How to fill out a bank deposit slip is a fundamental skill for anyone managing their finances, a seemingly simple task that can become a source of minor anxiety if not approached with clarity. This guide demystifies the process, transforming a routine transaction into a straightforward, confident action. We’ll navigate the essential components of the slip, ensuring you understand each field and its purpose, from your personal details to the specifics of your cash and checks.

Understanding the bank deposit slip is the first step towards a smooth banking experience. This document serves as a critical record of your transaction, detailing exactly what you are depositing into your account. By breaking down each section, we’ll equip you with the knowledge to accurately record your name, address, account number, and the precise amounts of cash and checks you are entrusting to the bank.

Our journey will cover everything from meticulous denomination listing to the final sum, ensuring accuracy at every turn.

Understanding the Bank Deposit Slip

The bank deposit slip is a fundamental tool in managing your finances, serving as the official record of a cash or check deposit made to your bank account. It’s more than just a piece of paper; it’s your receipt and the bank’s instruction manual for crediting your account correctly. Understanding its components and purpose ensures accuracy and avoids potential discrepancies, streamlining the process of getting your money into your account.A well-filled deposit slip is crucial for efficient banking.

It provides the bank teller or the ATM with all the necessary details to process your transaction accurately. This includes identifying your account, specifying the amount being deposited, and detailing the breakdown of funds if multiple checks are involved. Familiarity with this document empowers you to manage your deposits with confidence and precision.

Purpose of a Bank Deposit Slip

The primary purpose of a bank deposit slip is to document and facilitate the process of depositing funds into a specific bank account. It acts as a transactional record for both the depositor and the bank, ensuring that the correct amount is credited to the intended account. Without it, depositing funds would be a much more manual and error-prone process for bank staff.

Essential Sections of a Deposit Slip

A typical bank deposit slip is designed to capture all the critical information needed for a successful transaction. While designs may vary slightly between banks, the core elements remain consistent, allowing for clear and unambiguous processing.Here are the essential sections you’ll commonly find on a bank deposit slip:

- Account Number: This is the unique identifier for your bank account. It’s crucial to write this accurately to ensure the deposit goes into the correct account.

- Date: The date the deposit is being made. Banks often pre-print this, but it’s good practice to verify or fill it in if necessary.

- Name: Your full name or the name of the account holder.

- Address: Your mailing address. This is often used for verification purposes.

- Phone Number: Your contact number, which the bank may use if there are any issues with the deposit.

- Cash: A line item to record the total amount of physical currency being deposited.

- Checks: Separate lines or a designated area to list individual checks being deposited. This usually includes the amount of each check.

- Total Deposit: A space to sum up all the cash and checks being deposited. This is the final amount the bank will credit to your account.

- Less Cash Received: Some slips include a section to indicate if you are withdrawing cash from the deposit. This is less common for simple deposit slips but might be present on combined deposit/withdrawal slips.

- Net Deposit: The final amount after any cash received is subtracted from the total deposit.

Information Required for Deposit Slips

Filling out a deposit slip accurately requires attention to detail, ensuring all fields are completed correctly to avoid delays or errors. Banks require specific information to process your deposit efficiently and securely.The general process involves providing the following details:

- Your Account Information: This includes your account number and name. Double-check that the account number is precisely as it appears on your bank statements or cards. An incorrect account number is the most common reason for deposit errors.

- Deposit Details: You’ll need to specify the amount of cash you are depositing. If depositing checks, you must list each check individually with its corresponding amount.

- Totaling the Deposit: Sum up all the cash and individual check amounts to arrive at the total deposit amount. This figure should be clearly written in the designated “Total Deposit” field.

For example, if you are depositing $50 in cash and two checks for $125.50 and $75.20 respectively, you would:

- Write “$50.00” in the “Cash” section.

- Write “$125.50” on one of the “Checks” lines.

- Write “$75.20” on another “Checks” line.

- Calculate the total: $50.00 + $125.50 + $75.20 = $250.70.

- Write “$250.70” in the “Total Deposit” section.

This structured approach ensures that bank personnel can quickly verify the deposit against the physical cash and checks presented.

Filling Out Personal Information: How To Fill Out A Bank Deposit Slip

Accurately completing your personal details on a bank deposit slip is crucial for ensuring your funds are credited to the correct account without delay. This section of the slip serves as the primary identifier for both you and the bank, preventing errors and streamlining the deposit process. A well-filled slip minimizes the chances of your deposit being misplaced or misapplied, which can lead to significant inconvenience.The bank deposit slip requires specific personal information to link your deposit to your unique bank account.

