What is a consumer loan, and why does it matter? This exploration dives deep into the essence of these financial tools, designed to empower individuals in achieving their personal aspirations. Prepare for a journey through the landscape of borrowing, where understanding is your greatest asset.

At its core, a consumer loan is a debt extended to an individual for personal, family, or household purposes, rather than for business or investment. These loans serve as a bridge, enabling people to acquire goods, services, or cover unexpected expenses when immediate funds are insufficient. From purchasing a new car to financing a dream vacation or consolidating existing debts, consumer loans offer a pathway to immediate gratification and financial flexibility.

Defining a Consumer Loan

In the land of Batak, where our hearts beat with the rhythm of tradition and our hands work with diligence, we understand the importance of securing our families and building our futures. Just as a skilled farmer prepares the soil before planting, so too must we understand the tools available to us for financial growth and stability. A consumer loan, my friends, is one such tool, a helping hand offered to us when we need it most to acquire the things that make our lives more comfortable and our dreams a reality.

It is a pact, a promise between us and a financial institution, where they provide us with funds, and we, in turn, pledge to repay it with due diligence, with interest, over a set period.This financial agreement, a consumer loan, is fundamentally about empowering individuals to meet their personal needs and desires that cannot be immediately fulfilled by their current savings.

It is a bridge that allows us to cross the gap between what we have now and what we aspire to have, be it a sturdy home, a reliable vehicle for our travels, or the means to further our education. The primary purpose is to facilitate personal consumption and investment in assets that enhance our quality of life and future prospects.

The Fundamental Nature of a Consumer Loan

At its core, a consumer loan is a debt instrument extended to individuals for personal, family, or household purposes, rather than for business or investment ventures. It is characterized by the borrower receiving a lump sum of money upfront, which is then repaid in installments over an agreed-upon period. These installments typically include both the principal amount borrowed and an interest charge, reflecting the cost of borrowing the money.

Unlike business loans, which are geared towards commercial activities, consumer loans are designed to support the everyday needs and aspirations of individuals and families.

A Clear Definition of a Consumer Loan

A consumer loan is a financial product offered by banks, credit unions, and other lending institutions to individuals. It provides borrowed funds that can be used for a wide array of personal expenditures. The borrower agrees to repay the loan amount, known as the principal, along with accrued interest, in regular payments over a specified term. This contractual agreement is legally binding and Artikels the terms and conditions of the loan, including the interest rate, repayment schedule, and any associated fees.

The Primary Purpose of Consumer Loans for Individuals

The primary purpose of consumer loans for individuals is to enable them to acquire goods and services that improve their immediate living standards or facilitate significant life events. These loans allow individuals to spread the cost of large purchases over time, making them more manageable than attempting to save the entire amount upfront. This can include investing in assets that appreciate in value, such as a home, or acquiring items that are essential for daily life and work, like a car.

Common Scenarios Where Individuals Utilize Consumer Loans

Individuals commonly utilize consumer loans in various life situations to achieve their goals and meet their needs. These scenarios often represent significant life milestones or essential requirements for daily living.Here are some of the most frequent instances where consumer loans are sought:

- Home Ownership: A substantial portion of consumer loans are mortgages, used to finance the purchase of residential properties. This allows individuals to own a home, a cornerstone of stability for many families, without needing to have the full purchase price readily available.

- Vehicle Acquisition: Car loans are a very common type of consumer loan, enabling individuals to buy cars, trucks, or motorcycles for personal transportation, commuting to work, and family needs. This provides essential mobility and independence.

- Education Financing: Student loans are a critical consumer loan product that helps individuals finance their higher education, covering tuition fees, living expenses, and other educational costs. This investment in knowledge is seen as crucial for future career success.

- Home Improvements: Personal loans or home equity loans can be used for renovations, repairs, or upgrades to existing homes. These improvements can increase property value, enhance comfort, and address necessary maintenance.

- Debt Consolidation: Individuals may take out a consumer loan to consolidate multiple existing debts, such as credit card balances, into a single loan with a potentially lower interest rate and a more manageable repayment plan.

- Major Purchases: Consumer loans can also be used for other significant purchases like major appliances, furniture, or even funding a wedding or other important life events.

