How to delete a bank account in quickbooks is a critical procedure for maintaining an accurate and streamlined financial record within your accounting software. This process, while seemingly straightforward, involves understanding the nuances of account types, potential data implications, and the correct sequence of operations to ensure data integrity. Navigating this task effectively requires a clear grasp of both the technical steps and the strategic reasons behind account removal.

This comprehensive guide will dissect the multifaceted aspects of removing a bank account from your QuickBooks company file, covering everything from the initial decision-making process to the final confirmation of deletion. We will explore the common scenarios prompting such actions, differentiate between connected bank feeds and manually entered accounts, and clearly define the distinctions between deactivating and permanently deleting an account.

Furthermore, meticulous preparation, including transaction reconciliation and risk mitigation, will be emphasized as essential precursors to any deletion action. The guide will then provide detailed, step-by-step instructions for both QuickBooks Online and QuickBooks Desktop users, addressing both connected and manually added accounts. Finally, we will examine best practices, viable alternatives to deletion, and procedures for handling previously deleted or reopened accounts, ensuring a complete understanding of this important accounting function.

Understanding the Need to Remove a Bank Account in QuickBooks: How To Delete A Bank Account In Quickbooks

In the management of financial records within QuickBooks, there are occasions where the removal of a bank account becomes a necessary administrative task. This action is not undertaken lightly but is often dictated by specific business circumstances or changes in financial infrastructure. Understanding the precise reasons and implications behind this process is crucial for maintaining data integrity and operational efficiency within your accounting software.The decision to remove a bank account from QuickBooks typically stems from several common scenarios.

These can range from the closure of a specific bank account by the institution, the cessation of its use for business transactions, or the consolidation of financial services with a different banking provider. In some instances, an account might have been mistakenly added to the QuickBooks file and requires rectification. The implications of removal differ significantly based on how the account was initially integrated into the system.

Distinguishing Connected Bank Feeds from Manually Entered Accounts

The process and consequences of removing a bank account in QuickBooks are fundamentally influenced by whether the account was linked via a direct bank feed or if its transactions were entered manually. A connected bank feed automatically synchronizes transactions from the financial institution to QuickBooks. Removing such an account severs this automatic synchronization, preventing future transactions from appearing. Conversely, a manually entered account relies on the user to input all transaction data.

Deleting a manually entered account removes all associated records, whereas a bank feed connection, when disconnected, primarily stops the flow of new data.

Differentiating Account Deactivation from Deletion

Within QuickBooks, the terms “deactivate” and “delete” regarding accounts carry distinct meanings and operational outcomes. Deactivating an account is a method of removing it from active use and visibility in reports and dropdown menus without permanently erasing its historical data. This is often the preferred method for accounts that are no longer in use but may still hold historical financial information that could be relevant for auditing or reference purposes.

Deletion, on the other hand, is a more permanent action that permanently removes the account and all its associated transaction history from the QuickBooks company file. This is generally reserved for accounts that were created in error or have no historical value.The primary difference lies in data preservation. Deactivation preserves historical data, making the account and its transactions inaccessible for day-to-day operations but retrievable if needed.

Deletion permanently eradicates all data associated with the account. Therefore, careful consideration must be given to the long-term implications before choosing to delete an account outright.

Preparing to Delete a Bank Account

Before proceeding with the deletion of a bank account in QuickBooks, it is imperative to undertake a series of preparatory steps to ensure data integrity and prevent unintended consequences. This phase is critical for a smooth and accurate financial record-keeping process. Thorough preparation minimizes the risk of data loss and facilitates a clean removal of the account.The primary objective of this preparatory stage is to ensure that all financial transactions associated with the bank account are accounted for and that the account balance is zero.

This prevents discrepancies in your overall financial reporting and ensures that the deletion process is as straightforward as possible.

Reconciling Outstanding Transactions

Reconciliation is the process of comparing the transactions recorded in your QuickBooks account with the corresponding transactions on your bank statement. This ensures that all deposits, withdrawals, checks, and other financial activities have been accurately recorded and that the QuickBooks balance matches the bank’s balance. Before deleting an account, it is essential to reconcile all outstanding transactions to ensure no open items remain.

