thereby undoing years of diligent savings and debt reduction efforts.

The psychological toll of living with minimal financial reserves can also be significant, leading to increased stress and anxiety.

Insurance Coverage Considerations

During an intense debt payoff period, reviewing and potentially adjusting life insurance and disability insurance coverage is paramount. These forms of insurance act as crucial risk management tools, protecting your financial plan and your dependents from catastrophic financial loss.

- Life Insurance: If dependents rely on your income, life insurance ensures that your mortgage and other financial obligations can be met in the event of your premature death. While aggressively paying down the mortgage reduces the total debt burden, a significant outstanding balance still exists. Adequate life insurance coverage provides a safety net, preventing your family from being burdened with the remaining debt or facing financial hardship.

The coverage amount should ideally be sufficient to cover the outstanding mortgage balance, replace lost income for a period, and fund other essential family expenses.

- Disability Insurance: Income is the engine driving the aggressive mortgage payoff. Disability insurance protects this engine. If you become unable to work due to illness or injury, disability insurance replaces a portion of your lost income, enabling you to continue making your mortgage payments and cover essential living expenses. Without this coverage, a disabling event could halt your debt repayment progress and force you to draw from any remaining savings, potentially jeopardizing your financial stability.

Opportunity Cost of Mortgage Payments

The decision to allocate all available extra funds towards mortgage repayment involves a significant opportunity cost. This refers to the potential benefits missed from alternative uses of those funds, primarily investing. While paying off a mortgage offers a guaranteed return in the form of saved interest, this return is often lower than the potential returns from diversified investment portfolios, especially in a strong market.

Opportunity Cost = Value of the Next Best Alternative Forgone

For example, if your mortgage interest rate is 4%, paying it off provides a guaranteed 4% “return” by avoiding interest payments. However, historically, the stock market has yielded average annual returns of around 7-10% over the long term. By dedicating all extra funds to the mortgage, you forgo these potentially higher investment returns. This decision is a trade-off between the certainty of debt freedom and the potential for wealth accumulation through investment.

A balanced approach might involve making extra mortgage payments while also contributing to retirement accounts or other investment vehicles, depending on individual risk tolerance, time horizon, and financial goals. For instance, a young individual with a long time horizon might prioritize investing for higher potential growth, while someone nearing retirement might favor the security of a debt-free home.

| Scenario | Action | Potential Outcome | Risk |

|---|---|---|---|

| Aggressive Mortgage Payoff | Allocate all extra funds to mortgage principal. | Mortgage paid off in 5 years, guaranteed interest savings. | Depleted emergency fund, missed investment growth, vulnerability to unexpected events. |

| Balanced Approach | Allocate a portion to mortgage principal, a portion to investments (e.g., retirement accounts). | Slower mortgage payoff, potential for investment growth, maintained emergency fund. | Lower guaranteed return than full mortgage payoff, market volatility affecting investments. |

| Prioritize Investing | Allocate extra funds primarily to investments, make minimum mortgage payments. | Potentially higher overall wealth accumulation, mortgage remains longer. | Significant interest paid on mortgage, higher risk if investment performance is poor. |

Mortgage Features and Options: How To Pay Off 0 000 Mortgage In 5 Years

Understanding the specific features and available options within your mortgage agreement is paramount to effectively accelerating your payoff timeline. Not all mortgages are structured identically, and certain characteristics can significantly impact your ability to make extra payments and the overall cost of your loan. This section delves into how to leverage existing or alternative mortgage products and features to meet your aggressive five-year payoff goal.

Leveraging Shorter-Term Fixed-Rate Mortgage Products

A 15-year fixed-rate mortgage, or any similar shorter-term loan product, inherently facilitates faster principal repayment compared to its longer-term counterparts. By design, these loans require higher monthly payments, which directly translate to a quicker amortization schedule. If you are considering a new mortgage or have the option to switch, a 15-year term would significantly shorten the duration to pay off $110,000, often requiring payments that align with or are only slightly higher than what might be needed for a 30-year loan with aggressive extra payments.

For example, a $110,000 loan at a 6% interest rate:

- A 30-year term would have a principal and interest payment of approximately $659.44.

- A 15-year term would have a principal and interest payment of approximately $891.04.

