how to delete a bank reconciliation in quickbooks online is a critical process that, when undertaken without proper understanding, can lead to significant data integrity issues. This guide will meticulously detail the implications, prerequisites, procedural steps, and troubleshooting necessary for effectively managing this function within QuickBooks Online, ensuring financial accuracy is maintained.

The act of deleting a bank reconciliation in QuickBooks Online necessitates a thorough comprehension of its downstream effects on financial reporting and account balances. Users must be aware of the potential for data corruption and the importance of accurate record-keeping to avoid cascading errors. This exploration will cover the necessary precautions and the step-by-step methodology for performing such an action, along with alternative solutions for error correction.

Understanding the Implications of Deleting a Bank Reconciliation

Embarking on the journey to delete a bank reconciliation in QuickBooks Online is akin to unraveling a carefully woven tapestry of your financial history. While sometimes necessary, this action carries significant weight, impacting the integrity and accuracy of your financial records. It’s a step that should be approached with a clear understanding of its ripple effects, ensuring you’re prepared for the changes it will bring to your financial landscape.Deleting a completed bank reconciliation in QuickBooks Online is not a trivial act; it’s a process that directly alters the historical accuracy of your financial statements.

When you reconcile your bank account, you’re essentially telling QuickBooks that the transactions listed in your bank statement match the transactions recorded in your books for a specific period. Removing this confirmation means that this crucial link between your bank’s records and your company’s ledger is broken. This can lead to discrepancies that might go unnoticed, creating a cascade of potential errors in your financial reporting.

Impact on Financial Report Accuracy

The immediate and most profound consequence of deleting a bank reconciliation is the potential for your financial reports to become inaccurate. When a reconciliation is removed, QuickBooks effectively “un-marks” all the transactions that were previously cleared. This means that reports such as the Balance Sheet, Profit and Loss statement, and the Reconciliation Report itself will no longer reflect the verified state of your accounts for that period.

Transactions that were once considered accounted for may reappear as uncleared, leading to inflated or deflated account balances. For instance, a company relying on an accurate Balance Sheet to assess its liquidity might be misled by a balance that no longer reflects actual cleared funds, potentially impacting investment decisions or loan applications.

Common Scenarios for Deleting a Reconciliation

There are several justifiable reasons why a user might find themselves needing to delete a bank reconciliation. Often, this occurs when a significant error is discoveredafter* the reconciliation has been completed. This could range from a missed transaction, a duplicated entry, or an incorrect amount entered. In other cases, a business might be switching accounting software or implementing a new chart of accounts, requiring a clean slate for their historical data.

Another scenario involves correcting a prior period adjustment that was improperly handled during the initial reconciliation. For example, if a large unrecorded expense was found for a previous month and the reconciliation was completed without addressing it, deleting and re-reconciling might be the cleanest way to ensure accuracy moving forward.

Risks of Improperly Deleted Bank Reconciliations

The risks associated with an improperly deleted bank reconciliation are substantial and can undermine the very foundation of your financial management. If transactions are deleted without a clear plan for correction or if the reconciliation is simply removed without understanding the implications, it can lead to a persistent state of financial disarray. This can result in:

- Persistent Discrepancies: Transactions that were thought to be reconciled may continue to appear as outstanding, making future reconciliations increasingly difficult and time-consuming.

- Misleading Financial Statements: As mentioned, this can lead to incorrect asset and liability balances, affecting cash flow analysis, tax reporting, and strategic business planning.

- Audit Trail Compromise: Deleting reconciliations can obscure the audit trail, making it harder for auditors to verify the accuracy of your financial records.

- Loss of Confidence in Data: Repeated errors and discrepancies can erode trust in the accounting system, leading to increased manual checks and reduced efficiency.

It’s crucial to remember that QuickBooks Online’s reconciliation feature is designed to provide assurance. Tampering with it without due diligence can inadvertently open the door to significant financial inaccuracies.

Prerequisites and Preparations Before Deleting

Embarking on the journey to undo a bank reconciliation in QuickBooks Online is akin to retracing your steps on a well-trodden path. Before you begin this delicate operation, a thorough preparation is not just recommended; it’s your compass and map, ensuring you navigate the process with confidence and avoid getting lost in a labyrinth of financial data. Imagine you’re an explorer about to chart unknown territory; you wouldn’t set off without your essential supplies and a clear understanding of your objective.This meticulous preparation phase is designed to equip you with all the necessary insights and safeguards.

