Is FFS covered by insurance? Navigating healthcare coverage can feel like a maze, but this deep dive will cut through the confusion. We’ll break down everything from understanding FFS itself to figuring out what’s covered, how much it’ll cost, and where to find the answers you need.

FFS, or Fee-for-Service, is a common healthcare model. Understanding how your insurance interacts with FFS is key to avoiding surprises and managing your health costs effectively. We’ll explore the nuances of different insurance plans, coverage variations, and the factors that affect your final bill.

Defining “FFS”

FFS, in the realm of healthcare, stands for Fee-for-Service. This payment model is a cornerstone of many healthcare systems worldwide, shaping how patients access and receive care. Understanding its nuances is crucial for navigating the complexities of healthcare insurance.Fee-for-service arrangements establish a straightforward payment structure, where providers are reimbursed for each service rendered to patients. This model fosters a degree of autonomy for both patients and providers, offering patients flexibility in choosing their healthcare providers.

The system’s emphasis on individual services can sometimes lead to fragmentation of care, however.

FFS Abbreviations and Meanings

Various abbreviations and acronyms exist for “Fee-for-Service” across different healthcare contexts. For example, in some regions, “FFS” might be used directly, while other locales may employ different shorthand terms. This diversity reflects the global variations in healthcare systems.

Types of Healthcare Plans with FFS Coverage

FFS plans often encompass a wide spectrum of healthcare coverage. These plans can be stand-alone or integrated components within broader healthcare packages. They may cover various services, including preventive care, acute care, and specialized treatments. A critical element is the determination of what services are covered, often dependent on the specifics of the plan.

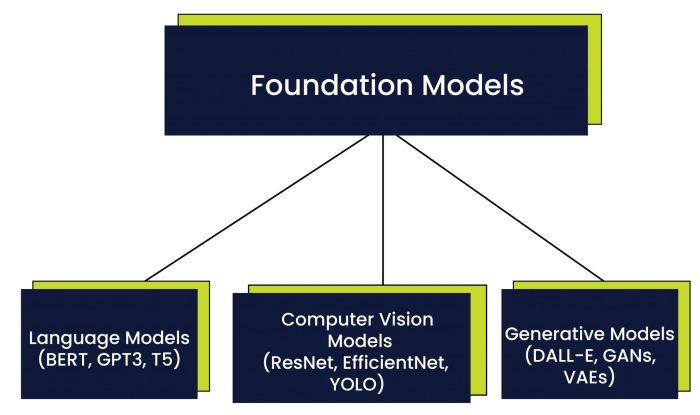

FFS vs. Other Insurance Models

Fee-for-service differs significantly from other insurance models, such as Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). Understanding these differences is essential for making informed choices about healthcare plans.FFS plans typically offer a wider network of providers, granting patients more freedom in selecting their doctors. However, this freedom often comes with higher out-of-pocket costs for patients. Conversely, HMOs often restrict patient choices to in-network providers, but typically offer lower premiums and more controlled costs.

PPOs provide a balance between the two, allowing patients to see out-of-network providers with a higher co-pay.

Comparison of FFS, HMO, and PPO Models

| Feature | FFS | HMO | PPO |

|---|---|---|---|

| Network of Providers | Wide, often including both in-network and out-of-network providers | Limited to in-network providers | Wider than HMOs, encompassing both in-network and out-of-network providers, with varying levels of cost-sharing |

| Cost-Sharing | Generally higher out-of-pocket costs for patients | Lower premiums and potentially lower out-of-pocket costs | Balance between FFS and HMO models, offering lower costs for in-network care and potentially higher costs for out-of-network care |

| Patient Choice | High degree of patient choice in selecting providers | Limited patient choice to in-network providers | Greater choice than HMOs, but still often influenced by cost-sharing considerations |

| Cost Control | Less control over costs compared to HMOs | More control over costs through restrictions on provider networks | Moderate control over costs, balancing patient choice and cost containment |

Coverage Variations: Is Ffs Covered By Insurance

Insurance companies often employ diverse approaches to covering Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs), a fact that significantly influences the practical application of these accounts. Understanding these variations is crucial for making informed decisions about utilizing these financial tools for healthcare expenses. The complexities of individual plans and their associated rules require meticulous scrutiny to ensure optimal utilization.The extent of coverage for FFS procedures varies significantly between insurance providers.

