how to delete a bank account from quickbooks unfolds as a journey towards clarity and precision in your financial landscape. This process, often perceived as complex, is in reality a vital step in maintaining the purity and integrity of your accounting records. Embracing this task allows for a renewed focus on what truly matters in your financial narrative, shedding the weight of outdated or extraneous connections.

Understanding the nuances of removing a bank account from your QuickBooks system is paramount for accurate financial stewardship. Whether it’s due to a closed account, a change in banking institutions, or simply an error in initial setup, the implications of neglecting this can ripple through your financial statements, affecting decision-making and overall business health. This guide illuminates the path to a streamlined and truthful financial record, ensuring your QuickBooks reflects the vibrant reality of your current operations.

Understanding the Need to Remove a Bank Account in QuickBooks

Yo, so sometimes you gotta clean up your QuickBooks game, right? Especially when it comes to your bank accounts. It ain’t just about making things look tidy, it’s about keeping your money biz on point.Having old or messed-up bank connections in QuickBooks can be a major headache, leading to all sorts of financial drama. It’s like trying to navigate with a broken GPS – you’re gonna get lost, fam.

Common Scenarios for Bank Account Removal

There are a few legit reasons why you might need to ditch a bank account from your QuickBooks setup. It’s all about keeping your financial records super accurate, so you don’t get blindsided by weird numbers.

- Closed Accounts: If you’ve officially shut down a bank account, like with a bank that’s gone kaput or you just don’t use it anymore, it’s gotta go from QuickBooks. Leaving it in there is just confusing.

- Duplicate Entries: Sometimes, things get duplicated by accident, especially when you’re first setting things up or if there’s a glitch. Having two of the same account is a big no-no for clarity.

- Incorrect Linking: Maybe you accidentally linked the wrong account, or the connection went wonky and started pulling data from somewhere else. This messes up your transactions big time.

- Account Consolidation: If you’ve merged accounts or moved your money to a new primary account, the old ones become obsolete in QuickBooks.

Implications of Outdated or Incorrectly Linked Accounts

Leaving old or wrongly connected bank accounts hanging around in QuickBooks is like inviting financial chaos. It can totally mess up your reports and make it hard to see what’s really going on with your cash flow.

Imagine this: You’re trying to check your profit and loss, but the numbers are all skewed because a closed account is still showing transactions, or a wrongly linked account is throwing in random charges. That’s not just annoying, it’s bad for making smart business moves.

Importance of Accurate Financial Data

Keeping your QuickBooks spick and span with accurate bank account info is crucial, bro. It’s the foundation for everything from tracking your spending to planning for the future.

Accurate financial data in QuickBooks is your superpower for making smart business decisions.

When your bank accounts are legit and up-to-date, you can:

- Trust your reports: Your balance sheets, income statements, and cash flow reports will actually reflect reality.

- Spot discrepancies fast: If something’s off, you’ll catch it early before it becomes a major problem.

- Make informed decisions: Knowing your real financial picture helps you decide where to invest, cut costs, or expand.

- Simplify tax season: No more scrambling to figure out where money came from or went when tax time rolls around.

Prerequisites and Preparations Before Deleting a Bank Account

Yo, before you go ghosting a bank account in QuickBooks, gotta make sure you’re not leaving a mess behind, you know? It’s like ditching your squad without a heads-up – not cool and can cause drama. So, let’s get our ducks in a row, so everything’s clean and tidy.This part is all about making sure your QuickBooks game is solid before you hit that delete button.

When you need to remove a bank account from QuickBooks, it’s a straightforward process. Understanding how to manage your financial data, much like knowing can you track your bank card , ensures better control. Once you’ve addressed any tracking needs, you can proceed with deleting that QuickBooks account.

We’re talking about checking your transaction history, making sure everything’s squared away, and, super important, making a backup. You don’t want to mess things up and then be like, “Oops, my bad!”

Reconciling and Handling Transactions

Alright, so before you even think about hitting ‘delete,’ you gotta make sure all the money stuff for that account is sorted. No loose ends, fam. This means making sure every deposit, every withdrawal, every single transaction is accounted for and matched up. It’s like checking your receipts before you toss your wallet.You need to ensure that all transactions linked to the bank account you’re about to delete have been properly reconciled.