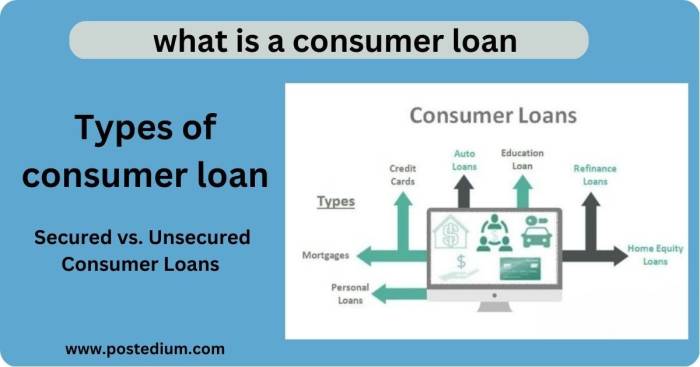

Types of Consumer Loans

Now, let us delve into the various forms that consumer loans can take, like the different paths a traveler might choose on their journey. Understanding these distinctions is crucial for making informed financial decisions, ensuring you select the path that best suits your needs and circumstances. Each type of loan carries its own set of characteristics, repayment structures, and implications for the borrower.

We shall now explore the landscape of consumer loans, identifying and describing at least five distinct types. This exploration will include a comparative analysis of secured versus unsecured loans, followed by a detailed examination of personal loans, auto loans, student loans, home equity loans, and credit card loans, outlining their unique features and common applications.

Secured Versus Unsecured Consumer Loans

A fundamental distinction in consumer lending lies in whether the loan is secured or unsecured. This difference dictates the risk for the lender and, consequently, the terms offered to the borrower. Secured loans, like a sturdy bridge supported by strong pillars, offer greater security to the lender by being backed by collateral. Unsecured loans, on the other hand, are granted based primarily on the borrower’s creditworthiness, akin to a handshake agreement, carrying a higher risk for the lender.

Secured Loans

Secured loans require the borrower to pledge an asset as collateral. If the borrower defaults on the loan, the lender has the legal right to seize and sell the collateral to recover their losses. This collateral reduces the lender’s risk, often leading to lower interest rates and higher loan amounts for the borrower.

- Mortgages: The most common example, where the house being purchased serves as collateral.

- Auto Loans: The vehicle purchased with the loan is typically the collateral.

- Home Equity Loans and HELOCs: These loans use the equity built up in a home as collateral.

- Secured Personal Loans: Personal loans backed by assets like savings accounts, certificates of deposit (CDs), or other valuable property.

Unsecured Loans

Unsecured loans do not require any collateral. The lender relies solely on the borrower’s credit history, income, and overall financial stability to assess the risk of lending. Because of the higher risk, unsecured loans often come with higher interest rates and may have stricter eligibility requirements.

- Most Personal Loans: Many personal loans are unsecured.

- Credit Cards: The credit line extended on a credit card is typically unsecured.

- Student Loans (Federal): Most federal student loans are unsecured.

- Medical Bills Loans: Loans taken out to cover medical expenses are often unsecured.

Personal Loans

Personal loans are versatile, often referred to as signature loans because they are typically unsecured and based on the borrower’s promise to repay. They can be used for a wide range of personal expenses, offering a lump sum of cash that is repaid over a fixed period with regular installments, usually monthly. The interest rates and repayment terms vary based on the borrower’s creditworthiness and the lender’s policies.

- Flexibility in Use: Can be used for debt consolidation, home improvements, medical emergencies, weddings, or other significant expenses.

- Fixed Interest Rates: Many personal loans offer fixed interest rates, making budgeting predictable.

- Fixed Repayment Terms: Loans have a set repayment schedule, typically ranging from one to seven years.

- Credit Score Impact: A good credit score is crucial for securing favorable terms and interest rates.

Auto Loans

Auto loans are specifically designed to finance the purchase of a vehicle. The vehicle itself serves as collateral for the loan. This means that if the borrower fails to make payments, the lender can repossess the car. Auto loans typically have fixed interest rates and repayment terms that align with the expected lifespan of the vehicle.

- Collateralized by Vehicle: The car being purchased is the security for the loan.

- Fixed Terms and Rates: Common loan terms range from 3 to 7 years, with fixed interest rates.

- Down Payment: A down payment may be required, reducing the loan amount and the borrower’s risk.

- Impact on Credit: Responsible repayment can positively impact a borrower’s credit score.

