Is 771 a good credit score? This is a question that echoes in the minds of many navigating the often-opaque world of personal finance. It’s a number that holds significant sway, a silent arbiter of financial opportunities and a key that unlocks doors to better loan terms, more attractive credit card offers, and ultimately, a smoother financial journey. Understanding where this score lands within the broader credit spectrum is the first step towards leveraging its power effectively.

The landscape of credit scores can seem complex, with various tiers and categories often defined by different credit bureaus. Generally, scores fall into broad classifications like excellent, good, fair, and poor, each carrying its own set of implications. Factors such as payment history, credit utilization, length of credit history, credit mix, and the number of new credit inquiries all play a crucial role in shaping this numerical representation of your financial reliability.

Knowing these influences is paramount to both achieving and maintaining a strong score.

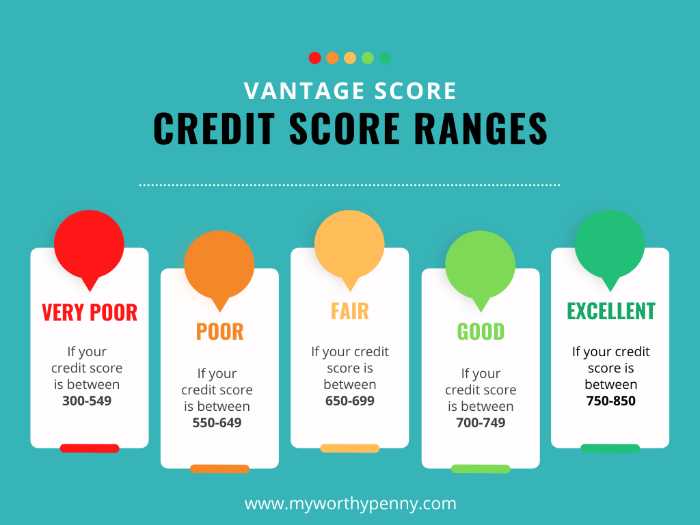

Understanding Credit Score Ranges

Navigating the world of credit scores can seem complex, but understanding the general ranges and what they signify is a crucial step for financial health. These scores, typically ranging from 300 to 850, act as a financial report card, influencing a consumer’s ability to secure loans, mortgages, and even rent an apartment. The number itself is a powerful indicator of creditworthiness, reflecting how reliably an individual has managed their debt in the past.Credit scoring models, such as FICO and VantageScore, utilize sophisticated algorithms to analyze vast amounts of consumer credit data.

While the exact formulas remain proprietary, the underlying principles are consistent: demonstrating responsible credit behavior generally leads to higher scores. This score serves as a vital tool for lenders, allowing them to assess risk and determine appropriate interest rates and loan terms.

General Credit Score Categories

Credit scores are broadly categorized into distinct tiers, each representing a different level of credit risk. These categories provide a quick snapshot of a consumer’s financial standing and are widely used by lenders to make informed decisions. Understanding where your score falls within these ranges can empower you to take targeted actions to improve your credit profile.The typical tiers are as follows:

- Exceptional (800-850): Scores in this range indicate an extremely low credit risk. Individuals with exceptional scores typically have a long history of responsible credit management, including timely payments and low credit utilization. They are likely to receive the most favorable loan terms and interest rates.

- Very Good (740-799): This tier signifies a strong credit history with minimal risk. Borrowers in this range are considered highly creditworthy and can expect competitive offers from lenders.

- Good (670-739): A good credit score demonstrates a generally responsible approach to credit. While not as advantageous as higher tiers, it still qualifies individuals for most standard loan products with reasonable terms.

- Fair (580-669): Scores in the fair range suggest a moderate level of credit risk. Consumers in this category may face higher interest rates or may need a co-signer for certain loans. This tier often indicates some past credit challenges that need addressing.

- Poor (300-579): This lowest tier signifies a significant credit risk. Individuals with poor scores have likely experienced severe credit issues, such as defaults, bankruptcies, or extensive late payments. Obtaining credit can be challenging and will likely come with very high interest rates and strict terms.