This means matching them against the bank statement to confirm accuracy. If there are any outstanding transactions or discrepancies, you need to address them. This could involve clearing old outstanding checks, categorizing uncategorized transactions, or resolving any differences found during reconciliation.Here’s the lowdown on making sure your transactions are on point:

- Final Reconciliation: Perform a final reconciliation for the bank account up to the date you intend to stop using it in QuickBooks. This ensures all cleared transactions are accounted for.

- Review Outstanding Transactions: Carefully review any outstanding transactions. These are items that have been recorded in QuickBooks but haven’t yet cleared the bank. Decide whether to clear them or adjust them if they are no longer valid.

- Categorize Uncategorized Transactions: Make sure there are no uncategorized transactions hanging around for this account. Assign them to the correct expense or income accounts.

- Handle Pending Transactions: If there are any pending transactions that won’t clear, you’ll need to decide how to handle them. This might involve voiding them or adjusting them.

It’s crucial to get this right because if you delete an account with uncleared transactions, it can mess up your financial reports and make it super hard to track where your money went.

Backing Up Your QuickBooks Data

Seriously, fam, this is non-negotiable. Before you make any major moves like deleting a bank account, you gotta back up your QuickBooks data. Think of it as a digital safety net. If anything goes sideways, you’ve got a pristine copy of your entire financial universe to fall back on. It’s like having a save point in a video game – you can always go back if you mess up.A backup is essentially a snapshot of your QuickBooks company file at a specific point in time.

This allows you to restore your data to that state if any errors occur during the deletion process or if you accidentally delete something important.The process of backing up your QuickBooks data is pretty straightforward:

- Navigate to the Backup Feature: In QuickBooks Desktop, go to the “File” menu, then select “Create Backup.” For QuickBooks Online, the backup process is usually automatic and cloud-based, but you can still download a copy of your company file.

- Choose Backup Location: Decide where you want to save your backup file. It’s best to save it to a different drive or external storage device than your computer’s main hard drive.

- Follow On-Screen Prompts: QuickBooks will guide you through the rest of the process, asking you to name your backup file and confirm the backup location.

- Verify the Backup: Once the backup is complete, it’s a good idea to check the backup file to ensure it was created successfully and is not corrupted.

“Always back up your data before making significant changes. It’s your get-out-of-jail-free card for QuickBooks errors.”

This backup is your golden ticket to undoing any accidental deletions or data corruption. Don’t skip this step, or you might be regretting it later when your financial data looks like a Jackson Pollock painting.

Step-by-Step Guide to Deleting a Bank Account in QuickBooks Online

Alright, so you’ve decided to yeet that bank account from your QuickBooks Online, right? It’s not rocket science, but you gotta follow the steps, or things can get messy, which is totally not the vibe. This section breaks down exactly how to get it done, so you can clear out the clutter and keep your finances looking fresh.Deleting a bank account in QuickBooks Online is pretty straightforward, but it’s important to know where to click.

We’re gonna walk through the whole process, from finding the right settings to making sure it’s actually gone. No cap, this is how you do it.

Navigating QuickBooks Online to Locate Bank Account Settings

To start deleting that account, you first need to find where all your bank accounts are listed and managed in QuickBooks Online. It’s like finding the right door in a maze, but way less stressful. This involves a few clicks through the main navigation menu.Here’s how you get to the spot where you can manage your bank accounts:

- Log in to your QuickBooks Online account.

- On the left-hand navigation bar, click on ‘Accounting’.

- From the dropdown menu, select ‘Chart of Accounts’.

This ‘Chart of Accounts’ is basically the master list of all your financial accounts, including your bank accounts, credit cards, and other assets or liabilities. It’s where you’ll find the account you want to remove.

Procedure for Removing a Bank Account from QuickBooks Online

Once you’re in the ‘Chart of Accounts’, you’re super close to deleting that bank account. This is the main event, so pay attention. It’s crucial to follow these steps precisely to avoid any oopsies.The process involves finding the specific account and then using the delete function:

- In the ‘Chart of Accounts’, locate the bank account you wish to delete. You can use the search bar if you have a lot of accounts.

- Once you’ve found the account, click on the ‘Action’ dropdown menu located to the right of the account name.

- From the ‘Action’ menu, select ‘Delete’.

- QuickBooks will pop up a confirmation message asking if you’re sure you want to delete the account. Read this carefully. It will usually warn you about any transactions associated with the account.

- If you’re certain, click ‘Yes’ or ‘Delete’ to confirm.