This involves reviewing cleared and uncleared transactions, identifying any discrepancies, and making necessary adjustments. A fully reconciled account at the point of deletion signifies that all financial activity has been properly documented.

Identifying Potential Data Loss Risks and Mitigation Strategies

Deleting a bank account in QuickBooks can lead to the permanent removal of all associated transaction data. This includes historical records of deposits, withdrawals, checks, and any other financial activity linked to that account. The risk of data loss is significant if not properly managed. To mitigate these risks, a comprehensive backup of your QuickBooks company file should be performed before initiating the deletion process.

This backup serves as a safety net, allowing you to restore your data if any unforeseen issues arise. Furthermore, consider exporting relevant historical data from the account to a separate file format, such as a CSV or Excel spreadsheet, for archival purposes. This provides a tangible record of the account’s financial history that can be accessed independently of QuickBooks.

Pre-Deletion Task Checklist

To ensure a systematic and thorough approach to deleting a bank account, adherence to a predefined checklist is highly recommended. This checklist Artikels the essential tasks that must be completed prior to initiating the account removal process, thereby safeguarding against errors and data loss.

The following checklist provides a structured approach to preparing for bank account deletion:

- Perform a complete backup of your QuickBooks company file.

- Ensure the bank account balance is zero.

- Reconcile all outstanding transactions for the account up to the current date.

- Review and record any pending transactions that need to be addressed before deletion.

- Export any critical historical transaction data from the account for archival purposes.

- Verify that no outstanding bills or invoices are directly linked to this bank account for payment processing.

- Confirm that no recurring transactions or scheduled payments are tied to this account.

- Document the account’s purpose and its historical significance within your financial records.

Deleting a Connected Bank Account (Bank Feed)

![[Fixed] Folder Access Denied: You Need Permission to Delete File in ... [Fixed] Folder Access Denied: You Need Permission to Delete File in ...](https://i1.wp.com/images.squarespace-cdn.com/content/v1/6193ecda19fd5e3743ed1d8d/d38743f2-0f77-4b7f-8b93-0f2a4b38d34f/How+to+Mass+Delete+Emails+in+Outlook.png?w=700)

Disconnecting a bank feed from QuickBooks is a crucial step when an account is no longer in use or when transitioning to a different accounting system. This process prevents duplicate transactions and ensures the integrity of your financial data. It is imperative to handle this procedure with care, ensuring all relevant transactions are accounted for before severing the connection.Before proceeding with the disconnection of a bank feed, it is essential to ensure that all downloaded transactions have been thoroughly reviewed and categorized.

Failure to do so can result in incomplete or inaccurate financial records, making future reconciliation and reporting more challenging. This preparatory phase is vital for maintaining data accuracy.

Disconnecting a Bank Feed from QuickBooks Online, How to delete a bank account in quickbooks

QuickBooks Online offers a straightforward process for disconnecting bank feeds. This involves navigating to the banking section and selecting the option to disable or edit the connection. It is important to confirm the disconnection to prevent any further data synchronization.To disconnect a bank feed in QuickBooks Online, follow these steps:

- Navigate to the “Banking” or “Transactions” section.

- Locate the bank account for which you wish to disconnect the feed.

- Click on the pencil icon (edit) or a similar option associated with the bank connection.

- Select the option to “Disconnect this account on save” or “End connection.”

- Confirm your decision when prompted.

Before disconnecting, ensure all downloaded transactions are categorized. This involves reviewing each transaction that has been imported into QuickBooks Online and assigning it to the appropriate account. Transactions that are uncategorized or incorrectly categorized should be rectified to reflect the actual financial activity.

Removing a Bank Feed Connection in QuickBooks Desktop

QuickBooks Desktop also provides a method for removing bank feed connections, typically referred to as online banking or bank feeds. The process involves accessing the bank connection settings and disabling or deleting the existing connection.The procedure for removing a bank feed connection in QuickBooks Desktop is as follows:

- Go to the “Banking” menu.

- Select “Bank Feeds.”

- Choose “Bank Feed Center.”

- Locate the account you wish to disconnect.

- Click on the “Edit Account Info” or a similar option.

- In the account information window, find the option to “Remove this online services connection” or “Disable this bank feed.”

- Confirm the removal when prompted.

