Is ECT covered by insurance? This is a crucial question for anyone considering electroconvulsive therapy (ECT). Navigating insurance policies for mental health care can be a real headache, especially with ECT, which often involves hefty costs. This guide breaks down the ins and outs of insurance coverage for ECT, covering everything from the basics of insurance to the specific factors that can influence coverage.

We’ll also share tips on how to handle potential claim denials and where to find help along the way.

Different insurance plans have different policies regarding ECT. Some plans might cover the procedure fully, while others might only partially cover it, or not at all. The specific coverage details depend on various factors, including the type of plan, the insurance provider, and the specifics of your case. Understanding these details is key to getting the treatment you need without breaking the bank.

Insurance Coverage Overview

Yo, fam! Insurance is like a safety net, but it ain’t free. It’s all about protecting yourself and your stuff from the unexpected. Different types of insurance cover different things, and the details can get kinda complex, but we’ll break it down so it’s easy to understand.Insurance is a contract between you and the company, where you pay a premium, and they promise to pay for certain losses or damages.

Think of it like buying a ticket to ride on a good life train. You gotta pay the fare, but if something goes wrong, you’re covered.

Types of Insurance Plans

Insurance comes in many flavors, from health insurance to car insurance. Health insurance is the most important one for most people, because it covers medical expenses. Supplemental insurance is like an extra layer of protection, adding more benefits to your health plan. There’s also life insurance, home insurance, and more, depending on your needs.

Common Elements of Insurance Policies

Every policy has key components. Deductibles are the amount you have to pay out of pocket before the insurance kicks in. Co-pays are fixed amounts you pay for certain services. Coverage limits set the maximum amount the insurance will pay for a specific issue. Understanding these elements is crucial to knowing what you’re getting into.

How Insurance Companies Determine Coverage

Insurance companies use a variety of factors to decide how much they’ll pay for medical procedures. Medical necessity, pre-existing conditions, and the specific treatment plan all play a role. They might also consider the provider’s reputation and the facility’s credentials. Essentially, they’re evaluating the cost and value of the care provided.

Table of Health Insurance Plans

| Plan Type | Deductible | Co-pay | Coverage for ECT |

|---|---|---|---|

| Bronze | $1,500 | $25 | Partial, typically requires pre-authorization |

| Silver | $2,000 | $15 | Partial, typically requires pre-authorization |

| Gold | $3,000 | $10 | Generally better coverage, potentially with lower pre-authorization requirements |

| Platinum | $5,000 | $5 | Excellent coverage, often with no pre-authorization requirements |

This table provides a general overview. Specific coverage can vary significantly between providers and plans. Always check the policy details for your specific situation.

ECT Procedure Details

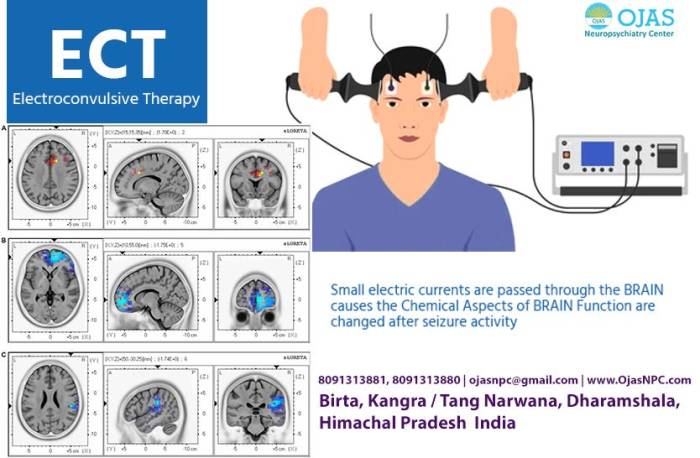

Yo, fam, this ain’t no joke. Electroconvulsive therapy, or ECT, is a serious treatment for mental health issues. It’s used when other methods just ain’t cutting it, and it can actually help a lot of people. Let’s break down the lowdown on how it works and the potential risks.ECT is a powerful treatment for severe mental illnesses, like major depression and bipolar disorder, that haven’t responded to other therapies.

