Can a bank statement be used as proof of address? This is a question many folks ponder when they need to show where they live for official stuff. It’s like having a little piece of paper that says, “Yep, this is where I hang my hat!” We’re gonna dive deep into how these bank statements can be your trusty sidekick for address verification, making sure you’ve got all the juicy details right from the start.

A bank statement, my friends, is more than just a list of your spending. It’s a document packed with important info that many institutions recognize as legit proof of where you reside. From your name and address to the bank’s official seal, it’s all there to confirm your domicile. We’ll explore the common situations where you might need this, like when you’re signing up for new services, dealing with landlords, or even going through government processes.

Think of it as a friendly handshake from your bank to the outside world, confirming your address with a smile!

Understanding the Role of a Bank Statement for Address Verification

A bank statement, often perceived as a mundane record of financial transactions, plays a surprisingly pivotal role in establishing an individual’s residential bona fides. In a world increasingly reliant on digital interactions and remote processes, the physical or digital manifestation of one’s banking activity serves as a tangible link to a confirmed domicile. This document, issued regularly by financial institutions, is more than just a ledger; it’s a cornerstone for numerous official verifications, acting as a quiet yet powerful guarantor of your stated address.The primary functions of a bank statement in official contexts revolve around its inherent reliability and the personal information it contains.

It acts as a self-authenticating document, backed by the reputation and regulatory oversight of the issuing bank. For many organizations, from government agencies to utility providers, verifying an applicant’s address is a crucial step in preventing fraud, ensuring accurate service delivery, and complying with legal requirements. The statement’s consistent issuance and the detailed information it presents make it an ideal tool for this purpose, offering a level of assurance that other less formal documents might lack.

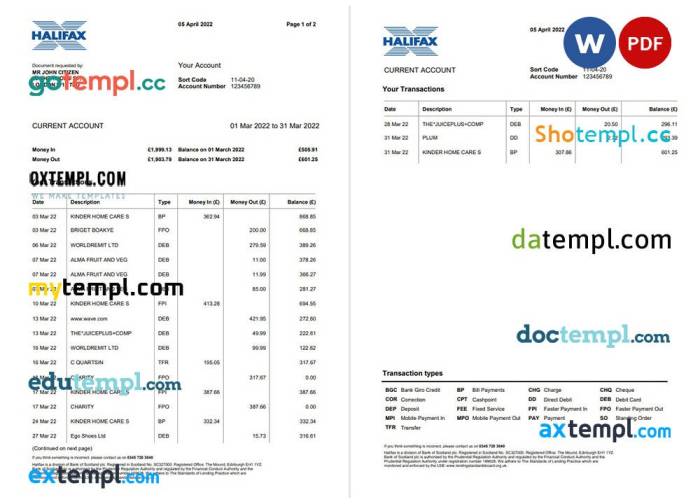

Information Present on a Bank Statement for Address Verification

A typical bank statement is a treasure trove of data, meticulously organized to provide a clear picture of an account holder’s financial life. However, for the specific purpose of address verification, certain elements are of paramount importance. These details are deliberately included by banks to serve this very function, making the statement a widely accepted form of identification.The essential information that makes a bank statement a valid proof of address includes:

- Full Name of the Account Holder: This confirms the identity of the individual.

- Residential Address: This is the most critical piece of information, clearly stating where the account holder resides. It must match the address provided in the application or request.

- Bank’s Name and Logo: This authenticates the issuer of the document.

- Account Number: While not directly related to the address, it is a unique identifier for the account.

- Statement Date or Issue Date: This indicates the recency of the document, as many institutions require a statement issued within a specific timeframe (e.g., the last three months).

- Transaction History: While the details of transactions are not usually the focus for address verification, their presence signifies an active account and a legitimate statement.

Common Scenarios Requiring Proof of Address

The need to provide proof of address arises in a multitude of everyday situations, often when establishing a new relationship with an institution or service provider. These instances underscore the importance of having readily available, up-to-date documentation like a bank statement.Individuals commonly need to present proof of address for the following reasons:

- Opening a New Bank Account: Financial institutions require this to comply with Know Your Customer (KYC) regulations.