It’s about understanding what you’re about to alter, why it matters, and how to ensure the integrity of your financial records remains uncompromised. By gathering key information and implementing preventative measures, you transform a potentially daunting task into a manageable and controlled procedure, preserving the accuracy and reliability of your financial narrative.

Essential Information Gathering

Before you even consider clicking that “delete” button, arm yourself with the crucial details that will guide your actions. This isn’t about guesswork; it’s about precision. Think of it as gathering intelligence before a strategic move. Having this information at your fingertips will clarify the scope of your task and highlight any potential complexities.The following are the vital pieces of information you need to collect:

- The specific bank account involved in the reconciliation you intend to delete.

- The exact reconciliation period (e.g., month and year) you wish to undo.

- The opening balance of the bank account as it appeared at the start of the reconciliation period.

- The ending balance of the bank account as it appeared at the end of the reconciliation period.

- A list of all transactions that were cleared and marked as reconciled during that specific period.

- Any notes or comments associated with the reconciliation, which might offer context for why certain adjustments were made.

The Imperative of Data Backup, How to delete a bank reconciliation in quickbooks online

In the dynamic world of financial management, change is constant, but so is the potential for unforeseen issues. Deleting a bank reconciliation is a significant alteration to your historical financial data. Before you proceed, it is paramount to create a robust backup of your QuickBooks Online data. This act is your financial safety net, a digital insurance policy against any unintended data corruption or errors that might arise during the deletion process.Consider this analogy: before performing a complex surgical procedure, a doctor ensures all necessary equipment is sterilized and that there’s a plan for potential complications.

Similarly, backing up your data is the critical first step in ensuring that if anything goes awry, you can restore your system to its previous, stable state, safeguarding your entire financial history.

Accessing Previous Reconciliation Reports

To effectively understand the reconciliation you’re about to undo, and to have a point of reference for rebuilding it later, accessing previous reconciliation reports is indispensable. These reports are the detailed blueprints of your past financial balancing acts, offering a clear snapshot of what was agreed upon between your QuickBooks records and your bank statements.You can access these historical treasures by navigating to the accounting section within QuickBooks Online.

From there, you’ll typically find an option to view past reports. Look for reports specifically labeled as “Reconciliation Reports” or “Statement Charges.” These documents will provide the exact cleared status of transactions, the cleared balance, and any discrepancies that were resolved at the time of the original reconciliation. Having these reports readily available allows you to meticulously compare and contrast, ensuring you don’t miss any critical details when you eventually re-reconcile.

Ensuring All Transactions Are Accounted For

The integrity of your financial records hinges on the accuracy of every transaction. Before deleting a reconciliation, a crucial step is to verify that all transactions related to that period are not only present but also correctly categorized and accounted for in your QuickBooks Online file. This proactive check prevents the deletion from introducing new errors or obscuring existing ones.Imagine you are an architect reviewing blueprints before a renovation.

You need to ensure all structural elements are sound and accounted for. In QuickBooks, this means going through your bank feed, your general ledger, and any outstanding transactions to confirm they align with your expectations and that no transactions have been inadvertently duplicated, missed, or misapplied. This thorough review ensures that when you do delete the reconciliation, you are working with a clean slate, ready to re-establish accuracy with confidence.

Step-by-Step Procedure for Deleting a Bank Reconciliation

Embarking on the journey to undo a bank reconciliation might feel like navigating a labyrinth, but with a clear map, even the most intricate paths become navigable. This section will guide you through the precise steps within QuickBooks Online to locate and initiate the deletion of a reconciliation, ensuring you understand each turn and potential pitfall. We’ll cover confirming the deletion, handling the reappearance of transactions, and the crucial act of re-reconciling your account.Imagine you’ve discovered an error in a past reconciliation – perhaps a transaction was miscategorized, or an amount was entered incorrectly.

The thought of redoing weeks or months of work can be daunting, but QuickBooks Online offers a structured way to rectify these situations. By following these steps, you can confidently undo the reconciliation, make the necessary corrections, and then set your account back on the path to accuracy.

Locating and Initiating Deletion

The digital corridors of QuickBooks Online hold the key to undoing a reconciliation. To begin this process, you must first navigate to the banking section where your reconciliations are managed. This is not a feature found in every menu; it requires a specific sequence of clicks to access the historical reconciliation reports and their associated actions.To pinpoint the reconciliation you wish to delete, follow this precise navigational path:

- From the left-hand navigation menu, click on “Accounting.”

- Within the Accounting menu, select “Reconcile.”