It involves passing a controlled electric current through the brain to induce a seizure. This seizure is carefully monitored and brief, and is usually a short-term fix to help stabilize mood and symptoms.

ECT Procedure Overview

This process is pretty intense, but it’s done in a controlled environment with medical professionals watching closely. First, you’ll be given medication to relax and potentially put you to sleep (anesthesia). Then, electrodes are placed on your temples, and a small electric current is passed through your brain, triggering a seizure. This whole thing is quick, and you’ll be closely monitored throughout the procedure and after.

Risks and Side Effects

Like any medical procedure, ECT has risks and potential side effects. These can range from mild to more serious. Possible side effects include short-term memory problems, confusion, and headaches. Some people might experience nausea or muscle aches after the procedure. Long-term effects are rare but can sometimes include difficulty with learning and memory.

It’s crucial to discuss these risks with your doctor before undergoing treatment.

Steps Involved in Receiving ECT

Getting ECT treatment is a multi-step process that involves a team of medical professionals. Here’s a rundown:

- Initial Consultation: You’ll meet with a psychiatrist to discuss your symptoms, medical history, and the potential benefits and risks of ECT. They’ll evaluate if ECT is an appropriate treatment option for you.

- Medical Evaluation: You’ll undergo a physical examination and tests to ensure you’re healthy enough to undergo ECT. This includes blood tests and a review of your current medications.

- Pre-Treatment Planning: A team of medical professionals, including an anesthesiologist and psychiatrist, will work together to develop a personalized treatment plan. This plan will detail the frequency and duration of ECT sessions.

- ECT Procedure: The procedure itself is done under anesthesia. Electrodes are placed on your head, and a controlled electric current is passed through your brain. This induces a brief seizure.

- Post-Treatment Care: After the procedure, you’ll be closely monitored for any side effects. You might experience confusion or memory problems, so your care team will help you adjust.

- Follow-up Appointments: Regular follow-up appointments are crucial to monitor your progress and address any lingering issues.

Comparison of ECT to Other Treatments

This table compares ECT to other common mental health treatments, highlighting cost, potential side effects, and effectiveness. Remember, effectiveness varies greatly depending on the individual and the specific condition.

| Treatment Method | Cost | Side Effects | Effectiveness |

|---|---|---|---|

| ECT | Can be variable depending on insurance and location. May be higher than some other treatments. | Potential for short-term memory loss, confusion, headaches, nausea, muscle aches. Long-term effects are rare. | Generally highly effective for severe depression and other mental illnesses that haven’t responded to other treatments. |

| Medication | Variable, depending on the medication. May be covered by insurance. | Potential for side effects like nausea, drowsiness, weight gain, and others, depending on the specific medication. | Effective for managing symptoms of many mental health conditions, but may not be a cure for all. |

| Therapy (e.g., Cognitive Behavioral Therapy – CBT) | Generally lower cost than ECT. May be covered by insurance. | Potential for emotional distress during sessions, but side effects are generally less severe. | Effective for many mental health conditions, but may not be as effective for severe cases. |

| Lifestyle Changes | Low cost, or no cost. | Potential for emotional challenges and difficulties adapting. | Effective for improving mental health but may not be sufficient for severe conditions on its own. |

Insurance Coverage for ECT

Yo, fam, getting ECT can be a serious move, but you gotta know if your insurance will cover it. It’s a major procedure, so you need to be clued in on the ins and outs of your policy. This ain’t no joke; we’re talking about your health and your wallet.Insurance coverage for ECT is complex and varies wildly depending on the individual plan.

So, ECT’s insurance coverage is a bit of a grey area, right? It really depends on the policy, but if you’re after a rough idea of the out-of-pocket costs, checking out how much braces cost in Texas without insurance might give you a better handle on the potential financial hit. This article on Texan brace prices could help with that.

