Can I use bank statements as receipts for taxes? This question often surfaces for individuals and businesses navigating the often-complex world of tax preparation. Within these pages, we delve into the intricate relationship between your financial records and the demands of tax authorities, offering a clear path through the often-murky waters of documentation.

Understanding the nuances of what constitutes acceptable proof of expenditure is crucial for a smooth tax filing process. Bank statements, while containing vital transactional data, may not always be the complete picture required by tax regulations. This exploration aims to illuminate the circumstances under which they suffice and when additional documentation is a must, ensuring you can confidently support your tax claims.

Understanding the Role of Bank Statements in Tax Filings

Bank statements are more than just a record of money coming in and going out; they are a cornerstone of a well-prepared tax return. For individuals and businesses alike, these documents provide essential proof of financial activity, acting as a primary source of substantiation for income and expenses. Understanding their role is crucial for accurate tax reporting and ensuring compliance with tax regulations.These statements serve as an objective audit trail, detailing every transaction processed through your bank account.

Tax authorities often require such documentation to verify the accuracy of the figures reported on your tax forms. Without them, claiming deductions or reporting income could be challenged.

Bank Statements as Primary Documentation for Financial Transactions

The fundamental purpose of bank statements in tax preparation is to offer irrefutable evidence of financial dealings. They meticulously record dates, amounts, and descriptions of deposits and withdrawals, directly linking these to your financial activities. This level of detail is vital for reconstructing your financial picture for tax purposes.When you claim an expense as a deduction, tax authorities need to see proof that the expense was legitimate and occurred.

Bank statements, alongside other supporting documents like invoices or receipts, help to build a comprehensive case for your deductions. They confirm that funds were indeed disbursed for the claimed purpose.

Common Expenses Substantiated by Bank Statements

Many everyday and business-related expenses can be validated using bank statements. While specific receipts are often preferred for detailed itemization, bank statements provide the overarching proof of payment.Here are some common examples of expenses that bank statements can help substantiate:

- Business operating expenses, such as rent, utilities, and office supplies.

- Travel expenses, including flights, accommodation, and fuel.

- Marketing and advertising costs.

- Software subscriptions and professional development courses.

- Donations to registered charities.

- Medical expenses.

- Mortgage interest and property taxes.

It’s important to note that while a bank statement shows the outflow of funds, it might not always detail the specific goods or services purchased. Therefore, it’s often best practice to keep original receipts or invoices in conjunction with your bank statements for more complex or significant deductions.

General Acceptance of Bank Statements by Tax Authorities

Tax authorities, such as the IRS in the United States or HMRC in the UK, generally accept bank statements as valid documentation for tax filings. They are considered reliable evidence of financial transactions. However, the extent to which they are accepted can depend on the nature and amount of the expense being claimed.For routine or smaller expenses, a bank statement showing the transaction might be sufficient.

For larger or more specific deductions, additional documentation like itemized receipts, invoices, or contracts may be required to fully support the claim. The key is to be able to demonstrate the business purpose or deductibility of the expense.

“Bank statements provide a verifiable record of financial activity, essential for demonstrating the legitimacy of income and expenses to tax authorities.”

Identifying What Constitutes a Valid Tax Receipt

While bank statements offer a snapshot of transactions, they don’t always meet the stringent requirements of a valid tax receipt. For tax purposes, a receipt needs to be more than just proof of payment; it must contain specific details that allow tax authorities to verify the legitimacy and deductibility of an expense. Understanding these essential elements is crucial to avoid potential issues during an audit.A valid tax receipt is a document that formally acknowledges a transaction and provides sufficient information for tax deduction claims.

It serves as proof that an expense was incurred for business purposes or meets other criteria for tax relief. The key is that the document clearly links the payer, the payee, the amount paid, and the nature of the goods or services received.

Essential Elements of a Valid Tax Receipt

To be considered a valid tax receipt, a document must contain several key pieces of information. These details are not arbitrary; they are designed to prevent fraudulent claims and ensure accurate tax reporting. Without these components, a document, even if it shows a payment, may not be accepted as proof for tax purposes.The following information is typically required on a tax receipt:

- Vendor or Service Provider Name: The full legal name or business name of the entity that provided the goods or services.