- On the Reconcile page, look for the “History” link, typically found in the upper right corner. Click on this link.

- This will present you with a list of past reconciliation reports. Identify the specific reconciliation you need to delete based on the date and account.

- Once you’ve found the correct reconciliation, click on the “View” link next to it.

- On the reconciliation report screen, you will see an option to “Edit” or “Undo” the reconciliation. The exact wording might vary slightly based on your QuickBooks Online version, but look for an action that allows you to reverse the reconciliation. Click on this option.

This sequence is your gateway to reversing a completed reconciliation. It’s designed to be deliberate, preventing accidental deletions by requiring you to actively seek out the reconciliation history.

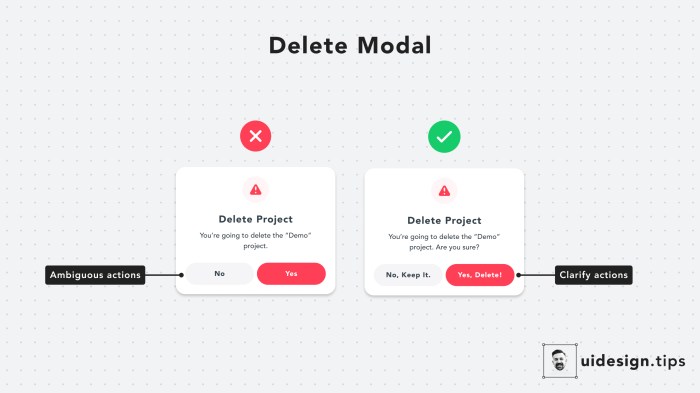

Confirming the Deletion and Handling Warnings

Once you’ve signaled your intent to delete a reconciliation, QuickBooks Online will present you with a confirmation step. This is a critical juncture, designed to ensure you understand the gravity of your action and the potential consequences. It’s akin to a final checkpoint before a significant journey, prompting you to double-check your course.Before proceeding, QuickBooks Online will often display a warning message.

This message typically Artikels that undoing the reconciliation will un-clear all transactions that were marked as cleared during that specific reconciliation period. It might also remind you that any subsequent reconciliations that relied on the accuracy of the deleted one will also need to be redone.

“Undoing this reconciliation will un-clear all transactions included in this reconciliation. You will need to re-reconcile this account.”

This warning is not merely a formality; it’s a vital piece of information. It highlights that the act of deletion is not an isolated event but has ripple effects throughout your accounting records. You will be prompted to confirm your understanding and intent, often by clicking a button like “Undo Reconciliation” or “Yes, Undo.” It is imperative to read these messages carefully and ensure you are prepared for the subsequent steps.

Handling Uncleared Transactions After Deletion

When a bank reconciliation is undone, the transactions that were previously marked as “cleared” in QuickBooks Online revert to their “uncleared” status. This means they will appear in your bank feed or transaction list as if they haven’t been processed by the reconciliation yet. It’s like tidying up a room and then finding some items you’d put away have reappeared on your desk.The reappearance of these uncleared transactions is a normal and expected outcome.

Your task now is to address them appropriately:

- Review Each Transaction: Go through each transaction that has reappeared. Compare it against your bank statement and your QuickBooks Online records to ensure accuracy.

- Correct Errors: If you find any discrepancies (e.g., incorrect amounts, wrong dates, or miscategorized accounts), this is the opportune moment to make those corrections. Click on the transaction to edit its details.

- Re-categorize if Necessary: Sometimes, the reason for undoing a reconciliation is a miscategorization. Ensure each transaction is assigned to the correct income or expense account.

- Mark as Cleared Again (Once Correct): After you have reviewed and corrected any errors, you will need to mark these transactions as “cleared” again when you are ready to re-reconcile the account. This is done within the reconciliation screen itself.

Think of this phase as a quality control check. The deletion has given you a clean slate to verify and rectify any inaccuracies before moving forward.

Re-reconciling the Account

With the previous reconciliation undone and any identified errors corrected, the final, crucial step is to perform a new reconciliation. This process is identical to the initial reconciliation you would have done, but now it benefits from the corrections you’ve made. It’s the act of setting your financial ship back on its proper course.To re-reconcile the account, follow these steps:

- Navigate back to the “Accounting” section and then click on “Reconcile.”

- Select the correct bank account you are working with.

- Enter the ending balance and ending date from your bank statement for the period you are reconciling.

- As you go through the transactions, compare them with your bank statement. Mark the transactions that match as “cleared” in QuickBooks Online.