Factors such as the specific procedure, the provider’s credentials, and the patient’s overall health status can all play a role in the insurance company’s decision on whether to cover the procedure. Moreover, the plan’s specific terms and conditions, often found in dense policy documents, are vital to navigate these complexities.

Factors Influencing FFS Coverage Decisions

Insurance providers consider various factors when deciding whether to cover FFS procedures. These factors encompass the nature of the procedure itself, the provider’s credentials, and the patient’s health history. The financial implications of covering the procedure also influence the decision-making process. Additionally, the insurance company’s internal guidelines and the specific terms of the policy play a pivotal role in determining coverage.

Coverage Amounts for Similar Procedures

Comparing coverage amounts for similar FFS procedures under different plans is essential for maximizing the benefits of these accounts. Significant variations exist between plans, and this often depends on the specifics of the plan. The level of coverage might differ significantly for identical procedures, based on the chosen insurance plan. This highlights the necessity of meticulously comparing plans to ensure the best possible outcome for healthcare expenses.

Examples of Typically Covered FFS Procedures

Commonly covered FFS procedures encompass routine checkups, vaccinations, and preventative care measures. Specific procedures often covered include physical therapy sessions, lab tests, and certain dental treatments. However, coverage may vary widely depending on the specifics of the insurance plan.

So, is FFS covered by insurance? It’s a bit of a wild goose chase, isn’t it? You’re basically trying to find a needle in a haystack, especially when you’re looking at Kaiser insurance. Digging deeper, you’ll find that the answer to whether Kaiser insurance covers therapy depends a lot on the specifics of your plan. Check out this helpful resource to see if Kaiser insurance covers therapy does kaiser insurance cover therapy.

Ultimately, though, figuring out if FFS is covered by insurance still comes down to understanding your individual policy. It’s a real brain twister, isn’t it?

FFS Procedures Covered by a Sample Insurance Plan

The following table showcases a sample of FFS procedures covered by a hypothetical insurance plan. This example illustrates the potential range of coverage and serves as a useful guide, but it should not be interpreted as a comprehensive representation of all plans.

| Procedure | Coverage Amount | Notes |

|---|---|---|

| Annual Physical Examination | 100% | Routine check-up |

| Preventive Dental Cleaning | 80% | Up to $100 |

| Blood Pressure Monitoring | 100% | Included in annual physical |

| Vaccinations | 100% | Required by the insurance plan |

| Vision Examination | 50% | Up to $50 |

Factors Affecting Coverage

FFS plans, while offering flexibility, are subject to numerous determinants for coverage. Understanding these factors is crucial for patients to anticipate and manage their healthcare expenses effectively. These factors vary widely, impacting everything from the most routine checkups to specialized procedures.Navigating the intricacies of FFS coverage can be daunting. However, a thorough comprehension of these influencing factors empowers patients to make informed decisions about their healthcare.

This understanding can potentially minimize surprises and optimize financial planning.

Procedure-Specific Coverage Criteria

FFS plans often employ specific criteria for determining coverage. These criteria can be complex, varying based on the nature and necessity of the procedure or service. For instance, preventive care may be fully covered, while elective procedures might require pre-authorization or have a higher cost-sharing component. The complexity of these criteria highlights the need for careful review of plan details.

- Diagnostic testing: Blood tests, X-rays, and MRIs, while often necessary, can vary in coverage depending on their specific use. Routine checkups might include some diagnostic testing as part of a package, while additional or specialized testing may necessitate separate approvals and cost-sharing.

- Surgical procedures: Coverage for surgical procedures hinges on factors like the complexity of the surgery, the specific surgeon, and the patient’s overall health. A simple appendectomy might be fully covered, while a complex heart bypass surgery could involve extensive pre-authorization and potentially higher out-of-pocket expenses.

