Can I use a bank statement as proof of address? This seemingly simple question unlocks a world of practicalities for anyone navigating the labyrinth of official documentation. From opening new accounts to proving your residency for essential services, understanding the validity of your bank statement is paramount. This exploration delves into the nuances, revealing when this common financial document becomes your key to verification.

Bank statements, often overlooked beyond their financial tracking purpose, serve a crucial role in establishing your residential bona fides. They are a snapshot of your financial life, but more importantly, they contain the verifiable details that institutions require to confirm where you live. We’ll dissect what makes a statement a reliable proof of address, the common situations where it’s accepted, and the essential information it must contain to pass scrutiny.

Understanding the Basics of Bank Statements as Proof of Address

So, you’ve got your bank statement ready, but is it actually a golden ticket for proving where you live? Think of a bank statement as your financial diary, spilling the beans on your transactions. But for official purposes, it’s also a powerful tool for proving your residency. It’s like showing your ID, but instead of a photo, it’s your address that’s front and center, confirming you’re a bona fide resident of that location.The magic of a bank statement as proof of address lies in its official nature and the verifiable information it contains.

Financial institutions are bound by strict regulations, making their statements a reliable source of truth. When an organization asks for proof of address, they’re essentially looking for an official document that clearly links your name to a specific residential address. A bank statement, with its printed letterhead, your name, and your address, checks all these boxes with flying colors.

Primary Function of a Bank Statement in Verifying Residency

A bank statement’s primary role in verifying residency is to provide an independent, third-party confirmation of your physical location. It acts as a concrete piece of evidence that you are indeed residing at the address listed. This is crucial for many services and applications, from opening new accounts and applying for loans to registering for utilities and even some government services.

It’s the bank’s way of saying, “Yep, this person lives here, and we’ve got the paperwork to prove it.”

Essential Elements for a Valid Proof of Address Bank Statement, Can i use a bank statement as proof of address

For your bank statement to be accepted as proof of address, it needs to have a few key ingredients. Think of it like baking a cake – you need all the right components for it to turn out perfectly. These elements are what make the document official and trustworthy in the eyes of verifiers.Here are the non-negotiable elements that make a bank statement a valid proof of address:

- Your Full Name: It must precisely match the name on your application or the service you’re trying to access. No nicknames or abbreviations allowed!

- Your Residential Address: This is the star of the show. It needs to be your current, physical address, including street name, number, city, state/province, and postal code. PO Boxes are generally not accepted as they don’t represent a physical residence.

- Bank’s Official Letterhead/Logo: The statement should clearly display the name and logo of the bank, signifying its authenticity.

- Date of Issue: Most institutions require the statement to be recent, typically within the last three months. This ensures the address is current and hasn’t changed recently.

- Account Information (Optional but common): While not always strictly necessary for address proof, the presence of account numbers or transaction details further validates the statement as a genuine banking document.

Common Scenarios for Bank Statement Address Verification

You’ll find that bank statements are a widely accepted form of address verification across a surprisingly diverse range of situations. It’s a go-to document because it’s something most adults have readily available and it carries a good deal of official weight.Here are some common scenarios where a bank statement shines as proof of address:

- Opening a New Bank Account: Ironically, when you’re trying to prove your address to open an account, a statement from

another* bank can often be used.

- Applying for Loans or Mortgages: Lenders need to know where you live to assess risk and send important correspondence.

- Setting Up Utilities: Whether it’s electricity, gas, or internet, utility companies require proof of residency.

- Renting a Property: Landlords often request a bank statement to confirm your address and financial stability.

- Obtaining a Driver’s License or ID Card: Many government agencies use bank statements as one of the acceptable forms of address verification.

- Registering for Services: This can include anything from a new mobile phone contract to a gym membership.

- Immigration or Visa Applications: For certain immigration processes, a bank statement can be a supporting document to prove your ties to a country.

Requirements for a Valid Bank Statement as Proof of Address

So, you’ve got your bank statement, ready to prove you live where you say you do. But hold on a sec! Not every bank statement is a golden ticket. There are a few key ingredients that make a bank statement officially legit for proving your address. Think of it like a secret handshake; get it right, and you’re in!To ensure your bank statement is accepted as proof of address, it needs to pack a punch with specific, verifiable information.

This isn’t just about showing your latest spending spree; it’s about presenting a clear, official document that unequivocally links you to a physical location. Let’s break down what makes a bank statement a champion in the proof-of-address arena.