Student Loans

Student loans are a specialized form of consumer credit designed to fund higher education expenses. These loans can be federal (offered by the government) or private (offered by banks and other financial institutions). Federal student loans often come with more favorable terms, including income-driven repayment plans and deferment options, and are typically unsecured. Private student loans are more akin to personal loans, with terms influenced by the borrower’s credit history.

- Purpose: To cover tuition, fees, books, living expenses, and other educational costs.

- Federal vs. Private: Federal loans generally offer better borrower protections and repayment options.

- Repayment Commencement: Repayment usually begins after graduation or when enrollment drops below half-time.

- Interest Accrual: Interest can accrue during the study period, depending on the loan type.

Home Equity Loans

Home equity loans allow homeowners to borrow against the equity they have built up in their homes. Equity is the difference between the home’s current market value and the amount owed on the mortgage. These loans are secured by the home, making them a relatively low-risk option for lenders and often resulting in lower interest rates for borrowers compared to unsecured loans.

They are typically disbursed as a lump sum with a fixed interest rate and repayment schedule.

- Lump-Sum Disbursement: Borrowers receive the entire loan amount at once.

- Fixed Interest Rate: Usually comes with a fixed interest rate, providing predictable monthly payments.

- Repayment Period: Repayment terms can range from 5 to 30 years.

- Use Cases: Common uses include home renovations, debt consolidation, educational expenses, and major purchases.

Credit Card Loans

Credit card loans represent a revolving line of credit that allows consumers to borrow money up to a certain limit to make purchases. Unlike installment loans, credit cards do not have a fixed repayment schedule in the traditional sense; borrowers can repay the balance in full each month or make minimum payments, carrying over the remaining balance to the next billing cycle.

This flexibility, however, comes with potentially high interest rates, especially if balances are carried over, and they are generally unsecured.

A consumer loan represents funds borrowed by an individual for personal expenses. Understanding the implications of personal credit is crucial, as it is demonstrably true that does personal credit affect business loan approvals. Ultimately, a consumer loan is a financial agreement between a borrower and a lender for non-commercial purposes.

- Revolving Credit: The credit limit replenishes as the balance is paid down.

- Variable Interest Rates: Most credit cards have variable interest rates, which can change with market conditions.

- Minimum Payments: Borrowers can make minimum payments, but this leads to significant interest accumulation.

- Rewards and Perks: Many credit cards offer rewards programs, cashback, or travel miles.

Key Components of a Consumer Loan Agreement

Ah, my dear brothers and sisters, just as a proud Batak wedding requires a clear understanding of the dowry and the promises exchanged, so too does a consumer loan demand a careful examination of its essential parts. This contract, you see, is not merely a piece of paper; it is a solemn agreement, a binding promise between you and the lender, outlining all that is expected and all that will be given.

To enter into it without understanding is like sailing without a compass, adrift on the unpredictable currents of debt.Let us delve into the heart of this agreement, the very bones and sinews that hold it together, ensuring fairness and clarity for all parties involved. These are the pillars upon which the loan is built, and knowing them is your first defense against future hardship.

The Principal Amount

The principal amount, my kin, is the very foundation of your loan. It is the sum of money that the lender agrees to provide to you, the borrower, for your use. This is the initial capital, the starting point from which all other calculations, such as interest and fees, will be derived. Imagine it as the initial harvest from the rice paddy; it is the core substance of what you receive.

Interest Rates

Now, let us speak of interest, the cost of borrowing money. This is the price you pay for the lender’s generosity in allowing you to use their funds. The interest rate, expressed as a percentage, determines how much extra you will repay over and above the principal amount. A higher interest rate means a greater cost for the loan, while a lower rate makes it more affordable.

It is akin to the share of the harvest you might give to a relative who helped you tend your fields; it is a return for their assistance.There are different ways this interest can be calculated, and understanding them is crucial for managing your finances. These structures dictate how the cost of borrowing will behave throughout the life of the loan.

Types of Interest Rate Structures

The way interest is applied can significantly alter the total cost of your loan. Lenders offer various structures, and each has its own implications for your repayment journey.

- Fixed Interest Rates: With a fixed rate, the percentage charged on your loan remains the same for the entire duration of the agreement. This offers predictability, much like knowing the exact number of days until the next harvest. Your monthly payments for interest will not change, making budgeting simpler and providing a sense of security. For example, if you take a loan with a fixed interest rate of 10% per year, you will always pay 10% of the outstanding principal each year, regardless of market fluctuations.