While the monthly payment is higher by about $231.60, the loan is paid off in half the time, and the total interest paid over the life of the loan is substantially reduced. Opting for a shorter term from the outset is often the most straightforward strategy if your financial capacity supports the higher monthly outlay.

Refinancing to a Shorter Mortgage Term

Refinancing involves replacing your current mortgage with a new one, often to secure a lower interest rate or to change the loan term. To accelerate your payoff, you would refinance into a mortgage with a shorter term, such as 15 or 10 years. The process typically involves a new loan application, underwriting, and closing costs, which can include appraisal fees, title insurance, origination fees, and recording fees.

These costs can range from 2% to 6% of the loan amount. For a $110,000 mortgage, this could mean an additional $2,200 to $6,600 in upfront expenses. However, if the new loan offers a significantly lower interest rate and the refinance costs are outweighed by the savings in interest and the accelerated payoff, it can be a beneficial strategy. It is crucial to conduct a thorough cost-benefit analysis, comparing the total interest paid on your current loan versus the new loan, including all refinance expenses.

Advantages of Mortgages Without Prepayment Penalties

A mortgage product that has no prepayment penalties is highly advantageous for individuals aiming to pay off their loan ahead of schedule. Prepayment penalties are fees charged by some lenders if you pay off your mortgage loan, or a significant portion of it, before the scheduled maturity date. These penalties can be structured as a percentage of the outstanding balance or a set number of months’ worth of interest.

For example, a 1% penalty on a remaining balance of $100,000 would cost $1,000. By avoiding these penalties, you are free to make as many extra principal payments as your budget allows without incurring additional costs, maximizing the efficiency of your accelerated payoff strategy. This flexibility is critical for achieving a five-year goal, as it allows for consistent and substantial principal reduction.

Extra Payments on Variable-Rate vs. Fixed-Rate Mortgages

Making extra payments is a cornerstone of accelerated mortgage payoff, but its impact can differ between variable-rate and fixed-rate mortgages.

- Fixed-Rate Mortgage: On a fixed-rate mortgage, every extra dollar paid directly reduces the principal balance. Since the interest rate is constant, a larger principal reduction means less interest will accrue over the remaining life of the loan, and the loan will be paid off faster. The benefit is predictable and directly proportional to the extra amount paid.

- Variable-Rate Mortgage (ARM): With a variable-rate mortgage, the interest rate fluctuates based on an underlying index. When making extra payments on an ARM, the effect on principal reduction is also direct. However, the long-term benefit of these extra payments can be amplified or diminished by future interest rate changes. If rates rise, the extra payments will save you more on interest because they reduce the principal on which higher future interest would be calculated.

Conversely, if rates fall, the savings from extra payments might be less dramatic, but they still contribute to faster principal payoff.

The primary advantage of making extra payments on a variable-rate mortgage, especially if rates are expected to rise, is the potential for greater overall interest savings compared to a fixed-rate mortgage, as you are reducing the principal on which higher future interest would be calculated. However, the predictability of savings is lower with an ARM. For a guaranteed five-year payoff, a fixed-rate mortgage with consistent extra payments offers more certainty.

Lifestyle Adjustments and Mindset

Achieving an aggressive mortgage payoff goal like eliminating $110,000 in five years necessitates a significant recalibration of personal finances and, more importantly, a robust mental framework. This phase focuses on cultivating the internal discipline and making tangible external changes required to sustain the financial momentum generated by earlier strategies. It’s about transforming the aspiration into a lived reality through conscious choices and consistent reinforcement.The psychological aspect of such an ambitious undertaking cannot be overstated.

Without a strong mindset, even the most meticulously planned financial strategies can falter under the weight of temptation or the perception of deprivation. This section aims to equip individuals with the tools to not only endure but thrive during this period of intense financial focus, ensuring long-term commitment and a positive outlook.

Motivational Framework for a 5-Year Payoff Goal

Establishing a compelling motivational framework is crucial for maintaining unwavering commitment over a five-year period. This involves deeply understanding the “why” behind the goal and translating it into tangible motivators that can be accessed during moments of doubt or fatigue. A well-defined framework provides the psychological scaffolding necessary to navigate the challenges inherent in accelerated debt repayment.The effectiveness of motivation is amplified when it is personalized and consistently reinforced.

This can involve visualizing the future benefits of being debt-free, celebrating milestones, and creating a support system. The goal is to foster an environment where financial discipline feels less like a sacrifice and more like a purposeful pursuit of freedom and security.