- Continue this process until the difference between your QuickBooks Online balance and your bank statement balance is zero.

The goal, as always, is to achieve a difference of zero. This indicates that your QuickBooks Online records now accurately reflect the transactions on your bank statement for that period. If you encounter a difference, you’ll need to revisit the uncleared transactions, review your entries, and potentially go back to the “Handling Uncleared Transactions After Deletion” phase. Successfully re-reconciling signifies that your financial records are once again in alignment.

Troubleshooting Common Issues During Deletion

As you navigate the process of unwinding a bank reconciliation in QuickBooks Online, it’s akin to retracing your steps after a complex journey. Sometimes, the path isn’t perfectly clear, and you might encounter a few unexpected detours or roadblocks. This section is your compass, designed to help you navigate these common challenges with confidence, ensuring your financial records remain a true reflection of your business’s reality.When the QuickBooks Online system presents an error message or a seemingly insurmountable obstacle, it’s crucial to understand its language.

These messages are not random; they are signals from the software, guiding you toward the root cause of the problem. By deciphering these signals, you can efficiently address the issue and proceed with the deletion of your bank reconciliation.

Understanding Potential Error Messages

Occasionally, QuickBooks Online will present specific error messages during the bank reconciliation deletion process. These messages are designed to inform you about what is preventing the action or what has gone wrong. Understanding their meaning is the first step to resolution.Here are some common error messages and their implications:

- “This reconciliation cannot be deleted because there are outstanding transactions.” This message typically indicates that while you might have reconciled a period, some transactions within that period or subsequent periods remain uncleared. QuickBooks requires all transactions to be accounted for before a reconciliation can be fully undone.

- “This reconciliation is linked to a future reconciliation.” This signifies that a subsequent bank reconciliation has already been performed and has built upon the reconciliation you are attempting to delete. To delete the earlier reconciliation, you must first delete the later ones that depend on it.

- “Access Denied: You do not have permission to perform this action.” This error points to user role limitations. Certain administrative privileges are required to modify or delete reconciled data. Ensure your user profile has the necessary permissions.

- “System Error: Please try again later.” While less specific, this message suggests a temporary glitch within the QuickBooks Online system. It’s often resolved by simply waiting a short period and attempting the action again.

Resolving Unavailable or Greyed-Out Delete Options

It can be frustrating when the ‘delete’ option for a reconciliation appears disabled, like a locked door. This usually happens for specific, logical reasons dictated by the software’s internal checks and balances to maintain data integrity.The primary reasons the delete option might be unavailable include:

- Prior Reconciliations Exist: If you have reconciled subsequent periods, QuickBooks will not allow you to delete an earlier reconciliation without first deleting the ones that follow it. This is to prevent a cascade of errors. The solution is to work backward, deleting the most recent reconciliation first, then the one before it, and so on, until you reach the reconciliation you intend to delete.

- Outstanding Transactions in the Period: As mentioned in the error messages, if there are still transactions within the reconciliation period that have not been cleared or matched, the delete option may be greyed out. You must first ensure all transactions within that specific reconciliation period are accounted for before you can delete the reconciliation itself.

- User Permissions: Not all QuickBooks Online users have the authority to delete reconciliations. This action is typically reserved for administrators or users with specific accounting privileges. If you are not an administrator, you will need to request assistance from someone who has the necessary permissions.

- Company File Corruption (Rare): In extremely rare cases, minor data corruption might affect the functionality. If all other troubleshooting steps fail, this could be a possibility, though it’s highly unlikely for a standard deletion process.

Addressing Discrepancies After Deletion and Re-attempt

Sometimes, even after successfully deleting a reconciliation, you might find that your accounts don’t immediately balance when you re-attempt the process. This is like finding a puzzle piece out of place after you thought you had it solved. These discrepancies often arise from transactions that were altered or added after the initial reconciliation, or a misunderstanding of what was truly “cleared” versus “uncleared.”When discrepancies appear after a deletion and re-attempt:

- Review All Transactions Within the Period: Carefully examine every transaction that falls within the reconciliation period you are trying to re-reconcile. Look for any that might have been edited, duplicated, or entered incorrectly since the original reconciliation.

- Check for Unmatched Bank Feed Transactions: If you use bank feeds, ensure that all transactions downloaded from your bank have been correctly matched to QuickBooks entries or categorized appropriately. Unmatched transactions can cause significant imbalances.

- Verify Manual Entries: If you manually entered any transactions (e.g., journal entries, payments, deposits), double-check their amounts, dates, and account coding for accuracy.