- Mental health services: The coverage of mental health services can differ significantly across plans. Some plans might have a broader network of therapists, while others may have strict criteria for approving specific types of therapy.

Geographic Location’s Influence

Patient location plays a significant role in FFS coverage. Geographic variations in healthcare costs and provider availability can influence the price and availability of services. For example, a procedure performed in a rural area might have different costs compared to a metropolitan area.

- Provider availability: In some areas, specialized providers, such as cardiologists or neurosurgeons, might be scarce. This can affect the availability of services covered by the FFS plan, possibly necessitating travel or referrals to providers in different locations.

- Local costs: The cost of healthcare services can fluctuate considerably across different regions. FFS plans might factor in these local variations when determining the reimbursement rates for providers in specific areas.

- Emergency care: In some regions, the availability and cost of emergency care can be significantly higher, which can impact the coverage of emergency services in an FFS plan.

Pre-Authorization Requirements

Pre-authorization is a common element in FFS plans. It involves obtaining prior approval from the insurance company before a procedure or service can be performed. The process varies by plan, but it often aims to ensure that the treatment is medically necessary and appropriate.

- Medical necessity: Pre-authorization requests are often evaluated to determine if the proposed treatment is medically necessary. A comprehensive evaluation of the patient’s condition and the proposed treatment is crucial for securing pre-authorization.

- Time constraints: The pre-authorization process can sometimes involve delays, impacting the timing of treatment. Patients should be aware of the typical timeframe involved in pre-authorization requests to avoid potential treatment delays.

- Rejection possibilities: Pre-authorization requests might be denied if the plan deems the proposed treatment unnecessary or inappropriate. Understanding the reasons for denial and appealing the decision are essential for patients.

Patient’s Medical History’s Impact

A patient’s medical history can significantly affect FFS coverage decisions. Conditions, past treatments, and related complications can influence the cost-sharing or even eligibility for specific procedures or services. This is particularly relevant for chronic conditions or pre-existing conditions.

- Chronic conditions: Patients with chronic conditions, such as diabetes or hypertension, might encounter different coverage levels for related procedures or medications. A comprehensive understanding of the plan’s coverage for chronic conditions is crucial for proactive management.

- Pre-existing conditions: Pre-existing conditions can impact the coverage for certain treatments. Some FFS plans may have exclusions or limitations for pre-existing conditions, requiring patients to be aware of these stipulations.

- Past treatments: Past treatments and related complications can also affect the coverage for future treatments. Patients with a history of complications from previous procedures might face different coverage requirements.

Physician/Provider Network Influence

The physician/provider network associated with the FFS plan plays a vital role in coverage decisions. Patients are often limited to providers within the network, and the coverage rates can differ based on the provider’s status within the network.

- In-network providers: Services from in-network providers are often covered at a more favorable rate compared to out-of-network providers. Patients should be aware of the specific network of providers associated with their plan.

- Out-of-network providers: Procedures performed by out-of-network providers often have higher cost-sharing, or the coverage might be limited. It’s crucial to understand the cost implications of using out-of-network providers.

- Specialization: The specific specialization of the provider can also affect the coverage for particular procedures or services. For example, a specialist in a specific area of medicine might have different coverage rates compared to a general practitioner.

Out-of-Pocket Expenses

Navigating the labyrinth of healthcare costs can be daunting, especially when dealing with Flexible Spending Accounts (FSAs) and other financial tools. Understanding out-of-pocket expenses associated with FFS (Fee-for-Service) plans is crucial for proactive financial management. This section delves into the specifics of deductibles, co-pays, and co-insurance, equipping you with the knowledge to estimate and prepare for these costs.

Determining Out-of-Pocket Costs for FFS Services

Out-of-pocket costs for FFS services are determined by the specific terms of your insurance plan. These costs are typically Artikeld in your policy documents, including the Summary of Benefits and Coverage (SBC). The plan defines the financial responsibilities of both the insured and the insurance provider.

Examples of Deductibles, Co-pays, and Co-insurance in FFS

Deductibles represent the amount you must pay out-of-pocket before your insurance starts to cover expenses. A co-pay is a fixed amount you pay for a specific service, such as a doctor’s visit or prescription. Co-insurance is a percentage of the cost of a service that you are responsible for after meeting your deductible. For instance, if a service costs $200 and your plan has 20% co-insurance, you would pay $40 out-of-pocket.