- Applying for a Loan or Mortgage: Lenders need to confirm your residence for credit assessment and risk management.

- Setting Up Utilities: Electricity, gas, water, and internet providers require proof of address to establish service at a specific location.

- Registering for Government Services: This includes obtaining a driver’s license, registering to vote, or applying for social benefits.

- Renting or Purchasing Property: Landlords and real estate agents often request it as part of the application process.

- Obtaining a Mobile Phone Contract: Many telecommunication companies require it to verify your identity and address.

- Applying for Insurance: Whether it’s car, home, or health insurance, providers use address to calculate premiums and assess risk.

Key Elements Making a Bank Statement Reliable for Address Verification

The inherent structure and the nature of the issuing authority imbue bank statements with a significant degree of credibility when used as proof of address. These documents are not easily fabricated and are backed by stringent banking regulations, making them a preferred choice for many official purposes.The key elements that contribute to the reliability of a bank statement as proof of address are:

- Official Issuance by a Regulated Entity: Banks are highly regulated institutions. Their statements are official documents, and any misrepresentation could have severe legal and financial consequences for the bank, thus ensuring accuracy.

- Personalized Information: The statement contains your full name and a specific residential address, directly linking the document to you and your place of residence.

- Recency: Most institutions require statements issued within a recent period (e.g., 30-90 days). This ensures that the address provided is current and not outdated.

- Consistent Formatting and Design: While designs vary between banks, there’s a standard format and appearance that makes them recognizable. This consistency aids in quick verification by officials.

- Imprint of Financial Activity: The presence of transaction details, even if not read for address verification, signifies an active and legitimate account, lending further credibility to the document.

“A bank statement is a testament to your established presence, a verifiable anchor in the fluid landscape of identity.”

Requirements and Acceptability of Bank Statements as Proof of Address

When a bank statement is presented as a document to verify your residential address, it’s not just any random piece of paper. Institutions, whether financial, governmental, or private, have specific criteria to ensure the statement is legitimate and reliably reflects your current living situation. This scrutiny is crucial for preventing fraud and maintaining accurate records.The core principle is that the document must clearly and unambiguously link your name to a physical address.

It serves as an independent third-party confirmation of your residency. This is why the details presented on the statement are so important, and why variations in these details can lead to its rejection.

General Criteria for Acceptable Bank Statements

Financial institutions and other entities typically look for several key pieces of information on a bank statement to accept it as proof of address. These elements are designed to authenticate the document and its contents, ensuring it’s a valid and current representation of your residency. The aim is to provide a robust and verifiable link between the individual and the stated address.The general criteria include:

- Full Name: The statement must clearly display your complete legal name, matching the name on your application or identification.

- Residential Address: The address shown must be your current, physical residential address, not a P.O. Box or a business address unless specifically permitted for certain account types.

- Bank Name and Logo: The official name and logo of the issuing bank must be visible to confirm the source of the document.

- Date of Issue: The statement needs to be recent, typically issued within the last three months, to ensure it reflects your current address.

- Account Holder Information: While not always mandatory, details about the bank account itself (like account number, though often partially masked for security) can add to the statement’s authenticity.

- Transaction History (Optional but common): While the primary purpose is address verification, the presence of recent transactions helps confirm the statement is active and current.

Variations in Acceptance Policies

The acceptance of bank statements as proof of address is not uniform across all types of organizations. Each entity has its own set of regulations and risk assessments that dictate what documents they will accept. These policies are often influenced by the sensitivity of the service being provided and the potential for fraudulent activity.Utility companies, for example, often accept bank statements readily as they are accustomed to verifying residency for service provision.

Government agencies, particularly for applications requiring high levels of security or official registration, might have more stringent requirements, sometimes preferring official government-issued documents. Landlords, when screening tenants, may have a more flexible approach, but will still prioritize clear evidence of a stable address.The nuances in these policies mean that what is acceptable for opening a new mobile phone contract might not be sufficient for applying for a mortgage or a government benefit.

It is always advisable to check the specific requirements of the organization you are dealing with beforehand.