It’s important to note that if the bank account has any transactions recorded in it, QuickBooks might prevent you from deleting it directly. In such cases, you’ll need to clear out all associated transactions first, which usually means categorizing them correctly or reconciling them. If it’s an old, unused account with no transactions, deletion should be smooth.

Confirming the Successful Deletion of the Bank Account

After you’ve hit that delete button, you wanna be sure it actually disappeared, right? Nobody wants to go through all that effort only to find the account still chilling in their list. A quick check is all you need to confirm it’s gone for good.To verify that the bank account has been successfully removed:

- Return to the ‘Chart of Accounts’ by navigating to ‘Accounting’ > ‘Chart of Accounts’ from the left-hand menu.

- Scan the list of accounts. The bank account you deleted should no longer be visible.

- You can also try searching for the account name again in the ‘Chart of Accounts’ search bar. If it doesn’t appear, it’s confirmed gone.

If, by some chance, the account is still there, double-check that you completed all the steps and that there weren’t any error messages during the deletion process. Sometimes, a refresh of the page or logging out and back in can help display the updated list.

Step-by-Step Guide to Deleting a Bank Account in QuickBooks Desktop

Alright, so if you’re rocking QuickBooks Desktop and need to ditch a bank account, it’s a bit different from the online version, but still totally doable. Think of it like cleaning out your digital wallet. We’re gonna walk through it, step-by-step, so you don’t get lost in the menus. It’s not super complicated, but you gotta follow the breadcrumbs, ya know?This section is all about getting that bank account off your books in the Desktop version.

We’ll cover the exact clicks and menu dives you need to make. It’s important to do this right to keep your finances clean and accurate.

Deleting a Bank Account in QuickBooks Desktop

Okay, so here’s the main deal. You can’t just hit a delete button like you’re tossing out an old app. QuickBooks Desktop is a bit more… protective of your data. This means you’ll be “deactivating” or “making inactive” the account rather than outright deleting it. This keeps the historical data intact, which is usually what you want, even if the account itself is no longer active.To start this process, you gotta open your company file in QuickBooks Desktop.

Make sure you’re logged in as an administrator, or at least someone with the power to make these kinds of changes. It’s like having the master key to your financial kingdom.Here’s how to make that bank account officially retired from your active list:

- Navigate to the Chart of Accounts. This is your central hub for all financial accounts. You can usually find this under the ‘Lists’ menu at the top. Click on ‘Chart of Accounts’.

- Locate the bank account you want to remove. Scroll through the list until you find the specific bank account you’re no longer using.

- Right-click on the bank account. Once you’ve found it, right-click on the account name. A context menu will pop up.

- Select ‘Make Account Inactive’. From that menu, choose the option that says ‘Make Account Inactive’. This is the key step.

When you choose to make an account inactive, QuickBooks doesn’t actually delete the transactions associated with it. Instead, it hides the account from your main lists and reports. This is super clutch because it prevents any disruption to your historical financial data, which is crucial for audits or just checking past performance. It’s like putting an old photo album in storage – the memories are still there, but it’s not cluttering your living room.

Troubleshooting Common Issues in QuickBooks Desktop Deletion

Sometimes, things don’t go as smoothly as planned. If you try to make an account inactive and QuickBooks throws a fit, don’t panic. There are a few common reasons why this might happen, and usually, they’re pretty easy to fix.The most frequent roadblock is when there are still uncleared transactions or outstanding balances linked to the account. QuickBooks wants to make sure everything is squared away before it lets you hide an account.Here are some tips to get past those pesky issues:

- Ensure All Transactions Are Cleared or Reconciled: Before making an account inactive, make sure all transactions are either reconciled or have been manually cleared. If there are still pending transactions, QuickBooks might flag it. You might need to go through your bank feeds or manually mark transactions as cleared.

- Check for Open Transactions or Memorized Transactions: Sometimes, an account might be linked to recurring transactions or memorized reports. You’ll need to find and update or delete these before you can deactivate the account. Go through your memorized reports and recurring transaction lists to check for any ties to the account.

- Verify No Outstanding Balances: If the bank account still has an outstanding balance (either positive or negative), QuickBooks will usually prevent you from making it inactive. You’ll need to transfer any remaining balance to another account or zero it out before proceeding.

- Check for Linked Accounts: Ensure the bank account isn’t set as a linked account for other features within QuickBooks, like payroll or undeposited funds. You might need to change these settings first.