As with QuickBooks Online, it is paramount to categorize all downloaded transactions before removing the connection. This ensures that no financial data is lost or misrepresented. Every imported transaction should be reviewed and assigned to its correct expense, income, or transfer category within QuickBooks Desktop.

Ensuring All Downloaded Transactions are Properly Categorized Before Disconnecting

The accuracy of your financial records hinges on the proper categorization of all downloaded bank transactions. Before disconnecting a bank feed, dedicate sufficient time to review each transaction. This process ensures that all financial activities are correctly reflected in your accounting software, which is crucial for accurate reporting and tax preparation.The importance of thorough transaction categorization prior to disconnecting a bank feed cannot be overstated.

It directly impacts:

- Financial Reporting Accuracy: Correctly categorized transactions form the basis of all financial statements, such as profit and loss reports and balance sheets.

- Tax Compliance: Accurate expense and income categorization is essential for correct tax filings.

- Reconciliation: A complete and accurate transaction history simplifies the bank reconciliation process, allowing you to easily match QuickBooks entries with your bank statements.

- Audit Preparedness: Well-organized and categorized transactions are vital for any internal or external audits.

To effectively categorize transactions, consider the following:

- Review Each Transaction: Go through every downloaded transaction, paying attention to the date, amount, and vendor or customer name.

- Assign Appropriate Accounts: Use your chart of accounts to assign each transaction to the correct income, expense, asset, liability, or equity account. For example, a payment to a utility company should be categorized under an appropriate utility expense account.

- Utilize Rules: QuickBooks allows you to set up rules for recurring transactions. This automates the categorization process for transactions from specific vendors or with specific descriptions. For instance, you can set a rule to always categorize payments to your internet provider as “Internet Expense.”

- Add Memorized Transactions: For highly repetitive transactions, consider memorizing them to streamline future data entry and categorization.

- Investigate Unfamiliar Transactions: If a transaction is unfamiliar, investigate its purpose to avoid miscategorization. This may involve checking receipts or contacting the vendor.

A best practice involves performing this categorization process regularly, ideally on a weekly or bi-weekly basis, rather than waiting until the point of disconnection. This proactive approach ensures that your books are always up-to-date and reduces the burden when it is time to remove a bank feed.

Deleting a Manually Added Bank Account

When a bank account is not connected to QuickBooks via a bank feed, it is typically entered manually. This process involves inputting transaction details directly into the software. Deleting such an account requires a different approach than removing a connected bank feed, primarily due to the absence of automated synchronization. It is crucial to manage the historical data associated with manually entered accounts carefully to maintain the integrity of your financial records.The procedure for removing a manually added bank account varies slightly between QuickBooks Online and QuickBooks Desktop.

Understanding these differences is essential to ensure a clean and accurate removal without negatively impacting your accounting data.

Deleting a Manually Added Bank Account in QuickBooks Online

In QuickBooks Online, manually added bank accounts can be deleted if they have not been reconciled and contain no associated transactions. If transactions exist, they must be addressed before the account can be removed.The steps to delete a manually added bank account in QuickBooks Online are as follows:

- Navigate to the Chart of Accounts. This can typically be found under the Accounting or Accounting Settings menu.

- Locate the bank account you wish to delete.

- Click the dropdown arrow or the Action menu next to the account name.

- Select Delete.

- If prompted, confirm the deletion. If the delete option is unavailable, it indicates that the account has associated transactions or has been reconciled.

If the delete option is unavailable due to existing transactions, you will need to either delete or reclassify these transactions. Deleting transactions should only be done if they are erroneous. Reclassifying them to another appropriate account is a more common approach to clear the balance before deleting the bank account.

Deleting a Manually Entered Bank Account in QuickBooks Desktop

QuickBooks Desktop also allows for the deletion of manually entered bank accounts, provided certain conditions are met. Similar to QuickBooks Online, the presence of transactions or reconciliation history can prevent direct deletion.The process for deleting a manually entered bank account in QuickBooks Desktop involves:

- Go to the Chart of Accounts. This is usually accessed by clicking the Company menu and then selecting Chart of Accounts.

- Find the bank account you intend to remove.

- Right-click on the account name.

- Select Delete Account from the context menu.

- If the option is grayed out or unavailable, it signifies that the account cannot be deleted directly. This is typically because there are transactions recorded in the account, or it has been reconciled.