Essential Information on Your Bank Statement

For your bank statement to be taken seriously by banks, government agencies, or utility companies, it must contain several crucial pieces of information. These elements act as the fingerprints of the document, confirming its authenticity and relevance to your identity and residence.Here’s a rundown of the non-negotiables:

- Your Full Name: It needs to precisely match the name on your application or the document you’re providing it for. No nicknames allowed!

- Your Current Residential Address: This is the star of the show. It must be your complete and accurate address, including street name, number, city, and postcode.

- Date of Issue: A clear date indicating when the statement was generated is vital. This helps verify its recency.

- Bank’s Official Logo and Name: The statement must clearly display the recognizable branding of the financial institution. This confirms it’s an official document from a legitimate bank.

- Account Details (Optional but common): While not always strictly required for proof of address, account numbers or sort codes are often present and don’t invalidate the statement.

- Transactions: While the transactions themselves aren’t the focus, their presence confirms the statement is active and in use.

Acceptable Age of a Bank Statement

The clock is ticking when it comes to the age of your bank statement! Institutions want to see evidence of your current address, so a statement from your college days might not cut it. The general consensus is that the statement should be recent enough to reflect your present living situation.

The golden rule is to aim for a bank statement that is no older than three months.

This timeframe ensures that the address listed is still your current place of residence. Some organizations might have stricter requirements, so it’s always a good idea to check their specific guidelines. For example, a mortgage application might require a statement from the last 30 days, while a mobile phone contract might accept one up to 90 days old.

Electronic vs. Physical Bank Statements

In our increasingly digital world, the question of whether to submit a printed copy or a digital file often arises. The good news is that most institutions are flexible, but there are nuances to consider.Generally, both electronic and physical copies are accepted, but the format might influence how you submit them.

- Physical Copies: These are straightforward. You can often mail them or present them in person. Ensure the printout is clear and legible.

- Electronic Copies (PDFs): Many institutions readily accept PDF versions downloaded directly from your bank’s online portal. These are often preferred for online applications as they can be uploaded easily. However, be mindful of the source; ensure it’s a genuine download from your bank and not a screenshot or a doctored image. Some might require a specific file format or even ask for a “verified” electronic copy, which your bank might be able to provide.

When in doubt, it’s always best to ask the requesting party what format they prefer or accept. Some might specifically request a “hard copy” or have instructions for submitting digital documents, such as requiring a watermark or a digital signature from the bank.

Institutions That Accept Bank Statements for Address Verification

So, you’ve got your bank statement, and you’re wondering who’s going to accept this trusty document as your golden ticket to proving where you hang your hat. It’s not just about having a bank account; it’s about leveraging that official correspondence to get things done. Let’s dive into the diverse world of institutions that understand the power of a bank statement.Think of your bank statement as a mini-autobiography of your financial life, complete with your official address.

This makes it a universally recognized and highly reliable document for many organizations. From the big governmental bodies to the companies that keep your lights on, many are happy to see that official bank logo and your name and address neatly printed.

Government Agencies and Public Services

Government agencies are often the strictest when it comes to verifying identity and address. They need to ensure you’re a resident for various services, from applying for a driver’s license to registering to vote. While they might have a long list of acceptable documents, a recent bank statement often makes the cut.Here’s a look at some common government-related scenarios where bank statements are accepted:

- Driver’s License and Vehicle Registration: When you’re getting your driver’s license or registering a vehicle, proving your residency is key. Many Department of Motor Vehicles (DMV) or equivalent agencies will accept a bank statement showing your name and current address.

- Voter Registration: To ensure you’re voting in the correct district, election boards often require proof of address. A bank statement is a straightforward way to satisfy this requirement.

- Social Security and Benefits Applications: If you’re applying for social security benefits, unemployment, or other government assistance programs, your address needs to be verified. Bank statements are frequently accepted for these purposes.

- Passport Applications: While a passport application has a comprehensive list of required documents, a bank statement can sometimes be used as supporting proof of address, especially if other primary documents are limited.

Financial Institutions

This might seem obvious, but financial institutions themselves are some of the biggest acceptors of bank statements as proof of address. When you’re opening new accounts, applying for loans, or even updating your details, they need to be sure you are who you say you are and where you say you live.Consider these instances within the financial realm:

- Opening New Bank Accounts: Ironically, when opening an account at a

-different* bank, your current bank statement can serve as proof of your address. - Loan and Mortgage Applications: Whether it’s a personal loan, car loan, or a mortgage, lenders will need to confirm your address. A bank statement is a standard document they’ll request.