Credit Bureau Score Categorization Comparison

While the general categories remain consistent, different credit bureaus and scoring models may present slightly varied numerical thresholds for each tier. This variation is due to differences in their proprietary algorithms and the specific data points they prioritize. However, the overall sentiment and risk assessment associated with each range remain largely aligned across major credit bureaus.For instance, FICO and VantageScore, the two most prominent credit scoring systems, have their own benchmarks.

A score that might be considered “very good” by one system could be on the cusp of “excellent” by another, but the fundamental implication of strong creditworthiness is preserved. It is important to check your score from multiple sources to get a comprehensive view.

Common Factors Influencing Credit Scores

A consumer’s credit score is not a static number; it is a dynamic reflection of their credit behavior over time. Several key factors are consistently analyzed by credit scoring models to determine a score. Demonstrating positive habits in these areas is paramount for building and maintaining a healthy credit profile.The primary factors that influence a credit score include:

- Payment History (approximately 35% of score): This is the most critical component. Making payments on time, every time, is essential. Late payments, missed payments, and defaults can significantly damage a credit score.

- Amounts Owed (Credit Utilization) (approximately 30% of score): This refers to the amount of credit you are using compared to your total available credit. Keeping credit utilization low, ideally below 30%, is crucial. High utilization signals to lenders that you may be overextended.

- Length of Credit History (approximately 15% of score): A longer credit history generally works in your favor. It provides lenders with more data to assess your long-term credit management habits.

- Credit Mix (approximately 10% of score): Having a mix of different types of credit, such as credit cards, installment loans (like mortgages or auto loans), can be beneficial. It shows you can manage various forms of credit responsibly.

- New Credit (approximately 10% of score): Opening multiple new credit accounts in a short period can negatively impact your score. It can be perceived as a sign of increased financial risk.

To illustrate the impact of payment history, consider two individuals with identical credit profiles except for one key difference: one consistently pays bills on time, while the other has a few 30-day late payments. The individual with perfect payment history will undoubtedly possess a significantly higher credit score, making them a more attractive candidate for lenders.

“Payment history is the single most important factor in determining your credit score, carrying more weight than any other element.”

Defining a “Good” Credit Score

In the intricate world of finance, a “good” credit score serves as a crucial indicator of an individual’s creditworthiness, signaling to lenders their reliability in managing debt. This numerical representation, typically ranging from 300 to 850, is a cornerstone of financial health, influencing access to capital and the terms on which it is offered. The current lending landscape places significant emphasis on this score, with a “good” score acting as a key to unlocking more favorable financial opportunities.A strong credit score is not merely a number; it is a passport to financial empowerment.

A score of 771 is indeed a good credit score, offering favorable loan terms. When considering financial products like a home equity line of credit, it’s important to understand how it might impact your credit standing, specifically, does a heloc affect credit score. Responsible management of such a line will help maintain that solid 771 score.

It signifies responsible financial behavior, demonstrating a history of timely payments and judicious credit utilization. This, in turn, translates into tangible benefits for consumers, impacting everything from securing a mortgage to obtaining competitive rates on insurance premiums. Lenders view individuals with good credit as lower risk, making them more attractive to partner with.

Benefits of a Good Credit Score

Possessing a good credit score opens doors to a multitude of financial advantages. It signifies a reduced risk profile for lenders, leading to more favorable terms and conditions across various financial products. This can translate into significant savings over time, particularly for major purchases like homes and vehicles.

Advantages of a Score of 771

A credit score of 771 firmly places an individual within the “very good” to “excellent” range, depending on the specific scoring model used. This score is highly regarded by lenders and significantly enhances the likelihood of loan approvals. Borrowers with a 771 score are typically viewed as low-risk, which often translates into access to the most competitive interest rates available in the market.

