What is variance analysis in finance? It’s a powerful tool for understanding and interpreting financial performance by comparing actual results to planned or predicted outcomes. This method, essential in various financial domains, provides insights into the factors driving deviations from expectations, ultimately helping to improve decision-making and resource allocation. This analysis is particularly useful for identifying areas where costs are higher than anticipated or revenues are lower, enabling companies to take corrective action and optimize profitability.

Understanding these key concepts is crucial for making informed financial decisions.

This comprehensive guide delves into the intricacies of variance analysis, from its foundational principles to its practical applications across different industries. We’ll explore the different types of variances, analyze their underlying causes, and discuss effective methods for interpreting and utilizing the results to improve financial performance. We’ll also examine the limitations of variance analysis and its specific role in supporting financial planning and decision-making.

The guide concludes with a summary of key takeaways and frequently asked questions.

Introduction to Variance Analysis in Finance

Variance analysis in finance is a systematic process of examining the difference between planned or budgeted figures and actual results. It’s a crucial tool for identifying areas where performance deviates from expectations, enabling businesses to pinpoint the root causes of discrepancies and take corrective actions. By highlighting these variances, companies can improve operational efficiency, control costs, and ultimately, enhance profitability.

Purpose and Objectives of Variance Analysis

Variance analysis serves the purpose of evaluating the performance of various departments or activities within an organization. Its objectives include pinpointing the reasons for any discrepancies between predicted and actual results. This allows for proactive management of resources, improvement of decision-making processes, and enhancement of overall business performance. Through identifying the root causes of deviations, companies can take corrective actions to align performance with targets.

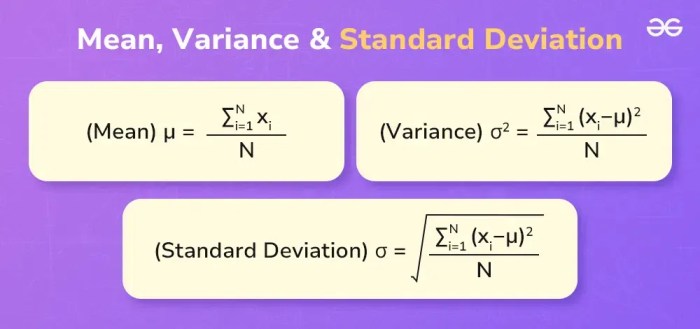

Key Concepts Underlying Variance Analysis

Several key concepts underpin variance analysis. These include:

- Standard Costs: Pre-determined costs established for specific products, services, or activities. These standards act as benchmarks for evaluating performance.

- Actual Costs: The actual costs incurred in the production or delivery of products or services. These are measured and recorded during the relevant period.

- Variances: The difference between standard costs and actual costs. Positive variances indicate favorable results, while negative variances signify unfavorable outcomes.

- Analysis of Variances: Examining the causes of variances to determine whether they are material or immaterial. This involves scrutinizing various factors influencing cost or revenue variations, such as changes in material prices, labor rates, or sales volumes.

History of Variance Analysis in Business

The development of variance analysis can be traced back to the early 20th century. The need for a systematic approach to cost control and performance measurement became increasingly apparent as businesses expanded. Early adopters of the technique found that understanding cost fluctuations facilitated more informed decision-making. This approach evolved over time to encompass a wider range of business functions and today serves as a crucial component of modern financial management.

Simple Example of Variance Analysis Calculation

Imagine a company budgeted for 10,000 units of product X at a standard cost of $10 per unit. Actual production was 12,000 units at a total cost of $110,000.

Total Variance = Actual Cost – Standard Cost = $110,000 – ($10 x 10,000) = $10,000

The $10,000 variance signifies that actual costs exceeded the budgeted costs. Further analysis is needed to pinpoint the specific reasons for this variance.

