What is a non qm mortgage loan? This query unlocks a fascinating segment of the mortgage market, moving beyond traditional lending parameters to accommodate a wider spectrum of borrowers. This exploration will demystify these unique financial instruments, revealing their structure, purpose, and the diverse individuals they serve. We will delve into the characteristics that set them apart from conventional loans, offering a comprehensive understanding of their role in facilitating homeownership.

This presentation will meticulously define non-QM mortgage loans, illuminating their fundamental concepts and primary distinguishing features from conventional Qualified Mortgages (QM). We will clarify the meaning of “QM” within the mortgage landscape and articulate the core objectives of non-QM loan products in the current lending environment. Furthermore, we will identify the typical borrower profiles that benefit from these loans, the common reasons for QM ineligibility, and the flexible income verification methods and documentation accepted for non-QM applications.

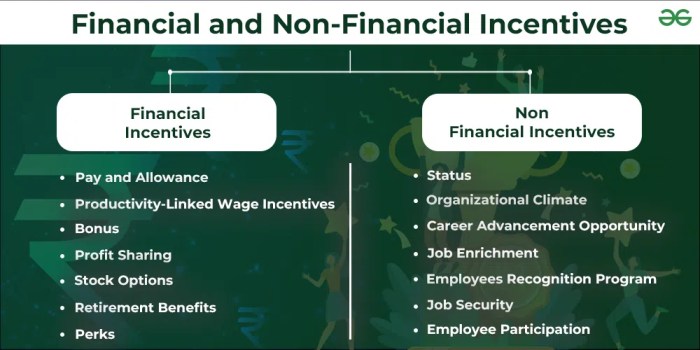

A comparative table will highlight the differences in income requirements between QM and non-QM loans.

Defining Non-QM Mortgage Loans: What Is A Non Qm Mortgage Loan

In the intricate tapestry of homeownership, the path to securing a mortgage often appears as a well-trodden, conventional route. Yet, for a significant segment of aspiring homeowners, this standard path may not accommodate their unique financial narratives. This is where the landscape of non-QM mortgage loans emerges, offering a crucial alternative for those whose circumstances fall outside the rigid parameters of traditional lending.

These loans are not merely a footnote in the mortgage industry; they represent a vital avenue for financial inclusion, unlocking the dream of homeownership for a broader spectrum of individuals.The fundamental concept of a non-QM mortgage loan is elegantly simple: it is a home loan that does not meet, or is not required to meet, the strict underwriting criteria established by the Consumer Financial Protection Bureau (CFPB) for Qualified Mortgages (QM).

This distinction is pivotal, as it signifies a departure from the standardized, highly regulated framework that governs conventional mortgages. While QM loans are designed to ensure borrowers can afford their payments and to protect lenders from certain risks, non-QM loans are crafted to serve borrowers whose financial profiles might be more complex or unconventional, yet still demonstrably capable of managing mortgage obligations.

Distinguishing Characteristics of Non-QM Loans

The divergence between non-QM and conventional QM loans is marked by several key characteristics that influence their structure, underwriting, and accessibility. These differences are not arbitrary; they are designed to cater to a wider range of borrower situations while still maintaining a responsible lending approach.The primary characteristics that distinguish a non-QM loan from a conventional QM loan are centered around the underwriting flexibility and the types of documentation accepted.

While QM loans adhere to stringent debt-to-income ratios, verifiable income, and specific loan terms designed to ensure repayment ability, non-QM loans offer more adaptability. This often translates to:

- Flexible Income Verification: Non-QM loans are more accommodating to borrowers with variable income streams, such as self-employed individuals, freelancers, or those with significant commission-based earnings. Instead of relying solely on traditional W-2s and tax returns spanning two years, non-QM lenders may consider bank statements, profit and loss statements, or even asset depletion strategies to establish repayment capacity.

- Broader Debt-to-Income (DTI) Ratios: While QM loans typically have strict DTI limits, non-QM loans may allow for higher DTI ratios, provided other compensating factors, such as a larger down payment or significant liquid assets, are present.

- Alternative Documentation: Lenders in the non-QM space are often more open to alternative forms of documentation that might not be standard for QM loans, broadening the scope of what is considered acceptable proof of financial stability.

- Credit Score Variations: While QM loans often require a minimum credit score, non-QM loans can be more accommodating to borrowers with less-than-perfect credit histories, though typically still requiring a baseline level of creditworthiness.

- Loan Structure and Features: Some non-QM loans may include features that are not permitted under QM guidelines, such as certain interest-only options or balloon payments, though these are often structured with careful consideration of borrower risk.

Definition of “QM” in Mortgage Context

In the realm of mortgage lending, “QM” is an abbreviation that holds significant weight and defines a specific category of home loans. It stands for Qualified Mortgage. This designation is rooted in federal regulations, specifically the Dodd-Frank Wall Street Reform and Consumer Protection Act, which aimed to establish clearer standards for mortgage origination to prevent predatory lending practices and to ensure borrowers could realistically afford their loans.A mortgage that meets the QM criteria is presumed to have been originated responsibly.

This presumption is crucial for lenders, as it offers a degree of legal protection against borrower lawsuits if the borrower defaults on the loan. To achieve QM status, a loan must satisfy a set of predefined underwriting standards, including limitations on loan terms, fees, and the borrower’s debt-to-income ratio.

Core Purpose of Non-QM Loan Products

The core purpose of non-QM loan products in the lending market is to bridge the gap for borrowers who, for a variety of legitimate financial reasons, do not fit neatly into the box of a Qualified Mortgage. These products are designed to serve as an inclusive and flexible alternative, recognizing that a borrower’s financial strength and ability to repay a mortgage cannot always be captured by the rigid metrics of QM guidelines.The fundamental aim is to expand access to homeownership for a wider demographic.

This includes:

- Self-Employed Individuals: Many entrepreneurs and small business owners experience fluctuating income that can make it challenging to meet the strict income verification requirements of QM loans, despite having substantial earnings and assets.

- Borrowers with Irregular Income: Individuals whose income is derived from sources like commissions, bonuses, or seasonal work may find non-QM loans more suitable.

- Those with Past Credit Challenges: Borrowers who may have experienced past financial difficulties, such as a bankruptcy or foreclosure, but have since demonstrated a stable financial recovery and capacity to manage debt, can find opportunities through non-QM lending.