- Your Name or Business Name: Your name or the name of your business as the recipient of the goods or services.

- Date of Transaction: The exact date the purchase was made or the service was rendered.

- Description of Goods or Services: A clear and specific description of what was purchased or the service provided. Vague terms like “miscellaneous” or “supplies” are often insufficient.

- Amount Paid: The total cost of the goods or services, including any applicable taxes.

- Payment Method (sometimes): While not always mandatory, indicating the method of payment can sometimes be helpful.

- Receipt Number (often): A unique identifier for the transaction.

- Vendor’s Contact Information (often): Address and phone number of the vendor.

Bank Statement Versus Traditional Itemized Receipt

A bank statement provides a chronological record of all financial transactions processed through a bank account. It lists debits and credits, dates, and amounts, along with the name of the merchant or payee. In contrast, a traditional itemized receipt is a document issued by the vendor at the point of sale or service completion, detailing the specific items purchased, their individual prices, and the total amount due.The primary difference lies in the level of detail.

While a bank statement confirms a financial outflow, it often lacks the specific description of goods or services that is vital for tax deduction purposes. For instance, a bank statement might show a charge from “Amazon,” but it won’t specify whether it was for office supplies, a business trip necessity, or a personal item. An itemized receipt from Amazon would provide this crucial detail.

Scenarios Where Bank Statements Alone Are Insufficient

There are numerous situations where relying solely on bank statements as proof of expenditure for tax purposes would be inadequate. These scenarios typically involve expenses that require specific substantiation to qualify for deductions or credits.Consider these common scenarios where a bank statement alone will likely not suffice:

- Detailed Business Expenses: For many business deductions, such as office supplies, travel expenses, or meals and entertainment, the tax authorities require a clear description of the business purpose. A bank statement entry like “Office Depot” does not explain what was purchased or why it was necessary for business operations.

- Client Meals and Entertainment: To deduct meals and entertainment expenses, you must prove that the expense was directly related to your business. This requires documentation of who attended, the business discussion, and the location. A bank statement entry for a restaurant is insufficient.

- Travel Expenses: While a bank statement shows you paid for a flight or hotel, it doesn’t provide details like the destination, dates of travel, or the business purpose of the trip.

- Mileage Reimbursements: If you are claiming mileage, you need a log detailing dates, destinations, mileage driven, and the business purpose, not just a record of gasoline purchases.

- Donations to Charity: While a bank statement shows a donation was made, a formal receipt from the charity is required, especially for larger amounts, to confirm the deductible status of the organization and the amount of the contribution.

- Purchases from Individuals or Informal Sellers: If you purchase goods or services from someone who does not typically issue formal receipts (e.g., a freelance contractor paid via personal check), you will need to create your own record that includes all the essential receipt elements.

- Capital Expenditures: For significant purchases that are capitalized rather than expensed, detailed invoices are essential for determining depreciation schedules and basis.

Situations Where Bank Statements Are Acceptable for Tax Claims: Can I Use Bank Statements As Receipts For Taxes

While specific receipts are the gold standard for tax documentation, bank statements can serve as a crucial supporting document, especially when original receipts are lost or unavailable. They provide a clear record of transactions, including the date, payee, and amount, which are essential for substantiating various tax claims. Understanding when and how to leverage bank statements can significantly streamline your tax preparation process and bolster your defense in case of an audit.Bank statements are particularly valuable for documenting routine business expenses, charitable donations, and medical costs.

While those bank statements might seem like perfect receipts for tax deductions, proving your tax-deductible expenditures, it’s worth noting that banks also handle financing for significant purchases. For instance, if you’re curious about whether do banks finance mobile homes , they certainly can. Regardless of your large purchase plans, remember to confirm with your tax advisor if your bank statements suffice as official receipts.

Their acceptability often hinges on the clarity of the information presented and whether it directly corroborates the deduction or credit being claimed. The key is to demonstrate a clear link between the transaction on your bank statement and the expense you are claiming for tax purposes.