- Credit Card Applications: Applying for a new credit card? The issuer will definitely want to verify your address, and your bank statement is a common way to do it.

- Investment Accounts: Opening a brokerage account or other investment vehicles often requires address verification, and bank statements are typically accepted.

Utility Companies and Service Providers

The companies that provide your essential services – electricity, gas, water, internet, and even your mobile phone – need to know where to send bills and connect services. This is where bank statements really shine.Here are some everyday services that rely on address verification:

- Electricity, Gas, and Water Companies: When setting up new service or transferring existing service, these providers will often accept a bank statement to confirm your address.

- Internet and Cable Providers: Getting your Wi-Fi or TV hooked up? They’ll need to know where to install the equipment, and a bank statement is a common verification method.

- Mobile Phone Providers: Whether you’re signing up for a new phone plan or porting your number, your address will need to be confirmed.

- Insurance Companies: For home, auto, or even life insurance, your address is a critical piece of information. Bank statements are frequently used to verify this.

Other Organizations and Services

The acceptance of bank statements extends beyond these core categories. Many other businesses and services recognize their validity.Think about these less obvious, but equally important, situations:

- Landlords and Rental Agencies: When applying to rent an apartment or house, landlords often ask for proof of address. A bank statement can help solidify your application.

- Employers: Some employers may request proof of address as part of their onboarding process, especially for roles that require background checks or specific location-based responsibilities.

- Online Services and Subscriptions: Certain high-value online services, or those requiring age verification, might ask for proof of address.

- Schools and Educational Institutions: For admissions or enrollment purposes, especially for local residency requirements, a bank statement might be accepted.

It’s worth noting that while bank statements are widely accepted, the specific requirements can vary. Always check with the institution directly to confirm their preferred documentation and the recency of the statement they will accept. Generally, a statement within the last three months is considered current.

Limitations and Alternatives to Using Bank Statements

So, you’ve got your bank statement ready to prove where you live, right? That’s fantastic! But what happens when the stars don’t align and your trusty bank statement isn’t quite cutting the mustard? Fear not, intrepid address-verifier! We’re about to dive into the nitty-gritty of when a bank statement might not be your golden ticket and what other documents can save the day.

Think of this as your backup plan, your emergency toolkit for proving your domicile.Sometimes, the very document that holds your financial secrets might not be enough to convince Uncle Sam (or your landlord, or your new phone company) that you’re actually living where you say you are. This isn’t usually a conspiracy; it’s more about specific requirements and what different institutions deem acceptable.

Let’s explore these scenarios and arm you with knowledge!

Indeed, a bank statement often serves as acceptable proof of address for various needs. If you’re contemplating the ambitious venture of how to start your own private bank , understanding such foundational documentation is crucial. Rest assured, that same bank statement you’re using for verification will be a key component in establishing your own financial institution’s credibility.

Scenarios Where a Bank Statement Might Not Be Sufficient

While bank statements are widely accepted, there are definitely situations where they might fall short. These often boil down to the age of the statement, the type of institution requiring verification, or the specific details printed on the document. Imagine trying to prove your address to a super-strict government agency; they might have a checklist longer than your grocery list!Here are some common roadblocks you might encounter:

- Outdated Information: Most institutions require proof of address that is recent, typically within the last three months. A statement from last year, showing your grandma’s address, probably won’t fly for opening a new account today.

- Digital vs. Physical Copies: Some places are a bit old-fashioned and might prefer a physical, mailed statement over a PDF download from your online banking. Always check if they have a preference.

- Incomplete or Unclear Details: If your bank statement is missing your full name, current address, or the date, it’s essentially a blank page for address verification purposes. Make sure all essential information is clearly visible.

- Non-Standard Bank Statements: If you bank with a very niche or international institution whose statement format is unusual, some verifiers might not recognize it or be able to process it easily.

- Specific Industry Requirements: Certain industries, like highly regulated financial services or government agencies, may have very specific documentation requirements that go beyond a standard bank statement. They might need utility bills or lease agreements.

- New Account Opening vs. Existing Customer: Sometimes, the requirements for opening a brand new account are stricter than for updating your address as an existing customer.