Common Requirements for Valid Proof of Address

To ensure your bank statement is likely to be accepted as proof of address, it needs to meet a set of common, standardized requirements. These are the fundamental checks that most organizations perform to validate the document.A bank statement is generally considered valid for address verification if it meets the following criteria:

- Issued within a Specific Timeframe: Most institutions require statements to be no older than 90 days. Some may accept older statements if accompanied by other supporting documents or if specific circumstances are explained.

- Original or Certified Copy: While many now accept clear digital copies or printouts, some may still insist on an original paper statement or a certified copy from the bank.

- Legible and Unaltered: The statement must be clear, easy to read, and show no signs of tampering or alteration. All essential details should be discernible.

- Full Statement, Not Just a Snippet: Typically, the entire statement showing the bank’s details, your name, address, and account activity is required, rather than just a summary page.

- Consistent Information: The name and address on the bank statement must precisely match the name and address provided in your application or on other forms of identification.

Digital Versus Physical Bank Statements

The digital age has brought about a shift in how financial documents are delivered and accepted. Both digital and physical bank statements can serve as proof of address, but their acceptability can vary. Physical Bank Statements:These are the traditional paper statements mailed by the bank. They are often seen as highly reliable because they are printed on official bank stationery and bear physical signatures or stamps (if applicable).

However, they can be lost in the mail, take time to arrive, and may require scanning or photocopying for submission to digital platforms. Digital Bank Statements:These are statements accessed and downloaded from the bank’s online portal or received via email. They are convenient and readily available. Many institutions now accept PDF versions downloaded directly from the bank’s website, provided they contain all the necessary security features (like watermarks or bank branding) and are clearly legible.

Some organizations might require a specific format or may ask for verification of the download source. It’s crucial that the digital file itself is not altered. For instance, a screenshot might be less acceptable than a properly downloaded PDF.

The key is not just the format, but the verifiable authenticity and clarity of the information presented.

Generating and Obtaining a Valid Bank Statement for Proof of Address

Securing a bank statement that accurately reflects your current address is a straightforward process, often involving a direct interaction with your financial institution or a few clicks through their digital platforms. This document, while seemingly mundane, serves as a crucial piece of evidence for many official purposes, underscoring the importance of obtaining it correctly. The key lies in understanding the options available and the specific details required by the entity requesting the proof.The type of statement you receive can vary, and choosing the right one ensures it meets the necessary criteria.

Whether you need a comprehensive overview of your account activity or a very specific period, your bank can accommodate your request. The method of delivery also offers flexibility, from traditional mail to instant digital downloads.

Requesting a Bank Statement from Your Financial Institution

Initiating the process to obtain a bank statement typically involves reaching out to your bank through their established channels. This is a fundamental step to procure the necessary documentation for address verification. The procedure is designed to be accessible, catering to various levels of technological comfort.The primary methods for requesting a statement include:

- Online Banking Portal: Most banks offer a secure online platform where you can manage your accounts. This is often the quickest and most convenient way to access and download statements.

- Mobile Banking App: Similar to the online portal, a bank’s mobile application usually provides access to account statements.

- In-Person Visit: Visiting a local branch allows you to speak directly with a teller or customer service representative who can assist you with your request.

- Telephone Banking: You can often request statements by calling your bank’s customer service line. Be prepared to verify your identity over the phone.

- Mail Request: Some banks may still allow or require a written request by mail, though this is less common for immediate needs.

When you contact your bank, be ready to provide specific information to facilitate the request. This ensures the bank can locate your account and generate the correct statement without delay.The essential information typically required includes:

- Your full name as it appears on the account.

- Your account number(s).

- Your date of birth.

- Your registered address (which should be the address you are trying to prove).

- The period for which you require the statement (e.g., the last month, the last three months).

- The reason for the request (e.g., “for proof of address”).

Types of Bank Statements Available

Financial institutions offer various types of statements, each serving different informational needs. For proof of address, the most common and generally accepted is the standard monthly statement, but other options exist depending on the specific requirements of the verifying party. Understanding these distinctions helps in selecting the most appropriate document.The common types of bank statements include:

- Monthly Statements: These are the most frequently issued and contain a summary of all transactions, deposits, withdrawals, and fees for a given month. They are almost universally accepted as proof of address.