- Compare with Bank Statements Again: As a final verification, meticulously compare your QuickBooks entries against your actual bank statement for the period, line by line. This is the most definitive way to pinpoint any missing or incorrect entries.

Contacting Support for Unresolved Deletion Problems

If you’ve exhausted all troubleshooting steps and are still facing an intractable issue with deleting a bank reconciliation, it’s time to enlist the expertise of QuickBooks Online support. They have access to advanced tools and knowledge bases that can help diagnose and resolve complex problems.When you contact support, be prepared to provide the following information to expedite the process:

- Your QuickBooks Online Company ID: This is a unique identifier for your company file.

- The specific bank account involved.

- The reconciliation period you are trying to delete.

- Any error messages you have encountered.

- A detailed description of the steps you have already taken to resolve the issue.

QuickBooks Online offers several support channels, including phone, chat, and community forums. For immediate assistance with persistent technical issues, direct phone or chat support is often the most effective route. They can often guide you through advanced diagnostics or escalate the issue to a specialist if necessary.

Alternatives to Deleting a Bank Reconciliation: How To Delete A Bank Reconciliation In Quickbooks Online

Sometimes, the path to financial clarity isn’t a sweeping deletion, but a series of precise adjustments. While deleting a bank reconciliation might seem like the quickest fix for an erroneous period, QuickBooks Online offers a more nuanced approach. Exploring these alternatives ensures you maintain the integrity of your historical data while still correcting mistakes. These methods empower you to pinpoint and rectify specific errors without the drastic step of undoing an entire reconciliation, safeguarding your audit trail and providing a clearer picture of your financial journey.

When needing to delete a bank reconciliation in QuickBooks Online, ensure you’ve correctly identified all transactions. If you’re unsure about your banking details, you might need to find out how do i find my bank access number with your institution. Once verified, proceed with the steps to undo the reconciliation in QuickBooks Online for accurate financial records.

When faced with an incorrect bank reconciliation, the instinct to simply erase the problem can be strong. However, QuickBooks Online provides a suite of powerful tools that allow for more surgical corrections. Understanding these alternatives not only helps you fix immediate issues but also cultivates a deeper understanding of your accounting practices. We’ll delve into editing transactions, voiding or deleting individual entries, and the art of the adjusting journal entry, each offering a unique way to restore accuracy without resorting to wholesale deletion.

Editing Transactions Versus Deleting an Entire Reconciliation

The decision to edit individual transactions versus deleting an entire reconciliation hinges on the scope and nature of the error. Deleting a reconciliation is akin to starting over for that specific period, wiping the slate clean but potentially losing valuable audit history if not handled with extreme care. Editing transactions, on the other hand, is a more targeted approach. It allows you to correct specific amounts, dates, or descriptions of individual entries that were mistakenly included or handled incorrectly during the reconciliation process.

Consider the benefits:

- Editing Transactions: Preserves the reconciliation for the period up to the point of the edit, maintaining a cleaner audit trail. It’s ideal for minor errors like a transposed digit or a misclassified expense. The benefit here is minimal disruption to the overall reconciliation process, allowing you to focus on the specific incorrect item.

- Deleting an Entire Reconciliation: This is a more drastic measure, best reserved for situations where multiple errors have occurred, making it impractical to edit each one individually, or if the reconciliation was fundamentally flawed from the outset. The primary benefit is a complete reset, allowing for a fresh start for that reporting period. However, it necessitates re-reconciling the entire period, which can be time-consuming and requires careful attention to ensure all transactions are accounted for correctly the second time around.

Voiding or Deleting Individual Transactions Included in a Reconciliation

When a specific transaction has been mistakenly included in your bank reconciliation, or was entered incorrectly, the most precise solution is often to void or delete that individual entry. This preserves the integrity of the rest of your reconciled transactions while addressing the specific error. Voiding a transaction effectively cancels it out, while deleting removes it entirely from your QuickBooks Online records.

The choice between the two depends on whether you need to retain a record of the transaction’s existence, even if it’s no longer considered valid.

Here’s how to approach this:

- Locate the Transaction: Navigate to the relevant register (e.g., Bank Register, Credit Card Register) or find the transaction within the unreconciled transactions list from a previous reconciliation.

- Select the Transaction: Click on the transaction to open its details.

- Void or Delete: Depending on your needs, you can either click “Void” or “Delete” from the transaction’s action menu. “Void” is generally preferred as it leaves a record of the transaction’s original entry and cancellation.

