Is a reverse mortgage taxable, a question that often hovers in the minds of homeowners considering this unique financial tool. This exploration delves into the intricate tax landscape surrounding reverse mortgage proceeds, aiming to demystify the process and empower you with clarity. Prepare to uncover the nuances that dictate whether these funds are a taxable event or a welcome reprieve.

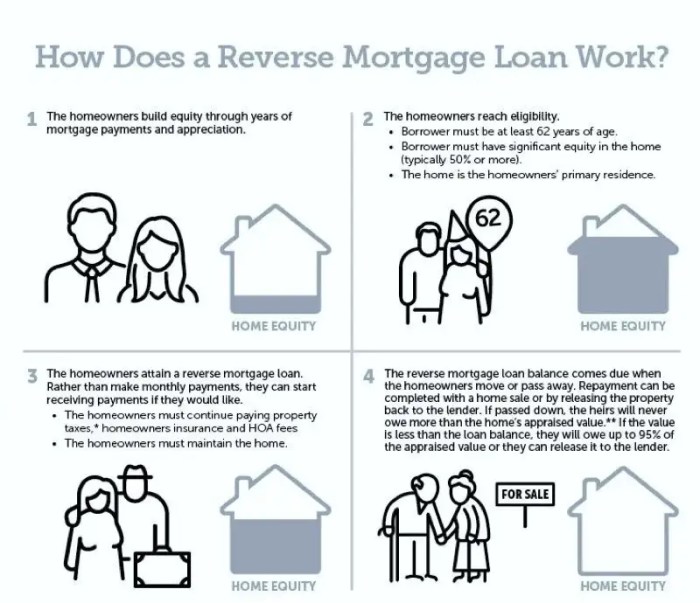

Understanding the taxability of reverse mortgage proceeds is paramount for homeowners seeking to leverage their home equity. Generally, the disbursements received from a reverse mortgage are not considered taxable income by the IRS. This is because these payments are treated as loan proceeds, akin to borrowing money that you will eventually repay. However, specific circumstances can alter this general rule, making it crucial to grasp the finer details of how your disbursements are structured and utilized.

Understanding the Taxability of Reverse Mortgage Proceeds

Navigating the financial landscape of retirement often involves exploring options like reverse mortgages. A crucial aspect to grasp is how the funds you receive are treated from a tax perspective. While generally not considered taxable income, understanding the nuances can prevent unexpected tax liabilities.Reverse mortgage loan disbursements are typically viewed as loan proceeds, not income. This means that, in most scenarios, you don’t owe federal income tax on the money you receive from a reverse mortgage.

The Internal Revenue Service (IRS) generally considers these disbursements as a way to access the equity in your home, which is not reportable as income.

Circumstances for Taxability of Reverse Mortgage Funds, Is a reverse mortgage taxable

While the general rule is that reverse mortgage proceeds are not taxable, there are specific situations where portions of the funds could be subject to income tax. These exceptions usually arise when the loan is used for purposes that the IRS might interpret differently, or when there are outstanding debts that are being paid off with the reverse mortgage funds.The most common scenario where reverse mortgage funds might be considered taxable involves the repayment of a previous mortgage or other debts.

If a portion of the reverse mortgage proceeds is used to pay off an existing mortgage or other loans, that portion might be viewed as a taxable event if the original loan was not for a qualified home improvement. Another less common scenario could involve specific tax implications related to the death of a borrower or a sale of the property, where accrued interest might be factored into tax calculations for heirs.

It’s essential to consult with a tax professional to understand these specific edge cases.

Tax Treatment of Disbursement Methods

The way you receive your reverse mortgage funds can influence how they are perceived for tax purposes, although the fundamental tax treatment remains consistent. The IRS generally views the source of the funds (your home equity) as the primary determinant of taxability, not the disbursement method.

- Lump-Sum Disbursements: When you receive the entire loan amount as a single lump sum, it is still considered loan proceeds and not taxable income. This is often used to pay off an existing mortgage or for significant home modifications.

- Monthly Payouts: Regular monthly payments, often referred to as tenure or term payments, are also treated as loan proceeds. These are designed to supplement your retirement income and are not taxed.