- Visualize the End Goal: Regularly imagine the feeling of making the final mortgage payment and the subsequent freedom from this significant financial obligation. This could involve creating a vision board with images representing debt-free living, such as a clear financial statement or images of desired future investments or experiences.

- Define Your “Why”: Articulate the core reasons for wanting to pay off the mortgage early. This might include financial independence, increased disposable income for other goals (e.g., early retirement, travel, investing), or reducing stress. Write these reasons down and refer to them frequently.

- Break Down the Goal into Milestones: Divide the five-year goal into smaller, manageable yearly, quarterly, or even monthly targets. Achieving these smaller milestones provides a sense of accomplishment and momentum, making the overall goal feel less daunting. For instance, aiming to pay off $22,000 per year ($110,000 / 5 years) can be broken down into paying off approximately $1,833 per month in addition to the regular payment.

- Celebrate Progress: Acknowledge and celebrate the achievement of each milestone. These celebrations should be proportionate to the achievement and should not derail the overall financial plan. For example, after successfully hitting a yearly payoff target, a small, pre-budgeted celebratory meal or a modest purchase of something desired could be appropriate.

- Seek Accountability: Share your goal with a trusted partner, family member, or a financial accountability group. Regular check-ins with an accountability partner can provide encouragement and help you stay on track.

Practical Tips for Reducing Discretionary Spending

Reducing discretionary spending is a cornerstone of accelerating mortgage payoff. This involves a strategic re-evaluation of non-essential expenses, identifying areas where savings can be maximized without significantly impacting overall quality of life. The key is to differentiate between genuine needs and wants, and to find creative ways to fulfill desires more affordably.The process of cutting back should be approached with a problem-solving mindset rather than one of deprivation.

By understanding the true cost of each discretionary item and its impact on the payoff timeline, individuals can make informed decisions that align with their financial objectives.

- Track Every Expense: For at least one month, meticulously track all spending to understand exactly where money is going. Use budgeting apps, spreadsheets, or a simple notebook. This awareness is the first step to identifying areas for reduction.

- Analyze Subscription Services: Review all recurring subscriptions (streaming services, gym memberships, software, magazines). Cancel those that are not frequently used or are redundant. Consider sharing accounts where permissible.

- Reduce Dining Out and Takeaway: Eating out is a significant discretionary expense for many. Plan meals, cook at home more often, and pack lunches for work. When dining out, look for happy hour deals, coupons, or opt for less expensive restaurants.

- Re-evaluate Entertainment Habits: Explore free or low-cost entertainment options. This could include visiting local parks, attending free community events, borrowing books and movies from the library, or hosting game nights at home instead of going to paid venues.

- Smart Shopping for Necessities: While focusing on discretionary spending, also optimize spending on essential items. This includes buying generic brands, shopping sales and using coupons, buying in bulk for non-perishables, and avoiding impulse purchases.

- Delay Non-Essential Purchases: For larger non-essential purchases, implement a waiting period (e.g., 30 days). This allows time to assess if the purchase is truly necessary and if the desire persists. Often, the urge to buy will pass.

- Transportation Optimization: If possible, explore ways to reduce transportation costs. This might involve carpooling, using public transport more frequently, combining errands to reduce driving, or maintaining your vehicle for better fuel efficiency.

Importance of Regular Financial Check-ins and Progress Tracking

Consistent monitoring of financial progress is paramount to staying motivated and ensuring the chosen strategies are effective. Regular check-ins allow for timely adjustments, identification of potential roadblocks, and reinforcement of the commitment to the goal. Without this oversight, even the best-laid plans can drift off course.These check-ins serve as a critical feedback loop, providing tangible evidence of progress and highlighting areas that may require more attention.

They transform abstract financial goals into concrete, measurable achievements, fostering a sense of control and empowerment.

- Schedule Dedicated Time: Set aside specific times for financial reviews. This could be weekly for detailed transaction review, monthly for budget vs. actual analysis, and quarterly for a broader assessment of progress towards the 5-year goal.

- Utilize Budgeting Tools: Employ budgeting software or apps that automatically track spending, categorize expenses, and visualize financial progress. Many tools offer features to set and monitor debt reduction goals.