This can lead to substantial savings on interest payments over the life of a loan, whether it’s for a mortgage, an auto loan, or personal financing. For instance, a difference of even half a percentage point in an interest rate on a 30-year mortgage can amount to tens of thousands of dollars saved.

Financial Products Accessible with a Score of 771

With a credit score of 771, consumers can expect a broad spectrum of financial products to be readily accessible, often with preferential terms. This includes:

- Mortgages: Securing a home loan becomes considerably easier, with access to lower interest rates and a wider selection of loan products, including conventional and jumbo loans. Lenders are more willing to offer higher loan-to-value ratios and potentially waive private mortgage insurance (PMI) requirements sooner.

- Auto Loans: Obtaining financing for a vehicle is straightforward, with opportunities to secure the lowest available interest rates, significantly reducing the overall cost of the car. This can lead to lower monthly payments and less interest paid over the loan term.

- Credit Cards: A score of 771 qualifies individuals for premium credit cards offering lucrative rewards programs, such as travel miles, cashback, and exclusive perks. These cards often come with higher credit limits and introductory 0% APR offers.

- Personal Loans: Unsecured personal loans are readily available with competitive interest rates, suitable for debt consolidation, home improvements, or unexpected expenses. The approval process is typically faster and requires less stringent documentation.

- Student Loans: While federal student loans are not typically credit-dependent, private student loans or refinancing options for existing loans will offer more favorable terms and interest rates for borrowers with a 771 credit score.

- Rental Agreements: Landlords often check credit scores as part of the tenant screening process. A score of 771 can make it easier to secure rental properties, especially in competitive markets, and may even reduce security deposit requirements.

- Insurance Premiums: In many states, credit scores are used to help determine insurance rates for auto and homeowners insurance. A good score can lead to lower premiums, reflecting a perceived lower risk of filing claims.

Impact of a 771 Credit Score on Financial Opportunities

A credit score of 771 positions individuals in a highly favorable category, significantly broadening access to a wide array of financial products and services. This score signals to lenders a strong history of responsible credit management, making borrowers with this rating attractive prospects. Consequently, individuals with a 771 score can expect to benefit from more competitive terms and lower costs across various financial dealings.This elevated credit standing translates directly into tangible financial advantages, from securing more affordable home loans to obtaining premium credit cards.

The following sections detail the specific opportunities and benefits associated with maintaining a credit score of 771.

Mortgage Interest Rates for a 771 Credit Score

Borrowers with a credit score of 771 are typically considered prime candidates by mortgage lenders, often qualifying for the most competitive interest rates available in the market. These lower rates can lead to substantial savings over the life of a mortgage. While exact rates fluctuate based on market conditions, lender policies, and other borrower-specific factors like down payment and loan-to-value ratio, individuals in this bracket can anticipate rates significantly below the national average.

Auto Loan Interest Rates for a 771 Credit Score

Securing an auto loan with a 771 credit score generally means accessing some of the lowest available interest rates. This score indicates a low risk of default, allowing lenders to offer preferential terms. Lower interest rates on auto loans translate directly into reduced monthly payments and less money paid in interest over the loan’s duration, making vehicle ownership more affordable.

Credit Card Approval and Premium Rewards

Individuals with a 771 credit score are highly likely to be approved for credit cards that offer premium rewards and benefits. These cards often come with lucrative sign-up bonuses, generous points or cashback programs, travel perks, and exclusive access to events. Lenders view applicants with this score as responsible users of credit, making them ideal candidates for higher credit limits and premium product offerings.

Mortgage Payment Comparison: 771 vs. 650 Credit Score

To illustrate the financial impact of a 771 credit score, consider the difference in monthly payments for a $300,000 mortgage. A score of 771 typically garners an interest rate of approximately 6.5%, while a score of 650 might result in a rate closer to 8.5%. This difference in interest rates has a significant effect on the total cost of borrowing.

| Credit Score | Estimated Interest Rate | Estimated Monthly Payment (Principal & Interest) | Total Interest Paid Over 30 Years |

|---|---|---|---|

| 771 | 6.5% | $1,896.20 | $382,632.00 |

| 650 | 8.5% | $2,201.31 | $492,471.60 |

The table above demonstrates that a borrower with a 771 credit score would pay approximately $305.11 less per month on their mortgage compared to someone with a 650 credit score. Over the 30-year life of the loan, this difference amounts to substantial savings of over $100,000 in interest payments alone. This highlights the critical financial advantage of maintaining a strong credit profile.