Deductible Expenses Supported by Bank Statements

Many common business expenses can be effectively supported using bank statements when original receipts are unavailable. These include recurring costs like software subscriptions, utility bills, and recurring professional service fees. For instance, a monthly payment to a cloud storage provider or a subscription to industry-specific software can be evidenced by the recurring debit on your bank statement.For a small business owner, meticulously tracking these expenses is vital for accurate tax filing.

When an invoice or a formal receipt is misplaced, the bank statement acts as a reliable alternative, provided it contains sufficient detail.Here are common business expenses where bank statements are frequently accepted:

- Software Subscriptions: Recurring monthly or annual payments for business software, CRM systems, or project management tools.

- Utilities: Payments for electricity, internet, phone, and water for a business office or home office space.

- Rent/Lease Payments: If you rent office space or equipment, a bank statement showing regular payments can serve as proof.

- Professional Fees: Payments to accountants, lawyers, or consultants for ongoing services.

- Advertising and Marketing: Online advertising costs, social media promotion expenses, or payments to marketing agencies.

- Insurance Premiums: Business insurance, professional liability insurance, or health insurance for employees.

- Travel Expenses: While not ideal, bank statements can show payments for flights, hotels, or train tickets when receipts are lost. However, it’s best to supplement these with any available itinerary or booking confirmation.

Charitable Contributions Documented by Bank Statements

For charitable donations, especially smaller, recurring contributions made via electronic transfer or direct debit, bank statements are often sufficient proof. The Internal Revenue Service (IRS) allows for certain types of contributions to be substantiated with bank records. For cash contributions of $250 or more, a written acknowledgment from the charity is generally required, but for smaller, recurring donations, the bank statement provides the necessary trail.The critical aspect here is that the bank statement must clearly identify the recipient organization.

If the payee name on the statement is ambiguous (e.g., “Online Payment”), it might not be sufficient on its own.

Medical Expenses Substantiated by Bank Statements

When claiming medical expenses, bank statements can be used to prove payment for services and goods. This is particularly useful for out-of-pocket expenses like co-pays, prescription drugs, or services from healthcare providers not covered by insurance.To effectively use a bank statement for medical expense claims, ensure the statement clearly shows:

- The date of the transaction.

- The name of the healthcare provider or pharmacy.

- The amount paid.

If the statement only shows a generic payee name, it’s advisable to cross-reference it with other available documentation, such as an Explanation of Benefits (EOB) from your insurance company, which often lists the patient, service, and date.

Extracting Relevant Information from Bank Statements

To effectively use bank statements for tax claims, you need to be adept at extracting the pertinent details. Each transaction on a statement is a potential piece of evidence. The key is to identify transactions that directly correspond to the expenses you are claiming.Here’s how to extract relevant information:

- Identify the Transaction: Locate the specific debit or credit on your bank statement that matches the expense you are claiming.

- Note the Date: The date of the transaction is crucial for matching it to the tax year and the period the expense was incurred.

- Record the Payee: The name of the vendor, service provider, or charity is essential to confirm the legitimacy of the expense.

- Confirm the Amount: The exact amount paid must be clearly visible.

- Add a Description: If the payee name is unclear, you might need to add a handwritten note or annotation on a printed copy of the statement explaining what the transaction was for, especially if you have other supporting documents like an invoice or receipt stub.

Consider a scenario where you paid for a business conference. Your bank statement might show a debit to “Eventbrite XYZ” for $500. If you have the conference registration confirmation email, you can easily link this bank transaction to the specific event.

Using Bank Statements to Justify Business Expenses, Can i use bank statements as receipts for taxes

A systematic approach is vital when using bank statements to justify business expenses for tax purposes. This process ensures that your documentation is organized, comprehensive, and readily available should you need to present it.Here is a step-by-step procedure:

- Categorize Your Expenses: Before you even look at your bank statements, have a clear understanding of the types of business expenses you are claiming (e.g., supplies, travel, rent, software).