Types of Variances

A table outlining common types of variances is provided below. Understanding these variances helps to diagnose and address performance gaps.

| Type of Variance | Description |

|---|---|

| Sales Volume Variance | Difference between actual sales volume and budgeted sales volume. |

| Sales Price Variance | Difference between actual selling price and budgeted selling price. |

| Direct Materials Variance | Difference between actual direct materials cost and standard direct materials cost. |

| Direct Labor Variance | Difference between actual direct labor cost and standard direct labor cost. |

| Variable Overhead Variance | Difference between actual variable overhead cost and standard variable overhead cost. |

| Fixed Overhead Variance | Difference between actual fixed overhead cost and standard fixed overhead cost. |

Types of Variances

Variance analysis in finance is a crucial tool for understanding the difference between planned and actual results. It allows businesses to pinpoint the reasons behind discrepancies and make necessary adjustments to improve performance. By identifying the sources of variances, companies can take corrective actions to enhance profitability and efficiency.

Cost Variances, What is variance analysis in finance

Understanding cost variances is essential for evaluating operational efficiency. These variances highlight deviations between budgeted and actual costs for various resources. Accurate analysis helps pinpoint areas needing improvement and allows for informed decision-making.

- Material Variances: These variances assess discrepancies between the standard and actual costs of materials used in production. They are categorized into price and quantity variances. Price variances examine differences in the actual cost per unit of material compared to the standard cost. Quantity variances focus on the difference between the actual amount of materials used and the standard amount expected for production output.

For instance, if a company expected to use 100 kg of material at Rp 10,000 per kg, but actually used 120 kg at Rp 12,000 per kg, both price and quantity variances would be present.

- Labor Variances: Labor variances analyze the difference between the standard and actual costs of labor. Similar to material variances, they are segmented into rate and efficiency variances. Rate variances compare the actual wage rate to the standard wage rate. Efficiency variances measure the difference between the actual labor hours used and the standard labor hours expected for the production level.

For example, if a company anticipated 100 hours of labor at Rp 20,000 per hour, but spent 120 hours at Rp 22,000 per hour, both rate and efficiency variances would exist.

- Overhead Variances: Overhead variances examine the discrepancy between budgeted and actual overhead costs. They are typically divided into spending and volume variances. Spending variances compare the actual overhead expenses incurred with the standard overhead costs. Volume variances assess the difference between the actual production level and the level anticipated when setting the overhead budget. A company expecting Rp 50,000 in overhead for a given production level, but incurring Rp 60,000, would reveal a spending variance.

Revenue Variances

Revenue variances are vital for evaluating the performance of sales and marketing strategies. They pinpoint deviations between projected and actual revenue figures. This analysis is crucial for assessing the effectiveness of sales and pricing policies.

- Sales Volume Variance: This variance reflects the difference between the expected revenue based on the planned sales volume and the actual revenue generated. For example, if a company planned to sell 100 units at Rp 10,000 each, but only sold 80 units, a sales volume variance would exist.

- Pricing Variance: This variance assesses the difference between the expected revenue based on the planned selling price and the actual revenue generated. For instance, if a company anticipated selling units at Rp 12,000 but sold them at Rp 11,000, a pricing variance would arise.

- Sales Mix Variance: This variance focuses on the impact of changes in the proportion of different product sales compared to the planned mix. For instance, if a company anticipated selling 60% of product A and 40% of product B, but the actual sales mix was 70% of product A and 30% of product B, a sales mix variance would result.

Key Differences Between Variances

| Type of Variance | Focus | Impact |

|---|---|---|

| Material Variance | Material costs | Impacts raw material costs |

| Labor Variance | Labor costs | Impacts labor costs |

| Overhead Variance | Overhead costs | Impacts indirect costs |

| Sales Volume Variance | Sales volume | Impacts total revenue |

| Pricing Variance | Selling price | Impacts total revenue |

| Sales Mix Variance | Product mix | Impacts revenue from different products |

Causes of Variances: What Is Variance Analysis In Finance

Variance analysis in finance helps pinpoint the reasons behind deviations from predicted financial performance. Understanding these causes is crucial for effective corrective actions and strategic adjustments. Identifying the root causes, whether internal or external, allows businesses to optimize operations, control costs, and improve profitability.