- Line-of-Credit Disbursements: A line of credit allows you to draw funds as needed. Any amount you draw from the line of credit is considered a loan disbursement and is not taxable. You only access and receive the funds you actually draw, and those are not income.

It’s crucial to remember that while the principal loan disbursements are not taxable, any accrued interest on the reverse mortgage loan that is added to the loan balance is generally not taxed until the loan is repaid or becomes due.

IRS Publications and Forms for Homeowner Assistance Funds

The IRS provides guidance on various financial matters, including those related to homeowner assistance and loans. While specific publications directly detailing reverse mortgage taxability might not exist under a broad “homeowner assistance funds” umbrella, general principles of loan taxation and specific IRS forms provide the framework for understanding.

So, is a reverse mortgage taxable? It’s a good question, and understanding related concepts like what is cltv mortgage can actually help clarify things. Ultimately, the money you get from a reverse mortgage is generally not considered taxable income, so you don’t have to worry about Uncle Sam taking a cut.

The IRS Publication 525, Taxable and Nontaxable Income, is a key resource for understanding what constitutes taxable income versus what is considered nontaxable. While it may not specifically mention reverse mortgages, the principles it Artikels for distinguishing between loans and income are directly applicable.

For reporting purposes, if any portion of the reverse mortgage were to become taxable (which is rare for the loan proceeds themselves), it would likely be reported on standard income tax forms like Form 1040. However, the primary interaction with the IRS concerning reverse mortgages often relates to the sale of the home or the eventual repayment of the loan, where details about the loan balance and accrued interest might be relevant for heirs or the estate.

The IRS also provides information on mortgage interest deduction, but this typically applies to

- borrowed* funds used for homeownership, not reverse mortgage

- disbursements* received by the homeowner. Always refer to the latest IRS publications or consult a tax professional for the most accurate and up-to-date information.

Tax Implications for Heirs and Estates: Is A Reverse Mortgage Taxable

When a borrower passes away, the reverse mortgage doesn’t vanish. Instead, it becomes a crucial factor in settling their estate, and understanding its tax implications is vital for both the estate administrators and the heirs. This section dives deep into how the outstanding reverse mortgage balance impacts the deceased borrower’s taxable estate, the process of its settlement, and the specific tax considerations for those who inherit the property.The reverse mortgage balance is not an income that passes to heirs; it’s a debt that must be satisfied.

The way this debt is handled has direct tax consequences for the estate and can influence the inheritance received by beneficiaries.

Reverse Mortgage Balance and the Taxable Estate

The outstanding balance of a reverse mortgage is treated as a debt against the deceased borrower’s estate. This debt typically reduces the net value of the estate, which can have significant implications for estate tax calculations. The total value of the estate, including all assets and minus all liabilities, determines if any estate tax is due.In essence, the loan amount that the borrower received, plus any accrued interest and fees, is subtracted from the total value of the property when determining the net worth of the estate.

This reduction can potentially lower the taxable estate below the threshold at which federal estate taxes apply.

Settling the Reverse Mortgage Debt After Borrower’s Passing

Upon the borrower’s death, the reverse mortgage loan typically becomes due and payable. The heirs or the estate administrator usually have a set period, often 12 months (with a possible extension), to repay the loan. This repayment can be made through various means, most commonly by selling the property.The proceeds from the sale of the home are used to pay off the outstanding reverse mortgage balance.

If there are any remaining funds after the debt is settled, these proceeds belong to the heirs. If the sale proceeds are insufficient to cover the full loan balance, the specific terms of the reverse mortgage, particularly if it was a non-recourse loan (common for FHA-insured HECMs), generally protect the heirs from owing more than the home’s value. The lender or mortgage insurer absorbs the loss.

Deductibility of Remaining Loan Balance for Estate Tax Purposes

Debts of the deceased are generally deductible from the gross estate for federal estate tax purposes. Therefore, the outstanding balance of a reverse mortgage, including any accrued interest and fees, is typically deductible. This deduction directly reduces the taxable estate.

For estate tax purposes, liabilities of the decedent, including reverse mortgage debts, are generally deductible, thereby reducing the taxable estate.