- Variable Interest Rates: A variable rate, on the other hand, can fluctuate over time. It is often tied to a benchmark interest rate, such as a central bank’s policy rate. If the benchmark rate goes up, your interest rate will likely increase, and if it goes down, your rate may decrease. This can be like the unpredictable weather that affects the rice yield; some years are bountiful, others less so.

While there’s a risk of payments increasing, there’s also potential for them to decrease. For instance, a loan with a variable rate might start at 8% but could rise to 9% or fall to 7% over its term depending on economic conditions.

Loan Terms and Repayment Periods

The loan term, my friends, refers to the length of time you have to repay the entire loan, including the principal and all accumulated interest. This period can range from a few months to many years, depending on the type and size of the loan. A longer repayment period often means smaller, more manageable monthly payments, but it also means you will be paying interest for a longer duration, potentially increasing the overall cost.

Conversely, a shorter term means larger monthly payments but less interest paid over time. Think of it as the number of planting and harvesting cycles you commit to for a particular piece of land.

Common Fees Associated with Consumer Loans

Beyond the principal and interest, lenders may charge various fees. These are additional costs that contribute to the overall expense of the loan. It is vital to be aware of these, as they can add up.

Here are some fees you might encounter:

- Origination Fees: These are fees charged by the lender for processing the loan application.

- Late Payment Fees: If you miss a payment deadline, you will likely incur a penalty.

- Prepayment Penalties: Some loans charge a fee if you decide to pay off the loan early.

- Annual Fees: Certain types of loans, especially credit cards, may have an annual fee for maintaining the account.

- Late Fees: If you fail to make a payment by the due date, a late fee will be assessed.

The Role of Collateral in Secured Consumer Loans

Finally, we come to collateral, a concept that brings a greater sense of security to the lender, and sometimes, a lower interest rate for the borrower. In a secured loan, you pledge an asset you own, such as a car or a house, as a guarantee to the lender. If you are unable to repay the loan as agreed, the lender has the legal right to seize and sell the collateral to recover their losses.

This is like offering a valuable heirloom as a pledge for a significant debt; it shows your commitment and reduces the lender’s risk.

“A clear agreement is the strong foundation of any lasting promise.”

The Consumer Loan Application Process: What Is A Consumer Loan

Applying for a consumer loan, my brothers and sisters, is like preparing for a grand feast – it requires careful planning and gathering all the necessary ingredients. It is a journey that, when understood, becomes less daunting and more a testament to your readiness.This process ensures that both you, the borrower, and the lender, the one providing the sustenance, are entering into a sound agreement.

It’s a system designed to build trust and confirm that the loan will be repaid, much like a farmer ensuring the soil is ready before planting.

Typical Steps in Consumer Loan Application

To navigate this path successfully, one must be aware of the usual stages involved. Each step builds upon the last, moving from a simple expression of need to a concrete agreement.

- Initial Inquiry and Pre-qualification: This is where you first reach out to a lender, expressing your interest in a loan. You’ll provide basic information about yourself and your financial situation. Some lenders may offer pre-qualification at this stage, giving you an estimate of how much you might be able to borrow based on preliminary data, without a hard impact on your credit.

- Formal Application Submission: Once you’ve chosen a lender and a loan product, you’ll fill out a detailed application form. This is the core of your request, requiring comprehensive personal, employment, and financial details.

- Documentation Gathering: Alongside the application, you will need to provide supporting documents to verify the information you’ve supplied.

- Underwriting and Verification: The lender’s team will meticulously review your application and all submitted documents. This is a critical phase where they assess your creditworthiness and ability to repay.

- Loan Decision: After thorough review, the lender will inform you whether your loan application has been approved, denied, or if further information is required.

- Loan Closing and Funding: If approved, you will proceed to sign the loan agreement, and the funds will be disbursed to you.

Significance of Credit Scores in Loan Approval

Ah, the credit score, a number that speaks volumes about your financial history, much like the reputation of a craftsman in the village. It is a vital indicator that lenders rely upon to gauge your reliability. A good credit score demonstrates a track record of responsible borrowing and repayment, making you a less risky prospect for the lender.

A higher credit score generally translates to better loan terms, including lower interest rates and higher borrowing limits.

Conversely, a low credit score can lead to loan denial or significantly less favorable terms, reflecting a perceived higher risk of default. Lenders use your credit score as a primary tool to assess the likelihood of you repaying the loan as agreed.