- Run Verify and Rebuild Data: If you’re still stuck, sometimes running QuickBooks’ built-in ‘Verify Data’ and ‘Rebuild Data’ utilities can fix underlying data integrity issues that might be preventing the account from being deactivated. You can find these under the ‘File’ menu.

Remember, the goal is to have a clean slate. If an account is truly no longer in use and has no outstanding financial implications, making it inactive is the best way to keep your QuickBooks file tidy and your financial reporting accurate. It’s all about keeping your digital books in check, fam.

Alternative Actions to Deleting a Bank Account

So, you’re thinking about ditching a bank account in QuickBooks, but maybe straight-up deleting it feels a bit too extreme, right? Totally get it. Sometimes, you just need to clean things up without erasing all the history. Luckily, QuickBooks has got your back with a couple of other moves you can make that are way less permanent than hitting the delete button.

It’s all about keeping your books tidy and making sure your financial story stays intact, even if a specific account is no longer in play.There are definitely times when inactivating or just tweaking the account details is a smarter play than a full-on deletion. It’s like deciding whether to ghost someone or just mute their notifications – different vibes, different outcomes.

Understanding these options helps you make the best call for your QuickBooks setup and keeps your financial records looking fresh.

Inactivating a Bank Account

Instead of completely nuking a bank account from your QuickBooks, you can choose to make it inactive. This basically hides the account from your active lists and reports, but all the historical data is still there, just tucked away. Think of it as putting something in storage rather than throwing it out. This is super useful for accounts you’re no longer using but might need to refer back to later, or if you’re worried about messing up past reports.

- Advantages of Inactivating:

- Preserves historical data for auditing or reference.

- Prevents accidental data entry into an old account.

- Keeps your active account list clean and uncluttered.

- Avoids potential issues with linked transactions or previous reconciliations.

- Disadvantages of Inactivating:

- The inactive account still exists in your chart of accounts, just not prominently displayed.

- Might require an extra step to view if you need to access its historical data.

Comparing Inactivating Versus Deleting

Choosing between inactivating and deleting is a big decision for your QuickBooks setup. Deleting is like hitting the big red button – it’s permanent and wipes the slate clean for that account, including all its transactions. This is usually only recommended for brand new accounts that haven’t had any activity or if you’ve made a serious mistake and need to start over with that specific account.

Inactivating, on the other hand, is more of a “put it on pause” situation. It keeps the data safe and sound but removes the account from your everyday view.

Deleting an account is irreversible and removes all associated transactions. Inactivating an account hides it from active use while retaining all historical data.

Editing Account Details as an Alternative

Sometimes, the problem isn’t that you want to get rid of the account entirely, but that its details are just wrong. Maybe the account name is misspelled, or the account number is incorrect. In these cases, instead of going through the whole deletion or inactivation process, you can simply edit the existing account details. This is a quick fix that ensures your account information is accurate without impacting any of your financial data.

It’s the easiest route if the account is still active and in use but just needs a little sprucing up in terms of its description or numbers.

Handling Transactions and Data After Deletion: How To Delete A Bank Account From Quickbooks

So, you’ve finally axed that old bank account from your QuickBooks, good on ya! But hold up, it ain’t like the account just vanished into thin air. There’s still some cleanup to do, fam, to make sure your financial records are straight outta Compton, you feel? We gotta talk about what happens to all those transactions and how it messes with your reports.Deleting an account can be a bit of a mind-bender if you don’t know what you’re doing.

It’s like deleting your ex from your Insta feed – the pics are gone, but the memories (and the drama) might still linger if you ain’t careful. We’re gonna break down how to deal with the leftover receipts, how your fancy financial statements will look, and how to keep your other accounts on the straight and narrow.

Managing Historical Transactions from a Deleted Bank Account, How to delete a bank account from quickbooks

Even though the account is gone from your active list, QuickBooks doesn’t just yeet all the transaction data into the void. It’s still there, lurking in the background, which is kinda creepy but also kinda useful. Think of it like finding old photos of your ex – they’re not in your current life, but you can still dig ’em up if you need to remember something.When you delete a bank account, QuickBooks typically reassigns any uncleared transactions to a default account, often the “Opening Balance Equity” account.

This is done to prevent data loss and maintain the integrity of your overall financial picture. For cleared transactions, they remain attached to the deleted account’s historical record, meaning they won’t disappear entirely from your audit trail, but they won’t be actively linked to an account you can see or work with.