This is a crucial point for estate planning, as it can significantly impact the overall tax liability of the estate. The executor or administrator of the estate will need to provide documentation to the IRS detailing the outstanding loan balance and any accrued interest.

Tax Implications for Heirs Inheriting a Property with an Outstanding Reverse Mortgage

Heirs face a few primary scenarios when inheriting a property with a reverse mortgage:

-

Selling the Property: This is the most common scenario. The heirs can sell the home to repay the reverse mortgage. Any equity remaining after the sale, once the loan is satisfied, is distributed to the heirs. There is generally no income tax on the inheritance of the equity itself, as it’s considered a return of their rightful share of the deceased’s assets.

However, if the heirs decide to rent out the property after inheriting it and before selling, any rental income would be taxable.

-

Keeping the Property: Heirs may choose to keep the property. To do so, they must repay the outstanding reverse mortgage balance. They can either pay the debt out-of-pocket or refinance the property with a traditional mortgage. If they keep the property, they inherit the property itself, not the debt. The value of the property at the time of inheritance is typically their cost basis for future capital gains tax purposes.

If they later sell the property for more than its inherited value, they will owe capital gains tax on the profit.

- Deed in Lieu of Foreclosure: If the property’s value is less than the outstanding loan balance, and the heirs do not wish to pursue the property, they might opt for a deed in lieu of foreclosure. In the case of a non-recourse HECM, the heirs are typically not responsible for the shortfall, and the lender absorbs the loss. There are no tax implications for the heirs in this scenario, as they receive no equity.

It’s important for heirs to consult with an estate attorney and a tax advisor to fully understand their options and the associated tax consequences based on their specific circumstances and the terms of the reverse mortgage. The inherited basis of the property is usually “stepped-up” to the fair market value at the time of the borrower’s death, which can significantly reduce potential capital gains tax liability if the property is later sold.

Specific Scenarios and Exceptions

While reverse mortgage proceeds are generally not taxable income, understanding how these funds are used and any specific circumstances can clarify potential tax implications. Certain applications of these funds might align with tax-advantaged strategies, offering additional benefits to borrowers.When a borrower receives funds from a reverse mortgage, the primary principle is that these are loan proceeds, not income. However, the

purpose* for which these funds are subsequently used can sometimes intersect with tax rules, particularly concerning deductions or exclusions.

Tax Treatment of Reverse Mortgage Proceeds for Specific Purposes

The taxability of reverse mortgage proceeds remains consistent regardless of their intended use; they are loan repayments and therefore not taxable income. However, thedeductibility* of expenses paid for with these funds is a separate tax consideration. For instance, if reverse mortgage proceeds are used to pay for significant home repairs or modifications, these expenses might be deductible under specific tax laws, such as those related to medical expenses or home improvements for accessibility.For example, if a borrower uses reverse mortgage funds to install a ramp or modify a bathroom to accommodate a disability, these costs could potentially be deductible as medical expenses, provided they meet IRS criteria for qualified medical expenses.

Similarly, if the improvements are made to enhance the home’s energy efficiency, there might be specific tax credits available, though these are separate from the reverse mortgage itself. The key is that the reverse mortgage funds themselves are not taxed, but the underlying expense may have its own tax implications.

Potential Tax Benefits or Deductions Available to Borrowers

While reverse mortgage proceeds are not directly taxable, borrowers may indirectly benefit from tax advantages depending on how they utilize the funds. These benefits are not inherent to the reverse mortgage but stem from how the funds are applied to expenses that have tax implications.The primary way borrowers can leverage tax benefits is by applying reverse mortgage funds towards deductible expenses.

For instance:

- Medical Expenses: If funds are used for qualified medical care or home modifications to accommodate a disability, these costs may be deductible as medical expenses on federal income taxes, subject to Adjusted Gross Income (AGI) limitations.

- Home Improvement Credits: While less common directly tied to reverse mortgage funds, if improvements made with these proceeds qualify for energy-efficient home improvement tax credits, borrowers could claim those credits.