- Investors and Those with Complex Financials: Individuals with multiple income streams, significant investment portfolios, or other complex financial situations that don’t align with standard QM underwriting can benefit from the tailored approach of non-QM loans.

In essence, non-QM loans serve as a vital mechanism for financial innovation and inclusion, allowing lenders to assess risk more holistically and to extend the dream of homeownership to a broader segment of the population whose financial profiles are robust but unconventional. They represent a more personalized approach to mortgage underwriting, acknowledging that financial success is not always expressed in standardized terms.

Eligibility Criteria for Non-QM Loans

For those whose financial narratives don’t neatly fit the conventional mold, non-QM loans emerge as a beacon of possibility. These loans are crafted for individuals who, for a variety of valid reasons, find themselves outside the strict confines of Qualified Mortgage (QM) guidelines. They represent a more personalized approach to homeownership, acknowledging that a person’s ability to repay a mortgage is often more nuanced than what standard documentation can capture.The beauty of non-QM loans lies in their adaptability, offering a lifeline to borrowers who might otherwise be shut out of the housing market.

This flexibility is not a waiver of responsibility but rather a sophisticated recalibration of risk assessment, opening doors to a broader spectrum of aspiring homeowners.

Typical Borrower Profiles Benefiting from Non-QM Loans

Non-QM loans are a tailored solution for a diverse group of individuals whose financial situations may be complex or fall outside traditional underwriting parameters. These borrowers often possess strong creditworthiness and the capacity to repay, but their income or employment history presents unique characteristics.

- Self-Employed Individuals: Entrepreneurs, freelancers, and small business owners often experience fluctuating income, making it challenging to meet the stringent income verification requirements of QM loans. Their tax returns may show significant deductions, reducing their “qualified” income.

- Gig Economy Workers: Those working in the gig economy, with multiple income streams from various sources, may also struggle to present a consistent, verifiable income that satisfies QM standards.

- Recent Immigrants: Individuals who are new to the country may have limited credit history or income documentation available in the U.S. that meets QM requirements.

- Borrowers with Past Credit Challenges: While QM loans have strict credit score and debt-to-income ratio requirements, non-QM loans can offer more leniency for those with minor blemishes on their credit history, provided they can demonstrate current financial stability.

- Investors with Multiple Properties: Real estate investors who rely on rental income from multiple properties may find non-QM options more accommodating for financing additional investments.

- Borrowers with Large Assets but Irregular Income: Individuals with substantial savings or investments but whose regular income is not easily quantifiable might find non-QM loans a suitable option.

Reasons for Not Qualifying for a QM Loan

The Qualified Mortgage (QM) rule, designed to protect consumers and lenders, sets specific parameters for loan eligibility. When a borrower’s financial profile doesn’t align with these parameters, they may be steered towards non-QM options.

- Income Volatility: QM loans generally require a stable and verifiable income history, typically over a two-year period. Borrowers with fluctuating self-employment income, commission-based earnings, or inconsistent freelance work may not meet this criterion.

- High Debt-to-Income (DTI) Ratio: QM loans have strict limits on the borrower’s DTI ratio. If a borrower’s monthly debt obligations, including the proposed mortgage payment, exceed these limits, they will not qualify for a QM loan.

- Limited Credit History: While QM loans do have credit score requirements, they also look for a certain depth of credit history. Borrowers with very thin credit files may not meet the QM criteria.

- Non-Standard Employment Situations: Employment that doesn’t fit the traditional W-2 employee model, such as contract work, seasonal employment, or short-term jobs, can make it difficult to satisfy QM income verification.

- Large Lump Sum Deposits: While often a sign of financial health, large, unexplained deposits in a borrower’s bank accounts can sometimes be viewed with suspicion by QM underwriters, as they can obscure the true nature of regular income.

- Certain Loan Features: QM loans also have restrictions on certain loan features, such as balloon payments or negative amortization, which may be present in some non-QM products.

Flexibility in Income Verification Methods for Non-QM Borrowers

One of the most significant advantages of non-QM loans is the broadened scope of income verification. Lenders understand that traditional methods may not capture the full financial picture for many borrowers. This allows for more creative and comprehensive ways to demonstrate repayment ability.Instead of solely relying on pay stubs and W-2s, non-QM lenders often employ alternative verification strategies. This might include utilizing bank statements to analyze cash flow and average deposits, or reviewing profit and loss statements for self-employed individuals.

The emphasis shifts from a rigid adherence to a single method to a more holistic assessment of the borrower’s financial capacity.

Acceptable Documentation for Proving Income and Assets in Non-QM Applications

The documentation required for non-QM loans, while more flexible, still necessitates thorough evidence of a borrower’s financial standing. Lenders need to be confident in the borrower’s ability to manage their mortgage obligations.

- Bank Statements: Typically, 12 to 24 months of complete bank statements (checking and savings) are required. These statements are crucial for self-employed individuals and those with irregular income to demonstrate consistent cash flow and average monthly deposits. Lenders will analyze these statements to calculate an effective income.

- Tax Returns: For self-employed borrowers, typically two years of complete personal and business tax returns, including all schedules, are requested. This allows lenders to assess profitability and the borrower’s overall financial health.

- Profit and Loss (P&L) Statements: A year-to-date P&L statement, often prepared by a CPA, can be used in conjunction with tax returns to provide a more current picture of a business’s performance.

- Asset Documentation: Proof of assets can include statements for savings accounts, checking accounts, investment accounts (stocks, bonds, mutual funds), retirement accounts (401(k)s, IRAs), and other liquid or illiquid assets. These are used to verify reserves and down payment funds.

- Letters of Explanation: For any unusual transactions or discrepancies in financial documents, a detailed letter of explanation from the borrower may be required.

- Business Financials: For business owners, additional documentation like balance sheets or business debt schedules might be requested to provide a comprehensive view of their financial landscape.