This includes your name, address, and most importantly, your account number. Precision in these fields is paramount; even a minor error can create a bureaucratic hurdle or, in worst-case scenarios, lead to funds being deposited into an incorrect account.

Name and Address Entry

When entering your name, use the full name as it appears on your bank account. This typically means including your first name, middle initial (if applicable), and last name. Consistency is key; if your account is under “John A. Smith,” do not abbreviate it to “J. Smith” or use a nickname.

This ensures the bank can unequivocally identify the account holder. Similarly, your address should be entered as it is registered with the bank, including the street number, street name, apartment or suite number (if applicable), city, state, and ZIP code. This information acts as a secondary verification layer, especially in cases where account numbers might be misread.

Account Number Accuracy

The account number is the most critical piece of information on the deposit slip. It is the unique identifier that directs your funds to your specific account. Double-checking and triple-checking this number is non-negotiable. A single digit out of place can result in your deposit being credited to someone else’s account, initiating a lengthy and often frustrating process to rectify the error.

Banks often have dedicated departments to handle such discrepancies, but it’s far more efficient to prevent them from occurring in the first place.

The bank account number is the digital fingerprint of your account; ensure it’s perfectly replicated on the deposit slip.

Legibility of Identifying Details

Ensuring all your identifying details are legible is as important as their accuracy. A messy or illegible handwritten entry can be misinterpreted by bank tellers or automated processing systems. This is where best practices come into play.To guarantee legibility, consider the following:

- Use a dark pen: Black or dark blue ink is generally preferred by banks as it scans and photocopies best. Avoid light colors, pencil, or erasable ink, which can fade or be difficult to read.

- Write clearly and deliberately: Take your time to form each letter and number distinctly. Avoid cursive if your handwriting is difficult to decipher; block printing is often clearer.

- Use all available spaces: Fill out all the designated lines and boxes completely. If your name or address is long, ensure you utilize the entire space provided without overlapping into other fields.

- Avoid smudges and erasures: While minor corrections might be permissible, excessive smudging or crossing out can make the slip appear unprofessional and may lead to misinterpretation. If a significant error occurs, it’s often best to ask for a new deposit slip.

- Consider using a template: Some banks offer online printable deposit slip templates. Filling these out digitally and then printing can ensure consistent and clear formatting.

Recording Cash Deposits

:max_bytes(150000):strip_icc()/GettyImages-1540766447-79fd4ba1355947158706c0fba58fd189.jpg?w=700)

Successfully depositing cash into your bank account is a fundamental banking task. A bank deposit slip serves as your record and the bank’s receipt for this transaction. Accurately detailing your cash helps prevent errors and ensures your funds are credited correctly. This section will guide you through the process of documenting cash contributions on your deposit slip.

When depositing cash, the key is precision. Banks require a clear breakdown of the denominations you are depositing to verify the total amount. This meticulous approach not only aids the bank in processing your deposit efficiently but also provides you with a clear audit trail.

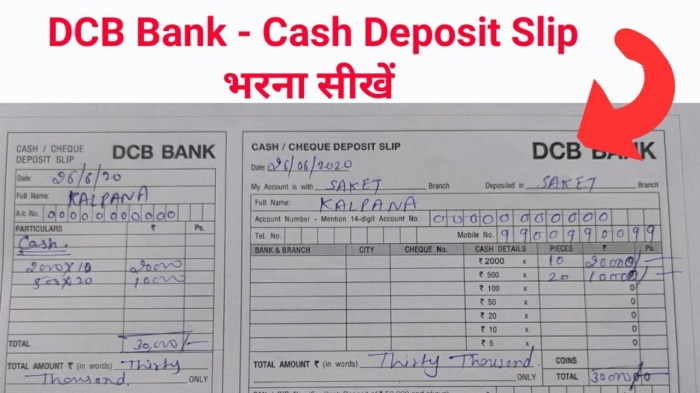

Listing Individual Cash Denominations

The deposit slip typically has a dedicated section for cash. Here, you’ll list the number of bills you have for each denomination. Common denominations include $100, $50, $20, $10, $5, and $1 bills. Some slips may also include a line for coins, though this is less common for larger cash deposits.

To accurately list your denominations:

- Count the number of bills for each specific denomination.

- Write the count next to the corresponding denomination on the deposit slip. For instance, if you have five $20 bills, you would write “5” in the space designated for $20.