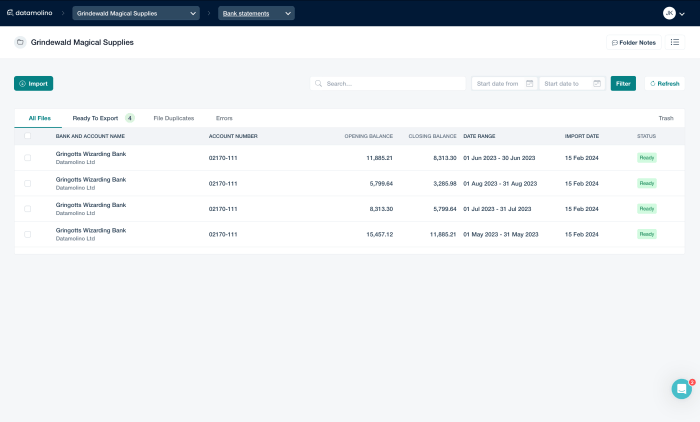

- Gather All Bank Statements: Collect all relevant bank statements for the tax year in question. This includes checking accounts, savings accounts, and any dedicated business accounts.

- Review Each Statement for Business Transactions: Go through each statement chronologically or by transaction date.

- Highlight or Mark Relevant Transactions: As you find transactions that correspond to your business expenses, highlight them directly on a printed statement or use digital annotation tools if you’re working with PDFs.

- Cross-Reference with Other Documentation: If you have any other supporting documents (e.g., invoices, credit card statements, receipts for partial amounts), use them to corroborate the bank statement entries.

- Create a Summary Sheet: For each expense category, create a summary sheet or a spreadsheet. List the date, payee, amount, and a brief description of the expense as it appears on the bank statement. If you have a matching invoice, note its reference number.

- Attach Bank Statements as Supporting Evidence: When filing, you may not need to attach all bank statements. However, keep them organized and readily accessible. If the IRS or tax authority requests proof of a specific deduction, you can then provide the relevant statement(s) and your summary sheet.

For example, if you are claiming home office expenses, you would look for utility payments, internet bills, and rent or mortgage interest payments on your bank statement. You would then create a summary listing each of these payments, the date, payee, and amount, and note that they relate to your home office.

Best Practices for Maintaining Bank Statements for Tax Audit Readiness

Proactive record-keeping is your best defense against potential tax audit issues. Maintaining your bank statements in an organized manner ensures that you can quickly retrieve the information needed to support your tax filings.Here are some best practices:

- Digital Archiving: Most banks provide online access to statements. Download and save your statements digitally in a secure, organized folder structure. Name your files clearly (e.g., “2023_Checking_Statement_Jan.pdf”).

- Regular Backups: Ensure your digital records are backed up regularly to prevent data loss. Use cloud storage or external hard drives.

- Physical Storage (if applicable): If you prefer or need to keep physical copies, store them in a safe, dry place, organized by year and month.

- Annotation and Cross-Referencing: As mentioned, annotating statements with brief descriptions or linking them to corresponding invoices or receipts can be invaluable.

- Retention Period: Keep bank statements for at least three years from the date you filed your tax return, as this is the typical period the IRS can audit your returns. For certain situations, like if you underreport income by more than 25%, the IRS may go back six years.

- Dedicated Business Account: If you operate a business, using a dedicated business bank account significantly simplifies record-keeping and makes it easier to distinguish business expenses from personal ones.

Limitations and Potential Issues with Using Bank Statements as Receipts

While bank statements can offer a convenient way to track expenses, they are not always a universally accepted substitute for formal receipts when it comes to tax filings. Relying solely on bank statements without understanding their limitations can lead to missed deductions, audits, or even penalties. It’s crucial to recognize when a bank statement falls short and what additional documentation might be required to substantiate your tax claims effectively.

Inadequacy of Bank Statements as Sole Proof of Expenditure

Bank statements, by their nature, provide a summary of financial transactions rather than detailed proof of the goods or services purchased. For many tax authorities, a bank statement alone may not be sufficient to verify the legitimacy and business-related nature of an expense. This is particularly true for deductions that require specific information about the vendor, the nature of the purchase, and the business purpose.