Comparison of QM and Non-QM Income Requirements

The fundamental difference in income requirements between QM and non-QM loans lies in the rigidity of verification and the types of income that are readily accepted. QM loans adhere to a more standardized and conservative approach, while non-QM loans offer a broader and more inclusive perspective.

| Feature | QM Loan Income Requirements | Non-QM Loan Income Requirements |

|---|---|---|

| Primary Verification Method | W-2s, pay stubs, tax returns (focus on verifiable, stable employment income) | Bank statements (analyzing cash flow and average deposits), tax returns (including self-employment income), P&L statements, asset documentation. |

| Income Stability Assumption | Assumes stable, predictable income over a minimum of two years. | Accommodates fluctuating, irregular, or non-traditional income sources. |

| Deductions on Tax Returns | May limit the acceptance of income after significant business deductions, potentially reducing “qualified” income. | More likely to accept income calculated based on gross receipts or average deposits, even with significant business deductions. |

| Types of Income Accepted | Primarily traditional employment income, consistent self-employment income. | Self-employment income (even with volatility), commission-based income, rental income, dividend income, social security, pension, etc., with more flexible verification. |

| Documentation Depth | Standard documentation like W-2s, recent pay stubs, and two years of tax returns. | May require more extensive documentation, such as 12-24 months of bank statements, year-to-date P&Ls, and detailed asset statements. |

| Underwriting Focus | Strict adherence to ability-to-repay rules based on specific income calculations. | Holistic assessment of borrower’s overall financial capacity and ability to service debt, using a wider range of financial indicators. |

Types of Non-QM Mortgage Products

:max_bytes(150000):strip_icc()/non-597bbae15f9b58928bda1128.jpg?w=700)

Beyond the well-trodden paths of conventional lending, a vibrant landscape of non-QM mortgage products exists, each sculpted to meet the unique financial narratives of borrowers who may not fit neatly into traditional boxes. These innovative solutions acknowledge that a person’s financial story is often richer and more complex than a simple credit score and W-2 can convey. They offer a breath of fresh air, opening doors to homeownership for a broader spectrum of aspiring homeowners.The world of non-QM loans is as diverse as the dreams they help fulfill.

From those whose wealth is intricately tied to their assets to seasoned investors managing portfolios, and even individuals whose income streams are less conventional, there’s a non-QM product designed to align with their specific circumstances. Understanding these varied offerings is key to unlocking the right financing solution.

Asset-Based or Bank Statement Loans

These loans are a beacon for self-employed individuals, small business owners, or those with significant investment income that doesn’t always translate into a straightforward salary. Instead of relying solely on tax returns, asset-based and bank statement loans meticulously review a borrower’s financial history through their bank statements. This approach allows lenders to assess repayment ability by examining consistent cash flow and reserves.The core feature of these loans is the lender’s willingness to look beyond traditional income verification methods.

For asset-based loans, the focus is on the borrower’s liquid and non-liquid assets, such as savings accounts, investment portfolios, and even retirement funds, which can be leveraged to demonstrate financial stability and the capacity to repay. Bank statement loans, on the other hand, scrutinize 12 to 24 months of business or personal bank statements to calculate an average monthly income.

This method can be particularly beneficial for those who have substantial business expenses or irregular income patterns that might artificially lower their reported income on tax returns.

Investor Property Loans

For those who view real estate not just as a place to live, but as a strategic investment, investor property loans within the non-QM space offer tailored financing. These loans are specifically designed for borrowers purchasing or refinancing properties intended for rental income or resale. The underwriting process for these loans often places a greater emphasis on the property’s income-generating potential and the borrower’s experience as a real estate investor, rather than solely on their personal income and creditworthiness.The structure of investor property loans typically involves a higher loan-to-value (LTV) ratio compared to owner-occupied properties, and interest rates may also reflect the perceived risk.

Lenders will often assess the expected rental income from the property, comparing it against the projected mortgage payments and other property-related expenses, to ensure the investment is financially sound. Experience with managing investment properties can also be a significant factor in the approval process, as it demonstrates a borrower’s understanding of the market and their ability to handle the responsibilities of property ownership.

Stated Income or No-Doc Loan Variations

In a category that emphasizes trust and streamlined processes, stated income or “no-doc” loan variations within the non-QM realm allow borrowers to declare their income without extensive documentation. While the term “no-doc” can be somewhat misleading, as lenders still require some form of verification, these loans significantly reduce the paperwork compared to traditional mortgages. The borrower states their income, and the lender verifies it through alternative means or relies on the borrower’s declaration, often with a higher down payment or stricter credit requirements to mitigate risk.These loan types are best suited for individuals with highly stable income sources that are difficult to document conventionally, such as freelance professionals with fluctuating earnings, or those who have significant assets that can serve as collateral.

The lender’s decision is often based on a combination of the stated income, credit history, asset verification, and the overall market conditions.

Common Non-QM Loan Types

The non-QM market offers a variety of products, each with distinct features to cater to diverse borrower needs. Understanding these common types can illuminate the path to securing financing for those who fall outside traditional lending parameters.

- Bank Statement Loans: Verify income by analyzing 12-24 months of personal or business bank statements, ideal for self-employed individuals or those with irregular income.

- Asset-Based Loans: Utilize the borrower’s assets (savings, investments, retirement accounts) as a primary indicator of repayment ability, often for individuals with substantial net worth but less conventional income.

- Investor Property Loans: Specifically for purchasing or refinancing investment properties, focusing on the property’s rental income potential and the borrower’s investment experience.

- Stated Income Loans: Allow borrowers to state their income, with lenders performing alternative verification methods or relying on the declaration, often requiring higher down payments.

- Foreign National Loans: Designed for non-U.S. citizens purchasing property in the United States, often with specific documentation requirements and LTV ratios.

- ITIN Loans: For individuals who have an Individual Taxpayer Identification Number (ITIN) but not a Social Security Number, enabling them to secure a mortgage.

- Jumbo Loans (Non-QM): For loan amounts exceeding conventional conforming limits, but with underwriting criteria that differ from traditional jumbo loans.

- Rehab Loans: For borrowers looking to purchase a property that requires significant renovations, combining the purchase price and renovation costs into a single loan.

The Open Doors of Non-QM Loans: Unlocking Homeownership’s Potential

For many, the dream of homeownership can feel like a distant star, obscured by the rigid constellations of conventional lending. But what if there was a pathway, a less trodden, yet equally valid, route to that cherished hearth? Non-QM (Non-Qualified Mortgage) loans are precisely that pathway, offering a breath of fresh air for those whose financial narratives don’t fit neatly into the traditional box.