- Specific Transaction History: If you need to show activity within a particular timeframe that doesn’t align with a full month, you can often request a custom transaction history. This might be for a specific week or a custom date range.

- Account Summary Statements: These provide a high-level overview of your account balances and recent activity without detailing every single transaction. While useful for some purposes, they may not always be sufficient for strict address verification.

- Year-End Statements: These consolidate account information for the entire tax year and are often used for tax purposes. They typically include your address.

For the purpose of proving your address, a standard monthly statement is usually the most suitable and readily available option. It clearly displays your name and the address where the statement was mailed or is electronically delivered.

Downloading and Printing a Bank Statement from an Online Banking Portal

Accessing and printing your bank statement through an online portal is a common and efficient method. This digital approach allows for immediate retrieval of the document, which can then be printed for submission. The process is generally intuitive, guided by the bank’s user interface.Here is a step-by-step procedure for downloading and printing a bank statement from a typical online banking portal:

- Log in to your Online Banking Account: Navigate to your bank’s official website and enter your username and password to access your secure online banking portal.

- Locate the Statements or Documents Section: Once logged in, look for a menu option or tab labeled “Statements,” “Documents,” “Account Activity,” or similar. This is where your past statements are usually stored.

- Select the Account: If you have multiple accounts, choose the specific account for which you need the statement.

- Choose the Statement Period: A list of available statements, often organized by month and year, will be displayed. Select the statement corresponding to the month and year that includes your current address.

- Download the Statement: Click on the statement you wish to view. It will typically open in a new tab or window, often in PDF format. Look for a download icon (usually an arrow pointing downwards) or a “Download” button. Click this to save the statement file to your computer.

- Open the Downloaded File: Navigate to the location where you saved the PDF file on your computer and open it using a PDF reader (like Adobe Acrobat Reader).

- Print the Statement: Ensure your printer is connected and functioning. From your PDF reader, go to “File” and select “Print.” Review the print settings to ensure the entire statement will be printed legibly. Click “Print.”

It is important to ensure that the printed statement clearly displays your name, address, the bank’s name and logo, and the date range of the statement. For many verification purposes, a physical, printed copy is preferred over a digital one.

The most reliable bank statements for proof of address are those that are official, current, and clearly display your name and residential address as registered with the bank.

Information on a Bank Statement Crucial for Address Verification

A bank statement is more than just a record of your financial dealings; it’s a document that, when presented correctly, can serve as a powerful testament to your identity and, crucially, your place of residence. For institutions requiring proof of address, the details meticulously laid out on a bank statement are examined with a discerning eye. Understanding which pieces of information are paramount ensures that your statement will be accepted without a hitch.The effectiveness of a bank statement as proof of address hinges on the presence and clarity of specific details.

These elements are not arbitrary; they are the building blocks that an verifying entity uses to confirm your identity and location. Let’s delve into the critical components that make a bank statement a reliable document for this purpose.

Account Holder’s Name and Address on the Statement

The most fundamental requirement for a bank statement to be accepted as proof of address is the clear and unambiguous display of the account holder’s full name and residential address. This information serves as the primary link between the individual and the stated location. Without this direct correlation, the document loses its primary function as verification.The name must precisely match the name of the individual requesting the service or account.

Any discrepancies, even minor ones, can lead to rejection. Similarly, the address listed must be the residential address that the individual is seeking to verify. This is typically a street address, including house or apartment number, street name, city, and postal code. P.O. boxes are generally not accepted as proof of residential address because they do not confirm a physical living location.

Statement Date and Period Covered

The date of the bank statement and the period it covers are vital for establishing the recency and validity of the address verification. Most institutions will specify a timeframe within which the statement must have been issued, typically within the last three to six months. This ensures that the address provided is current and not an outdated one.The statement date indicates when the document was generated, and the period covered shows the transactions that occurred during a specific billing cycle.

This dual information confirms that the address was associated with the account during that particular timeframe. A statement that is too old will not be considered relevant for current address verification.