Should direct deletion be prevented, you must first address all transactions associated with the account. This may involve deleting incorrect entries or reassigning valid transactions to a different account. After clearing the account of all activity, you can then proceed with its deletion.

Considerations for Handling Historical Data of a Manually Deleted Account

When deleting a manually added bank account, it is imperative to consider the implications for your historical financial data. The objective is to remove the account without compromising the accuracy or completeness of your records.Key considerations include:

- Reconciliation Status: Ensure that all prior periods for the account have been reconciled. If not, you must reconcile them before deleting the account. This confirms that all recorded transactions are accounted for.

- Transaction Integrity: If the account contains transactions that need to be retained, they must be reclassified to another appropriate account. For example, if the account represented a specific project or temporary fund, its remaining balance and transactions could be moved to a general operating account or a more suitable permanent account.

- Audit Trail: QuickBooks maintains an audit trail, which records all changes made within the software. While deleting an account removes it from the active Chart of Accounts, the audit trail will still reflect its prior existence and deletion. This is important for transparency and future reference.

- Tax Implications: Depending on the nature of the account and the transactions within it, there might be tax implications to consider. Consult with a tax professional if you are unsure about how deleting an account might affect your tax filings.

- Reporting: Deleting an account will remove it from future financial reports. However, historical reports generated before the deletion may still reflect the account. If you need to retain historical reporting data that includes the deleted account, consider exporting those reports before proceeding with the deletion.

The deletion of a manually entered bank account necessitates a thorough review of all associated transactions to ensure that no financial data is lost or misrepresented.

Deleting a bank account in QuickBooks is a straightforward process, much like when you’re ready to how to close a business bank account. Understanding the nuances of account closure, whether personal or business, helps in accurately removing it from your QuickBooks records. Once finalized, deleting ensures your financial overview remains clean and precise.

If the account represents a closed entity or a financial instrument that is no longer in use, and all its financial activity has been resolved, deletion is appropriate. However, if the account’s activity is still relevant or requires ongoing tracking, reclassification rather than deletion is the recommended course of action.

Best Practices and Alternatives to Deletion

While the direct deletion of a bank account in QuickBooks may seem like a straightforward solution for accounts no longer in use, it is crucial to consider the potential implications for your historical financial data. QuickBooks employs a robust accounting system where the removal of an account can impact audit trails and reporting accuracy. Therefore, exploring alternative methods that preserve data integrity is paramount before resorting to outright deletion.This section will delve into alternative strategies for managing unused bank accounts within QuickBooks, focusing on methods that maintain data continuity and auditability.

Understanding these alternatives allows for informed decision-making, ensuring that your financial records remain accurate and accessible for future reference, analysis, or compliance purposes.

Making an Account Inactive

The most common and recommended alternative to deleting a bank account in QuickBooks is to mark it as inactive. This process effectively removes the account from your active chart of accounts, preventing it from appearing in dropdown menus for new transactions, thereby simplifying your day-to-day data entry. However, the account and its associated historical transactions remain within your QuickBooks company file.

This is particularly important for maintaining a complete financial history for reporting, auditing, or tax purposes.The procedure for making an account inactive varies slightly depending on the version of QuickBooks you are using (e.g., QuickBooks Online vs. QuickBooks Desktop). Generally, it involves navigating to the Chart of Accounts, locating the desired bank account, and selecting an option to “Make Inactive” or a similar designation.

Comparison of Inactivating vs. Deleting Accounts

To effectively manage your QuickBooks data, it is beneficial to understand the distinct advantages and disadvantages of making an account inactive versus deleting it. Each method serves a different purpose and carries different consequences for your financial records.

| Feature | Making Account Inactive | Deleting Account |

|---|---|---|

| Data Preservation | Preserves all historical transaction data associated with the account. The account and its transactions remain in the file. | Permanently removes the account and all associated historical transactions from the company file. This data cannot be recovered. |

| Audit Trail | Maintains the integrity of the audit trail, as historical entries are not erased. This is critical for compliance and tracking changes. | Breaks the audit trail for the deleted account’s transactions, which can raise red flags during audits. |

| Reporting Impact | Historical reports will continue to include data from the inactive account, providing a complete financial picture over time. | Historical reports will no longer reflect the transactions of the deleted account, potentially skewing past financial analysis. |

| Ease of Use (Active Lists) | Removes the account from active lists, simplifying transaction entry and reducing clutter in dropdown menus. | Removes the account entirely, which can be simpler if the account is truly obsolete and never needed again. |

| Recovery Options | The account can be easily reactivated if needed, restoring its visibility and functionality. | Once deleted, the account and its data are gone. Recovery typically requires restoring from a backup, which may overwrite newer data. |