- Monitor Net Worth: Beyond just tracking mortgage payments, monitor your overall net worth. This includes assets (savings, investments) and liabilities (mortgage, other debts). An increasing net worth, even with aggressive debt repayment, indicates positive financial health.

- Review Spending Patterns: Regularly analyze spending habits to identify any creeping expenses or areas where discipline has waned. This proactive approach helps in course-correcting before small deviations become significant problems.

- Assess Progress Against Milestones: Compare actual progress with the pre-defined yearly or quarterly milestones. If falling behind, analyze the reasons and implement corrective actions. If ahead, acknowledge the success and consider how to maintain or accelerate the pace.

- Adjust the Budget as Needed: Life circumstances can change. Be prepared to adjust the budget and payoff strategy based on income fluctuations, unexpected expenses, or changes in financial priorities. Flexibility is key to long-term success.

Affirmations and Daily Reminders for Commitment Reinforcement

Integrating affirmations and daily reminders into your routine can significantly bolster mental fortitude and reinforce the commitment to paying off your mortgage in five years. These tools serve as constant anchors, keeping the goal at the forefront of your mind and counteracting the influence of short-term desires or external pressures.The power of these reminders lies in their ability to reprogram subconscious thought patterns and to foster a positive, goal-oriented mindset.

By consistently engaging with these statements, you build a psychological resilience that supports your financial discipline.

- Morning Affirmation: Start each day with a powerful affirmation. For example: “I am a debt-free homeowner. Each payment I make brings me closer to financial freedom. I am disciplined, focused, and capable of achieving my $110,000 mortgage payoff in five years.”

- Visual Reminders: Place visual cues in prominent locations. This could be a printed copy of your payoff plan on your refrigerator, a sticky note with your goal on your bathroom mirror, or a screensaver on your computer displaying an image that symbolizes your financial freedom.

- Midday Check-in: During a brief break in the day, take a moment to reflect on your financial actions. Ask yourself: “Did my recent decisions align with my goal? How can I make better choices moving forward?”

- Evening Gratitude: End your day by acknowledging the progress made, no matter how small. Express gratitude for the ability to make these payments and for the future financial security you are building. For instance: “I am grateful for the progress I made on my mortgage today. I am building a secure financial future for myself and my family.”

- Listen to Motivational Content: Incorporate listening to podcasts, audiobooks, or music that inspires financial discipline and goal achievement during commutes or workouts.

- Buddy System Reminders: If you have an accountability partner, schedule brief daily or bi-weekly text messages or calls to share a quick affirmation or a note of encouragement related to the mortgage payoff goal.

Illustrative Scenarios and Examples

To solidify the practical application of paying off a $110,000 mortgage in five years, examining specific scenarios is crucial. These examples will demonstrate the tangible financial benefits and the accelerated path to debt freedom achievable through strategic overpayments. By quantifying the impact of extra payments, individuals can better visualize their progress and remain motivated.The following scenarios are designed to illustrate the power of accelerated mortgage repayment.

We will analyze a baseline scenario with consistent extra payments and then compare it to a scenario where only minimum payments are made, highlighting the significant differences in payoff time and total interest incurred.

Scenario 1: Aggressive Repayment with $1,200 Extra Monthly Payment, How to pay off 0 000 mortgage in 5 years

This scenario Artikels the journey of an individual who has secured a $110,000 mortgage at an annual interest rate of 5%. To achieve their five-year payoff goal, they commit to paying an additional $1,200 each month beyond their scheduled principal and interest payment.The initial calculation for the standard monthly payment (principal and interest) on a $110,000 loan at 5% over 30 years (a common amortization period) is approximately $590.48.

By adding $1,200 to this, the total monthly outflow for the mortgage becomes $1,790.48.

The formula for calculating the monthly payment (M) of a loan is:M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]Where:P = Principal loan amount ($110,000)i = Monthly interest rate (Annual rate / 12 = 0.05 / 12 = 0.00416667)n = Total number of payments (Loan term in years

- 12 = 30

- 12 = 360)

Applying these figures:M = 110000 [ 0.00416667(1 + 0.00416667)^360 ] / [ (1 + 0.00416667)^360 – 1]M ≈ $590.48With the aggressive payment of $1,790.48 per month, the loan will be paid off significantly faster than the original 30-year term. Using a mortgage amortization calculator or financial modeling, the projected payoff date for this scenario is approximately 64 months, which is just over 5 years and 4 months.