Transaction History Reinforcing Address Linkage

While the primary focus is on the static information, the transaction history on a bank statement can, in fact, subtly reinforce the address linkage. Even a minimal transaction history, such as a direct deposit or a utility bill payment, shows activity at the stated address during the statement period. This demonstrates that the account holder is actively using the account, and by extension, residing at the address associated with it.The presence of transactions originating from or being sent to the verified address can provide secondary confirmation.

For instance, if a debit card transaction for a local grocery store appears on the statement, and that store is located in the same city as the stated address, it adds a layer of plausibility.

Bank’s Official Letterhead and Contact Information

The authenticity of a bank statement is paramount, and this is often conveyed through the bank’s official letterhead and contact information. A legitimate bank statement will always bear the distinctive branding of the financial institution, including its logo, name, and official address.Furthermore, the inclusion of the bank’s contact details, such as a customer service phone number or website, allows the verifying entity to independently confirm the legitimacy of the document if necessary.

This transparency is a crucial safeguard against fraudulent documents.

A bank statement’s efficacy as proof of address is directly proportional to the clarity, accuracy, and recency of the account holder’s name, residential address, and the statement’s issuance date, all presented on the bank’s official letterhead.

Potential Challenges and Alternatives for Proof of Address: Can A Bank Statement Be Used As Proof Of Address

While a bank statement is a widely accepted document for address verification, it’s not a universal solution. Several scenarios can arise where it might fall short, prompting the need for alternative documentation. Understanding these limitations and knowing your options is crucial for a smooth verification process.There are specific circumstances and common reasons why a bank statement might be deemed insufficient or outright rejected by institutions requiring proof of address.

Being aware of these pitfalls allows for proactive preparation and the selection of appropriate alternative documents.

Situations Where a Bank Statement May Not Suffice, Can a bank statement be used as proof of address

A bank statement’s suitability as proof of address can be compromised by its age, content, or the specific requirements of the verifying entity. For instance, many organizations stipulate that the document must be no older than three months. If your most recent statement is from six months ago, it will likely be rejected. Furthermore, some entities have very specific formatting requirements or may not accept digital copies, even if they are official PDF statements from the bank.

In cases where an applicant has recently moved, a bank statement might not reflect their current residential address if they haven’t yet updated it with their bank, or if the bank’s statement generation cycle doesn’t align with their move-in date.

Common Reasons for Bank Statement Rejection

Institutions often have stringent criteria to prevent fraudulent activity and ensure the validity of the address provided. Common reasons for rejection include:

- The statement is outdated, exceeding the acceptable age limit (typically 3-6 months).

- The address displayed on the statement does not precisely match the address provided in the application. Even minor discrepancies, like a missing apartment number or an incorrect street name spelling, can lead to rejection.

- The statement is not a clear, legible copy. Smudged ink, poor scanning quality, or cropping that obscures essential details can render it unusable.

- The document is not an original or a certified copy, if such a requirement is specified. While many institutions accept clear digital copies, some may still require physical originals.

- The statement shows a P.O. Box address instead of a residential address. Most verifications require a physical residential location.

- The statement does not contain the applicant’s full name, matching that on their identification.

Alternative Documents for Proof of Address

When a bank statement is not an option or is rejected, a range of other documents can serve as valid proof of address. These alternatives often provide similar levels of verification, confirming residency at a specific location.Here are several common types of alternative documents:

- Utility Bills: These are highly favored as they are issued regularly and directly link an individual to a specific address for essential services. Examples include electricity bills, gas bills, water bills, and landline telephone bills. Internet and cable bills are also frequently accepted. The key is that the bill must be recent (usually within 3-6 months) and clearly display the applicant’s name and current residential address.

- Government-Issued Documents: Official correspondence from government bodies is considered very reliable. This can include tax assessments, council tax bills, or letters from the Department for Work and Pensions (DWP). These documents typically bear the applicant’s name and address and are issued by trusted authorities.

- Rental Agreements or Leases: A signed and dated rental agreement or lease document is strong proof of residency. It explicitly states the tenant’s name and the property address for a specified period. Landlord-provided letters confirming tenancy can also be accepted in some cases, though a formal agreement is generally preferred.