These loans are designed to be more flexible, acknowledging the diverse tapestry of financial realities that modern life presents. They are a testament to the idea that your homeownership aspirations should not be dictated solely by a standardized checklist.Non-QM loans serve as a vital bridge, connecting borrowers with unique financial circumstances to the stability and joy of owning a home.

Unlike QM loans, which adhere to strict debt-to-income ratios and borrower income verification standards set by regulations like the Dodd-Frank Act, non-QM loans offer a more personalized approach. This flexibility is not a sign of weakness but rather a deliberate design to cater to a broader spectrum of responsible borrowers who might otherwise be excluded from the mortgage market. They represent an evolution in lending, recognizing that a singular approach to financial assessment can leave valuable potential homeowners behind.

Facilitating Homeownership for the Self-Employed

The entrepreneurial spirit, while commendable, often leads to income streams that are less predictable and harder to document in the conventional sense. Self-employed individuals, freelancers, and small business owners frequently experience fluctuating incomes, extensive business deductions, or a combination of both. These factors can make it challenging to meet the stringent income verification requirements of traditional QM loans, which typically demand a consistent two-year history of verifiable employment and income.

Non-QM loans, however, are crafted with these realities in mind.Lenders offering non-QM products often utilize alternative documentation methods. This can include bank statements, profit and loss statements, or even asset-based evaluations, allowing borrowers to demonstrate their ability to repay based on a more holistic view of their financial capacity. For instance, a self-employed graphic designer might have a year with lower reported income due to significant business investments, but a strong history of profitability and substantial assets.

A non-QM loan could allow them to qualify based on their average income over several years or their overall net worth, opening the door to purchasing a home that would be out of reach with a QM loan. This adaptability is crucial for fostering homeownership within a significant and growing segment of the workforce.

Accommodating Unique Financial Situations

Beyond self-employment, numerous other financial scenarios can benefit from the tailored approach of non-QM loans. Borrowers with a history of credit challenges, such as past bankruptcies or foreclosures, but who have since stabilized their finances, might find it difficult to secure a conventional mortgage. Non-QM loans can offer a second chance, focusing on current ability to pay and future financial stability rather than solely on past credit blemishes.Other unique situations include:

- Non-traditional income sources: This can include rental income from multiple properties, significant investment income, or other forms of passive income that are not easily categorized by QM guidelines.

- High net worth individuals with complex tax structures: Those who utilize aggressive tax strategies that result in lower reported taxable income might still possess substantial wealth and a strong capacity to manage mortgage payments.

- Recent credit events: Individuals who have experienced recent, explainable credit issues (like a medical emergency) but have since rebuilt their creditworthiness may find non-QM loans to be a viable option.

- Foreign national borrowers: Individuals who are not U.S. citizens or permanent residents but have established income and assets in the U.S. may find non-QM loans more accessible than traditional options.

Scenarios Favoring Non-QM Loans Over Conventional Loans

The decision to pursue a non-QM loan often hinges on specific circumstances where conventional lending falls short. Consider the following scenarios:

- The “Asset Rich, Income Poor” Borrower: An individual who has accumulated significant assets through investments or inheritance but has a lower reported income due to retirement or a career choice that doesn’t generate high wages. A non-QM loan can assess their ability to repay based on their substantial asset portfolio, allowing them to leverage their wealth for homeownership.

- The Borrower with a Recent Credit Improvement: Someone who had a significant financial setback a few years ago (e.g., a divorce, job loss) but has since demonstrated consistent income and responsible financial management. While a QM loan might still view the past negatively, a non-QM lender can look at the borrower’s current financial health and credit behavior.

- The Investor with Multiple Properties: An experienced real estate investor who owns several rental properties and relies heavily on rental income. The complex income verification and debt-to-income calculations for QM loans can be cumbersome for such individuals. Non-QM loans often have more streamlined processes for investors and can account for the net rental income more effectively.

- The Borrower Seeking Faster Closing Times: While not always the case, some non-QM lenders, due to their flexible underwriting, can sometimes offer quicker closing times for borrowers who meet their criteria, especially when compared to the extensive documentation required for certain QM loans.

“Non-QM loans are not a fallback option; they are a thoughtfully designed alternative that broadens the horizons of homeownership for a diverse and deserving group of individuals.”

In essence, non-QM loans are a powerful tool for financial inclusion, offering a more personalized and adaptable approach to mortgage financing. They acknowledge that a person’s financial story is often richer and more complex than what a standardized application can capture, thereby opening doors to homeownership for those who might otherwise be left on the outside looking in.

Disadvantages and Risks of Non-QM Loans

While non-QM loans offer a beacon of hope for those who might not fit the conventional mold, it is crucial to approach these flexible financing options with a clear understanding of their inherent complexities and potential pitfalls. Like navigating a lesser-traveled path, the journey with a non-QM loan requires vigilance and informed decision-making to avoid unforeseen obstacles.It is imperative for prospective borrowers to acknowledge that the very flexibility that defines non-QM loans often comes with a trade-off.

This means a deeper dive into the specifics of interest rates, fees, and the long-term financial implications is not just recommended, but essential for safeguarding one’s financial future and ensuring the dream of homeownership doesn’t morph into a burden.

Interest Rate and Fee Structures Compared to QM Loans

The landscape of interest rates and fees for non-QM loans typically diverges from their Qualified Mortgage (QM) counterparts. This difference stems from the increased risk lenders undertake by not adhering to the stringent QM guidelines, which are designed to protect borrowers from predatory lending practices. Consequently, lenders often compensate for this perceived higher risk through adjustments in the loan’s pricing.

Here’s a breakdown of the typical differences:

- Interest Rates: Non-QM loans often feature higher initial interest rates compared to QM loans. This premium reflects the lender’s assessment of elevated risk, particularly for borrowers with non-traditional income verification or credit histories. For instance, a QM loan might offer a rate of 6.5%, while a comparable non-QM loan could be priced at 7.5% or even higher, depending on the specific risk factors.

- Fees: Origination fees, points, and other closing costs can also be more substantial with non-QM products. These fees contribute to the overall cost of the loan and are a way for lenders to recoup potential losses and account for the additional due diligence required for these non-standard applications. A borrower might find that the upfront costs for a non-QM loan are several percentage points higher than for a QM loan.