Material Cost Variances

Material cost variances arise from discrepancies between the actual and standard costs of materials used in production. Several factors can contribute to these differences. Poor purchasing decisions, changes in material prices, and issues with material quality can all affect the final cost. Variations in material yields, such as spoilage or waste, also contribute significantly.

- Poor Purchasing Decisions: Inaccurate forecasting of material requirements or failing to negotiate favorable prices with suppliers can lead to higher-than-expected material costs. For instance, if a company buys raw materials in bulk during a period of low prices, it might be able to reduce its overall material cost. Conversely, if they buy during a period of high prices, their material costs will likely increase.

Variance analysis in finance, a crucial tool for assessing financial performance, compares actual results against predicted outcomes. This helps pinpoint areas where spending deviates from budget. Navigating the complexities of auto financing, as detailed in this helpful resource on can you return a car after financing it , often involves similar analytical principles. Ultimately, variance analysis aids in optimizing financial decisions, whether in personal finance or corporate strategy.

- Changes in Material Prices: Fluctuations in market prices for raw materials are a significant factor. A sudden increase in the cost of steel, for example, will directly impact the material cost variance. Unexpected events like global supply chain disruptions can also push prices upward, leading to higher costs.

- Material Quality Issues: Defective or substandard materials can lead to higher costs due to rework, scrap, or the need for replacements. For example, if a company uses lower-grade wood in furniture production, the final product may need more finishing, leading to increased costs.

- Material Yield Variations: Waste or spoilage during the production process can impact the actual quantity of materials used. If there is a high rate of material waste, the actual cost per unit will be higher than expected.

Labor Rate and Efficiency Variances

Labor rate and efficiency variances stem from discrepancies between the actual and standard labor costs. These variances reflect differences in the actual wages paid to employees and the productivity achieved.

- Labor Rate Variance: This variance is caused by differences between the actual wage rate paid to workers and the standard wage rate. Factors like overtime pay, labor union agreements, or hiring employees with different pay scales can influence this variance. If a company pays its employees more than anticipated, this variance will be unfavorable.

- Labor Efficiency Variance: This variance arises from differences between the actual hours worked and the standard hours expected for producing a given output. Factors such as employee training, motivation, technological advancements, and the efficiency of production processes affect this variance. For example, new machinery can increase efficiency and reduce labor hours per unit.

Overhead Variances

Overhead variances arise from differences between the actual and standard overhead costs. Several factors can influence these variances.

- Variable Overhead Variances: These are often caused by fluctuations in the volume of production, which affects the utilization of variable overhead resources. If production levels are lower than expected, variable overhead costs might be lower than predicted. For example, lower machine usage can lead to lower utility costs, thus a favorable variance.

- Fixed Overhead Variances: These variances result from differences between the actual and budgeted fixed overhead costs. Factors like depreciation, rent, and property taxes can impact these variances. Unexpected maintenance expenses can increase fixed overhead costs.

Sales Volume and Price Variances

Sales volume and price variances reflect differences between the actual and budgeted sales figures. External factors often influence these variances.

- Sales Volume Variance: This variance results from differences between the actual sales volume and the budgeted sales volume. Economic conditions, market demand, and competitor actions can all influence sales volume. A recession, for instance, can drastically reduce sales.

- Sales Price Variance: This variance arises from differences between the actual selling price and the budgeted selling price. Factors like pricing strategies, competitor pricing, and market conditions affect the variance. Promotional campaigns or competitor price reductions can affect the sales price variance.