- Interest Deduction (Limited Cases): In very specific situations, if the reverse mortgage loan is secured by a principal residence, and the loan proceeds are used to pay off an existing mortgage, the interest on the reverse mortgage may be deductible. However, this is a complex area, and typically, the interest on a reverse mortgage itself is not deductible until the loan is repaid.

Common Misconceptions Regarding Reverse Mortgage Taxability

It’s crucial to dispel common myths surrounding the tax implications of reverse mortgages to ensure borrowers make informed decisions. The fundamental understanding that these are loan proceeds, not income, is often misunderstood.Here’s a list of prevalent misconceptions:

- Misconception: All reverse mortgage payments are taxable income. This is incorrect. As loan proceeds, they are not considered income.

- Misconception: Heirs will inherit a tax liability on the reverse mortgage balance. While the loan balance is repaid from the estate, the inherited property’s value is typically what is considered, and the loan itself doesn’t create a taxable income for heirs.

- Misconception: Using reverse mortgage funds for daily living expenses makes them taxable. The source of the funds (a loan) dictates their tax status, not their application for living expenses.

- Misconception: Reverse mortgage interest accrues tax liability for the borrower annually. The interest is added to the loan balance and typically becomes a factor for repayment or estate settlement, not an annual tax deduction for the borrower while the loan is active.

Scenario Demonstrating Non-Taxable Fund Receipt

Consider Eleanor, an 80-year-old homeowner who decides to take out a Home Equity Conversion Mortgage (HECM), a type of reverse mortgage. Eleanor needs to cover significant out-of-pocket medical expenses for a chronic condition and also wants to make her home more accessible with a stairlift.Eleanor opts for a lump-sum payout from her reverse mortgage. She receives $100,000. This $100,000 is a loan advance and is not considered taxable income by the IRS.

Eleanor then uses $40,000 of these proceeds to pay for her medical bills and $20,000 to install the stairlift.The $60,000 spent on medical expenses and home accessibility modifications might, under specific IRS rules and limitations, be eligible for deduction as medical expenses on her tax return. However, the $100,000 she received from the reverse mortgage itself remains entirely non-taxable. The tax benefit, if any, comes from the deductibility of theexpenses* she incurred, not from the receipt of the loan proceeds.

The remaining $40,000 sits in a separate account, available for future use, and is also not taxable.

Financial Planning and Tax Considerations

Reverse mortgages offer a unique financial tool for seniors, but their tax implications are far from straightforward. Integrating these nuances into your broader financial strategy is paramount to maximizing benefits and avoiding unforeseen liabilities. This section delves into how to weave the taxability of reverse mortgage proceeds into your financial tapestry, ensuring a more secure and informed retirement.When you receive funds from a reverse mortgage, it’s crucial to view these disbursements not as income, but as loan proceeds.

This fundamental distinction dictates their tax treatment. However, how youuse* these funds can have significant tax consequences, especially when considering deductions or potential future tax obligations. Effective financial planning means understanding this interplay and making informed decisions.

Incorporating Reverse Mortgage Tax Implications into Overall Financial Planning

A reverse mortgage can be a powerful asset in your retirement toolkit, but its effectiveness hinges on how well it aligns with your existing financial plan. Thinking about the tax implications from the outset allows you to strategically deploy these funds to achieve your retirement goals without creating tax headaches down the line. This proactive approach can significantly impact your long-term financial well-being.Here’s how to integrate reverse mortgage tax considerations into your financial planning:

- Cash Flow Management: Use reverse mortgage funds to supplement retirement income, potentially deferring taxable withdrawals from other retirement accounts (like IRAs or 401(k)s) to later years when you might be in a lower tax bracket. This strategy can reduce your overall lifetime tax burden.

- Tax-Efficient Asset Allocation: If you anticipate needing funds for major expenses, consider how reverse mortgage proceeds can cover these costs, preserving tax-advantaged accounts for growth or future tax-deferred income.

- Estate Planning Alignment: Understand how reverse mortgage repayment affects your estate. Discuss with your heirs how the loan will be handled and its impact on the inheritance they receive. This clarity prevents surprises and potential financial strain on your estate.