- Adjustable-Rate Mortgages (ARMs): While QM loans have limitations on adjustable-rate structures to protect borrowers from significant payment shocks, some non-QM loans may offer more aggressive ARM structures. This can lead to lower initial payments but carries the risk of substantial increases once the introductory fixed-rate period expires.

Implications of Potentially Higher Monthly Payments

The financial ramifications of potentially higher monthly payments on a non-QM loan are significant and require careful consideration within a borrower’s budget. These increased payments are a direct consequence of the higher interest rates and fees often associated with these products. For many, this translates to a tighter monthly financial squeeze, demanding meticulous budgeting and a robust understanding of their income stability.

A higher monthly mortgage payment directly impacts disposable income, potentially limiting funds available for savings, investments, or other essential living expenses.

For example, consider two hypothetical loans for the same principal amount: a QM loan with a 6.5% interest rate resulting in a $2,528 monthly principal and interest payment, and a non-QM loan with a 7.5% interest rate, leading to a monthly payment of $2,840. This $312 difference per month, or $3,744 annually, can accumulate substantially over the life of a 30-year mortgage, affecting a borrower’s long-term financial health and ability to meet other financial obligations.

This necessitates a thorough pre-approval process that stresses affordability based on the highest potential payment scenarios.

Importance of Understanding All Loan Terms and Conditions

Embarking on the path of a non-QM mortgage necessitates an unwavering commitment to scrutinizing every facet of the loan agreement. The intricate nature of these products, while offering solutions, also presents a landscape where hidden clauses or unfavorable terms can significantly impact a borrower’s financial well-being. Therefore, a comprehensive and diligent review of all terms and conditions before signing is not merely a procedural step but a fundamental safeguard.

Key areas demanding meticulous attention include:

- Prepayment Penalties: Some non-QM loans may include prepayment penalties, which are fees charged if the borrower pays off the loan early, either through refinancing or selling the property. Understanding the duration and structure of these penalties is crucial for those who anticipate potentially selling their home in the near future.

- Escrow Requirements: While common in QM loans, non-QM products might have different or more stringent escrow requirements for property taxes and homeowners insurance, which can affect the overall monthly outlay.

- Balloon Payments: Certain non-QM loans might be structured with a balloon payment, where a large lump sum is due at the end of a shorter loan term. Failing to understand this can lead to a significant financial shock if the borrower is not prepared to pay it off or refinance.

- Servicing Transfers: It is important to understand the loan servicer and the possibility of the loan being sold or transferred to another entity. This can sometimes lead to changes in billing, customer service, or even payment processing, and borrowers should be aware of their rights and responsibilities in such scenarios.

- Default and Foreclosure Clauses: A thorough understanding of the conditions that constitute default and the lender’s rights in case of foreclosure is paramount. This includes awareness of grace periods, notification procedures, and any associated fees or costs.

The Role of Lenders in the Non-QM Market

In the vibrant landscape of non-QM (non-qualified mortgage) loans, lenders are the architects, the risk-takers, and the navigators who open doors for borrowers who may not fit the traditional mold. These institutions are the vital conduits through which dreams of homeownership are realized, even when conventional pathways are obscured. They are the innovators, adapting to diverse financial profiles and creating bespoke solutions.The non-QM market thrives on the flexibility and specialized knowledge of its lenders.

Understanding what is a non QM mortgage loan means recognizing options beyond traditional lending. To effectively navigate this space and secure business, knowing how to get clients as a mortgage broker is crucial. This expertise then allows you to explain the nuances of a non QM mortgage loan to a wider audience.

Unlike the rigid guidelines of QM loans, non-QM lenders operate with a broader understanding of borrower circumstances, employing sophisticated methods to assess creditworthiness and manage risk. This adaptability is what makes non-QM loans a crucial component of a more inclusive housing market, offering opportunities where they might not otherwise exist.

Types of Lenders Offering Non-QM Mortgage Loans

The non-QM lending space is populated by a diverse array of financial institutions, each bringing unique strengths and approaches to the market. These lenders are not confined by the same stringent regulations as traditional banks, allowing them greater latitude in product development and borrower qualification.The primary categories of lenders active in the non-QM market include:

- Specialty Finance Companies: These are often the most prominent players, specifically established to originate and service non-QM loans. They are highly agile and possess deep expertise in evaluating non-traditional borrower profiles.

- Mortgage Banks: Many established mortgage banks have developed dedicated non-QM divisions or product lines to cater to a wider spectrum of borrowers. They leverage their existing infrastructure and market reach.

- Private Lenders and Funds: These entities, often backed by private capital, provide flexible lending solutions. They are particularly adept at handling complex financial situations and can offer faster closing times.

- Credit Unions and Community Banks: While some smaller institutions may stick strictly to QM loans, a growing number of credit unions and community banks are exploring non-QM offerings to serve their local communities better and expand their loan portfolios.

- Wholesalers: These lenders operate by originating loans through third-party brokers or correspondents, often focusing on niche markets and specific borrower needs.

The Underwriting Process for Non-QM Loans, What is a non qm mortgage loan

The underwriting process for non-QM loans is a nuanced art, diverging significantly from the automated and standardized approach of QM loans. It requires a more in-depth, human-centric evaluation of a borrower’s financial narrative. Underwriters delve into details that might be overlooked or deemed insufficient by traditional lenders, seeking to understand the borrower’s capacity to repay from a holistic perspective.Key elements of the non-QM underwriting process include:

- Detailed Income Verification: Instead of solely relying on W-2s and tax returns, non-QM underwriters meticulously review alternative income documentation. This can include bank statements to show consistent cash flow, profit and loss statements for self-employed individuals, 1099 forms, and even business tax returns. The focus is on demonstrating a stable and verifiable income stream, even if it’s irregular or derived from unconventional sources.

- Asset-Based Underwriting: For borrowers with substantial assets but fluctuating or lower documented income, asset-based underwriting becomes a critical tool. Lenders assess the borrower’s liquid assets, investments, and other reserves to determine their ability to cover mortgage payments. This often involves calculating a “seasoned asset” requirement, where a certain amount of the borrower’s funds must remain in their accounts after closing.