Analyzing External Factors Impacting Variance

External factors such as economic downturns, changes in consumer preferences, or supply chain disruptions can significantly impact the variance analysis. By identifying and assessing these factors, companies can better predict and manage the effects of these factors on their operational performance. For example, during a pandemic, businesses experienced significant disruptions in supply chains and consumer behavior. Analyzing these external factors is vital to understand the true performance of a company.

| Variance Type | Possible Causes |

|---|---|

| Material Cost | Poor purchasing decisions, price fluctuations, quality issues, yield variations |

| Labor Rate | Overtime pay, union contracts, wage adjustments, employee skill differences |

| Labor Efficiency | Training effectiveness, employee motivation, production process efficiency, technological changes |

| Overhead | Variable overhead volume fluctuations, fixed overhead cost changes, maintenance expenses |

| Sales Volume | Economic conditions, market demand, competitor actions |

| Sales Price | Pricing strategies, competitor pricing, market conditions, promotional activities |

Analysis Methods

Variance analysis in finance is a crucial tool for understanding the reasons behind deviations from expected results. By systematically examining the differences between actual and budgeted or standard costs, revenues, or other financial metrics, companies can pinpoint areas needing improvement and optimize their operations. This process involves various methods and techniques, each with its own strengths and weaknesses.

Different Methods for Calculating Variances

Several methods exist for calculating variances, each tailored to different situations and levels of detail. The most common methods include the following:

- Standard Costing: This method establishes predetermined standard costs for materials, labor, and overhead. Actual costs are then compared to these standards to identify variances. Standard costing provides a benchmark for performance and facilitates the identification of inefficiencies. It’s particularly useful in manufacturing environments where costs are relatively stable and predictable.

- Flexible Budgeting: Instead of using a single budget for all activity levels, a flexible budget allows for adjustments based on the actual activity achieved. This method is useful for evaluating performance in environments where activity levels vary. It’s commonly used in service industries or situations where volume fluctuates significantly.

- Contribution Margin Analysis: This focuses on the contribution of each product or service to overall profitability. By comparing actual contribution margins to budgeted or standard margins, managers can assess the profitability of individual offerings and identify areas for improvement.

Steps Involved in Variance Analysis

Effective variance analysis follows a systematic approach, enabling a clear understanding of the causes of deviations. The steps involved typically include:

- Identifying the Variance: The first step is to determine the difference between actual and budgeted or standard figures. This involves comparing actual figures with planned figures for various aspects like revenue, costs, and efficiency.

- Analyzing the Variance: Once the variance is identified, the next step is to break down the variance into its component parts to understand the contributing factors. For example, a labor variance could be further dissected into rate and efficiency variances.

- Investigating the Causes: Thorough investigation into the underlying reasons for the variance is crucial. This often involves gathering data from various departments and individuals involved in the process.

- Taking Corrective Action: Based on the analysis, appropriate corrective actions are implemented to address the identified issues and prevent future variances. This could involve process improvements, cost reductions, or training initiatives.

Standard Costing in Variance Analysis

Standard costing plays a vital role in variance analysis. It provides a benchmark for evaluating performance by establishing predetermined costs for inputs like materials, labor, and overhead. Variances between actual and standard costs reveal areas where performance deviates from expectations. Standard costing is often used in conjunction with flexible budgeting to analyze cost variances at different activity levels.

Example: A company might establish a standard cost of $10 per unit for materials. If the actual cost for a particular period is $12 per unit, a variance of $2 per unit exists. This variance necessitates further investigation to understand the cause.

Comparing and Contrasting Variance Analysis Methods

Different variance analysis methods have varying strengths and weaknesses. Standard costing is beneficial for manufacturing settings with stable production levels, while flexible budgeting is more suitable for environments with fluctuating activities. Contribution margin analysis focuses on profitability and is useful for identifying the profitability of individual products or services. The choice of method depends on the specific needs and context of the analysis.

Method for Isolating the Causes of a Variance

Isolating the root cause of a variance requires a systematic approach. This involves breaking down the variance into its component parts and analyzing each component to determine the cause. For example, a material price variance can be further decomposed into factors such as supplier price changes, quantity discounts, and quality differences.