- Do not combine different denominations in a single line; each must be listed separately.

Organizing Cash Totals

After listing each denomination, the next crucial step is to calculate the total value of the cash deposit. This is done by multiplying the number of bills for each denomination by its value and then summing up these amounts. Accuracy here is paramount to ensure the deposited amount matches the physical cash you are handing over.

The deposit slip will have a line for the total cash amount. To calculate this accurately:

- For each denomination, multiply the count of bills by the bill’s value. For example, 5 bills x $20 = $100.

- Sum the results from each denomination.

- If coins are included, calculate their total value and add it to the total bill value.

Total Cash = (Number of $100 Bills x $100) + (Number of $50 Bills x $50) + (Number of $20 Bills x $20) + (Number of $10 Bills x $10) + (Number of $5 Bills x $5) + (Number of $1 Bills x $1) + Total Coin Value

Example of a Cash Deposit Section

To illustrate, consider a scenario where you are depositing cash consisting of several bills. A well-filled-out cash section on a deposit slip would look organized and precise, making it easy for the bank teller to process.

Here is a sample of how the cash deposit section might be filled out:

| Denomination | Quantity | Total |

|---|---|---|

| $100 | 2 | $200 |

| $50 | 1 | $50 |

| $20 | 5 | $100 |

| $10 | 3 | $30 |

| $5 | 10 | $50 |

| $1 | 25 | $25 |

| Coins | – | $2.75 |

Following this example, the total cash amount to be written on the deposit slip would be the sum of all the individual totals: $200 + $50 + $100 + $30 + $50 + $25 + $2.75 = $457.75. This systematic approach minimizes the chance of errors and ensures a smooth deposit process.

Recording Check Deposits

Moving beyond cash, checks form a significant part of many deposits. Accurately recording each check ensures your deposit slip reflects the exact amount you’re submitting, preventing discrepancies and potential delays in funds availability. This section details how to meticulously document each check for a smooth banking experience.The bank deposit slip provides a dedicated section to list individual checks. This structured approach allows both you and the bank to easily track each item, verify amounts, and identify any potential issues quickly.

Understanding the required information for each check is crucial for accurate record-keeping.

Listing Each Check with Bank and Routing Number

To properly record a check deposit, you’ll need to identify the issuing bank and its routing number. The routing number, a nine-digit code, uniquely identifies the financial institution. This information is typically found at the bottom of the check, alongside the account number and check number. It’s essential for the bank to process the check correctly through the Automated Clearing House (ACH) network or other payment systems.When filling out the deposit slip, you’ll usually find a specific area for listing checks.

Mastering the bank deposit slip is a foundational skill, much like navigating the complexities outlined in a practical guide to sap multi bank connectivity filetype:pdf. Understanding these financial tools, from basic cash and check entries to account numbers, ensures smooth transactions. This knowledge simplifies your banking, even when dealing with advanced financial systems.

For each check being deposited, you will enter the following details:

- Bank Name: The name of the bank on which the check is drawn.

- Routing Number: The nine-digit routing transit number (RTN) of the issuing bank. This is often presented as three sets of numbers (e.g., 000-000-000).

Accurately transcribing these details is paramount. A misplaced digit in the routing number can lead to processing errors or delays.

Entering the Amount for Each Individual Check, How to fill out a bank deposit slip

After identifying the bank and routing number, the next critical step is to enter the exact monetary value of each check. This is typically done in a designated column on the deposit slip, often labeled “Amount” or simply “$”. It’s imperative to write the amount clearly and precisely, mirroring the amount written on the check itself.For each check, you will:

- Locate the amount line on the check.

- Write this amount in the corresponding “Amount” field on the deposit slip for that specific check.

- Ensure there are no discrepancies between the amount on the check and the amount recorded on the slip.

Precision here is key. Even a small error can cause your deposit to be short or over, leading to reconciliation issues.

Structured Example of a Check Deposit Section

To visualize how this information is typically presented on a deposit slip, consider the following example. This table format helps organize the details for each check being deposited.

| Bank | Routing Number | Amount |

|---|---|---|

| Chase Bank | 071000013 | $150.75 |

| Wells Fargo | 121000248 | $325.00 |

| Bank of America | 026009593 | $75.50 |

This structured approach ensures that each check is accounted for with its originating bank, routing number, and precise monetary value, facilitating a clear and accurate deposit.