- Reconcile Again: After voiding or deleting, you will need to perform a new reconciliation for the affected period to reflect the change.

It’s crucial to remember that once a transaction has been reconciled, voiding or deleting it will “unreconcile” that specific item. This means it will appear as an outstanding transaction in your next reconciliation attempt for that bank account.

Adjusting Entries to Correct Errors Without Full Deletion

Adjusting entries are the unsung heroes of financial accuracy. They are journal entries made to correct errors or to bring account balances up to date without necessarily deleting an entire reconciliation. This method is particularly useful when the error isn’t a simple data entry mistake but rather a misclassification or an omission that needs to be accounted for after the reconciliation has been completed.

The power of adjusting entries lies in their ability to:

- Correct Misclassifications: If an expense was recorded in the wrong category, an adjusting entry can move it to the correct one. For example, if a utility bill was mistakenly coded as office supplies, an adjusting entry would debit Utilities Expense and credit Office Supplies.

- Account for Accruals or Prepayments: Adjusting entries are vital for recognizing revenue or expenses in the period they are earned or incurred, regardless of when cash changes hands.

- Address Timing Differences: Sometimes, bank statements and accounting records might have slight timing discrepancies that can be resolved with an adjustment.

The process typically involves creating a journal entry in QuickBooks Online. You’ll debit one account and credit another to balance the entry. For instance, if you discovered that a deposit recorded in your books was actually a loan repayment and should not have been treated as income, you would create an adjusting entry to debit the loan liability account and credit the income account, effectively reversing the erroneous income recognition.

Scenario: Making a Journal Entry is a Better Alternative to Deleting a Reconciliation

Imagine Sarah, a small business owner, has just completed her monthly bank reconciliation for her checking account. As she reviews her profit and loss statement for the month, she realizes that a significant expense, a new piece of equipment, was accidentally categorized as a regular operating expense instead of being capitalized as an asset. This misclassification has artificially lowered her net income for the month and distorted her balance sheet.

Sarah’s dilemma is whether to delete the entire bank reconciliation and start over, or find a more targeted solution. Deleting the reconciliation would mean re-entering and re-checking all her transactions for the month, a process that is both time-consuming and prone to introducing new errors. Instead, she opts for an adjusting journal entry.

Here’s how Sarah handles it:

- Identify the Error: Sarah confirms the incorrect categorization of the equipment purchase.

- Determine the Correct Treatment: She consults with her accountant and confirms that the equipment should be capitalized as an asset and depreciated over its useful life.

- Create the Journal Entry: Sarah goes to “New” > “Journal Entry” in QuickBooks Online. She debits the “Fixed Assets” account for the cost of the equipment and credits the “Operating Expenses” account for the same amount. This action effectively moves the cost from an expense to an asset on her balance sheet.

- Impact on Reconciliation: While the original transaction might have already been reconciled, this journal entry is a separate accounting event. It doesn’t necessarily “unreconcile” the original transaction itself but corrects its financial impact. In her next reconciliation, she would ensure this journal entry is also accounted for if it pertains to bank activity, or if it’s a purely internal adjustment, it simply corrects the overall financial picture.

In this scenario, the journal entry is a far superior alternative to deleting the entire reconciliation. It precisely addresses the specific accounting error, maintains the integrity of the reconciled bank transactions, and saves Sarah significant time and effort. It highlights how strategic adjustments can preserve financial history while ensuring accurate reporting.

Best Practices for Future Reconciliations

Having navigated the sometimes-treacherous waters of deleting a bank reconciliation, it’s wise to equip yourself with the knowledge to prevent such a situation from arising again. Think of it as fortifying your financial fortress, ensuring smoother sailing and a more serene accounting experience. These best practices are your blueprints for accuracy, efficiency, and peace of mind, transforming reconciliation from a chore into a powerful tool for financial oversight.By adopting a proactive approach, you not only minimize the chances of needing to undo your work but also build a foundation of reliable financial data.

This makes every subsequent reconciliation a testament to your diligence, rather than a puzzle to be solved. Let’s delve into the strategies that will make your future reconciliations a breeze.

Checklist for Preventing Future Deletions

To steer clear of the need to delete a bank reconciliation, a consistent and thorough approach is key. Creating and adhering to a checklist ensures that no critical step is overlooked, acting as your reliable guide through the reconciliation process. This systematic approach builds confidence and reduces the likelihood of errors that necessitate a reset.Here is a comprehensive checklist designed to be your steadfast companion:

- Verify Starting Balances: Before you even begin to match transactions, confirm that the starting balance on your bank statement or download matches the ending balance from your previous reconciliation in QuickBooks Online. Any discrepancy here is an early warning sign.