Ultimately, you’ll need to dig into your specific plan for a definitive answer on ECT coverage though.

Factors like your specific policy, the provider’s network, and the details of your treatment all play a huge role in whether or not ECT is covered. It’s not always a simple yes or no, so let’s dive into the gritty details.

Factors Influencing Insurance Coverage

Insurance companies often have specific criteria for approving mental health treatments. Factors like pre-authorization requirements, the type of provider, and the level of care required all come into play. Also, your insurance company may have a specific list of mental health professionals they approve.

Reasons for Denial or Limited Coverage

Insurance companies might deny or limit ECT coverage for various reasons. One common reason is that the treatment isn’t considered medically necessary or that it’s not part of the approved procedures for your plan. Another factor is if the provider isn’t in-network. Some plans may limit the number of sessions covered or the total amount they’ll pay.

Importance of Understanding Policy Terms

Understanding your insurance policy’s language is key. This means knowing the exact definitions of terms like “pre-authorization,” “in-network provider,” “mental health care,” and “out-of-pocket maximum.” If you’re unsure about any part of your policy, reach out to your insurance provider for clarification. Your insurance company might have specific definitions for “medically necessary” or “mental health condition.”

Questions to Ask Your Insurance Provider

Don’t be afraid to ask questions about your coverage! This is crucial to making sure you’re financially prepared for the procedure. Here’s a breakdown of important inquiries:

- Does my plan cover ECT?

- What are the pre-authorization requirements?

- Is the provider I want in-network?

- What is the maximum amount the insurance will pay?

- What is the deductible, copay, and coinsurance for ECT?

- What’s the limit on the number of sessions covered?

- What specific criteria determine if ECT is medically necessary?

Appealing a Denied Claim, Is ect covered by insurance

If your claim for ECT coverage is denied, don’t panic! You have the right to appeal the decision. This often involves gathering documentation to support your need for ECT. This might include letters from your psychiatrist, a description of the treatment plan, and any relevant medical records. You should carefully review the insurance company’s appeal process, as Artikeld in your policy.

It’s a good idea to keep detailed records of all communications with the insurance company during the appeal process. Often, insurance companies require a detailed explanation of why the treatment is medically necessary. You might need to provide additional information to demonstrate that the treatment is appropriate and in line with the plan’s guidelines.

Variations in Coverage Across Plans

Yo, fam! Insurance ain’t always straightforward, especially when it comes to somethin’ serious like ECT. Different plans have different rules, so you gotta dig deep to see what’s covered. Some might cover the whole shebang, while others might only chip in a little. Knowing the variations is crucial for planning.Insurance companies often have varying policies on ECT coverage, reflecting different approaches to mental healthcare.

Some plans may have more generous coverage than others, potentially impacting the affordability of the procedure for patients. Understanding these differences is key to navigating the process and ensuring the treatment is accessible.

Coverage Policies Between Health Insurance Companies

Different insurance companies have diverse policies on ECT coverage. Some might cover the entire cost, while others might only cover a portion, or not cover it at all. Factors like pre-authorization requirements, the type of ECT procedure, and the patient’s specific health plan all play a role. This makes it essential to review your specific policy carefully.

Factors Influencing ECT Coverage

Several factors influence the level of ECT coverage in a health insurance plan. These include the specific type of plan (e.g., HMO, PPO, etc.), the plan’s overall generosity towards mental healthcare, and any pre-existing conditions. Some plans may require pre-authorization, which can delay treatment. Also, the number of sessions covered and the provider’s network impact the cost.

Pre-Authorization Procedures and ECT Coverage

Pre-authorization, or prior approval, is a common hurdle in getting ECT coverage. Insurance companies might require approval from them before any ECT treatment can begin. This process often involves submitting specific documentation to the insurer and waiting for their approval. The time frame for pre-authorization can vary, potentially delaying treatment. This step can significantly impact the patient’s ability to receive timely care.