For cleared transactions from a deleted account, QuickBooks preserves their historical data. This ensures that your audit trail remains intact, even though the account itself is no longer visible in your active chart of accounts.

If you need to access or reference these old transactions, you might have to get a bit creative. It’s not as simple as clicking on a live account. You might need to run historical reports that include deleted accounts or, in some cases, consult with a QuickBooks ProAdvisor if the data is critical and hard to retrieve. The goal is to have a clear understanding of what happened financially, even if the account is no longer part of your daily operations.

Impact of Account Deletion on Reports and Financial Statements

Deleting a bank account definitely shakes things up in your reports, fam. It’s like removing a player from your fantasy league – the whole game changes, and you gotta adjust your strategy. Your Balance Sheet will look different, your Profit and Loss statements might show some weird shifts, and your bank reconciliation will be a whole new ballgame.Here’s the lowdown on how your financial statements will get a makeover:

- Balance Sheet: The deleted bank account’s ending balance will no longer appear as an asset. This will directly affect your total assets and potentially your equity, depending on how the opening balance was handled. The “Opening Balance Equity” account might see a temporary increase or decrease to balance things out.

- Profit and Loss (P&L) Statement: Transactions that were previously categorized under the deleted bank account and impacted your P&L will still be reflected in historical P&L reports for the periods they occurred. However, for current and future reporting periods, these transactions will not be part of any ongoing account activity. If reclassification was done, the P&L will reflect the new categorization.

- Bank Reconciliation Reports: You won’t be able to reconcile the deleted account anymore, obviously. Any outstanding transactions that were previously associated with it might now appear in the “Opening Balance Equity” or another default account, and you’ll need to manage those.

- Audit Trail: While the account is gone, the audit trail for transactions that occurred within it is usually preserved. This means you can still see who did what and when, which is crucial for compliance and tracking.

It’s super important to run reportsbefore* you delete the account to have a baseline. That way, you can compare and see exactly what changed.

Reconciling Remaining Accounts to Ensure Data Integrity

After you’ve yeeted that old account, you gotta make sure your other bank accounts are still vibing correctly. It’s like making sure your crew is still solid after one of your homies moves away. You don’t want any of your other financial accounts looking sus or throwing off your whole money game.The main goal here is to make sure your QuickBooks balances still match your actual bank statements for all youractive* accounts.

This process, known as bank reconciliation, is your BFF for spotting any weirdness that might have popped up after the deletion.Here’s how to keep your remaining accounts on point:

- Review Reassigned Transactions: Check the “Opening Balance Equity” account (or wherever QuickBooks moved those uncleared transactions). See if these reassignments make sense. You might need to re-categorize them to the correct accounts if they were meant to be expenses or income that should be tracked elsewhere.

- Perform Standard Reconciliations: For every other bank account that’s still active in QuickBooks, go through the usual reconciliation process. Compare the transactions in QuickBooks with your bank statements. Look for any discrepancies, especially if they seem related to the timing of the deleted account’s transactions.

- Investigate Discrepancies: If you find differences, dig deep. Sometimes, a transaction that was cleared in the deleted account might have caused a ripple effect. Use the audit trail to trace back any suspicious entries.

- Adjust as Necessary: If you find errors, make the necessary adjustments in QuickBooks. This could involve editing transaction amounts, dates, or categories. The key is to get everything to match your bank statements exactly.

Keeping your reconciliations tight is the ultimate flex for ensuring your QuickBooks data is legit. It’s the final boss of making sure everything is on the up and up after you’ve cleared out old accounts.

Visualizing the Process: Interface Elements and Navigation

So, you wanna ditch a bank account in QuickBooks? Gotta know what you’re looking at, right? This section breaks down how the screens look and where to click, so you don’t get lost in the digital maze. It’s all about making sure you’re in the right spot before you hit that delete button.Navigating through QuickBooks, whether it’s the online version or the desktop software, has its own vibe.

Each platform has its own way of presenting information, and understanding these visual cues is key to a smooth operation. We’ll check out what the screens typically show and the paths you gotta take to get to where you need to be.

QuickBooks Online Bank Account Settings Appearance

In QuickBooks Online, when you’re poking around your bank account settings, it’s usually pretty clean and straightforward. You’ll find a list of your connected accounts, and each one has its own little hub. Think of it like a digital dashboard for each bank.When you click on a specific bank account to manage it, you’ll often see a screen with the account name, type, and sometimes the last four digits of the account number.