Appropriate Scenarios for Deletion vs. Inactivation

The decision between deleting an account and making it inactive hinges on the account’s history and your specific business needs. Generally, inactivation is the preferred method due to its data preservation capabilities.Consider the following guidelines:

- Delete an account only if:

- The account was created in error and has never had any transactions posted to it.

- You are absolutely certain that no historical data related to this account will ever be required for reporting, tax purposes, or audits.

- The account is for a temporary, one-time purpose that has concluded, and its existence is causing confusion or clutter in active lists.

- Make an account inactive if:

- The account was used for a period but is no longer active (e.g., a closed credit card, a closed savings account).

- The account is still linked to historical transactions that might be needed for reference, analysis, or audits.

- There is any doubt about whether the account’s historical data might be required in the future.

- The account is a sub-account of another account that is being closed or modified.

In essence, the principle of least disruption to your financial data should guide this decision. Preserving historical accuracy is almost always more beneficial than complete removal, especially in a business context where financial records are subject to scrutiny.

Handling Reopened or Previously Deleted Accounts

In the course of managing financial records within QuickBooks, situations may arise where a bank account that was previously deleted or disconnected needs to be re-established. This can occur due to various reasons, such as a temporary disconnection, a change in accounting software usage, or an accidental deletion that requires rectification. The process of re-adding such an account is designed to restore the continuity of financial data and ensure accurate reporting.Re-establishing a connection or re-adding a bank account in QuickBooks is a critical step to ensure that all financial transactions are accurately captured and reconciled.

This process is particularly important if the account was deleted or disconnected and you now need to resume tracking its activity within your QuickBooks file. Careful adherence to the established procedures will prevent data discrepancies and maintain the integrity of your financial statements.

Re-adding a Previously Deleted or Disconnected Bank Account

When a bank account has been deleted from QuickBooks, or its connection to the bank feed has been severed, it is possible to re-integrate it. The method for doing so depends on whether the account was a connected bank feed or a manually added account. The primary objective is to re-establish the link or manually input the necessary information to resume tracking.The process of re-adding a bank account in QuickBooks typically involves navigating to the Chart of Accounts and initiating the setup for a new account, or in the case of a disconnected bank feed, re-establishing the online connection.

For manually added accounts, you will recreate the account structure and then manually import or enter transactions. For connected accounts, QuickBooks will guide you through the process of linking to your financial institution again.

Recovering or Re-establishing a Connection for an Accidentally Removed Bank Account

Accidentally removing a bank account from QuickBooks can be a disquieting experience, but the software is designed to allow for its recovery. If the account was connected via a bank feed, the process focuses on re-establishing that online connection. If it was a manually entered account, you will need to recreate it and then import historical data if necessary.To recover an accidentally removed bank feed account, you will generally follow the steps for connecting a new bank account.

This involves searching for your bank, entering your online banking credentials, and authorizing QuickBooks to access your account information. For manually entered accounts, the recovery involves creating a new account with the same name and details and then importing transactions from a bank statement file (e.g., CSV, QBO) if historical data needs to be reinstated.

Troubleshooting Common Issues When Re-adding Bank Accounts

Encountering issues when re-adding a bank account is not uncommon. These problems can range from connection errors to data synchronization failures. Addressing these issues promptly is crucial to avoid prolonged disruption in your financial tracking.Common issues and their resolutions include:

- Connection Errors: These often arise from incorrect online banking credentials, a temporary outage with the bank’s server, or security protocols that block QuickBooks.

- Resolution: Verify your username and password for the bank’s website. Ensure that your bank’s website is accessible. Contact your bank to confirm if there are any service disruptions or if they have specific requirements for third-party access.

Resetting your online banking password can sometimes resolve persistent connection issues.