Calculating the Total Deposit

![Free Printable Bank Deposit Slip Examples [Filled Out] +PDF Free Printable Bank Deposit Slip Examples [Filled Out] +PDF](https://i2.wp.com/www.typecalendar.com/wp-content/uploads/2023/05/Bank-Deposit-Slip-1-768x432.jpg?w=700)

Once you’ve meticulously recorded all your cash and checks, the next crucial step is to accurately sum them up to determine your total deposit. This final figure is what the bank teller will verify against your deposit slip and your physical cash and checks. Precision here prevents discrepancies and ensures your account balance reflects the correct amount.The process of calculating your total deposit is straightforward but requires careful attention to detail.

It involves adding all the individual amounts you’ve listed on the deposit slip. This ensures that every dollar you intend to deposit is accounted for, leading to a smooth transaction at the bank.

Summing Cash and Checks

To arrive at your total deposit, you’ll need to combine the value of all the cash denominations you’re depositing with the sum of all the checks you’re presenting. This requires a systematic approach to ensure no amount is missed or incorrectly added.You will perform the following steps:

- Add the amounts for each individual cash denomination (e.g., $20 bills, $10 bills, $5 bills, $1 bills, coins).

- Sum the face values of all the checks you are depositing.

- Add the total cash amount to the total check amount.

For instance, if you have $150 in cash and checks totaling $300, your calculation would be $150 (cash) + $300 (checks) = $450 (total deposit).

Arriving at the Final Total Deposit Figure

The final total deposit figure is the culmination of adding all the individual cash and check amounts recorded on your deposit slip. This is the single, consolidated number that represents the entirety of your transaction. It’s essential that this number precisely matches the sum of the physical currency and checks you are submitting.The formula for the total deposit is:

Total Deposit = Total Cash + Total Checks

This equation is the bedrock of a successful deposit. If you’ve accurately itemized your cash and checks, then summing these two sub-totals will yield the correct final figure.

Double-Checking the Total Deposit

Preventing errors in your deposit is paramount. A simple mistake in calculation can lead to a discrepancy that requires follow-up with the bank, causing unnecessary delays and potential frustration. Therefore, taking a moment to double-check your math is a highly recommended practice.Here are effective methods for verifying your total deposit:

- Recalculate: Add up all the cash amounts again, and then add up all the check amounts again. Finally, sum these two totals.

- Use a Calculator: Employ a calculator for all additions, especially when dealing with multiple checks or a significant amount of cash.

- Compare with Your Records: If you maintain a personal ledger or use a mobile banking app to track your spending and deposits, compare the calculated total with your expected deposit amount.

- Cross-Reference: If you’ve written down the individual amounts of each check on the deposit slip, quickly re-add those specific check amounts to ensure their subtotal is correct before adding it to your cash total.

Submitting the Deposit Slip

Once your bank deposit slip is meticulously filled out, the next crucial step is its submission. This seemingly simple act is the gateway to ensuring your funds are accurately credited to your account. Understanding the physical process and where to present your completed slip at the bank will streamline this transaction, saving you time and potential hassle.The physical act of submitting your deposit slip is straightforward, designed for efficiency and accuracy.

It involves a clear and organized presentation of your funds and the accompanying documentation to the bank teller or designated deposit area.

Attaching the Slip to Your Deposit

To ensure a smooth deposit process, it’s essential to physically organize your cash and checks with the deposit slip. This prevents any mix-ups and clearly communicates the entirety of your deposit to the bank.The most common and recommended method is to place your cash and checks together and then securely attach the completed deposit slip to the top of this bundle.

Many banks provide small staples or clips for this purpose, but if not, a simple fold or placing the slip on top of a neatly stacked pile of bills and checks works effectively. For checks, ensure they are all facing the same direction. If you have a large number of items, consider using a paperclip to keep them organized before attaching the slip.

The goal is to present a single, unified package for the teller.

Where to Hand in the Completed Slip

Upon arrival at your bank, you will need to identify the correct point of submission for your deposit. This is typically a designated area staffed by bank personnel.Banks generally have a few primary locations for deposit submissions:

- Teller Window: This is the most traditional and widely used method. Approach any available teller window and hand over your deposit slip along with your cash and checks. The teller will then process your transaction.

- Deposit-Only ATM: Some banks offer ATMs equipped to accept deposits. In this case, you would follow the on-screen prompts, which will guide you on how to insert your deposit slip and your cash or checks.

- Night Drop Box: For after-hours deposits, banks often provide a secure night drop box. You would place your prepared deposit slip and funds inside a provided envelope (or a bank-approved envelope) and deposit it into the box. These deposits are typically processed the next business day.