Calculation Methods for Variances

| Variance Type | Calculation Method |

|---|---|

| Material Price Variance | (Standard Price – Actual Price) × Actual Quantity |

| Material Usage Variance | (Standard Quantity – Actual Quantity) × Standard Price |

| Labor Rate Variance | (Standard Rate – Actual Rate) × Actual Hours |

| Labor Efficiency Variance | (Standard Hours – Actual Hours) × Standard Rate |

| Variable Overhead Spending Variance | (Standard Variable Overhead Rate – Actual Variable Overhead Rate) × Actual Hours |

| Variable Overhead Efficiency Variance | (Standard Hours – Actual Hours) × Standard Variable Overhead Rate |

Practical Applications

Variance analysis is a powerful tool for businesses across various sectors. By identifying and understanding the reasons behind deviations from planned or expected outcomes, companies can make informed decisions, optimize operations, and enhance profitability. This crucial aspect of financial analysis enables proactive adjustments and strategic improvements, ultimately contributing to better performance and sustainability.Applying variance analysis in different industries reveals key insights into operational efficiency, cost management, and investment strategy.

Manufacturing processes, service delivery, and investment portfolios all benefit from variance analysis to pinpoint areas for improvement and achieve optimal results.

Manufacturing Setting Applications

Variance analysis in manufacturing settings plays a critical role in understanding and controlling costs. By comparing actual costs with standard costs, companies can pinpoint deviations and investigate the root causes. This allows for corrective actions to be implemented. For instance, a manufacturing company might discover that raw material costs are higher than anticipated due to a supplier price increase.

Variance analysis allows them to analyze this variance and explore strategies to mitigate the impact, such as negotiating better pricing with suppliers or exploring alternative materials. This proactive approach allows for more efficient production and minimized financial losses. Furthermore, variance analysis helps manage labor costs and overhead expenses.

Service-Based Industry Applications

Variance analysis is equally applicable to service-based industries. In a service sector, the focus shifts to measuring and analyzing variances in factors like service delivery time, customer satisfaction scores, and employee productivity. A service company, for example, might observe a higher-than-expected customer complaint rate in a particular department. Variance analysis helps to identify the root causes, such as inadequate employee training, inefficient processes, or insufficient staff resources.

By analyzing these variances, the company can implement targeted solutions to improve customer satisfaction and operational efficiency.

Investment Portfolio Applications

Variance analysis in investment portfolios assesses the variability of returns. It quantifies the dispersion of actual investment returns from the expected or target returns. Investors use variance analysis to measure the risk associated with different investment strategies. A high variance indicates higher risk, while a low variance suggests lower risk. Portfolio diversification strategies aim to reduce overall portfolio variance, thereby managing risk effectively.

This allows for better investment decisions and more stable returns over time.

Case Studies of Profitability Improvement

Several companies have successfully utilized variance analysis to enhance profitability. For example, a retail company might observe a significant variance in sales figures for a particular product line. By analyzing the variance, the company might discover that the product is not meeting consumer demand due to ineffective marketing campaigns. This insight enables the company to adjust its marketing strategies and improve sales.

Similarly, a healthcare provider might find that operating costs are exceeding projections. Variance analysis can highlight inefficiencies in resource allocation or billing processes, prompting changes to optimize operational costs and improve profitability.

Identifying Cost Reduction Areas

Variance analysis is a key instrument for pinpointing areas where cost reductions can be achieved. By comparing actual costs with standard costs, companies can identify variances and investigate the root causes. For example, if a company discovers that labor costs are higher than expected, it can investigate factors such as overtime pay, inefficient work processes, or inadequate employee training.

This analysis facilitates the implementation of cost-saving measures and promotes operational efficiency.