- Credit Profile Analysis: While credit scores are still considered, non-QM lenders place greater emphasis on the borrower’s credit history and patterns. They may look beyond a low score to understand the reasons behind it, such as past medical debt or a temporary job loss, and assess how the borrower has managed their credit since. Forgiveness for past credit blemishes might be considered if current financial behavior is strong.

- Loan-to-Value (LTV) Ratios: Non-QM loans may offer more flexible LTV ratios, potentially allowing for higher loan amounts relative to the property’s value, depending on the borrower’s overall financial strength and the specific loan product.

- Property Valuation: A thorough appraisal of the property is always conducted to ensure its value supports the loan amount, a standard practice across all mortgage types.

How Non-QM Lenders Assess Risk Differently from Traditional Lenders

The fundamental divergence in risk assessment between non-QM and traditional lenders lies in their methodology and the breadth of information they consider. Traditional lenders operate within a framework heavily influenced by regulatory mandates, prioritizing standardized data points and automated decision-making. Non-QM lenders, conversely, embrace a more qualitative and individualized approach to risk.Traditional lenders primarily rely on:

- Automated Underwriting Systems (AUS): These systems use algorithms to evaluate credit scores, debt-to-income ratios, and employment history against predefined criteria. A “yes” or “no” answer is often the outcome.

- Strict Debt-to-Income (DTI) Ratios: QM loans have defined DTI limits that are strictly adhered to.

- Standardized Documentation: W-2s, pay stubs, and tax returns are the bedrock of income verification.

Non-QM lenders, while still mindful of these factors, expand their risk assessment by:

- Focusing on Compensating Factors: They actively seek “compensating factors” that can mitigate perceived risks. These might include significant liquid assets, a strong payment history on other debts, substantial equity in other properties, or a stable business history for self-employed individuals.

- Analyzing Cash Flow and Reserves: Beyond DTI, non-QM lenders scrutinize a borrower’s cash flow and post-closing reserves. The ability to maintain a comfortable cushion of funds after covering all expenses, including the mortgage payment, is a strong indicator of financial stability.

- Understanding Borrower Narratives: Non-QM underwriters are trained to listen to and understand the borrower’s story. They can differentiate between a one-time financial hardship and a chronic inability to manage finances. This qualitative assessment is invaluable.

- Utilizing Alternative Data: They are more open to using alternative data sources, such as rental payment history or utility bill payments, to build a more comprehensive picture of a borrower’s financial responsibility, especially for those with limited traditional credit history.

- Product Specialization: Non-QM lenders often specialize in specific loan types (e.g., bank statement loans, ITIN loans), allowing them to develop deep expertise in the unique risks and opportunities associated with each.

This more granular and personalized approach allows non-QM lenders to serve borrowers who are often overlooked by conventional lending channels, thereby expanding access to homeownership.

The Regulatory Environment Surrounding Non-QM Loan Origination

The regulatory landscape for non-QM loans is a dynamic and evolving space, distinct from the more established rules governing Qualified Mortgages (QM). While QM loans are subject to strict consumer protection regulations designed to ensure borrowers can afford their loans, non-QM loans, by definition, fall outside many of these stringent requirements. This does not imply a lack of oversight, but rather a different set of regulatory considerations.Key aspects of the regulatory environment include:

- The Ability-to-Repay (ATR) Rule: While non-QM loans are exempt from the ATR rule’s presumption of compliance, lenders are still required to make a reasonable, good-faith determination that the borrower has the ability to repay the loan based on their current and expected income, assets, and other financial resources. This is a fundamental principle, even without the QM safe harbor.

- Consumer Protection Laws: Non-QM lenders must still adhere to general federal consumer protection laws, such as the Truth in Lending Act (TILA), the Real Estate Settlement Procedures Act (RESPA), and the Fair Housing Act. These laws ensure transparency in lending, prevent predatory practices, and prohibit discrimination.

- State-Specific Regulations: Many states have their own mortgage lending laws and licensing requirements that non-QM lenders must comply with. These can vary significantly from state to state, impacting origination, servicing, and disclosure practices.

- Investor Guidelines: While not strictly regulatory, the guidelines set by the investors who purchase non-QM loans from originators (e.g., private securitization firms) play a significant role in shaping lending practices. These investors often impose their own underwriting standards and risk management protocols.

- Potential for Future Regulatory Changes: The non-QM market is relatively newer compared to traditional mortgages, and regulators continue to monitor its growth and practices. There is always the potential for new regulations or adjustments to existing ones as the market matures and any potential risks become more apparent. For instance, the Consumer Financial Protection Bureau (CFPB) actively monitors the market for consumer protection concerns.

The regulatory environment aims to balance the need for innovation and access to credit in the non-QM market with the imperative to protect consumers from unfair or predatory lending practices. Lenders must navigate this complex web of rules to operate responsibly and sustainably.

Comparing Non-QM Loans to Other Loan Options

Navigating the landscape of mortgage financing can feel like charting an unfamiliar sea. For those whose financial stories don’t perfectly align with the traditional underwriting narratives, Non-QM loans emerge as a beacon, offering a different path to homeownership. Understanding how these flexible loans stack up against more conventional options is crucial for making an informed decision that aligns with your unique circumstances and aspirations.Each loan type serves a distinct purpose and caters to a specific borrower profile.

By dissecting their core features, eligibility requirements, and the benefits they offer, we can illuminate the advantages and potential trade-offs inherent in each, empowering you to choose the vessel that will best carry you to your dream home.

Non-QM Loans Versus FHA Loans

The Federal Housing Administration (FHA) loan program is a government-backed initiative designed to make homeownership accessible to a broader range of borrowers, particularly those with lower credit scores or smaller down payment capabilities. While both Non-QM and FHA loans aim to expand access to mortgages, their operational frameworks and target borrowers differ significantly. FHA loans are characterized by their government insurance, which reduces risk for lenders, allowing for more lenient credit score and down payment requirements.

However, they come with upfront and annual mortgage insurance premiums (MIP) that can add to the overall cost of the loan. Non-QM loans, conversely, operate in the private market without government backing. They are designed for borrowers who may have unique income situations, credit challenges that fall outside QM guidelines, or require larger loan amounts than FHA limits. The absence of government insurance means Non-QM lenders assess risk differently, often through more personalized underwriting and a wider array of acceptable documentation.