- Resolution: Verify your username and password for the bank’s website. Ensure that your bank’s website is accessible. Contact your bank to confirm if there are any service disruptions or if they have specific requirements for third-party access.

- Data Synchronization Failures: This can occur if the bank feed is not updating correctly, leading to missing transactions or duplicate entries.

- Resolution: After re-establishing the connection, it may be necessary to manually refresh the connection or to re-download transactions for a specific period. In some cases, QuickBooks may prompt you to categorize existing transactions to help align the imported data with your existing records.

- Account Not Found: The system may indicate that the account cannot be found, especially if the bank name or account details have been updated on the bank’s end.

- Resolution: Confirm that you are selecting the correct bank from the list provided by QuickBooks. If your bank has recently rebranded or merged, you may need to search for the new entity. Ensure that the account you are trying to add is an active account with your financial institution.

- Duplicate Transactions: Re-adding an account can sometimes lead to duplicate transactions if QuickBooks imports data that already exists in your file.

- Resolution: QuickBooks often has tools to identify and merge duplicate transactions. Review the downloaded transactions carefully and use the “Find Duplicates” feature if available. Manually deleting any confirmed duplicates is also an option, but this should be done with caution after verifying that they are indeed duplicates.

Visualizing the Deletion Process

Understanding the visual representation of deleting a bank account in QuickBooks is crucial for efficient financial management. This section provides a detailed walkthrough of the interface elements and required actions across different QuickBooks versions, ensuring clarity and minimizing potential errors during the account removal process.The visualization of the deletion process requires a clear understanding of the user interface and the specific steps involved.

While the core objective remains the same, QuickBooks Online and QuickBooks Desktop present these steps through distinct navigational paths and interface designs. A comparative overview will highlight these differences, aiding users in adapting to or selecting the appropriate version for their needs.

QuickBooks Online: Step-by-Step Visual Guide

Deleting a bank account in QuickBooks Online involves navigating through the Chart of Accounts and deactivating the specific account. This process is designed to be straightforward, with clear indicators for each step.The process begins by accessing the Chart of Accounts.

- Navigate to the ‘Accounting’ section in the left-hand navigation bar.

- Select ‘Chart of Accounts’. This will display a list of all accounts in your company file.

- Locate the bank account you wish to delete. You can use the search bar to find it quickly by name or account number.

- Click the dropdown arrow or the ‘Action’ menu (depending on your QuickBooks Online version) next to the account you want to delete.

- Select ‘Make inactive’. A confirmation message will appear, informing you that the account will be hidden from your reports and lists.

- Click ‘Yes’ to confirm the deactivation. The account will no longer appear in your active account lists.

It is important to note that QuickBooks Online does not permanently delete accounts. Instead, it marks them as inactive. This preserves historical data while removing the account from active use and view.

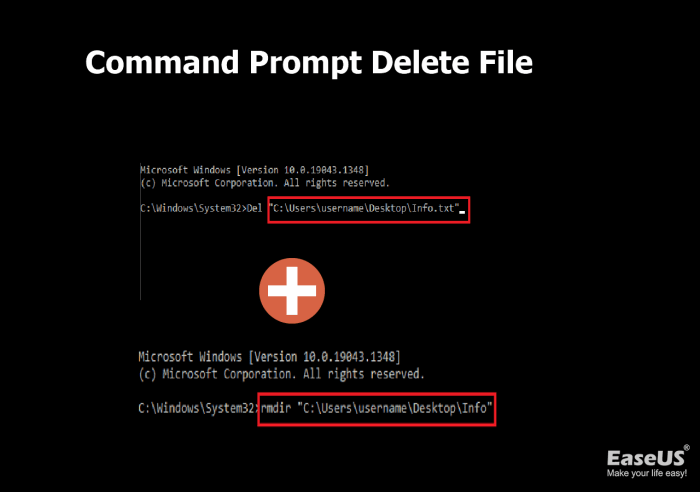

QuickBooks Desktop: Textual Representation of Interface Elements and Actions

In QuickBooks Desktop, the process of deleting a bank account involves a slightly different approach, particularly concerning accounts that have associated transactions. The ability to permanently delete an account is contingent on whether any transactions have been recorded for it.The primary interface for account management is the Chart of Accounts.