Alternative Documents for Address Verification

Don’t despair if your bank statement isn’t cooperating! The world is full of other official-looking papers that can vouch for your residence. Think of these as your trusty sidekicks, ready to step in when your primary proof needs backup.Here’s a rundown of other documents commonly accepted as proof of address:

- Utility Bills: Electricity, gas, water, or even landline phone bills are excellent proof. Just ensure they show your name and current address and are recent (usually within 3-6 months).

- Government-Issued Documents: This is a big one! Think driver’s licenses, ID cards, tax returns, or official correspondence from government bodies (like the IRS or your local council). These are usually highly trusted.

- Lease Agreements or Mortgage Statements: If you’re renting or own your home, your signed lease agreement or a recent mortgage statement is solid proof.

- Other Financial Statements: Statements from credit card companies, investment accounts, or loan providers can also work, provided they have your name and current address.

- Insurance Policies: Home or renter’s insurance policies can be accepted, again, with your name and address clearly displayed.

- Voter Registration Cards: In some regions, a voter registration card can be used as proof of address.

- Official Correspondence: Letters from your employer, educational institution, or a registered charity that clearly state your name and current address can sometimes be accepted.

Procedures for Obtaining a Bank Statement

So, what if you don’t have a recent bank statement lying around, or the one you have isn’t quite right? No sweat! Getting a new one is usually a straightforward process. It’s like ordering a fresh pizza when the last one was a bit burnt – easy peasy.Here’s how you can typically get your hands on a fresh bank statement:

- Online Banking Portal: This is the quickest and most common method. Log in to your bank’s website or mobile app. Navigate to the account statements or documents section. You can usually download statements as PDFs for the past several months or even years.

- Contact Your Bank Directly: If you can’t find it online, or you need a physical copy mailed to you, give your bank a call. Their customer service representatives can assist you. Be prepared to verify your identity.

- Visit a Branch: For a personal touch (and sometimes a physical copy on the spot), head to your local bank branch. Bring your ID, and they can print a statement for you.

- Requesting Specific Dates: If you need a statement for a very specific period that’s not easily accessible online, you might need to contact your bank directly. There might be a small fee for retrieving older statements.

Remember, when requesting a statement, always specify that you need it for “proof of address” purposes. This might prompt the bank to ensure all necessary details are included.

Preparing Your Bank Statement for Submission: Can I Use A Bank Statement As Proof Of Address

So, you’ve confirmed a bank statement is the golden ticket for proving your address, and you’ve navigated the jungle of requirements. Now comes the crucial part: making sure that statement is submission-ready. Think of it as dressing up your bank statement for its big interview – it needs to look sharp, presentable, and say all the right things! Let’s get this document looking its absolute best.Ensuring your bank statement is clear, legible, and packed with all the essential information is paramount.

A sloppy submission can lead to delays or outright rejection, and nobody wants that. We’re talking about presenting a document that’s easy for the verifying institution to read and understand, leaving no room for guesswork.

Ensuring Clarity and Legibility

The first rule of a good bank statement submission is: make it readable! No smudges, no faded ink, and definitely no critical information cropped out. Imagine trying to read a letter in dim light with shaky hands – that’s what a poor-quality scan or photo does to your statement.Here’s how to ensure your statement is crystal clear:

- High-Resolution Scan or Photo: Use a scanner for the best results. If you must use a phone camera, ensure good lighting, hold the phone steady, and capture the entire page without any distortion.

- Full Pages, No Cropping: Make sure all four corners of the statement page are visible. Critical details like your name, address, bank logo, and statement date must be fully displayed.

- Clear Font and Text: Avoid blurry or pixelated text. The font size should be easily readable. If you’re printing a digital statement, ensure it’s printed clearly.

- No Redactions (Unless Specified): Only redact sensitive information like account numbers if the receiving institution explicitly instructs you to do so. Otherwise, leave everything as is.

Essential Information Checklist

Before you hit that submit button, run through this quick checklist. It’s designed to catch those little oversights that can turn a simple submission into a headache.

- Your Full Name: Must match your name on other identification documents.

- Your Current Residential Address: This is the primary purpose of the statement, so it needs to be accurate and complete, including postcode/zip code.

- Bank’s Name and Logo: Clearly visible to confirm the document’s authenticity.

- Statement Date: Crucial for verifying the recency of the address. It should fall within the accepted timeframe (usually 3 months old).