Factors Contributing to a 771 Credit Score

A credit score of 771 is a strong indicator of responsible financial behavior, built upon a foundation of consistent and prudent management of credit. This score doesn’t materialize overnight; it’s the cumulative result of several key financial habits that lenders and creditors closely scrutinize. Understanding these contributing factors is crucial for anyone aiming to achieve or maintain such a favorable credit standing.Several pillars form the bedrock of a robust credit score like 771.

These elements, when consistently managed, signal reliability and trustworthiness to financial institutions, opening doors to a wider array of financial opportunities and more favorable terms.

Payment History Significance

The most impactful factor in any credit score, including a 771, is an impeccable payment history. This element accounts for a substantial portion of the overall score calculation, underscoring the critical importance of paying all bills on time, every time. Lenders view late payments as a significant red flag, suggesting a potential risk of default.A consistent record of on-time payments demonstrates a borrower’s commitment to fulfilling their financial obligations.

Even a single missed payment, especially if it’s more than 30 days late, can have a detrimental effect on a credit score, potentially knocking it down by dozens of points. Conversely, a long history of timely payments builds trust and significantly boosts a credit score.

Credit Utilization Ratio’s Role, Is 771 a good credit score

The credit utilization ratio, which measures the amount of credit being used compared to the total available credit, plays a pivotal role in maintaining a strong score. Experts generally recommend keeping this ratio below 30%, though a score of 771 often suggests utilization significantly lower than this benchmark, perhaps in the single digits or low teens.

“Lowering credit utilization below 30% is a universally advised strategy for credit score improvement, with ideal scenarios often reflecting utilization below 10%.”

High credit utilization can signal to lenders that a borrower is heavily reliant on credit and may be experiencing financial strain, even if payments are current. Maintaining a low utilization ratio indicates responsible credit management and a reduced risk for lenders. For instance, if a consumer has a total credit limit of $10,000 across all their credit cards and carries a balance of $1,000, their utilization ratio is 10%.

Length of Credit History Impact

The duration for which a credit history has been established also contributes significantly to a credit score of 771. A longer credit history, especially one with positive activity, allows credit scoring models to better assess a borrower’s long-term financial behavior and predictability. An older, well-managed account provides more data points for evaluation, thereby solidifying the score.The average age of accounts and the age of the oldest account are both considered.

While it’s not advisable to keep old, unused accounts open solely for the sake of credit history, maintaining a mix of older and newer accounts, all in good standing, can benefit the score. A credit history spanning several years, marked by consistent on-time payments and low utilization, is a hallmark of a strong score.

Influence of Credit Mix and New Credit

While payment history and credit utilization are the dominant factors, the types of credit accounts a person holds (credit mix) and the number of recent credit inquiries or new accounts opened (new credit) also play a role in achieving a 771 score. A healthy credit mix typically includes a combination of revolving credit (like credit cards) and installment loans (like mortgages or auto loans).

This demonstrates the ability to manage different types of credit responsibly.Opening too many new credit accounts in a short period can negatively impact a credit score. Each application for credit typically results in a “hard inquiry,” which can slightly lower a score. While a few inquiries are generally not problematic, a spree of applications can be interpreted as a sign of financial distress.

Similarly, closing older credit accounts, even if unused, can sometimes shorten the average age of credit history and reduce available credit, potentially increasing utilization.