This slight overshoot of the 5-year target is due to the initial amortization schedule heavily favoring interest in the early years. To precisely hit the 5-year mark (60 months), the total monthly payment would need to be slightly higher.However, the substantial impact on interest savings is evident. By paying off the loan in approximately 64 months instead of 360 months, the total interest paid would be around $20,669.

This represents a significant saving compared to the total interest paid over the full 30-year term, which would be approximately $102,572.

Total Interest Paid = (Total Payments)

(Principal Loan Amount)

Total Payments = Monthly Payment

Number of Months

For this scenario, the total payments made are approximately $1,790.48/month – 64 months = $114,590.72.Total Interest Saved = $102,572 (30-year term interest)

$20,669 (64-month term interest) = $81,903.

To conquer a $110,000 mortgage in just five years requires unwavering dedication and smart financial moves. Understanding the intricate world of finance, such as how to get into mortgage lending , can illuminate pathways to greater financial control. Armed with such knowledge, you can then strategically accelerate your repayment, turning that substantial debt into a distant memory with remarkable speed.

This calculation highlights the immense power of even a consistent, substantial extra payment.

Projected Principal Reduction Graph Description

A text-based description of a graph illustrating principal reduction over time with aggressive payments would depict two distinct curves. The x-axis would represent time in months, and the y-axis would represent the outstanding loan balance in dollars.The first curve, representing minimum payments, would start at $110,000 and decrease very gradually in the initial years, showing a slow, almost imperceptible slope.

Over time, the slope would become steeper, but the curve would remain relatively shallow for the majority of its length, extending close to the 360-month mark on the x-axis before reaching zero.The second curve, representing the aggressive $1,790.48 monthly payment, would also start at $110,000. However, its slope would be dramatically steeper from the outset. Within the first few years, this curve would descend far below the minimum payment curve.

By the 60-month mark (5 years), this curve would be approaching or at zero, indicating the loan’s payoff. The steep, rapid decline of this curve visually emphasizes the accelerated principal reduction achieved through consistent, higher payments. The area between the two curves, particularly in the earlier years, represents the substantial amount of interest being avoided.

Comparative Analysis: Minimum Payments vs. Aggressive Repayment

To underscore the financial advantages of accelerated repayment, consider two individuals, Alex and Ben, who both have identical $110,000 mortgages at 5% annual interest, amortized over 30 years.Alex chooses to make only the minimum required monthly payment of approximately $590.48. At this rate, Alex will continue to make payments for the full 30 years (360 months). The total amount paid over the life of the loan will be $590.48/month360 months = $212,572.80.

The total interest paid will be $212,572.80 – $110,000 = $102,572.80. Alex will finally own their home free and clear after 30 years.Ben, on the other hand, is determined to pay off the mortgage within five years. Ben decides to pay an extra $1,200 per month, resulting in a total monthly payment of $1,790.48. As demonstrated in Scenario 1, Ben’s loan will be paid off in approximately 64 months (just over 5 years and 4 months).

The total amount paid by Ben will be approximately $1,790.48/month64 months = $114,590.72. The total interest paid will be approximately $114,590.72 – $110,000 = $4,590.72.The stark difference is evident:

- Payoff Time: Alex takes 30 years (360 months), while Ben takes just over 5 years (64 months). This means Ben gains financial freedom and eliminates a significant debt burden decades earlier.

- Total Interest Paid: Alex pays approximately $102,572.80 in interest, while Ben pays only around $4,590.72 in interest. This is a saving of over $97,982 in interest for Ben, a substantial amount that can be reinvested, saved, or used for other financial goals.

- Cash Flow Impact: While Ben’s monthly payments are significantly higher ($1,790.48 vs. $590.48), this is a temporary commitment. The long-term benefit of not having a mortgage payment for the remaining 24-plus years of Alex’s repayment period is immense.

These comparative examples vividly illustrate that while aggressive repayment requires a higher short-term financial commitment, the long-term rewards in terms of reduced interest paid and accelerated debt freedom are overwhelmingly beneficial.

Final Review

Ultimately, conquering a $110,000 mortgage in five years is a testament to focused financial discipline and strategic action. By understanding the required monthly payments, implementing effective strategies to increase those payments, and optimizing every extra dollar, you can dramatically shorten your mortgage term. This aggressive approach not only saves a substantial amount on interest but also fosters invaluable financial habits and provides a profound sense of accomplishment, paving the way for future financial security and freedom.