Risks and Consequences of Sole Reliance on Bank Statements

The primary risk of using only bank statements is the potential disallowance of claimed expenses by tax authorities. This can result in a higher tax liability, interest charges on underpayments, and penalties. Furthermore, an audit can become a more arduous and stressful experience if you are unable to provide the necessary supporting documentation beyond your bank transactions. In severe cases, repeated non-compliance could lead to more significant scrutiny of future tax returns.

Comparison of Detail: Bank Statement vs. Itemized Receipt

The level of detail differs significantly between a bank statement and an itemized receipt, especially for complex transactions.

| Feature | Bank Statement | Itemized Receipt |

|---|---|---|

| Vendor Name | Often present, but may be abbreviated or unclear. | Clearly stated, usually with full business name and address. |

| Date of Transaction | Clearly stated. | Clearly stated. |

| Amount | Clearly stated. | Clearly stated. |

| Description of Goods/Services | Usually absent or very generic (e.g., “POS Purchase,” “Online Payment”). | Detailed breakdown of items purchased, quantities, and unit prices. |

| Business Purpose | Never stated. | May be explicitly noted by the taxpayer, or implied by the nature of the items. |

| Tax Information (e.g., VAT/GST) | Rarely included. | Often includes applicable taxes, allowing for potential tax credits. |

Consider a scenario where you purchase office supplies. A bank statement might show a single transaction for $150 to “OfficeMart.” An itemized receipt, however, would list each item purchased (pens, paper, stapler, ink cartridges), their individual prices, and the total amount, clearly indicating that these are business-related supplies.

Common Pitfalls in Using Bank Statements for Tax Claims

Taxpayers often encounter several common pitfalls when attempting to use bank statements as receipts:

- Generic Descriptions: Relying on transactions with vague descriptions that don’t clearly identify the nature of the expense.

- Lack of Business Purpose: Failing to document why a particular expense was necessary for business operations, which is crucial for business deductions.

- Missing Vendor Information: When the vendor name on the statement is illegible or absent, making it difficult to verify the legitimacy of the payee.

- Personal vs. Business Expenses: Commingling personal and business expenses on the same bank account without clear segregation, making it hard to prove business deductibility. For example, a single grocery store receipt might contain both personal food items and business-related supplies. A bank statement would only show one total amount.

- Online Subscriptions: For recurring online services, a bank statement might show a payment to a company like “Global Services Inc.” without specifying if it’s for software, a membership, or a subscription service, and whether it’s for business use.

- Cash Withdrawals: Treating cash withdrawals as deductible expenses without accompanying receipts to prove how the cash was spent for business purposes.

Best Practices for Documenting Tax-Related Expenses

While bank statements offer a foundational record of your financial activities, they are often just the first layer of documentation for tax purposes. To ensure a smooth and defensible tax filing, especially when relying on bank statements, a robust organizational system is paramount. This involves more than just collecting statements; it’s about creating a comprehensive audit trail that clearly links transactions to their business purpose and deductible status.Establishing clear protocols for managing your financial records from the outset can save significant time and stress when tax season arrives, and more importantly, during an audit.

This section Artikels practical strategies to build an effective documentation system.

Designing a System for Organizing and Categorizing Financial Transactions

A well-structured system for organizing and categorizing financial transactions is the bedrock of efficient tax preparation. This system should allow for quick retrieval of information and clear identification of deductible expenses. It’s about transforming raw data from bank statements into actionable tax intelligence.A systematic approach ensures that every transaction is accounted for and its relevance to your tax obligations is understood.

This proactive organization minimizes the risk of missing deductions or miscategorizing expenses, both of which can lead to penalties.

- Dedicated Business Accounts: If you operate a business, maintaining separate bank accounts for business income and expenses is crucial. This immediately segregates personal and business finances, simplifying the process of identifying deductible business expenses.

- Consistent Categorization: Develop a consistent method for categorizing expenses. This could involve using a chart of accounts or a predefined list of expense categories (e.g., office supplies, travel, utilities, marketing).

- Regular Reconciliation: Reconcile your bank statements with your accounting records on a monthly basis. This process helps identify any discrepancies, ensures accuracy, and catches errors or fraudulent transactions promptly.