- Download Transactions Regularly: Aim to download your bank and credit card transactions at least weekly, if not daily. The sooner you import them, the less likely they are to become lost or forgotten, and the smaller the batch of transactions you’ll need to review at any given time.

- Categorize Transactions Promptly: As soon as transactions are downloaded, assign them to the correct accounts. Don’t let them linger in the “uncategorized” or “needs review” section for extended periods.

- Match Existing Transactions: For transactions already entered in QuickBooks Online (like checks you’ve written or sales receipts), ensure they are correctly matched to the imported bank data.

- Review Unmatched Transactions: Pay close attention to any transactions that QuickBooks Online cannot automatically match. Investigate these thoroughly to ensure they are legitimate and correctly categorized.

- Address Discrepancies Immediately: If you notice a difference between your QuickBooks Online balance and the bank statement balance, do not proceed with finalizing the reconciliation. Stop, investigate, and correct the error before moving forward.

- Save Reconciliation Reports: Always save a copy of your reconciliation report, both in QuickBooks Online and potentially as a PDF. This provides a historical record and a point of reference if issues arise later.

- Reconcile All Accounts: Ensure that all bank accounts, credit card accounts, and any other accounts that have a bank-like statement are reconciled on a regular basis.

Tips for Accurate Transaction Categorization

The bedrock of a smooth reconciliation is accurate transaction categorization. When each income and expense is correctly assigned, the reconciliation process becomes a simple act of verification, not a detective mission. Investing a little extra time upfront in proper categorization pays dividends in time saved and accuracy gained down the line.Consider these actionable tips to sharpen your categorization skills:

- Understand Your Chart of Accounts: Have a clear grasp of your Chart of Accounts and what each account represents. If an account is unclear, rename it or add a sub-account for better clarity.

- Use Rules for Recurring Transactions: QuickBooks Online allows you to set up rules for transactions that occur repeatedly, such as recurring utility bills or payroll expenses. This automates categorization and significantly speeds up the process. For example, a rule could automatically categorize all transactions from “Utility Company X” to your “Utilities Expense” account.

- Leverage Memo Fields: When entering transactions manually or reviewing imported ones, utilize the memo field to add descriptive details. This context can be invaluable for future reference and for understanding the purpose of a transaction during reconciliation.

- Consult Supporting Documents: Always refer to invoices, receipts, or other supporting documentation when categorizing transactions. This ensures you’re not relying on guesswork. For instance, if a credit card charge appears on your bank feed as “POS Purchase,” your receipt will tell you if it was for office supplies or client entertainment.

- Review Uncategorized Transactions Regularly: Make it a habit to review the “Uncategorized Asset” and “Uncategorized Expense” accounts at least weekly. These accounts are often indicators of missed or improperly categorized transactions.

- Train Your Team: If multiple people are responsible for data entry, ensure they are all trained on the correct categorization procedures and understand the business’s financial structure.

Importance of Regular Reconciliation Frequency

The frequency with which you reconcile your accounts is not just a matter of good practice; it’s a critical component of maintaining financial integrity and detecting errors promptly. Imagine trying to find a single misplaced brick in a wall that’s been built over a year, versus finding it in a wall built last week. The latter is infinitely easier.Regular reconciliation frequency offers several compelling advantages:

- Early Detection of Errors and Fraud: The longer you wait to reconcile, the more transactions accumulate, making it harder to spot discrepancies, unauthorized transactions, or potential fraud. Reconciling monthly, or even more frequently for high-volume accounts, allows for immediate investigation.

- Improved Cash Flow Management: Knowing your accurate bank balance at all times is crucial for making informed decisions about spending, investments, and bill payments. Regular reconciliations provide this clarity.

- Accurate Financial Reporting: Your financial statements (Profit & Loss, Balance Sheet) rely on accurate data. If your bank accounts are not reconciled, these reports will not reflect the true financial health of your business.

- Reduced Stress and Workload: Tackling reconciliation in smaller, regular batches is far less daunting and time-consuming than trying to reconcile months of activity at once. This prevents it from becoming an overwhelming task.

- Compliance and Audit Readiness: For businesses subject to audits or regulatory requirements, maintaining consistently reconciled accounts is often a fundamental expectation.