- From the top menu bar, select ‘Lists’.

- Choose ‘Chart of Accounts’. This opens the Chart of Accounts window, displaying all your company’s accounts.

- Identify the bank account to be deleted. You can sort the list by account type or name for easier identification.

- If the account has no transactions, you can directly delete it. Right-click on the account name and select ‘Delete Account’. A confirmation dialog box will appear. Click ‘OK’ to confirm the deletion.

- If the account has transactions, QuickBooks Desktop will prevent direct deletion. You will need to clear all transactions associated with the account first. This typically involves voiding or deleting individual transactions, or reclassifying them to another appropriate account. Once all transactions are removed, the ‘Delete Account’ option will become available.

The interface for deleting an account with transactions will present a warning message, indicating that transactions must be cleared before deletion is possible. This is a critical safeguard to maintain data integrity.

Comparative Overview of User Interface for Deleting Bank Accounts

The user interface for managing and deleting bank accounts varies between QuickBooks Online and QuickBooks Desktop, reflecting their distinct architectural designs and operational philosophies. While both platforms aim to provide a clear path to account removal, the methods and terminology differ.QuickBooks Online emphasizes account ‘inactivation’ rather than permanent deletion, ensuring that historical data remains accessible. The interface is web-based and generally more streamlined.

- QuickBooks Online: Access is through the ‘Accounting’ > ‘Chart of Accounts’ menu. The action is ‘Make inactive’, presented as a dropdown option next to the account. Confirmation is a simple click on ‘Yes’. The visual presentation is clean and intuitive, with minimal steps.

QuickBooks Desktop, particularly for accounts with no historical transactions, offers a direct ‘Delete Account’ option. The interface is application-based, with a more traditional menu structure.

- QuickBooks Desktop: Access is through ‘Lists’ > ‘Chart of Accounts’. The action is ‘Delete Account’, accessed via a right-click context menu. A warning dialog box appears if transactions exist, prompting the user to clear them. The visual is a standard desktop application window with menu options and dialog boxes.

The key difference lies in the permanence of the action. QuickBooks Online’s ‘inactivate’ function preserves data and prevents future use, while QuickBooks Desktop’s ‘delete’ function, when applicable, removes the account and its associated entries entirely from the system, necessitating careful consideration of historical impact.

Closing Summary

In conclusion, the process of how to delete a bank account in quickbooks is a deliberate action that necessitates careful planning and execution. By understanding the underlying reasons, preparing diligently, and following the precise procedural steps Artikeld for both online and desktop versions, users can confidently manage their financial data. Whether dealing with connected bank feeds or manually entered accounts, the distinctions between deactivation and deletion are paramount.

Embracing best practices and considering alternatives like account inactivation ensures that financial records remain accurate and reflective of the business’s true financial standing. Should the need arise to reintroduce a previously removed account, the provided guidance offers clear pathways for recovery and reconnection, solidifying the user’s control over their QuickBooks environment.

FAQ Summary

What is the primary difference between deactivating and deleting a bank account in QuickBooks?

Deactivating an account in QuickBooks typically hides it from your active chart of accounts, preventing it from being used in new transactions while preserving its historical data. Deleting an account, however, removes it entirely from your company file, which can lead to data loss for associated transactions if not handled properly.

Can I delete a bank account if it has transactions associated with it?

In most cases, QuickBooks prevents the direct deletion of an account with associated transactions to safeguard data integrity. You will usually need to reassign or delete these transactions first, or opt for deactivation as an alternative.

What happens to historical data when a bank account is deleted?

When a bank account is deleted, especially a manually entered one, the historical transactions linked to it may also be removed from the company file, potentially impacting reports and audit trails. Connected bank feeds, when disconnected, retain historical data within QuickBooks unless specifically purged.

Is it possible to undo the deletion of a bank account?

Undoing a deletion can be challenging and depends on whether you have a backup of your QuickBooks file from before the deletion occurred. QuickBooks Online may offer limited recovery options, while Desktop versions rely heavily on prior backups.

What is the recommended approach if I only want to stop seeing a bank account in my reports?

If you simply wish to stop using a bank account but retain its historical data, the recommended approach is to deactivate the account rather than delete it. This removes it from active use without losing past financial information.