There are usually tabs or sections for things like Chart of Accounts, Transaction lists, and Settings. To get to the actual deletion option, you’ll typically look for a gear icon or a dropdown menu labeled “Actions” or “Edit” right next to the account name in the list or on its dedicated settings page. It’s designed to be pretty intuitive, so you can spot the options easily.

QuickBooks Desktop Menu Pathways for Bank Account Management

For those rocking the desktop version, the journey to managing bank accounts is a bit more traditional, like navigating through a classic software interface. You’ll be clicking through menus rather than just pointing and clicking on a dashboard.Here’s the typical drill to get to your bank account management section:

- Start by heading to the top menu bar.

- Click on “Lists.”

- From the dropdown menu, select “Chart of Accounts.” This is where all your financial accounts, including your bank accounts, are listed.

- Once you’re in the Chart of Accounts, find the bank account you want to remove.

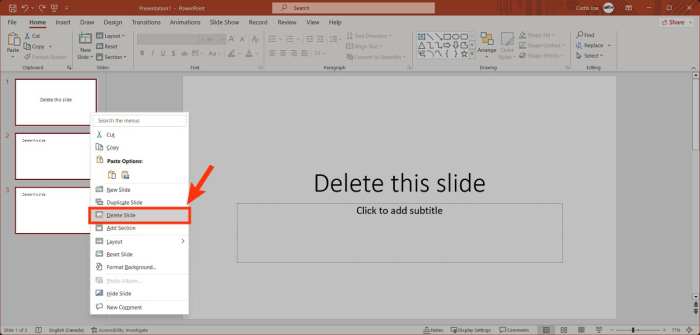

- Right-click on the specific bank account.

- A context menu will pop up. Look for the option that says “Delete Account.”

It’s a direct path, but you gotta know the right menu names to find it.

Visual Cues for Successful or Unsuccessful Bank Account Removal

Knowing if you actually got rid of that bank account is crucial. QuickBooks gives you visual feedback, so you’re not left guessing.After you’ve gone through the deletion process, keep an eye out for these signals:

- Successful Deletion: The most obvious sign is that the bank account will simply disappear from your list of accounts, whether that’s in the Chart of Accounts (Desktop) or the Banking section (Online). You won’t see it anymore when you’re looking at your active accounts. You might also get a confirmation message pop up saying the account has been deleted.

- Unsuccessful Deletion: If the account is still hanging around in your lists, that’s a clear indicator it wasn’t deleted. Sometimes, QuickBooks might prevent deletion if there are still uncleared transactions or if it’s the last active bank account. In such cases, you might see an error message explaining why it couldn’t be removed, or the “Delete Account” option might be greyed out.

Closing Summary

As we conclude this exploration, remember that the act of removing a bank account from QuickBooks is not an ending, but a transition. It’s about harmonizing your digital ledger with the physical flow of your finances, ensuring clarity and truthfulness in every entry. By diligently following these steps and considering the alternatives, you cultivate a financial environment that is both robust and responsive, empowering you to navigate your economic journey with newfound confidence and peace of mind.

Q&A

What happens to past transactions if I delete a bank account?

When a bank account is deleted, its associated transactions are typically removed from the active transaction list. However, QuickBooks often retains historical data for reporting purposes, though direct editing or re-linking becomes impossible. It is crucial to ensure all historical data has been properly accounted for or archived before deletion.

Can I recover a deleted bank account in QuickBooks?

Generally, recovering a directly deleted bank account within QuickBooks is not possible without restoring from a backup made prior to the deletion. It is always recommended to back up your QuickBooks data before performing significant actions like account deletion.

Is it better to delete or inactivate a bank account?

Inactivating a bank account is often preferred if the account is no longer in use but you wish to retain its historical data for reference or tax purposes. Deleting an account permanently removes it and its associated transaction history from the active view, which might be suitable for accounts that were added in error and have no transactions.

What are the risks of leaving an old bank account connected?

Leaving an old or disconnected bank account connected can lead to reconciliation errors, duplicate transactions, and confusion in your financial reporting. It can also create a false sense of available funds or obscure the true financial standing of your business.

How do I ensure all transactions are handled before deleting?

Before deleting, ensure all transactions for the account are reconciled up to the last statement. If the account is closed, make sure any outstanding checks have cleared or been voided, and that any pending transactions are accounted for either by manual entry or by closing the account in a reconciled state.