Helpful Answers

What is the total amount of principal and interest for a $110,000 mortgage paid over 5 years?

The total amount depends on the interest rate. For example, at a 5% interest rate, the total repayment would be approximately $126,370, with about $16,370 in interest. At 6%, it rises to about $128,950, with roughly $18,950 in interest. These figures highlight the significant cost of interest even over a shorter term.

How does an amortization schedule differ with accelerated payments?

With accelerated payments, the amortization schedule shows a much faster reduction of the principal balance. A larger portion of each payment goes towards the principal from the outset, meaning you pay down the debt more quickly and accrue less interest over the life of the loan compared to a standard repayment schedule.

What are some common ways to generate extra funds for mortgage payments?

Common methods include creating a strict budget to identify spending cuts, negotiating a salary increase, taking on a side hustle or freelance work, selling unused items, and directing windfalls like bonuses or tax refunds towards the mortgage.

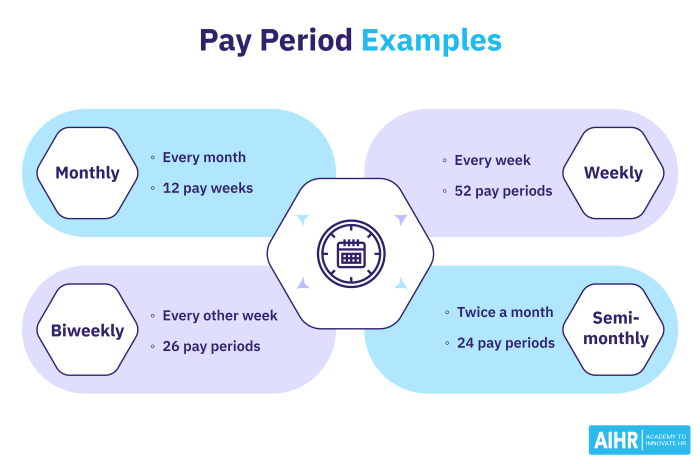

What is the difference between bi-weekly payments and an extra monthly payment?

Making bi-weekly payments means paying half of your monthly payment every two weeks, resulting in 26 half-payments per year, which equates to 13 full monthly payments instead of 12. A single extra monthly payment is simply adding one full monthly payment to your annual total. Both accelerate principal reduction, but bi-weekly payments can sometimes have a slightly more consistent impact due to the timing of the extra payment.

How do I ensure extra payments are applied to the principal?

You must explicitly instruct your lender, usually in writing or through their online portal, that any extra payments should be applied directly to the principal balance. Without this instruction, lenders may apply extra funds to future interest or principal payments, negating the acceleration benefit.

What are the risks of depleting my emergency fund for mortgage payments?

Depleting your emergency fund leaves you vulnerable to unexpected expenses like job loss, medical emergencies, or major home repairs. Without this safety net, you might have to take on high-interest debt or even risk foreclosure, undermining your entire financial goal.

What is opportunity cost in the context of aggressive mortgage payoff?

Opportunity cost refers to the potential returns you miss out on by choosing to put all extra funds towards your mortgage instead of investing them. For example, if your mortgage interest rate is 5% and you could potentially earn 8% in the stock market, the opportunity cost of paying down the mortgage is the 3% difference in potential earnings.

Are there specific mortgage features that help with rapid payoff?

Yes, a shorter-term fixed-rate mortgage (like a 15-year loan) inherently requires higher payments. Additionally, mortgages with no prepayment penalties allow you to make extra payments without incurring fees, which is crucial for accelerated repayment strategies.

What are the pros and cons of refinancing to a shorter term?

Pros include higher monthly payments that lead to faster payoff and significant interest savings. Cons can include potentially higher interest rates for shorter terms, closing costs associated with refinancing, and the risk of being unable to afford the higher payments if your financial situation changes.

How does paying extra on a variable-rate mortgage differ from a fixed-rate mortgage?

On a fixed-rate mortgage, extra payments directly reduce the principal, and the interest saved is predictable. On a variable-rate mortgage, extra payments also reduce the principal, but the total interest saved can fluctuate because the interest rate can change. The benefit of extra payments is still significant, but the exact savings are less certain.