Strategies for Maintaining or Improving a 771 Credit Score

A credit score of 771 signifies a robust financial standing, opening doors to favorable loan terms and financial products. However, maintaining this score requires ongoing diligence, and further improvement is achievable with strategic financial management. This section Artikels key strategies to safeguard and potentially enhance a credit score of 771.Cultivating strong credit habits is paramount to both preserving an excellent score and paving the way for even greater financial advantages.

By adhering to specific practices, individuals can solidify their creditworthiness and ensure continued access to the best financial opportunities.

Consistent On-Time Bill Payments

The cornerstone of a healthy credit score is the consistent, timely payment of all financial obligations. Payment history is the most significant factor influencing credit scores, and even a single missed payment can have a detrimental impact. Establishing a system that ensures every bill is paid by its due date is crucial for maintaining a 771 score.To design a plan for consistent on-time bill payments, consider the following approaches:

- Automated Payments: Set up automatic payments for recurring bills such as mortgages, car loans, credit cards, and utility bills. This eliminates the risk of forgetting a due date. Ensure sufficient funds are available in the linked account to prevent overdrafts.

- Calendar Reminders: Utilize digital calendars or physical planners to set reminders a few days before each bill’s due date. This provides a proactive prompt to review and submit payments.

- Budgeting and Cash Flow Management: Integrate bill payment deadlines into a comprehensive budget. Understanding monthly income and expenses allows for better allocation of funds to ensure all obligations are met on time.

- Consolidated Due Dates: Where possible, adjust billing cycles for credit cards or other accounts to align with a single, convenient payment date each month.

Effective Credit Utilization Management

Credit utilization, the ratio of a consumer’s revolving credit balance to their total available credit, is a critical component of credit scoring. Keeping this ratio low demonstrates responsible credit management and positively impacts a credit score. For a 771 score, maintaining a low utilization ratio is key to preventing any erosion of this excellent standing.Methods for managing credit utilization effectively include:

- Targeting a Low Utilization Ratio: Aim to keep the credit utilization ratio below 30% across all credit cards, and ideally below 10% for optimal score impact. For example, if a credit card has a limit of $10,000, keeping the balance below $3,000 is advisable.

- Paying Down Balances: Regularly pay down credit card balances, especially before the statement closing date. This ensures that a lower balance is reported to credit bureaus.

- Increasing Credit Limits: Requesting an increase in credit limits on existing credit cards can, if spending remains constant, automatically lower the utilization ratio. This should be done judiciously and only if there is confidence in maintaining disciplined spending.

- Strategic Use of Multiple Cards: Distribute spending across multiple credit cards rather than maxing out a single card. This helps maintain a lower overall utilization ratio.

Periodic Review of Credit Reports for Accuracy

Credit reports are the foundation upon which credit scores are built. Errors or inaccuracies on a credit report can unfairly lower a credit score, even one as strong as 771. Regularly reviewing these reports is a proactive measure to identify and rectify any discrepancies, thereby safeguarding the existing score.The benefits of periodically reviewing credit reports for accuracy are manifold:

- Identification of Errors: Credit reports may contain mistakes such as incorrect personal information, accounts that do not belong to the individual, or inaccurate payment histories.

- Prevention of Identity Theft: Unauthorized accounts or inquiries can be red flags for identity theft. Early detection allows for swift action to protect financial identity.

- Ensuring Accurate Score Calculation: Inaccurate information can lead to a lower credit score than warranted. Correcting these errors ensures the score accurately reflects responsible financial behavior.

- Dispute Resolution: Credit bureaus are legally obligated to investigate disputes. Promptly addressing inaccuracies can lead to their removal, potentially improving the credit score.

Individuals are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually through AnnualCreditReport.com.

Best Practices for Opening and Managing New Credit Accounts

While a 771 credit score indicates a well-established credit history, the decision to open new credit accounts should be approached with a strategic mindset. Responsible management of any new credit is essential to maintain and potentially further enhance this strong score.A set of best practices for opening and managing new credit accounts responsibly includes:

- Assess the Need: Before applying for new credit, evaluate whether it is truly necessary. Unnecessary applications can lead to multiple hard inquiries, which can temporarily lower a credit score.