- Transaction History (Optional but often present): While not always the focus, the presence of transactions confirms the account is active and linked to you.

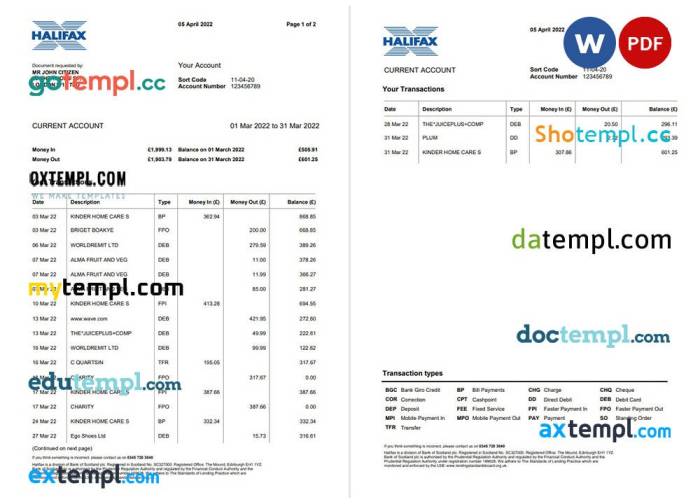

Presenting Your Bank Statement: A Visual Guide

Different institutions might have slightly different submission guidelines. Some prefer PDF uploads, others a clear JPEG. Understanding these nuances can save you time and hassle. Here’s a way to visualize how your statement should look, especially if you need to combine multiple pages.

| Aspect | Ideal Presentation | What to Avoid |

|---|---|---|

| Page Layout | Each page of the statement is presented as a separate, complete image or PDF page. | Overlapping pages, missing corners, or pages cut off. |

| Orientation | Pages are oriented correctly (portrait or landscape as it appears on the original document). | Pages rotated sideways or upside down. |

| File Format | Clear PDF or high-quality JPEG, as requested by the institution. | Low-resolution images, password-protected files (unless specifically allowed), or unsupported formats. |

| Content Visibility | All essential details (name, address, bank, date) are clearly visible on at least one page. | Key information obscured by shadows, fingers, or other objects. |

Scenario: The Perfectly Prepared Statement

Imagine you’re a detective, and your bank statement is the crucial piece of evidence. What would a perfectly prepared statement look like?Picture this: You open the digital file, and the first page is a crisp, full-page scan. Your name, “Eleanor Vance,” is clearly printed at the top left, followed by your address: “123 Maple Street, Anytown, CA 90210.” The logo of “Global Trust Bank” is prominent.

The statement date, “October 26, 2023,” is easy to spot. Below this, you see a list of recent transactions, all legible. The second page continues the transaction details, and if there’s a third page with account summaries, it’s also perfectly scanned. There are no dark shadows, no glare from a flash, and no text cut off. It’s as if you’ve directly handed over the original document, but in a digital format that’s easy to read on any device.

Every piece of information the institution needs is there, presented cleanly and professionally.

Conclusive Thoughts

In essence, the journey through understanding bank statements as proof of address reveals a powerful, accessible tool for verification. By knowing the requirements, the institutions that accept them, and how to present them correctly, you can confidently leverage your bank statement to meet various official needs. Remember, a little preparation can go a long way in ensuring your documentation is readily accepted, smoothing the path for your applications and verifications.

FAQ Guide

Can I use a very old bank statement as proof of address?

Generally, institutions prefer recent bank statements, typically no older than three months. Older statements may not be accepted as they don’t reflect your current address.

What if my bank statement has a different address than my ID?

This can be a problem. If your ID has an old address, you’ll likely need to provide additional documentation to bridge the gap, such as a utility bill or a signed letter from your landlord confirming your current residence.

Are electronic bank statements as valid as physical ones?

In most cases, yes. Many institutions accept clear, legible electronic statements, often requiring them to be downloaded directly from your bank’s portal. However, it’s always best to check the specific requirements of the requesting organization.

What should I do if my bank statement is too cluttered with transactions?

If the transaction details obscure your name and address, you can often highlight or circle the relevant sections. Alternatively, you might be able to request a simplified statement from your bank specifically for address verification purposes.

Can a statement from a digital-only bank be used as proof of address?

Yes, statements from digital or online banks are typically accepted, provided they contain all the necessary verifiable information (name, address, date, bank logo) and are recent.