Variance Analysis Applications Across Industries

| Industry | Potential Applications |

|---|---|

| Manufacturing | Raw materials, labor, overhead costs, production yields |

| Retail | Sales figures, inventory levels, customer acquisition costs |

| Service | Service delivery time, customer satisfaction, employee productivity |

| Investment | Investment returns, portfolio diversification, risk management |

| Healthcare | Operating costs, patient outcomes, billing processes |

Interpretation and Reporting

Variance analysis results, when properly interpreted and communicated, provide valuable insights for management decision-making. Understanding the magnitude and direction of variances helps pinpoint areas needing attention and allows for proactive adjustments. This section details the process of interpreting findings, emphasizing the importance of investigating significant discrepancies and effectively reporting variances to drive improvements.

Interpreting Variance Results

Variance analysis reveals the difference between planned and actual results. Interpreting these differences requires a nuanced approach, going beyond simply identifying the variance. The context surrounding the variance—market conditions, operational changes, or external factors—plays a crucial role in understanding its significance. A seemingly large variance might be insignificant if explained by external market shifts, while a small variance in a crucial operational area warrants immediate investigation.

Investigating Significant Variances

Significant variances—those exceeding predefined thresholds or falling outside expected ranges—demand immediate investigation. This investigation involves gathering data on the underlying causes. For instance, if sales revenue variance is negative, the analysis should consider factors like decreased demand, competitor actions, or promotional effectiveness. If a cost variance is high, the analysis should explore potential issues in supplier contracts, production efficiency, or material waste.

The objective is to identify the root cause and develop corrective actions.

Reporting Variances to Management

Reporting variances to management should be concise, clear, and actionable. A comprehensive report should include a summary of the key variances, their potential impact on the overall financial performance, and proposed corrective actions. The report should also clearly articulate the timeframe for implementing these actions and their expected results. Visual aids, such as charts and graphs, can enhance the clarity and comprehension of the report.

Guidance for Variance Magnitude Interpretation

| Variance Magnitude | Interpretation | Action |

|---|---|---|

| Significant (e.g., >10% of budgeted amount) | Requires immediate investigation and corrective action. | Investigate the root cause, implement corrective measures, and monitor the impact. |

| Moderate (e.g., 5-10% of budgeted amount) | Should be monitored closely. Investigate if underlying factors warrant further action. | Monitor performance, potentially explore corrective actions if the trend persists. |

| Minor (e.g., <5% of budgeted amount) | Generally not requiring immediate action, unless the variance is persistent or exhibits a concerning trend. | Monitor for trends, consider addressing if the variance becomes significant. |

Using Variance Analysis for Decision-Making

Variance analysis results provide critical data for informed decision-making. For example, if the variance analysis reveals a significant decrease in sales revenue, management can use this information to adjust pricing strategies, implement new marketing campaigns, or explore new market segments. Similarly, if material cost variances are high, management can renegotiate contracts with suppliers, optimize procurement processes, or explore alternative materials.

This allows proactive adjustments to maintain profitability and achieve organizational goals.

Communication Aspects of Variance Reporting

Effective communication of variance analysis results is crucial. Presenting the data in a clear and understandable manner, using visuals where appropriate, and providing context are essential for gaining management buy-in and fostering a shared understanding. The report should be tailored to the specific audience, focusing on the most critical information relevant to their roles and responsibilities. Open dialogue and discussion are vital for clarifying any uncertainties and encouraging a collaborative approach to resolving issues.

Limitations of Variance Analysis

Variance analysis, a powerful tool for assessing performance, has inherent limitations that must be acknowledged. Blindly relying on variance figures without considering the broader context can lead to flawed conclusions and potentially detrimental business decisions. Understanding these limitations is crucial for effective application and interpretation of the analysis.

Potential Limitations of Variance Analysis

Variance analysis is not a foolproof method. Its effectiveness hinges on the accuracy and appropriateness of the underlying assumptions. When these assumptions are violated, the results can be misleading. For example, if the standard cost used in the calculation is outdated or inaccurate, the variances calculated will be unreliable, potentially misguiding management. Furthermore, the analysis often assumes a stable environment, failing to account for external factors like economic downturns or changes in consumer preferences that may dramatically impact performance.