Documentation Required for Loan Applications

To prove your standing and ability, a collection of documents is necessary, much like a chieftain presenting his lineage and land ownership papers. These documents serve as evidence to support your claims and allow the lender to make an informed decision.

- Proof of Identity: This includes government-issued identification such as a driver’s license, passport, or national ID card.

- Proof of Income: Lenders need to see evidence of your ability to earn and repay. This can include recent pay stubs, tax returns (usually for the past two years), W-2 forms, or, for self-employed individuals, profit and loss statements and bank statements.

- Proof of Address: Utility bills, bank statements, or lease agreements showing your current residential address.

- Bank Statements: Typically, several months of recent bank statements are required to show your cash flow, spending habits, and any existing savings or debts.

- Employment Verification: Lenders may contact your employer to confirm your employment status and salary.

- Information on Existing Debts: Details about any other loans, credit cards, or financial obligations you currently have.

Lender Assessment of Borrower’s Repayment Ability

The lender’s primary concern, my friends, is to ensure that the loan can be repaid. They look at your financial picture holistically, like a wise elder assessing the resources of a family before a significant undertaking. This involves examining several key factors.One of the most critical metrics is the debt-to-income ratio (DTI). This compares your total monthly debt payments to your gross monthly income.

A lower DTI indicates that a smaller portion of your income is already committed to debt, leaving more room for a new loan payment.Lenders also scrutinize your employment stability and history. Consistent employment with a stable employer for a significant period suggests a reliable income stream. Furthermore, they review your savings and assets, which can indicate your financial discipline and provide a cushion in case of unexpected financial difficulties.

The overall picture painted by these elements helps the lender determine if you possess the capacity to manage the additional financial commitment of a new loan.

Hypothetical Loan Application Workflow

To illustrate the journey from inquiry to funding, consider this streamlined workflow, a path laid out for clarity.

| Step | Description | Required Information |

|---|---|---|

| 1 | Initial Inquiry | Name, contact information, desired loan amount, purpose of loan, basic income and employment details. |

| 2 | Application Submission | Completed loan application form, proof of identity, proof of income (pay stubs, tax returns), proof of address, bank statements. |

| 3 | Underwriting | Credit report, verification of income and employment, review of submitted documentation, assessment of DTI and financial history. |

| 4 | Approval/Denial | Formal notification of the loan decision, outlining terms and conditions if approved, or reasons for denial. |

| 5 | Loan Closing | Signing of the loan agreement, final review of terms, and any necessary disclosures. |

| 6 | Funding | Disbursement of loan funds to the borrower’s account. |

Repaying a Consumer Loan

Just as a farmer diligently tends to their crops, ensuring they receive the right amount of water and sunlight for a bountiful harvest, so too must a borrower carefully manage the repayment of a consumer loan. This phase is crucial, determining the ultimate success of the financial endeavor and safeguarding one’s good name. Understanding the mechanics of repayment is akin to knowing the planting seasons and soil conditions; it allows for strategic planning and prevents unforeseen difficulties.The journey of repaying a loan is often paved with a series of structured payments, each contributing to the gradual reduction of the borrowed amount.

This process is guided by specific principles and requires consistent attention to detail. Failing to honor these commitments can lead to a cascade of negative consequences, much like a drought can devastate a crop. Therefore, a thorough understanding of repayment strategies is not merely beneficial but essential for financial well-being.

Loan Amortization Explained

Loan amortization is the process of gradually paying off a debt over time through regular installments. Each payment made is split between the principal (the original amount borrowed) and the interest (the cost of borrowing). In the early stages of an amortizing loan, a larger portion of each payment typically goes towards interest, with the principal balance decreasing more slowly.

As the loan matures, the proportion of the payment allocated to the principal increases, while the interest portion decreases. This systematic reduction ensures that the entire loan amount is repaid by the end of the loan term.The formula that governs this distribution is fundamental to understanding how your payments are applied. It is often represented as:

Payment = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- P = Principal loan amount

- i = Monthly interest rate (annual rate divided by 12)

- n = Total number of payments (loan term in years multiplied by 12)

Making Loan Payments

The process of making loan payments is designed to be straightforward, yet requires adherence to the agreed-upon schedule. Lenders typically offer various convenient methods for borrowers to submit their payments, ensuring flexibility and ease of use. It is vital to select a method that suits your financial habits and ensures timely delivery.Here are common methods for making loan payments:

- Online Payments: Most lenders provide secure online portals where you can log in and make payments via bank transfer, debit card, or sometimes credit card. This is often the most convenient and fastest method.