- Research Account Terms: Thoroughly understand the interest rates, fees, rewards programs, and credit limits of any new credit account before applying. Choose accounts that align with financial goals and spending habits.

- Avoid Over-Application: Limit applications for new credit to a few well-researched options within a reasonable timeframe. Spreading applications out can mitigate the impact of hard inquiries.

- Maintain a Good Mix of Credit: A diverse credit mix, including revolving credit (credit cards) and installment loans (mortgages, auto loans), can be beneficial. However, do not open new accounts solely for the purpose of credit mix.

- Responsible Usage of New Accounts: Treat any new credit card or loan with the same discipline as existing accounts. Make payments on time, keep utilization low, and avoid excessive borrowing.

Potential Challenges or Nuances with a 771 Score: Is 771 A Good Credit Score

While a credit score of 771 generally signifies a strong financial standing, it’s crucial to understand that this number is not a universal golden ticket to the absolute best financial terms. Lenders and financial institutions evaluate applicants based on a complex interplay of factors, and a 771 score, while excellent, may still encounter specific scenarios where its impact is nuanced.

This section delves into these potential challenges and intricacies that can arise even with a robust credit profile.A credit score is a powerful indicator, but it represents a snapshot of creditworthiness. It doesn’t always capture the full picture of an individual’s financial behavior or the specific risk appetite of a particular lender. Therefore, understanding these nuances is key to navigating the financial landscape effectively and ensuring optimal outcomes.

Scenarios Where a 771 Score Might Not Guarantee Optimal Terms

Despite a strong 771 credit score, certain financial products or loan types might not automatically yield the lowest interest rates or the most favorable repayment terms. This can occur when lenders prioritize other risk factors or when the market conditions for a specific product are particularly competitive or restrictive. For instance, while a 771 score is excellent for a standard mortgage or auto loan, securing the absolute lowest introductory rate on a niche investment product or a specialized business loan might still depend on factors beyond just the credit score.Factors that can influence this include:

- Loan-to-Value Ratio: For mortgages, a high loan-to-value ratio (meaning you’re borrowing a large percentage of the home’s value) can increase lender risk, potentially leading to slightly higher rates even with a 771 score.

- Loan Term and Amount: Longer loan terms or exceptionally large loan amounts might involve more perceived risk for lenders, prompting them to adjust rates.

- Market Competition: In highly competitive markets for certain loan products, lenders might tighten their criteria for the absolute best rates, even for borrowers with excellent scores.

- Specific Product Requirements: Some financial products, like premium credit cards with exclusive rewards, may have additional qualification criteria that go beyond a credit score, such as income verification or existing banking relationships.

Lender-Specific Criteria Beyond General Score

Financial institutions employ proprietary algorithms and underwriting processes that can significantly influence lending decisions, even for individuals with identical credit scores. A 771 score is a strong baseline, but individual lenders may place varying degrees of emphasis on different components of a credit report. Some lenders might be more sensitive to recent credit inquiries, while others might place a higher value on a long credit history with a consistent payment record.This means that:

- Risk Tolerance Varies: Different lenders have different risk appetites. A more conservative lender might be less likely to offer the absolute lowest rate compared to a lender seeking to attract a broader customer base.

- Proprietary Scoring Models: Beyond the FICO or VantageScore, lenders often use their own internal scoring models that may weigh factors differently.

- Relationship Banking: Existing customers with a long and positive history with a particular bank might receive preferential treatment, even if their credit score is similar to a new applicant.

- Economic Conditions: Broader economic conditions can also influence a lender’s lending criteria. During periods of economic uncertainty, lenders may become more risk-averse across the board.