- Digital Filing System: Implement a digital filing system for your bank statements and supporting documents. Use clear naming conventions for files (e.g., “2023-10-BankStatement-BusinessChecking.pdf”) and organize them by year, month, and category.

- Color-Coding or Tagging: Within your accounting software or spreadsheet, consider using color-coding or tags to highlight specific types of expenses or to mark transactions that require further documentation.

Creating a Checklist of Supplementary Documents

Bank statements alone may not always provide sufficient detail to substantiate a tax deduction. Therefore, it is essential to create and maintain a checklist of supplementary documents that should be retained alongside your bank statements. These documents provide the necessary context and proof of the nature and business purpose of the expenditure.This checklist acts as a guide, ensuring that you gather all the required evidence for each type of expense, thereby strengthening your tax claims and preparing you for potential inquiries.A comprehensive checklist typically includes:

- Invoices and Receipts: For all purchases, especially those over a certain threshold (e.g., $75 or $100), keep original or digital copies of itemized invoices and detailed receipts. These should clearly show what was purchased, the vendor, the date, and the amount.

- Contracts and Agreements: For significant expenses like rent, leases, or service agreements, retain copies of the relevant contracts.

- Travel Itineraries and Expense Reports: For business travel, keep flight tickets, hotel bills, car rental agreements, and detailed expense reports outlining the purpose of the trip and the business activities undertaken.

- Mileage Logs: If you claim vehicle expenses, maintain a detailed log of business mileage, including dates, destinations, purpose of travel, and the total miles driven.

- Employee Reimbursement Forms: If you reimburse employees for business expenses, keep records of their submitted expense reports and receipts.

- Bank Deposit Slips and Merchant Statements: For income verification, keep records of deposit slips and merchant statements that detail sales and customer payments.

- Correspondence: In some cases, emails or letters that justify a particular expense or transaction might be relevant.

Demonstrating How to Use Accounting Software or Spreadsheets

While bank statements provide a transaction history, accounting software or spreadsheets transform this raw data into organized, reportable information suitable for tax filings. These tools allow for deeper analysis, categorization, and reporting of your financial activities, making it easier to identify and substantiate deductions.The effective use of these tools bridges the gap between a bank statement and a tax return, providing a clear narrative of your financial performance and tax liabilities.

Using Accounting Software

Accounting software, such as QuickBooks, Xero, or Wave, automates many of the processes involved in tracking expenses.

- Bank Feed Integration: Most accounting software can connect directly to your bank accounts, automatically importing transactions. This saves significant time compared to manual data entry.

- Categorization Rules: You can set up rules to automatically categorize recurring transactions (e.g., rent payments, software subscriptions).

- Reporting Features: Generate various financial reports, including profit and loss statements, balance sheets, and expense summaries, which are invaluable for tax preparation.

- Audit Trail: Software provides a robust audit trail, linking imported bank transactions to their assigned categories and supporting documents, making it easier to present during an audit.

- Receipt Capture: Many platforms allow you to upload or scan receipts directly, linking them to specific transactions within the software.

Using Spreadsheets

For smaller businesses or individuals with simpler financial structures, spreadsheets like Microsoft Excel or Google Sheets can be a powerful and cost-effective tool.

- Customizable Templates: Create custom templates to track income and expenses, tailored to your specific needs.

- Formulas for Calculations: Utilize formulas to automatically sum expenses by category, calculate profit margins, and perform other essential financial calculations.

- Data Sorting and Filtering: Easily sort and filter your data to analyze spending patterns or locate specific transactions.

- Linking to Scanned Documents: You can include hyperlinks within your spreadsheet to directly access scanned receipts or other supporting documents stored digitally.

- Example Spreadsheet Structure:

Date Description Category Amount Receipt Link/Reference Notes 2023-10-26 Office Depot Office Supplies $150.75 Receipt 1 Pens, paper, notebooks 2023-10-27 United Airlines Business Travel $450.00 Ticket 1 Flight to conference in Chicago

Strategies for Effectively Presenting Bank Statements and Supporting Documentation During a Tax Review

During a tax review or audit, the ability to present your financial documentation clearly and logically is as important as the documentation itself. A well-organized presentation instills confidence and can significantly streamline the review process. The goal is to make it easy for the tax authority to understand your financial records and verify your claims.Proactive organization and a clear presentation strategy can turn a potentially stressful situation into a manageable one.