- Mortgage Statements: For homeowners, a recent mortgage statement serves as excellent proof of address, clearly linking them to the property they own.

- Driver’s License or National Identity Card: While often used as primary identification, some institutions will accept a driver’s license or national identity card as proof of address if it contains the current residential address and is still valid. However, many require a separate document specifically for address verification, as the address on these documents might not be updated as frequently as utility bills.

- Other Official Correspondence: Depending on the institution’s policy, other official letters might be accepted. This could include correspondence from a registered doctor, dentist, or hospital, provided it is recent and clearly states the applicant’s name and address. Insurance policies for home or contents, also recent, can be another option.

Comparison of Bank Statements Versus Other Proof of Address Documents

Choosing the right document for address verification involves weighing the advantages and disadvantages of each option. A bank statement offers a good balance of accessibility and reliability, but other documents may be more suitable depending on individual circumstances and the verifying body’s specific requirements.Below is a comparative overview:

| Document Type | Pros | Cons |

|---|---|---|

| Bank Statement | Widely accepted by many institutions; readily available for most individuals with bank accounts; shows financial activity which can implicitly confirm residency. | Must be recent (typically 3-6 months); may not be accepted if address is newly updated or if digital copies are not permitted; some institutions may require specific formatting. |

| Utility Bill (Electricity, Gas, Water, Landline) | Highly reliable as it’s tied to essential services; issued regularly and usually reflects current address; generally accepted by most organizations. | Must be recent (typically 3-6 months); needs to be in the applicant’s name; may not be available for individuals living with others who pay the bills. |

| Government-Issued Document (Tax Bill, Council Tax) | Official and highly trustworthy; reflects official records of residency; often accepted without question. | May not be issued frequently enough to meet the recency requirement; specific types may not be universally recognized. |

| Rental Agreement/Lease | Directly confirms tenancy and address; legally binding document; good for new residents. | May not be accepted without a utility bill as supplementary proof; can be less common for long-term residents or homeowners. |

| Driver’s License/National ID | Convenient if already carried; can be used for multiple verification purposes. | Address may not be current; many institutions require a separate, more recent proof of address document; not all IDs display the address. |

Formatting and Presentation of a Bank Statement for Official Use

Navigating the submission of official documents can feel like deciphering a cryptic map, and a bank statement, while a powerful tool for address verification, is no exception. The way you present this crucial document can significantly influence its acceptance. A well-formatted and clearly presented statement speaks volumes, projecting an image of diligence and preparedness. Conversely, a haphazard submission can lead to unnecessary delays or outright rejection, turning a straightforward process into a bureaucratic hurdle.

Indeed, a bank statement often serves as a reliable proof of address, a crucial document when you’re considering if is credit union better than a bank for your financial needs. After all, the very same bank statement you use for verification can also reflect your choice in financial institutions.

It’s about ensuring the recipient can swiftly and confidently verify the information you’re providing.Ensuring your bank statement is presented in a manner that facilitates easy understanding and verification is paramount. This involves paying attention to the details, from the clarity of the scan to the completeness of the information displayed. Think of it as putting your best foot forward, ensuring that the official reviewing your document can do so without confusion or ambiguity.

This proactive approach minimizes potential misunderstandings and streamlines the entire verification process.

Best Practices for Presenting a Bank Statement

The objective when presenting a bank statement for address verification is absolute clarity. This means ensuring all essential details are legible and easily identifiable. A clean, well-organized presentation reduces the burden on the reviewing party and increases the likelihood of swift approval. It’s about making their job easier, which in turn makes your process smoother.Here are some key practices to adopt:

- Ensure the entire statement, including all pages, is scanned or photographed. Missing pages are a common reason for rejection.

- Use a scanner or a high-resolution camera to capture clear images. Blurry or pixelated documents are difficult to read and may be deemed invalid.

- If printing and scanning, ensure the print quality is excellent, with no smudged ink or faded text.

- Orient the document correctly. All pages should be upright and consistently aligned.

- Avoid any cropping that cuts off essential information, such as the bank’s logo, your name, address, or account details.