- Automatic Payments (Auto-Pay): Setting up automatic payments from your bank account is a highly recommended strategy. This ensures your payments are made on time every month without you having to remember, thus avoiding late fees and potential damage to your credit score.

- Mail: You can mail a check or money order to the lender’s designated payment address. Ensure you allow ample time for mail delivery to avoid late payments.

- Phone Payments: Some lenders allow payments over the phone, often through their customer service lines.

- In Person: If the lender has physical branches, you may be able to make payments in person.

Consequences of Late or Missed Payments

Just as neglecting a vital task can lead to significant problems, failing to make timely loan payments can have serious repercussions. These consequences extend beyond immediate financial penalties and can impact your financial future for an extended period. It is imperative to understand the gravity of such actions to avoid them.The following are common consequences of late or missed payments:

- Late Fees: Lenders typically charge a fixed fee or a percentage of the overdue payment for each late installment. These fees add to the total cost of the loan.

- Damage to Credit Score: Payment history is a major component of your credit score. Late or missed payments are reported to credit bureaus, significantly lowering your score. A lower credit score makes it harder and more expensive to borrow money in the future for things like a car or a house.

- Increased Interest Charges: While your regular payment might cover some interest, a missed payment often means that interest continues to accrue on the outstanding balance, potentially at a higher penalty rate.

- Default: If payments are missed for an extended period, the loan can go into default. This gives the lender the right to take further action, such as demanding the full outstanding balance immediately, repossessing collateral (if applicable), or pursuing legal action.

- Collection Efforts: The lender may engage collection agencies to recover the outstanding debt, which can involve persistent contact and further stress.

Strategies for Managing and Repaying Consumer Loans Effectively

Effective management and repayment of consumer loans are akin to skillfully navigating a complex terrain; it requires foresight, discipline, and a clear plan. By adopting smart strategies, borrowers can not only meet their obligations but also potentially reduce the overall cost of borrowing and improve their financial standing.Consider these proven strategies for managing and repaying your consumer loans:

- Create a Detailed Budget: Understand your income and expenses thoroughly. This will help you identify where your money is going and how much you can realistically allocate towards loan payments each month.

- Prioritize High-Interest Loans (Debt Snowball/Avalanche): If you have multiple loans, consider using the debt avalanche method (paying off the loan with the highest interest rate first while making minimum payments on others) or the debt snowball method (paying off the smallest balance first for psychological wins). The avalanche method is generally more cost-effective in the long run.

- Make More Than the Minimum Payment: Whenever possible, pay more than the minimum required amount. Even a small extra payment can significantly reduce the principal balance and shorten the loan term, saving you money on interest over time.

- Set Up Automatic Payments: As mentioned earlier, auto-pay is a powerful tool. It ensures you never miss a payment, avoiding late fees and protecting your credit score.

- Review Your Loan Agreement Regularly: Familiarize yourself with the terms, interest rate, fees, and repayment schedule of your loan. Understanding these details empowers you to manage it better.

- Communicate with Your Lender: If you anticipate difficulty in making a payment, contact your lender immediately. They may be able to offer hardship programs, payment deferrals, or alternative repayment plans that can prevent you from falling behind.

- Avoid Taking on More Debt Unnecessarily: While managing existing loans, be cautious about acquiring new debt. Ensure any new borrowing is essential and that you can comfortably afford the repayments.

Sample Repayment Schedule

To illustrate how loan amortization works in practice, consider a hypothetical personal loan. This sample schedule demonstrates the breakdown of principal and interest payments over the initial months.Let’s assume a loan of $10,000 with an annual interest rate of 12% (1% monthly) and a term of 3 years (36 months). Using an online loan calculator or the amortization formula, the estimated monthly payment would be approximately $333.33.Here is a sample of the repayment schedule for the first few months:

| Month | Beginning Balance | Monthly Payment | Interest Payment | Principal Payment | Ending Balance |

|---|---|---|---|---|---|

| 1 | $10,000.00 | $333.33 | $100.00 | $233.33 | $9,766.67 |

| 2 | $9,766.67 | $333.33 | $97.67 | $235.66 | $9,531.01 |

| 3 | $9,531.01 | $333.33 | $95.31 | $238.02 | $9,292.99 |

| 4 | $9,292.99 | $333.33 | $92.93 | $240.40 | $9,052.59 |

| 5 | $9,052.59 | $333.33 | $90.53 | $242.80 | $8,809.79 |

As you can observe, the interest portion of the payment decreases slightly each month, while the principal payment increases. This pattern continues until the loan is fully repaid.