It’s always advisable to look for signage indicating the correct queues or windows for deposits, especially during peak banking hours.

What to Expect After Submission

Once you’ve submitted your deposit slip, the bank’s internal process begins to ensure your funds are accurately recorded. Understanding these subsequent steps can provide peace of mind.After handing over your deposit, the bank teller will typically:

- Verify the total amount of your deposit against the amount written on the slip.

- Count your cash and endorse your checks.

- Input the deposit into their system.

- Provide you with a stamped copy of your deposit slip as a receipt. This receipt is crucial for your records.

The funds will then be reflected in your account balance, though the exact timing for availability can vary depending on the bank’s policies and the type of deposit. For instance, cash deposits are usually available immediately, while checks may have a holding period before the funds are fully accessible. Always check your bank’s specific availability policy if you have questions about when your deposited funds can be used.

Common Errors and How to Avoid Them

Even with a straightforward process, mistakes can happen when filling out bank deposit slips. These errors, though seemingly minor, can lead to processing delays, misapplied funds, or even temporary holds on your deposit. Understanding these common pitfalls and how to sidestep them is crucial for a smooth banking experience.Ensuring accuracy on your deposit slip is not just about neatness; it’s about safeguarding your funds and maintaining efficient access to them.

A correctly filled slip is the first step in a reliable transaction, while an erroneous one can create unnecessary friction.

Frequent Deposit Slip Mistakes

Several common errors appear regularly on deposit slips, often due to haste or oversight. Identifying these can help you be more vigilant.

- Incorrect Account Number: This is perhaps the most critical error. Entering the wrong digits can lead to your deposit being credited to another customer’s account, requiring a lengthy correction process.

- Miscalculations: Errors in adding up cash denominations or totaling checks can result in an incorrect deposit amount. This can lead to a discrepancy between what you believe you deposited and what the bank records show.

- Missing or Illegible Signatures: While less common for standard deposits, some banks may require a signature, especially for larger amounts or specific types of transactions. A missing or unreadable signature can cause delays.

- Omitting Date: While banks usually stamp the date, it’s good practice to ensure it’s present and correct.

- Incorrectly Listing Checks: Forgetting to list the individual check amounts or listing the wrong total for checks can cause confusion.

- Not Separating Cash and Checks: Some slips have designated areas for cash and checks. Mixing these can sometimes lead to processing issues.

Strategies for Error Prevention

Proactive measures can significantly reduce the likelihood of making errors on your deposit slip. Implementing a consistent routine will build accuracy.

Before you even pick up a pen, ensure you have all necessary information readily available. This includes your account number and the details of the checks you are depositing. Double-checking these details before starting can save significant time and prevent future issues.

- Verify Account Number: Always confirm your account number against a previous statement or your bank card before writing it down. Take an extra moment to count the digits.

- Systematic Cash Counting: When depositing cash, count it twice, preferably using a cash-counting machine if available, or by hand in a systematic way (e.g., counting bills by denomination).

- Accurate Check Endorsement: Ensure all checks are properly endorsed on the back with your signature or your business’s endorsement as required by the bank.

- Use a Calculator: For calculating the total cash and the total checks, use a calculator to ensure accuracy, especially for larger amounts or multiple checks.

- Write Legibly: Use a clear, legible handwriting. If your handwriting is often difficult to read, consider printing the information.

- Review Before Submitting: Before handing the slip to the teller or placing it in the ATM, take a moment to review all the information you’ve entered. Compare the written total with your calculated total.

Consequences of Incorrect vs. Correct Deposit Slips

The impact of a correctly filled deposit slip versus one with errors is substantial, affecting both the customer and the bank’s operational efficiency.

A correctly filled deposit slip acts as a clear and accurate record of your transaction. It ensures your funds are immediately and correctly credited to your account, providing you with access to your money without delay. For the bank, it streamlines the processing, reducing the chances of manual errors and allowing for efficient reconciliation of accounts.

A correct deposit slip is the bedrock of a seamless financial transaction, ensuring funds are accurately accounted for and readily accessible.

Conversely, an incorrect deposit slip can lead to a cascade of problems. If the account number is wrong, your money might be credited to someone else’s account, initiating a complex and time-consuming retrieval process. If the total amount is miscalculated, you might be shorted or overcredited, leading to discrepancies that require investigation. These errors can result in:

- Delayed Access to Funds: The bank may place a hold on the deposit until the discrepancy is resolved.