- Risk Mitigation: By providing a liquidity source, a reverse mortgage can act as a buffer against unexpected expenses, preventing the need to sell other assets at an inopportune time, which could trigger capital gains taxes.

Consulting a Tax Professional for Reverse Mortgage Disbursements

The decision to take out a reverse mortgage, and more importantly, how you receive and use the funds, is a significant financial event. Navigating the tax landscape surrounding these disbursements requires expert guidance. A qualified tax professional can provide personalized advice tailored to your unique financial situation, ensuring you make the most tax-advantageous decisions.It’s not just about understanding the basic tax treatment; it’s about optimizing your strategy.

A tax advisor can help you:

- Determine the Most Tax-Advantaged Disbursement Method: Whether you choose a lump sum, monthly payments, or a line of credit, each has different implications for your tax situation and how you might access funds in the future.

- Identify Potential Deductions: While the proceeds themselves aren’t taxable income, the interest paid on a reverse mortgage may be deductible under certain circumstances, especially if the loan was used for home improvements that qualify. Your tax advisor can guide you on these specific rules.

- Plan for Future Tax Liabilities: Understanding how reverse mortgage funds might affect your future tax bracket, Social Security benefits, or Medicare premiums is crucial for long-term planning.

- Ensure Compliance: A tax professional stays updated on the latest tax laws and regulations, ensuring your reverse mortgage transactions are compliant and you’re not missing out on any legitimate tax benefits.

Documenting Reverse Mortgage Fund Usage for Tax Audit Purposes

While reverse mortgage proceeds are generally not taxable income, maintaining meticulous records of how these funds are used is a best practice, especially in the event of a tax audit. This documentation serves as proof of legitimate use and can support any tax deductions you might claim related to the funds. Think of it as building your defense before you even need it.Here’s what to keep in mind for documentation:

- Categorize Expenses: Clearly label how the funds were spent. For example, if funds were used for home repairs that are tax-deductible, keep invoices and receipts clearly marked as such.

- Retain Bank Statements: Keep all bank statements showing the disbursement of reverse mortgage funds. This provides a clear audit trail from the lender to your accounts.

- Segregate Funds (If Possible): If you are using reverse mortgage funds for specific purposes, consider depositing them into a separate account to make tracking easier and to clearly delineate their use from your other funds.

- Maintain Supporting Documents: For any expenses you claim as deductible (e.g., home improvements, medical expenses), keep all original receipts, invoices, and contracts.

The key to surviving a tax audit with reverse mortgage funds is clear, consistent documentation proving the funds were used appropriately and in accordance with tax laws.

Hypothetical Case Study: The Tax Journey of a Reverse Mortgage Borrower

Let’s illustrate the tax considerations with a hypothetical scenario. Meet Eleanor, a 70-year-old homeowner with a paid-off home valued at $500,000. She has $200,000 in her IRA and receives $1,500/month in Social Security. Eleanor decides to take out a reverse mortgage to supplement her income and cover increasing healthcare costs. She takes out a $150,000 reverse mortgage, opting for monthly payments.

Year 1:Eleanor receives $1,000 per month from her reverse mortgage, totaling $12,000 annually. She also receives $18,000 from Social Security ($1,500 x 12). Her IRA remains untouched.

Taxable Income

Eleanor’s $12,000 in reverse mortgage payments is not taxable income as it’s loan proceeds. Her Social Security income is partially taxable. Based on her total income, a portion of her Social Security may be subject to federal income tax.

Financial Planning

Eleanor uses the reverse mortgage funds to cover her living expenses, reducing the need to withdraw from her IRA. This allows her IRA to continue growing tax-deferred. She carefully documents all expenses paid with the reverse mortgage funds. Year 3:Eleanor’s healthcare costs increase, and she needs an additional $5,000 for a medical procedure. She decides to take a lump sum disbursement of $5,000 from her reverse mortgage line of credit.

Taxable Income

The $5,000 lump sum is also not taxable income. Her annual monthly payments ($12,000) continue. Her Social Security and IRA remain stable.