- Credit Score Requirements: FHA loans typically allow for credit scores as low as 500 with a 10% down payment, or 580 with a 3.5% down payment. Non-QM loans can accommodate a wider range of credit profiles, sometimes accepting scores below traditional QM thresholds, but often at a higher interest rate or with specific compensating factors.

- Down Payment: FHA loans require a minimum down payment of 3.5% for borrowers with a credit score of 580 or higher. Non-QM loans have variable down payment requirements, often ranging from 5% to 20% or more, depending on the specific product and borrower’s risk profile.

- Loan Limits: FHA loan limits are set annually by the FHA and vary by county. Non-QM loans, especially jumbo Non-QM products, can often exceed these limits, catering to borrowers seeking higher-value properties.

- Mortgage Insurance: FHA loans mandate both an upfront Mortgage Insurance Premium (UFMIP) and annual MIP for the life of the loan in most cases. Non-QM loans do not have government-mandated mortgage insurance; instead, lenders may price in the risk through higher interest rates or fees.

- Documentation: FHA underwriting relies on standard income and employment verification. Non-QM loans are known for their flexibility in accepting alternative documentation, such as bank statements for income verification (DSCR loans) or profit and loss statements for self-employed individuals.

Non-QM Loans Versus VA Loans

Veterans Affairs (VA) loans are another significant government-backed mortgage program, offering substantial benefits to eligible service members, veterans, and surviving spouses. Similar to FHA loans, VA loans are designed to facilitate homeownership by reducing the financial burden on borrowers. The most prominent feature of VA loans is the absence of a down payment requirement and no private mortgage insurance (PMI).

Non-QM loans, while offering flexibility, do not possess these government-backed advantages. VA loans are secured by the U.S. government, which absorbs a significant portion of the lender’s risk, enabling these favorable terms. Non-QM loans, being privately funded, rely on the lender’s proprietary risk assessment models and the borrower’s overall financial picture to determine loan approval and terms. Borrowers who do not qualify for a VA loan due to specific circumstances, or those who have exhausted their VA loan entitlement, might find Non-QM loans a viable alternative.

- Eligibility: VA loans require specific military service eligibility. Non-QM loans are available to a broader audience, including self-employed individuals, those with fluctuating income, or those with credit issues that don’t fit traditional guidelines.

- Down Payment: VA loans typically require no down payment. Non-QM loans generally require a down payment, which can vary significantly based on the loan product and borrower’s risk assessment.

- Mortgage Insurance: VA loans do not require PMI or MIP. Non-QM loans do not have government-mandated insurance, but lenders may incorporate risk premiums into the interest rate or fees.

- Loan Limits: VA loan limits are influenced by county loan limits, though entitlement can allow for higher amounts. Non-QM loans, particularly jumbo Non-QM products, are often used for properties exceeding standard conforming loan limits.

- Interest Rates: VA loans often feature competitive interest rates due to the government guarantee. Non-QM loan interest rates can be higher than QM loans or VA loans, reflecting the increased risk assumed by the lender.

Non-QM Loans Versus Conventional QM Loans

Conventional Qualified Mortgages (QM) represent the standard in the mortgage industry, adhering to strict federal guidelines designed to ensure borrowers can afford their loans. These guidelines include limits on debt-to-income ratios, the “ability-to-repay” rule, and specific documentation requirements. Non-QM loans, by definition, do not meet all of these QM criteria. This divergence allows Non-QM loans to serve borrowers whose financial situations fall outside the rigid QM box.

For instance, a self-employed individual with inconsistent income documented through bank statements might not qualify for a QM loan, but could potentially secure a Non-QM loan. Similarly, borrowers with credit scores just below the typical QM threshold, or those who need to finance a property exceeding conforming loan limits, might turn to Non-QM options. The trade-off for this flexibility in Non-QM loans often comes in the form of slightly higher interest rates or fees compared to their QM counterparts, reflecting the increased risk the lender undertakes.

- Ability-to-Repay (ATR) Standards: QM loans must strictly adhere to the ATR rule, with defined parameters for verifying income, assets, and debt. Non-QM loans offer more flexibility in ATR verification, allowing for alternative income documentation and less stringent DTI ratios in some cases.

- Credit Score and DTI: QM loans generally require higher credit scores (often 620+) and stricter debt-to-income ratios. Non-QM loans can accommodate lower credit scores and higher DTI ratios, provided other compensating factors are present.

- Documentation: QM loans require standard income verification (W-2s, pay stubs, tax returns). Non-QM loans accept a broader range of documentation, including bank statements, P&L statements, and asset-based verification.

- Loan Types: QM loans include conforming and certain non-conforming loans that meet specific criteria. Non-QM loans encompass a wide array of products designed for unique borrower needs, such as bank statement loans, ITIN loans, and investor loans.

- Interest Rates: QM loans typically offer lower interest rates due to their adherence to established risk guidelines. Non-QM loans may have higher interest rates to compensate for the perceived increased risk.

Key Differences Between Loan Types

To crystallize these distinctions, a comparative table offers a clear visual representation of how Non-QM loans differentiate themselves from FHA, VA, and conventional QM loans. This table serves as a quick reference, highlighting the critical features that define each loan category and the specific borrower profiles they are best suited to serve. Understanding these differences is paramount in selecting the mortgage that best aligns with your financial journey and homeownership goals.

| Feature | Non-QM Loans | FHA Loans | VA Loans | Conventional QM Loans |

|---|---|---|---|---|

| Government-Backed | No | Yes | Yes | No |

| Primary Target Borrower | Unique income, credit challenges, high net worth, investors | First-time homebuyers, lower credit scores, lower down payments | Eligible service members, veterans, and surviving spouses | Borrowers with good credit, stable income, and standard documentation |

| Minimum Credit Score (Typical) | Varies widely (can be lower than 620) | 500 (with 10% down) or 580 (with 3.5% down) | No minimum set by VA, but lenders may have requirements (often 620+) | 620+ |

| Minimum Down Payment (Typical) | 5%-20%+ | 3.5% | 0% | 3%-20%+ |

| Mortgage Insurance | Not mandated; risk priced into rate/fees | Upfront MIP and Annual MIP | No PMI/MIP (Funding Fee applies) | PMI required if LTV > 80% |

| Documentation Flexibility | High (bank statements, P&L, asset verification) | Standard income and employment verification | Standard income and employment verification | Standard income and employment verification |

| Loan Limits | Can exceed conforming limits (jumbo options) | Set by FHA, varies by county | Based on entitlement and county limits | Conforming and non-conforming limits |

| Interest Rates (General Tendency) | Potentially higher than QM | Competitive, but MIP adds to total cost | Often very competitive | Generally lower than Non-QM |

Common Scenarios for Needing a Non-QM Loan

The landscape of homeownership is as varied as the dreams it fulfills. While traditional mortgages, often referred to as “Qualified Mortgages” (QM), cater to a predictable financial profile, life’s unique circumstances sometimes lead individuals down paths less traveled. Non-QM loans emerge as a beacon of possibility for those whose financial narratives don’t neatly fit into the QM box, offering flexible solutions where conventional lending might fall short.