- Inconvenience and Frustration: You’ll likely need to contact the bank, visit a branch, and provide additional documentation to correct the error.

- Potential Fees: In some cases, repeated errors or the need for significant manual correction might incur bank fees.

- Impact on Budgeting and Payments: If you are relying on the deposited funds for immediate expenses or bill payments, a delay can cause further financial complications.

For instance, imagine depositing $500 in cash and three checks totaling $750. If you accidentally write $400 as the total cash and fail to list the individual checks correctly, the bank’s system might flag a discrepancy of $100. This could lead to the entire deposit being temporarily held while the teller or back-office staff manually verifies the cash and checks against your slip.

This process could take hours or even days, preventing you from accessing your $1,250 immediately.

Visualizing the Process (Descriptive)

A completed bank deposit slip is a structured document designed for clarity and accuracy. It transforms a potentially complex transaction into a series of organized fields, ensuring that both the depositor and the bank can easily verify the details. The visual flow is intuitive, guiding the user from their personal identification to the specifics of the deposit.The typical layout of a deposit slip is designed for a logical progression of information.

This structure minimizes confusion and reduces the likelihood of errors, making the entire deposit process smoother. From the top, where essential identification details are placed, to the bottom, where the final sum is calculated, each section serves a distinct purpose in documenting the transaction.

Textual Representation of a Sample Deposit Slip

To truly grasp the visual organization, consider a textual representation of a filled-out deposit slip. This mimics the appearance and flow of information you would encounter on the physical document, allowing for a clear understanding of how each piece of data fits into the overall picture.

| DEPOSIT TICKET | Date: 10/26/2023 | ||

| Bank Name: Community First Bank | |||

| Account Name: Jane Doe | |||

| Account Number: 123-456-7890 | Type: Checking | Branch: Downtown | |

|

|

|||

| Deposit Details: | |||

| Cash: | $100.00 | $50.00 | $20.00 |

| Bills: | (1) x 100 | (1) x 50 | (1) x 20 |

| Coins: | |||

| Total Cash: | $170.00 | ||

|

|

|||

| Checks and Other Items: | |||

| Item 1 | Amount: $250.50 | Routing #: 012345678 | Account #: 987654321 |

| Item 2 | Amount: $75.25 | Routing #: 876543210 | Account #: 123456789 |

| Item 3 | Amount: $150.00 | Routing #: 112233445 | Account #: 556677889 |

| Total Checks: | $475.75 | ||

|

|

|||

| Less Cash Received: | $0.00 | ||

| Net Deposit: | $645.75 | ||

|

|

|||

| For Bank Use Only: | Teller ID: T101 | ||

This table illustrates how information is laid out, from the prominent bank and account details at the top to the itemized breakdown of cash and checks, culminating in the total net deposit. The use of clear labels and distinct sections ensures that each element is easily identifiable.

Concluding Remarks

Successfully navigating the process of how to fill out a bank deposit slip culminates in a sense of accomplishment and financial control. You’ve learned to decipher the slip’s anatomy, meticulously record your personal information, accurately detail your cash and check deposits, and confidently calculate the total. By internalizing these steps and understanding common pitfalls, you can ensure your deposits are processed swiftly and without error, reinforcing your mastery over this essential banking task.

General Inquiries

What is the purpose of a bank deposit slip?

A bank deposit slip serves as a record of the money you are depositing into your bank account. It details the cash and checks you are submitting and helps the bank accurately credit your account.

What information is typically required on a deposit slip?

Generally, you’ll need to provide your name, address, account number, the date, the amount of cash being deposited, and details for each check being deposited.

Do I need to list the denominations of cash?

Yes, most deposit slips require you to list the quantity of each bill denomination (e.g., $20s, $10s, $5s) and then sum them up. This helps the bank verify the cash amount.

What information do I need for each check deposit?

For each check, you typically need to list the bank’s routing number and the amount of the check. Some slips may also have a field for the check number.

What happens if I make a mistake on my deposit slip?

Minor errors might be corrected by the teller, but significant mistakes can lead to delays, incorrect credit to your account, or even the deposit being rejected. It’s best to fill it out carefully.

Can I use a pen or pencil to fill out the slip?

It’s highly recommended to use a pen, preferably in blue or black ink, for legibility and to prevent smudging. Pencils can be erased and may not scan well.

What if I’m depositing foreign currency?

Most standard deposit slips are not designed for foreign currency. You would typically need to exchange foreign currency for local currency before depositing, or consult with your bank about specific procedures.