- If submitting a digital copy, save it in a universally accepted format like PDF or JPG.

Avoiding Common Errors in Bank Statement Submission

Mistakes in submitting bank statements often stem from overlooking crucial details or improper handling of the document. Being aware of these common pitfalls can save you considerable time and frustration. The goal is to present a document that is as error-free as possible from the outset.Common errors to steer clear of include:

- Submitting statements that are too old. Most institutions have a specific timeframe for acceptable statements (e.g., within the last three months).

- Providing statements with redacted or obscured information. While you might want to hide certain transaction details, essential identifying information must remain visible.

- Submitting a screenshot of online banking instead of a formal statement. These are often not accepted as official proof.

- Failing to include all necessary pages of the statement.

- Submitting a statement that does not clearly show your name and current address matching the details provided elsewhere.

Ideal Layout for a Scanned or Photographed Bank Statement

When submitting a bank statement digitally, the visual presentation is critical. A well-structured digital file ensures that the reviewer can quickly locate and verify the necessary information without having to hunt for it. This structured approach is particularly important for multi-page documents.The ideal layout for a scanned or photographed bank statement includes:

- Each page of the statement should be presented as a separate, clearly labeled file, or as sequential pages within a single PDF document.

- The first page should prominently display the bank’s header, your full name, and your complete current address.

- Subsequent pages should maintain a consistent orientation and clarity, allowing for easy readability of transaction details and balances.

- Ensure there is no glare or shadows obscuring any part of the document, especially when using a camera.

- If combining multiple images into a single document, ensure they are in the correct order and that the transitions between pages are seamless.

Checklist of Essential Information to Verify on a Bank Statement

Before you even think about submitting your bank statement, a thorough review is essential. This checklist serves as your final gatekeeper, ensuring that all critical pieces of information are present and accurate, thereby maximizing the chances of a smooth verification process.Verify the following essential information:

| Information to Verify | Description |

|---|---|

| Bank Name and Logo | Must be clearly visible and identifiable. |

| Your Full Name | Must match your legal name exactly. |

| Your Current Residential Address | Must be complete, including street, city, state, and zip code, and match the address you are providing elsewhere. |

| Account Holder Name(s) | If the account is joint, all names should be present. |

| Account Number | While sometimes masked for security, it should be present or partially visible as per bank policy. |

| Statement Date/Period | Clearly indicates the timeframe the statement covers. |

| Transaction Details (optional but often present) | While not always necessary for address verification, their presence confirms it’s a genuine statement. |

| Bank’s Contact Information | Often includes a phone number or website, which can add to the statement’s legitimacy. |

Closing Notes

So, there you have it, folks! A bank statement can indeed be a super handy tool for proving your address, as long as it’s got all the right bits and pieces. We’ve covered what makes it tick, what folks look for, and how to get your hands on a good one. Remember to always check with the specific place you’re submitting it to, ’cause sometimes they have their own little quirks.

But generally, a well-presented bank statement is a solid bet. Keep this info in your pocket, and you’ll be navigating address verification like a pro!

Clarifying Questions

Can I use a statement from a digital-only bank?

Yes, often you can! Many digital banks provide statements that are just as valid as those from traditional banks. The key is that the statement must contain your name, current address, and the bank’s official branding. You might need to download and print it from their app or website.

What if my bank statement is old?

Most organizations prefer bank statements that are recent, typically no older than three months. If your statement is too old, it might not be accepted. It’s always best to get the most current statement available.

Can I edit my bank statement before submitting it?

Absolutely not! Tampering with any official document, including a bank statement, is a serious offense and will likely lead to rejection and potential legal issues. Always submit the original or a true copy as provided by your bank.

What if my name is slightly different on my bank statement?

Minor discrepancies might be overlooked, but significant differences could cause problems. If your name is significantly different (e.g., a nickname vs. your legal name), it’s best to try and get a statement with your full, official name or provide additional documentation to link the names together.

Do I need to include all pages of my bank statement?

Generally, yes. While the front page usually contains your name and address, other pages might have transaction details or bank information that helps verify its authenticity. It’s safer to submit the entire statement as issued by the bank unless specifically instructed otherwise.