Potential Negative Impacts of Recent Credit Inquiries

While a 771 credit score indicates responsible credit management, a significant number of recent credit inquiries, often referred to as “hard inquiries,” can temporarily ding the score. These inquiries occur when a lender checks your credit report to make a lending decision, such as when you apply for a new credit card, loan, or mortgage. Although one or two inquiries are unlikely to cause a substantial drop, a cluster of them within a short period can signal to lenders that you might be experiencing financial distress or are seeking a large amount of new credit, which increases perceived risk.The impact of inquiries is generally:

- Temporary: Hard inquiries typically remain on a credit report for two years but usually only affect the score for the first year.

- Minor Impact: Each hard inquiry typically lowers a credit score by a few points, but the cumulative effect of multiple inquiries can be more noticeable.

- Rate Shopping Exception: Credit scoring models often allow for a grace period (typically 14-45 days) for rate shopping on certain types of loans (mortgages, auto loans, student loans). Inquiries made within this window for the same type of loan are usually treated as a single inquiry.

Certain Types of Debt May Still Present Challenges

Even with a 771 credit score, the presence of certain types of debt or specific debt management patterns can still pose challenges or limit access to the most advantageous financial products. For example, while a good credit score suggests an ability to manage debt, a high credit utilization ratio on credit cards, even if paid on time, can still be viewed negatively by some lenders.

Similarly, a history of carrying significant balances on high-interest debt, even if it’s being paid down, might raise a flag.Consider these debt-related nuances:

- High Credit Utilization: If you have a 771 score but consistently carry balances close to your credit limits on your credit cards, this high utilization ratio can negatively impact your score and signal higher risk to lenders, potentially leading to less favorable terms. Lenders generally prefer to see credit utilization below 30%.

- Types of Debt: While a score of 771 is strong, a history dominated by certain types of debt, such as payday loans or a large number of retail store cards with high interest rates, might still be viewed with caution by some lenders compared to a history of diverse, well-managed credit.

- Recent Delinquencies: Even with an overall strong score, a very recent late payment or delinquency, even if it hasn’t significantly dropped the score below 771, can be a deterrent for some lenders offering their absolute best rates.

- Secured vs. Unsecured Debt: While managing secured debt like mortgages and auto loans well is positive, a large amount of unsecured debt, even with a good score, might be perceived as a higher risk by some lenders.

Final Wrap-Up

In essence, a credit score of 771 positions you favorably within the lending ecosystem, offering access to a wide array of financial products with competitive terms. While not always the absolute peak, it signifies a strong financial reputation built on responsible habits. By consistently applying the strategies discussed—prioritizing on-time payments, managing credit utilization wisely, and staying vigilant about your credit reports—you can not only maintain this robust score but potentially elevate it further, ensuring continued access to the best financial opportunities available.

Questions Often Asked

What are the typical credit score ranges?

Credit scores generally range from 300 to 850. Scores above 800 are considered exceptional, 740-799 are very good, 670-739 are good, 580-669 are fair, and below 580 are considered poor.

How does a 771 credit score compare across different credit bureaus?

While the exact ranges can vary slightly, a score of 771 is consistently viewed as “good” to “very good” by major credit bureaus like Experian, Equifax, and TransUnion. It generally places you in a strong position for most lending products.

What are the main factors influencing my credit score?

The most significant factors are payment history (paying bills on time), credit utilization (how much credit you’re using versus your limit), the length of your credit history, the mix of credit you have (e.g., credit cards, loans), and recent credit inquiries.

Can a 771 credit score get me approved for premium credit cards?

Yes, a score of 771 is typically high enough to qualify for many premium credit cards that offer attractive rewards, travel benefits, and other perks. Lenders often view this score favorably for such products.

Will a 771 score guarantee the absolute lowest interest rates?

While a 771 score offers excellent rates, the absolute lowest rates are often reserved for scores in the excellent or exceptional range (800+). However, the difference in rates might be marginal, and a 771 score still provides significant savings.

Do recent credit inquiries negatively impact a 771 score?

A few recent inquiries typically have a small, short-term impact. However, numerous inquiries in a short period can lower your score, as it might suggest you’re seeking a lot of new credit, which lenders can see as a risk.