System for Reviewing Reconciliation Reports

The final step before declaring a reconciliation complete is a thorough review of the reconciliation report. This isn’t just a formality; it’s your last line of defense against errors that could lead to future deletion headaches. A robust review system ensures that you are not just signing off on numbers, but on accuracy.Here’s how to design a system that instills confidence in your reconciliation reports:

- Compare Key Figures: On the reconciliation report, pay close attention to the “Cleared Balance” in QuickBooks Online and compare it directly to the ending balance on your bank statement. They must match precisely.

- Review the “Difference” Field: QuickBooks Online will explicitly show you the difference between your book balance and the bank balance. This should always be zero before you finalize. If it’s not, do not proceed.

- Scan the List of Cleared Transactions: Quickly scan the list of transactions that have cleared your bank. Look for any anomalies, such as transactions that seem out of place, unusually large amounts, or items you don’t recognize.

- Examine Outstanding Transactions: Review the list of outstanding transactions (those not yet cleared by the bank). Ensure these are items you expect to be outstanding and that they are correctly recorded in QuickBooks Online. For instance, outstanding checks should correspond to checks you have recently issued but that haven’t yet been cashed.

- Check for Prior Period Adjustments: If you had to make adjustments in prior periods, ensure they are clearly documented and understood. While adjustments are sometimes necessary, frequent or large adjustments warrant further investigation into underlying processes.

- Set a Reviewer (if applicable): If your business has multiple people involved in accounting, designate a specific individual (or yourself, if you’re the sole accountant) to perform the final review of the reconciliation report before it’s finalized. This provides an independent check.

Final Wrap-Up

![[Fixed] Folder Access Denied: You Need Permission to Delete File in ... [Fixed] Folder Access Denied: You Need Permission to Delete File in ...](https://i1.wp.com/images.squarespace-cdn.com/content/v1/6193ecda19fd5e3743ed1d8d/d38743f2-0f77-4b7f-8b93-0f2a4b38d34f/How+to+Mass+Delete+Emails+in+Outlook.png?w=700)

In conclusion, while the process of how to delete a bank reconciliation in quickbooks online is technically achievable, it should be approached with extreme caution and only when absolutely necessary. By understanding the profound implications, adhering to preparatory steps, executing the procedure correctly, and knowing how to troubleshoot, users can mitigate risks. Prioritizing best practices for future reconciliations will ultimately reduce the likelihood of needing to revisit this complex operation, thereby safeguarding the integrity of financial data.

Query Resolution

What are the primary implications of deleting a bank reconciliation?

Deleting a bank reconciliation reverts the account to its state prior to the reconciliation. This can impact the accuracy of financial reports, as previously matched transactions will become unmatched again, potentially leading to discrepancies if not re-addressed. It also means that any audit trail or historical record of that specific reconciliation is removed.

When might a user consider deleting a bank reconciliation?

Common scenarios include discovering a significant error that was made during the reconciliation process that cannot be easily corrected by editing individual transactions, or if the reconciliation was performed prematurely and needs to be redone with updated information. It might also be considered if the reconciliation was performed on an incorrect date or for the wrong period.

What is the most crucial preparation step before deleting a reconciliation?

The most crucial preparation step is to back up your QuickBooks Online data. This creates a recovery point, allowing you to restore your data to its previous state if any unforeseen issues arise during or after the deletion process, preventing permanent data loss or corruption.

What happens to uncleared transactions after a reconciliation is deleted?

Upon deletion of a reconciliation, all transactions that were marked as cleared in that reconciliation will revert to an uncleared status. They will reappear in the list of transactions needing reconciliation for the subsequent period.

What if the delete option for a bank reconciliation is greyed out?

If the delete option is unavailable or greyed out, it typically indicates that the reconciliation is protected, often due to subsequent transactions or reconciliations having been performed. In some cases, it may also be due to user permissions or specific QuickBooks Online system limitations. Contacting QuickBooks support is the recommended course of action.

Are there alternatives to deleting an entire bank reconciliation?

Yes, several alternatives exist. You can often edit individual transactions that were incorrectly included or categorized, void or delete specific transactions, or use adjusting journal entries to correct errors without resorting to deleting the entire reconciliation. These methods are generally less disruptive to data integrity.

How can I prevent the need to delete future reconciliations?

To prevent future deletions, adopt best practices such as reconciling accounts regularly (e.g., monthly), ensuring all transactions are accurately categorized before reconciling, reviewing bank statements and QuickBooks reports for discrepancies promptly, and using a checklist to verify all steps are completed before finalizing a reconciliation.