- Organize by Tax Year and Category: Prepare your documentation organized by tax year, and then by expense category. This mirrors the structure of most tax forms and makes it easy for reviewers to find specific information.

- Prepare a Summary Report: Create a summary report that Artikels your total expenses by category, referencing the total amount reported on your tax return. This report should be supported by the detailed documentation.

- Have Digital and Physical Copies Ready: While digital is often preferred, have both digital and physical copies of your bank statements and supporting documents readily accessible. Ensure your digital files are well-named and easily searchable.

- Use a Table of Contents: For physical binders or extensive digital folders, a table of contents can help reviewers navigate the documentation quickly.

- Be Prepared to Explain Transactions: While documentation should speak for itself, be ready to verbally explain the business purpose of any transaction if asked. Focus on clarity and conciseness.

- Highlight Key Documents: If a specific transaction is complex or significant, highlight the most critical supporting documents (e.g., the original invoice, contract, or travel itinerary).

- Use a Consistent Format: Ensure all your documentation is presented in a consistent format. For example, if you are using spreadsheets, ensure they are formatted cleanly and consistently.

- Example of Presentation: If audited on business travel expenses, you would present a summary of total travel expenses, followed by a folder or digital directory containing:

- Bank statements showing the credit card charges for flights and hotels.

- Copies of flight tickets and hotel invoices.

- A detailed travel itinerary outlining the business purpose of the trip, meetings scheduled, and attendees.

- If applicable, mileage logs for ground transportation.

This layered approach demonstrates thoroughness and provides clear evidence for each claimed expense.

Structuring Information from Bank Statements for Tax Purposes

Leveraging bank statements for tax documentation requires a systematic approach to ensure clarity, accuracy, and compliance. This involves transforming raw transaction data into a structured format that clearly delineates deductible expenses from personal spending. A well-organized system not only simplifies tax preparation but also strengthens your position in case of an audit.The goal is to create a clear narrative of your business finances, easily digestible by tax authorities.

This means moving beyond simply presenting a bank statement and instead providing a curated summary that highlights the information relevant to your tax return.

Report Template for Summarizing Key Financial Data

A standardized report template is crucial for presenting financial data extracted from bank statements in a tax-friendly manner. This template should act as a high-level overview, summarizing income, deductible expenses, and non-deductible expenditures.Consider the following structure for your report:

- Period Covered: Clearly state the tax year or reporting period.

- Total Income: Aggregate all revenue sources recorded in the bank statements.

- Total Deductible Expenses: Sum of all expenses identified as legitimate business deductions.

- Total Non-Deductible Expenses: Sum of personal or non-business-related expenditures.

- Net Profit/Loss: Calculated as Total Income minus Total Deductible Expenses.

- Key Expense Categories: A breakdown of major deductible expense areas (e.g., Rent, Utilities, Supplies, Travel, Professional Fees).

This report serves as a foundational document that consolidates information before diving into the granular details of individual transactions.

Sample Table for Presenting Deductible Expenses

To effectively showcase deductible expenses, a detailed table is indispensable. This table should capture the essential elements of each transaction that supports its tax-deductible status.Here’s a sample table structure:

| Date | Vendor/Payee | Description of Expense | Tax Category | Amount | Supporting Document Reference |

|---|---|---|---|---|---|

| 01/15/2023 | Office Supply Co. | Printer Ink Cartridges | Supplies | $75.50 | Invoice #12345 |

| 02/10/2023 | Local Gas Station | Fuel for Business Vehicle | Vehicle Expenses | $120.00 | Receipt #67890 |

| 03/20/2023 | Tech Solutions Inc. | Monthly Software Subscription (CRM) | Software & Subscriptions | $50.00 | Subscription Confirmation Email |

| 04/05/2023 | Web Hosting Pro | Domain Renewal and Hosting Fee | Website Expenses | $150.00 | Invoice #ABCDE |

This tabular format provides a clear, itemized list of deductible expenses, making it easy for you and your tax preparer to verify and categorize each entry. The “Supporting Document Reference” column is critical for audit trails.