Typical Out-of-Pocket Expenses for Common FFS Procedures

The table below illustrates typical out-of-pocket expenses for common FFS procedures. Note that these are examples and actual costs can vary widely based on the specific plan, provider, and location.

| Procedure | Estimated Deductible | Estimated Co-pay | Estimated Co-insurance (if applicable) |

|---|---|---|---|

| Annual Physical Exam | $200-$500 | $25-$50 | 10%-20% |

| Specialist Consultation | $200-$500 | $50-$100 | 10%-20% |

| X-Ray | $0 (often included in deductible) | $25-$50 | 0%-10% |

| Prescription Drug Fill | $0 (often included in deductible) | $10-$20 | 10%-20% |

| Emergency Room Visit | $200-$500 | $100-$200 | 20%-30% |

Estimating Out-of-Pocket Expenses for Specific FFS Procedures

To estimate out-of-pocket expenses for a particular FFS procedure, consult your insurance plan documents. Carefully review the specifics of your deductible, co-pay, and co-insurance percentages. For example, if you anticipate needing a specialist consultation, check your policy for the associated costs.

Finding Information about Out-of-Pocket Costs for a Particular FFS Plan

Your insurance provider’s website and policy documents are your primary resources for understanding out-of-pocket costs for your specific FFS plan. Contact your insurance provider’s customer service department if you need clarification or further details. Reviewing the Summary of Benefits and Coverage (SBC) document, often available online, provides a comprehensive overview of coverage details, including cost-sharing provisions.

Finding Coverage Information

Navigating the labyrinth of insurance policies can feel like searching for a needle in a haystack. Understanding your Flexible Spending Account (FSA) coverage, particularly for out-of-pocket expenses, requires meticulous research and clear communication. This section details various avenues to uncover the specifics of your FFS plan, empowering you to make informed decisions about your healthcare needs.

Researching FFS Coverage Under a Specific Plan

Locating FFS coverage information requires a proactive approach. Insurance providers typically provide detailed policy information on their websites. These websites often feature searchable databases of benefits, enabling quick access to specific provisions. Reviewing your plan documents, usually accessible through online portals or your account summary, is another crucial step. These documents are meticulously prepared by the insurance company, providing a comprehensive overview of the plan’s benefits, exclusions, and limitations.

Moreover, your insurance provider’s customer service representatives are trained to answer inquiries about your plan.

Resources Available to Patients

Patients have access to a wealth of resources to find out about FFS coverage. Online portals frequently host FAQs, frequently asked questions, about common insurance queries. These FAQs are designed to offer immediate answers to frequently asked questions about FFS benefits. Moreover, many healthcare providers maintain resources that provide detailed information about insurance plans. These resources are often integrated into their patient portals, allowing patients to quickly ascertain their coverage options.

Contacting Insurance Providers to Clarify FFS Coverage

Effective communication is key when seeking clarification about FFS coverage. Insurance providers usually offer various methods of contact, including phone support, email, or chat services. Understanding your provider’s preferred communication channel is important to facilitate swift and accurate responses. Be prepared to provide relevant information, such as your policy number, the specific service or treatment you’re inquiring about, and any other pertinent details.

Use clear and concise language to articulate your questions.

The Role of Insurance Brokers in Providing FFS Coverage Information

Insurance brokers play a vital role in helping individuals understand their FFS coverage. Brokers often possess in-depth knowledge of various insurance plans, including those with FFS options. They can provide guidance and explain complex provisions in simple terms, helping you navigate the intricacies of your insurance plan. Brokers can act as a liaison between you and the insurance company, ensuring that your questions are addressed accurately and promptly.

They can also compare different plans to help you find the best fit for your needs.