These loans are designed to accommodate a broader spectrum of borrowers, acknowledging that financial health can manifest in diverse ways.Understanding these common scenarios illuminates the vital role Non-QM loans play in bridging the gap for many aspiring homeowners and investors. They are not merely an alternative; they are often the key that unlocks doors previously thought to be shut, enabling individuals to achieve their property goals when standard options are unavailable.

Self-Employed Individuals and Business Owners

The entrepreneurial spirit often translates into fluctuating income streams, making it challenging for self-employed individuals to demonstrate consistent, verifiable income that satisfies traditional QM guidelines. Non-QM loans recognize the inherent value and potential of these individuals by offering alternative methods of income verification.

Consider Sarah, a freelance graphic designer who has experienced significant income growth over the past two years, but her tax returns show a dip in one of those years due to a large business expense. A QM loan might require her to wait until her income stabilizes over a longer period or to provide extensive documentation that still might not meet their strict Debt-to-Income (DTI) ratios.

A Non-QM lender, however, might look at her bank statements, profit and loss statements, or even her business’s cash flow to assess her ability to repay, allowing her to qualify for a mortgage sooner.

Another example is David, a small business owner whose company has a strong track record of profitability, but his personal income is lower due to reinvesting profits back into the business. Non-QM loans can allow lenders to consider the business’s overall financial health and David’s personal assets as indicators of his repayment capacity, rather than solely relying on his W-2 or personal tax returns.

This flexibility is crucial for those who are building wealth through their own enterprises.

Real Estate Investors Utilizing Rental Properties

For seasoned investors and those venturing into the world of rental income, Non-QM loans offer a powerful tool for portfolio expansion. The income generated from rental properties can be a significant factor in qualifying for new investments, and Non-QM products are specifically designed to accommodate this.

An investor like Maria aims to purchase several single-family homes to rent out. While her personal income from her primary job might be sufficient for a QM loan on a primary residence, acquiring multiple investment properties requires a different approach. Non-QM loans can utilize the projected rental income from the new properties, alongside existing rental income and the investor’s personal financial strength, to qualify for financing.

This allows for more aggressive portfolio growth without being solely constrained by traditional income verification.

Similarly, an investor looking to purchase a multi-unit property for personal residence and rental income might find Non-QM options particularly beneficial. Lenders can assess the combined income potential of the property, factoring in both the borrower’s personal income and the expected rental revenue, providing a more holistic view of the investment’s viability and the borrower’s capacity to manage it.

Borrowers with Less-Than-Perfect Credit History

Life happens, and sometimes credit scores can take a hit due to unforeseen circumstances such as medical emergencies, job loss, or past financial missteps. While a low credit score can be a significant barrier to traditional mortgage approval, Non-QM loans offer a pathway to homeownership for individuals who are diligently working to rebuild their financial standing.

Consider John, who experienced a few late payments on his credit cards a few years ago due to a prolonged illness that impacted his income. While his credit score has since improved and he has demonstrated responsible financial behavior recently, it might still be below the threshold for a conventional QM loan. A Non-QM lender can look beyond a single credit score, considering factors like a larger down payment, a lower loan-to-value (LTV) ratio, or a strong history of consistent rent payments and savings.

This allows borrowers with a history of credit challenges to still access homeownership.

Another scenario involves individuals who have undergone significant life events that temporarily impacted their credit, such as a divorce or a period of unemployment. Non-QM loans can be structured to account for these past events, focusing on the borrower’s current financial stability and their ability to manage new debt. The emphasis shifts from a strict adherence to credit score minimums to a more comprehensive evaluation of the borrower’s overall financial picture and their capacity to meet their obligations.

Final Review

In summation, non-QM mortgage loans represent a vital and adaptable component of the modern housing finance system. They provide essential pathways to homeownership for individuals whose financial profiles may not align with the stringent criteria of conventional QM loans. By understanding the various product types, eligibility requirements, and the inherent advantages and disadvantages, prospective borrowers can make informed decisions. The role of specialized lenders and a thorough application process are paramount to successfully navigating this market, ultimately empowering a broader range of individuals to achieve their homeownership goals.

Questions Often Asked

What does “non-QM” specifically mean?

“Non-QM” stands for “non-Qualified Mortgage.” It refers to mortgage loans that do not meet the specific regulatory standards set forth by the Consumer Financial Protection Bureau (CFPB) for Qualified Mortgages, primarily concerning the borrower’s ability to repay.

Who typically offers non-QM loans?

Non-QM loans are generally offered by portfolio lenders, mortgage bankers, and specialized non-bank lenders rather than traditional banks that primarily originate QM loans for sale on the secondary market.

Are non-QM loans riskier for borrowers?

While non-QM loans can have higher interest rates and fees, potentially leading to higher monthly payments, the primary risk lies in the borrower not fully understanding the loan terms and their ability to manage these payments long-term. Responsible borrowing and thorough due diligence are crucial.

Can someone with a lower credit score get a non-QM loan?

Yes, non-QM loans often accommodate borrowers with less-than-perfect credit histories, as the underwriting process is more flexible and focuses on other compensating factors beyond just credit score.

What is the main advantage of a non-QM loan for self-employed individuals?

The primary advantage is the flexibility in income verification. Self-employed individuals can often use alternative documentation like bank statements or profit and loss statements to prove their income, which may not be acceptable for QM loans.