Cross-Referencing Bank Statement Entries with Supporting Documents

The integrity of your tax claims hinges on the ability to link bank statement entries to their original source documents. This cross-referencing process is a cornerstone of robust tax record-keeping.The procedure involves the following steps:

- Identify Transaction on Bank Statement: Locate the specific debit or credit entry on your bank statement that corresponds to a business expense or income.

- Retrieve Supporting Document: Find the corresponding invoice, receipt, bill, or other documentation for that transaction.

- Verify Details: Compare the date, vendor, amount, and description on the bank statement with those on the supporting document. Ensure they match.

- Record Reference: In your expense tracking system or spreadsheet, note a reference to the supporting document (e.g., invoice number, receipt date) next to the bank statement entry. This could be the same reference used in the table above.

- Archive Documents: Store all supporting documents systematically, ideally organized by date or vendor, for easy retrieval.

“Every transaction on your bank statement that you claim as a tax deduction must have a corresponding, verifiable piece of evidence.”

This diligent practice ensures that you can substantiate every claim made on your tax return.

Identifying and Isolating Tax-Deductible Transactions

A critical skill in using bank statements for tax purposes is the ability to distinguish between business-related (deductible) and personal (non-deductible) transactions. This separation is fundamental to accurate tax reporting.The process for identifying and isolating these transactions typically involves:

- Dedicated Business Accounts: The most effective method is to maintain separate bank accounts for your business. This inherently segregates personal and business finances, simplifying identification. All business income and expenses should flow through this account.

- Transaction Review and Categorization: If a mixed-use account is unavoidable, a thorough review of each transaction is necessary. For each entry, ask: “Is this expense directly related to generating business income?”

- Utilize Software or Spreadsheets: Employ accounting software or a detailed spreadsheet to record and categorize every transaction from your bank statements. Tag each transaction with its appropriate tax category (e.g., Advertising, Office Supplies, Travel).

- Flagging Personal Expenses: Clearly mark or exclude any transactions that are purely personal. These should not be included in your deductible expense calculations.

- Reconciliation: Regularly reconcile your bank statements with your accounting records to ensure all transactions have been accounted for and correctly categorized.

For instance, a debit of $50 at a restaurant might be a business lunch (deductible) or a personal dinner (non-deductible). The context, such as who you dined with and the purpose, as evidenced by a note on the receipt or an invoice, is crucial for correct categorization.

Summary

Ultimately, while bank statements offer a foundational record of your financial activities, their role as sole tax receipts is nuanced. By understanding their limitations and complementing them with itemized receipts and other supporting documents, you build a robust defense for your tax filings. This proactive approach not only simplifies audits but also instills confidence in the accuracy and completeness of your tax submissions, ensuring peace of mind throughout the tax season and beyond.

Top FAQs

Can a single bank statement entry be enough for a tax deduction?

A single bank statement entry might be sufficient for very simple, low-value transactions where the description is clear. However, for most deductions, especially business-related ones, more detailed proof like an itemized receipt is usually preferred or required.

What if my bank statement doesn’t clearly show the vendor’s name?

If the vendor’s name is unclear on your bank statement, it can weaken its validity as a receipt. You would likely need to supplement it with an invoice or a more detailed receipt from the vendor that clearly identifies them.

Are there specific types of expenses where bank statements are almost always insufficient?

Expenses like travel, meals, or entertainment often require more than just a bank statement. These typically need itemized receipts showing the date, location, purpose of the expense, and who was present, which bank statements rarely provide.

How far back do I need to keep bank statements for tax purposes?

Generally, you should keep tax-related documents, including bank statements, for at least three years from the date you filed your return. However, some situations, like reporting income, might require keeping records for longer periods.

What should I do if I lost the original receipt but have the bank statement?

If you’ve lost the original receipt, try to obtain a duplicate from the vendor. If that’s not possible, your bank statement can serve as a starting point, but you may need to explain the situation and provide any other available evidence to the tax authority.