Resources for Researching FFS Coverage

This table provides a compilation of resources for researching FFS coverage:

| Resource | Description |

|---|---|

| Insurance Provider Website | Typically includes searchable databases of benefits, plan documents, and FAQs. |

| Plan Documents (Online Portal) | Comprehensive overview of plan benefits, exclusions, and limitations. |

| Insurance Provider Customer Service | Trained representatives to answer inquiries about your plan. |

| Healthcare Provider Resources | Often integrated into patient portals, providing information about insurance plans. |

| Insurance Brokers | Experts in insurance plans, offering guidance and comparing plans. |

Coverage Examples

Navigating the labyrinthine world of insurance coverage for Flexible Spending Accounts (FSAs) can feel like deciphering ancient hieroglyphs. Understanding what’s typically covered, what’s often excluded, and how pre-authorization and provider networks impact your options is crucial for maximizing your FSA benefits. This section provides a clearer picture of these complexities, illustrating common scenarios and clarifying the language used in insurance policies.

Commonly Covered FFS Procedures

Insurance plans frequently cover routine medical procedures paid for through FFS accounts, provided they align with the plan’s general coverage guidelines. Examples include preventive care, such as annual checkups, vaccinations, and routine dental cleanings. Many plans also cover certain types of physical therapy, particularly if recommended by a physician for a specific condition. Furthermore, some plans extend coverage to over-the-counter medications, though often with limits on amounts and types.

Procedures Often Excluded or with Limited Coverage, Is ffs covered by insurance

Not all procedures are created equal under an FFS plan. Cosmetic procedures, for instance, typically fall outside the scope of coverage. Similarly, treatments for pre-existing conditions, particularly if the condition isn’t adequately documented or managed prior to the start of the FSA, may have restricted or absent coverage. Furthermore, procedures that are deemed experimental or investigational are rarely covered.

Impact of Pre-Authorization on FFS Coverage

Pre-authorization is a crucial factor affecting FFS coverage. Many insurance plans require pre-authorization for certain procedures, especially those deemed more complex or expensive. Failure to obtain pre-authorization before the procedure can result in denial of coverage. This is often stipulated in the plan’s policy documents, emphasizing the importance of verifying the specific requirements. For example, a plan might require pre-authorization for procedures involving specific specialists or for extensive procedures exceeding a certain cost threshold.

Influence of Provider Networks on FFS Coverage

Provider networks directly impact FFS coverage. If a chosen provider isn’t part of the insurance network, the plan might limit or deny coverage for services provided by that practitioner. This often involves utilizing in-network providers to maximize coverage and avoid out-of-pocket expenses. For instance, a plan might offer a higher percentage of coverage for services rendered by physicians within its network, compared to those outside it.

Insurance Policy Explanations of FFS Coverage

Insurance companies employ various methods to explain FFS coverage in their policy documents. These often include detailed schedules of benefits, listing covered procedures with associated percentages of reimbursement. Furthermore, specific terms and conditions, like pre-authorization requirements, are typically highlighted within the policy document. This section also often describes the claims process, outlining the steps needed to obtain reimbursement.

For example, some plans might specify that claims must be submitted within a certain timeframe following the service date. These details are essential for understanding and maximizing FFS benefits.

Epilogue

So, is FFS covered by insurance? The answer isn’t a simple yes or no. It depends on your specific plan, the procedure, and various other factors. This guide armed you with the knowledge to explore your coverage options and make informed decisions about your healthcare. Remember to always check with your insurance provider for the most up-to-date information.

FAQ Guide

What is FFS?

FFS, or Fee-for-Service, is a healthcare model where providers are paid for each service they perform. It’s a contrast to managed care models like HMOs and PPOs, which often have restrictions on which doctors you can see.

How do I find out if a specific procedure is covered under my FFS plan?

Check your insurance plan’s policy documents, contact your insurer directly, or utilize online resources like your insurer’s website. Pre-authorization might be necessary for some procedures.

What are typical out-of-pocket expenses associated with FFS services?

Out-of-pocket costs vary significantly depending on your plan and the specific procedure. They include deductibles, co-pays, and co-insurance. Refer to your policy for specifics.

Does my location affect FFS coverage?

Potentially, yes. Your location might influence provider networks, which can impact coverage decisions for FFS services. Always double-check with your insurance provider.