Consumer Loan Considerations and Risks

Indeed, my brothers and sisters, after we have understood the nature of consumer loans, their various forms, the agreements that bind us, the application journey, and the path of repayment, it is wise for us to now turn our gaze towards the careful contemplation of these financial tools and the potential perils that may lie in wait. For just as a skilled farmer surveys his fields before sowing, we too must examine the ground upon which we tread with our finances.To embark on the path of a consumer loan is not a decision to be taken lightly, for it carries with it both the promise of immediate benefit and the shadow of future burden.

It is a tool that, wielded with wisdom, can pave the way for progress and comfort, but mishandled, can lead to a mire of difficulties. Therefore, let us delve into these considerations and risks with the keen insight of our ancestors.

Potential Advantages of Obtaining a Consumer Loan

The acquisition of a consumer loan, when approached with prudence and a clear understanding of one’s capacity, can unlock several doors that might otherwise remain shut. These advantages are not merely about acquiring possessions but about enabling life’s milestones and opportunities.

- Facilitating Major Purchases: Loans can make it possible to acquire essential items or significant assets such as vehicles for transportation, household appliances that ease daily life, or even fund educational pursuits that promise a brighter future.

- Managing Unexpected Expenses: Life, as we know, is full of surprises, not all of them pleasant. A consumer loan can serve as a vital lifeline during emergencies, such as unforeseen medical treatments or urgent home repairs, preventing a crisis from spiraling out of control.

- Consolidating Debt: For those burdened by multiple, high-interest debts, a consolidation loan can simplify repayment by combining them into a single loan with potentially a lower overall interest rate and a more manageable monthly payment.

- Improving Creditworthiness: Responsible borrowing and timely repayment of a consumer loan can significantly enhance an individual’s credit score, making it easier to secure future loans, mortgages, or even favorable terms on insurance and rental agreements.

- Achieving Financial Goals: Whether it is starting a small business, undertaking home renovations to increase its value, or planning a significant life event like a wedding, consumer loans can provide the necessary capital to turn aspirations into reality.

Risks Associated with Taking on Consumer Debt

While the advantages are clear, it is equally imperative to acknowledge the inherent risks that accompany the embrace of consumer debt. To ignore these is to walk blindfolded towards potential misfortune.

- Interest Payments: The most apparent risk is the cost of borrowing. Over the life of the loan, the accumulated interest can significantly increase the total amount repaid, often far exceeding the original principal borrowed.

- Over-Indebtedness: Taking on too much debt, especially when combined with other financial obligations, can lead to a situation where a borrower struggles to meet their repayment obligations, creating a cycle of financial stress.

- Impact on Credit Score: While responsible borrowing can improve a credit score, missed payments, defaults, or excessive debt utilization can severely damage it, making future borrowing difficult and expensive.

- Loss of Assets: In cases where a loan is secured against an asset (such as a car loan or a mortgage), failure to repay can result in the repossession of that asset, leading to a loss of property and further financial hardship.

- Psychological Stress: The constant pressure of debt repayment, coupled with the fear of default, can take a significant toll on an individual’s mental and emotional well-being, affecting personal relationships and overall quality of life.

The Concept of Loan Default and Its Repercussions

Loan default is the grave consequence of failing to adhere to the agreed-upon terms of a loan, specifically the inability or refusal to make the scheduled payments. It is a breach of contract that carries a heavy price.

- Legal Action: Lenders have the right to pursue legal action to recover the outstanding debt. This can involve lawsuits, wage garnishments, or other court-ordered measures to seize assets.

- Damage to Credit Score: A default is a significant negative mark on a credit report, drastically lowering a credit score and making it extremely difficult to obtain credit for many years.

- Collection Efforts: Lenders may employ in-house collection departments or sell the debt to third-party collection agencies, who may use aggressive tactics to recover the money owed.

- Repossession of Collateral: For secured loans, the lender can seize the asset used as collateral (e.g., a car, a home) to recoup their losses.