Circumstances Where Variance Analysis May Not Be Applicable

Certain situations may render variance analysis unsuitable. For instance, in rapidly changing industries with highly dynamic product lines, standard costs may become obsolete quickly, rendering the analysis less relevant. Similarly, businesses with highly variable production processes, such as those involving customized products, may find standard costs difficult to establish, impacting the reliability of the analysis. Industries with a significant proportion of indirect costs may face difficulties in attributing costs to specific products, thus making accurate variance analysis challenging.

Challenges Associated with Using Standard Costs

Standard costs are crucial to variance analysis, yet their application is not without challenges. The accuracy of standard costs hinges on the accuracy of estimations and predictions, which can be influenced by external factors and historical data that may no longer be representative. Moreover, maintaining consistent and up-to-date standard costs can be a significant administrative burden, requiring continuous monitoring and adjustments to reflect changes in input costs, labor rates, and other variables.

Furthermore, using historical data to establish standard costs can prove problematic if the business environment undergoes substantial changes.

Potential Pitfalls in Interpreting Variance Analysis Results

Interpreting variance analysis results requires careful consideration. A large variance may not always signal a problem; it might simply reflect an unusual event or a one-time occurrence. Similarly, a small variance may mask a more significant underlying issue that needs further investigation. Furthermore, correlation does not equate to causation; simply identifying a variance does not necessarily explain the root cause.

Therefore, a thorough investigation into the underlying reasons for the variance is critical before taking corrective action.

Influence of External Factors on Variance Analysis Results

External factors can significantly influence variance analysis results, potentially obscuring the true performance of the business unit. For example, unexpected changes in raw material prices or fluctuating demand can affect actual costs and revenues, leading to variances that are not directly attributable to internal inefficiencies. Furthermore, unforeseen economic downturns, changes in regulations, or technological advancements can all impact production and pricing strategies, affecting the accuracy of the variance analysis.

Summary Table of Limitations of Variance Analysis

| Limitation Category | Description |

|---|---|

| Inherent Assumptions | Variance analysis relies on accurate and appropriate assumptions about costs and performance. Violations of these assumptions can lead to misleading results. |

| Dynamic Environments | Rapidly changing industries or highly variable production processes can make standard costs obsolete, rendering variance analysis less relevant. |

| Standard Cost Challenges | Maintaining accurate and up-to-date standard costs can be administratively burdensome. Establishing accurate standard costs is challenging in rapidly evolving business environments. |

| Interpretation Pitfalls | Large or small variances may not always indicate problems; further investigation is crucial. Correlation does not equate to causation. |

| External Influences | Unexpected changes in raw material prices, demand, or economic conditions can distort variance analysis results, potentially masking true performance. |

Variance Analysis in Financial Decision Making

:max_bytes(150000):strip_icc()/Variance-TAERM-ADD-Source-464952914f77460a8139dbf20e14f0c0.jpg?w=700)

Variance analysis is a crucial tool in finance, providing insights into the performance of various financial aspects against predetermined benchmarks. It helps pinpoint deviations from planned outcomes, allowing businesses to understand the reasons behind these differences and make informed decisions to improve future performance. By analyzing variances, companies can refine their financial strategies and enhance their overall financial health.Variance analysis plays a vital role in various financial decision-making processes.

It supports strategic planning by highlighting areas where performance deviates from expectations, allowing for adjustments to budgets and forecasts. By identifying the root causes of variances, companies can implement corrective actions to achieve desired outcomes. Further, variance analysis can be used to assess investment opportunities, identify cost-saving measures, and enhance overall profitability.

Supporting Financial Planning

Variance analysis empowers financial planning by enabling a proactive approach to performance management. By comparing actual results with projected figures, companies can readily identify areas needing attention and implement corrective measures. This analysis aids in refining future budgets and forecasts, making them more realistic and accurate. For instance, if sales figures fall short of projections, variance analysis can help determine the reasons behind this discrepancy.

This analysis can then guide the development of new sales strategies, marketing campaigns, or product development plans to improve future sales.