Financial Planning

Eleanor uses the lump sum for her medical expenses, which might be deductible depending on her overall medical expenses and Adjusted Gross Income (AGI). She keeps detailed receipts for the procedure. Year 7:Eleanor’s home value has appreciated slightly, and her outstanding reverse mortgage balance has grown due to accrued interest. She decides to use some of her remaining line of credit to make significant home improvements, costing $15,000.

These improvements are deemed to increase the home’s value and are eligible for potential tax benefits related to home improvements.

Taxable Income

The $15,000 disbursement is not taxable. Her monthly payments continue.

Financial Planning

Eleanor works with her tax advisor. The interest accrued on the reverse mortgage up to this point might become deductible when the home is sold or if she itemizes deductions and meets certain criteria. The home improvements themselves don’t generate immediate taxable income but could influence future capital gains tax calculations when the home is sold. She meticulously documents the home improvement invoices.

Year 10 (Sale of Home):Eleanor decides to move into an assisted living facility. Her home is sold for $550,000. The outstanding reverse mortgage balance is $180,000 (principal + accrued interest).

Taxable Event

The sale of the home is a taxable event. However, Eleanor benefits from the primary residence exclusion. She can exclude up to $250,000 of capital gains if filing single.

Calculating Capital Gains

Sale Price

$550,000

Original Cost Basis (assuming it was paid off)

$0 for simplicity in this example (in reality, there would be a basis).

Home Improvement Costs

$15,000 (added to basis).

Net Proceeds from Sale (after paying off reverse mortgage)

$550,000 – $180,000 = $370,000.

Capital Gain

$370,000 (net proceeds)$15,000 (improvements basis) = $355,000.

Tax Implications

Eleanor can exclude $250,000 of the $355,000 capital gain. The remaining $105,000 gain would be subject to capital gains tax, depending on her tax bracket at that time.

Deductible Interest

Her tax advisor confirms that a portion of the reverse mortgage interest paid over the years may have been deductible if she had itemized. The final interest paid is settled through the sale.This case study highlights how reverse mortgage proceeds, while not income, can be strategically used to manage cash flow, cover expenses, and potentially benefit from tax deductions or exclusions, all while requiring diligent record-keeping and professional advice.

Last Point

Navigating the tax implications of a reverse mortgage requires a keen eye for detail and proactive financial planning. While the majority of reverse mortgage disbursements are non-taxable, understanding the exceptions and planning accordingly can prevent unforeseen tax liabilities. By consulting with financial and tax professionals, documenting your fund usage diligently, and staying informed about relevant IRS guidelines, you can ensure that your reverse mortgage experience aligns seamlessly with your overall financial well-being, leaving you with peace of mind and greater financial security.

FAQ Summary

Are reverse mortgage loan disbursements always non-taxable?

In most cases, reverse mortgage loan disbursements are treated as loan proceeds and are therefore not considered taxable income. However, if the funds are used in a way that could be construed as income, or if there are specific loan terms that differ from standard reverse mortgages, they might become taxable. It’s always best to consult with a tax professional to understand your specific situation.

What happens to the taxability if I receive a lump sum payment from my reverse mortgage?

A lump-sum disbursement from a reverse mortgage is generally not taxable. It is viewed as a loan advance. The tax treatment remains the same as for monthly payments or line-of-credit draws, which are typically not income.

Do my heirs have to pay taxes on the remaining reverse mortgage balance?

Heirs do not pay income tax on the remaining reverse mortgage balance. The outstanding loan balance is a debt against the property. When the property is sold to repay the loan, any remaining equity after the loan is satisfied goes to the heirs. The estate may have some tax considerations related to the property’s value, but the loan itself is not income to the heirs.

Can the unused portion of a reverse mortgage be taxed if I pass away?

The unused portion of a reverse mortgage is not taxed as income. It remains a loan balance that must be repaid by the estate or heirs. The property will be sold, and the loan will be satisfied from the proceeds. Any remaining equity is then distributed to the heirs.

Are there any tax benefits if I use reverse mortgage funds for home improvements?

While the reverse mortgage funds themselves are not taxable income, using them for certain home improvements might make those improvements eligible for tax credits or deductions, depending on the nature of the improvements and current tax laws. This is a separate consideration from the taxability of the loan proceeds themselves.