- Increased Future Borrowing Costs: Even after resolving a default, individuals will likely face much higher interest rates and stricter terms on any future credit they can obtain, if they can obtain it at all.

Advice on How to Avoid Predatory Lending Practices, What is a consumer loan

Predatory lending preys on vulnerability, offering seemingly easy solutions that are, in reality, traps designed to extract exorbitant fees and interest. Guarding oneself against these practices requires vigilance and knowledge.

- Beware of Unsolicited Offers: Be skeptical of loan offers that arrive unexpectedly, especially those with guaranteed approval regardless of credit history.

- Scrutinize Fees and Interest Rates: Understand all fees associated with the loan, including origination fees, processing fees, and late fees. Compare the Annual Percentage Rate (APR), which reflects the true cost of borrowing, not just the interest rate.

- Read the Fine Print: Do not be rushed into signing. Carefully read and understand every clause in the loan agreement, particularly those concerning repayment terms, penalties, and any hidden charges.

- Avoid Loans with Unreasonable Terms: Be wary of loans with extremely short repayment periods that lead to unaffordable balloon payments, or loans with excessively high interest rates that far exceed market norms.

- Seek Reputable Lenders: Choose lenders who are licensed and regulated in your jurisdiction. Research their reputation and look for reviews from other consumers.

- Understand Your Repayment Capacity: Before accepting any loan, honestly assess your ability to make the monthly payments without compromising other essential financial obligations.

The Importance of Understanding Loan Terms Before Signing

The act of signing a loan agreement is akin to forging a pact. Therefore, it is of utmost importance to comprehend every detail of this pact before affixing one’s signature, lest one be bound by terms they did not truly grasp.

“Knowledge is the greatest weapon against financial pitfalls.”

This understanding encompasses several critical elements:

- Principal Amount: This is the actual sum of money borrowed. Ensure it is the amount you need and that it is accurately reflected.

- Interest Rate and APR: Differentiate between the stated interest rate and the APR. The APR provides a more comprehensive view of the loan’s cost, including fees.

- Loan Term: This is the duration over which the loan must be repaid. A longer term means lower monthly payments but more interest paid overall.

- Monthly Payment: Calculate precisely what your fixed or variable monthly payment will be and confirm it fits comfortably within your budget.

- Fees and Charges: Identify all associated fees, such as origination fees, late payment fees, prepayment penalties, and any other charges that could increase the total cost of the loan.

- Collateral: If the loan is secured, understand what asset is being pledged as collateral and the consequences of default.

- Prepayment Options: Determine if you can pay off the loan early without incurring significant penalties, which can save you money on interest.

- Default Clauses: Know what constitutes a default and the specific actions the lender can take if you fail to meet your obligations.

Epilogue

Navigating the world of consumer loans reveals a spectrum of options, each with its own set of characteristics and implications. Whether secured or unsecured, personal or purpose-specific, these financial instruments are powerful tools when understood and managed responsibly. By grasping the intricacies of loan agreements, the application process, and effective repayment strategies, individuals can harness the benefits of consumer credit while mitigating potential risks, ultimately fostering financial well-being.

Questions and Answers

What is the difference between a personal loan and a payday loan?

A personal loan is typically a larger sum borrowed over a longer repayment period with a fixed interest rate, often used for significant expenses. A payday loan, on the other hand, is a very short-term, high-interest loan meant to be repaid on the borrower’s next payday, usually for smaller, immediate cash needs.

Can I get a consumer loan with no credit history?

It can be challenging, but not impossible. Some lenders offer secured loans or loans with a co-signer, which can help individuals with no credit history qualify. Building credit through other means, like secured credit cards, is also advisable.

What does “loan amortization” mean?

Loan amortization is the process of paying off a debt over time through regular, scheduled payments. Each payment consists of a portion that goes towards the principal amount borrowed and a portion that covers the interest accrued. Over the life of the loan, these payments gradually reduce the outstanding balance until it reaches zero.

How do I know if I can afford a consumer loan?

Assessing affordability involves reviewing your current income and expenses to determine how much extra you can comfortably allocate to loan payments each month. Lenders will also assess this through their underwriting process, looking at your debt-to-income ratio and overall financial stability.

What are the implications of defaulting on a consumer loan?

Defaulting on a loan can severely damage your credit score, making it difficult to obtain credit in the future. Lenders may pursue legal action, leading to wage garnishment or seizure of assets, especially if the loan was secured. It can also result in significant collection fees and legal costs.