Aiding Budget Control and Performance Evaluation

Variance analysis is instrumental in budget control and performance evaluation. It facilitates the comparison of actual financial results with the predetermined budget, revealing discrepancies. This process helps managers understand the reasons behind variances, allowing for timely corrective actions. The analysis also supports performance evaluation by assessing the effectiveness of strategies and resource allocation. A company might find that advertising expenses exceeded budget; variance analysis can help pinpoint the specific campaigns responsible for the overspending, allowing for better resource allocation in future campaigns.

Use in Investment Decision Making

Variance analysis is applicable to investment decisions by assessing the risk and return potential of various investment options. By comparing actual investment returns with projected returns, companies can gauge the effectiveness of their investment strategies. Variance analysis also helps evaluate the risks associated with specific investments. For example, a company considering an investment in a new technology might analyze the variance between projected returns and potential losses, assessing the associated risks and determining if the investment aligns with overall financial goals.

Influencing Strategic Financial Planning

Variance analysis provides valuable insights for strategic financial planning. By highlighting variances in key performance indicators (KPIs), companies can identify areas where their strategies need adjustment. This analysis also allows for a more comprehensive evaluation of different strategic options. For instance, a company considering expansion into new markets can use variance analysis to evaluate the financial implications of different expansion strategies.

This analysis can also help determine the feasibility and potential profitability of each strategy, helping to refine the strategic plan.

Informing Corrective Actions

Variance analysis directly informs corrective actions by pinpointing the causes of deviations from planned outcomes. This process helps companies adjust their strategies and operations to achieve better results. For example, if production costs are higher than anticipated, variance analysis can help pinpoint the specific factors driving the increased costs, such as material price increases or inefficient production processes.

This knowledge allows for immediate corrective actions, such as negotiating better material prices or implementing process improvements.

Summary Table: Role of Variance Analysis in Financial Decisions

| Financial Decision | Role of Variance Analysis |

|---|---|

| Financial Planning | Identifies areas needing attention, refines budgets and forecasts. |

| Budget Control & Performance Evaluation | Compares actual results with budget, identifies corrective actions, evaluates effectiveness of strategies. |

| Investment Decisions | Assesses risk and return potential of investments, evaluates effectiveness of investment strategies. |

| Strategic Financial Planning | Highlights variances in KPIs, evaluates strategic options, determines feasibility and profitability. |

| Corrective Actions | Identifies causes of deviations, allows for adjustments to strategies and operations. |

Closure

In conclusion, variance analysis in finance is a cornerstone of effective financial management. By comparing actual results to planned figures, this method allows businesses and investors to pinpoint the reasons behind deviations. This understanding facilitates informed decision-making, strategic planning, and the implementation of corrective actions to optimize profitability and resource allocation. The analysis, while insightful, also has limitations, demanding careful interpretation and consideration of external factors.

This guide provides a comprehensive overview, empowering readers to effectively utilize this critical financial tool.

FAQ Insights

What are the primary uses of variance analysis beyond cost control?

Variance analysis isn’t confined to cost control; it’s also instrumental in evaluating investment performance, identifying trends in revenue generation, and assessing the effectiveness of strategic initiatives. It can help understand market fluctuations and adapt strategies accordingly.

How does variance analysis differ from other financial analysis techniques?

While other techniques, like ratio analysis, focus on relationships between financial figures, variance analysis specifically examines the difference between planned and actual figures. It’s a method focused on identifying deviations and understanding the factors behind them.

What are some common pitfalls to avoid when interpreting variance analysis results?

One common pitfall is jumping to conclusions without thoroughly investigating the root causes of a variance. Another is neglecting external factors that may have influenced the results. A comprehensive analysis considers all relevant information before drawing conclusions.

Can variance analysis be used in non-profit organizations?

Absolutely. Variance analysis can be a valuable tool for non-profits to assess program effectiveness, track expenses against budgets, and ensure responsible resource allocation, helping them achieve their mission goals.