Frequently Asked Questions Regarding ECT Coverage

Here’s a rundown of common questions about ECT coverage, straight from the source:

- Does my plan cover ECT? Check your policy documents or contact your insurance provider directly for clarification. They’ll have the definitive answer on whether your plan covers ECT.

- What is the typical cost of an ECT session? The cost varies greatly depending on the insurance plan, location, and provider. Contact your insurer or provider for specific information.

- How long does the pre-authorization process usually take? Pre-authorization timelines can vary significantly. Your insurance provider should give you a more precise timeframe, or you can call your provider directly to ask.

- What if my insurance plan doesn’t cover ECT? If your plan doesn’t cover ECT, explore options like appealing the decision, looking into financial assistance programs, or exploring different treatment options.

Documentation and Claims Process

Yo, fam, getting your ECT insurance claim approved is like a whole process, but it’s totally manageable if you know the ropes. This ain’t no mystery; we’re breaking it down so you can crush it. You gotta have the right paperwork and follow the steps, and you’ll be good to go.

Required Documentation

This section lays out the crucial documents your insurance company needs to process your ECT claim. They want solid proof that you got the treatment and it was medically necessary. This means precise, detailed records that clearly show the justification for the ECT sessions.

- Physician’s Orders: These documents are the official orders from your doctor outlining the need for ECT. They’ll detail the specific reason for the treatment, the frequency and duration of sessions, and any special considerations.

- Patient History: Your medical history is important. It should include a detailed account of your condition, including prior treatments and any relevant family history.

- Pre-ECT Evaluation Reports: These reports contain the results of assessments before the ECT treatment. They establish a baseline and show the progression of your condition.

- Progress Notes: Detailed progress notes documenting the treatment process, including observations, patient responses, and any changes in condition during and after each ECT session. This is super important to show the effectiveness and necessity of the treatment.

- ECT Treatment Records: This is a complete record of every ECT session, including the date, time, and specific parameters used during each treatment.

- Post-ECT Evaluation Reports: These reports evaluate your condition after the ECT treatment, demonstrating the impact of the treatment and its necessity.

Examples of Medical Records

Here are some examples of the types of medical records you’ll need to submit for your ECT claim:

- Physician’s Orders: The order for the ECT procedure, detailing the need and frequency of treatments.

- Patient’s Intake Form: This document contains crucial details about your medical history and current condition.

- Progress Notes: Notes from your therapist documenting the patient’s progress, emotional state, and treatment response after each session.

- ECT Treatment Records: A detailed account of each ECT session, including the date, time, and parameters used.

Filing a Claim

Filing your claim is a straightforward process. Follow these steps to submit your claim efficiently:

- Gather All Documents: Compile all the required documents mentioned earlier. Make sure they’re all organized and easy to find.

- Complete the Claim Form: Fill out the insurance claim form accurately and completely. Provide all the necessary details about the treatment.

- Submit the Documents: Submit the completed claim form and all supporting documentation to your insurance provider as directed.

- Track the Claim: Monitor the status of your claim. Most providers have online portals to check the claim’s progress.

Claim Processing Time

The time it takes to process an ECT insurance claim can vary, depending on the insurance provider and the complexity of the claim. Some providers might take a few weeks, while others could take a couple of months. It’s always a good idea to contact your insurance provider directly to get an estimate of the timeframe. Usually, the more organized and complete your claim submission is, the faster it will be processed.

Common Reasons for Claim Denials

| Reason | Explanation | Documentation Needed | Resolution Steps |

|---|---|---|---|

| Insufficient Medical Necessity | Insurance company may question the need for ECT. | Comprehensive patient history, pre-ECT evaluations, progress notes, and post-ECT evaluations | Provide additional evidence supporting the medical necessity of the ECT treatment. If possible, consult with a second opinion from a specialist. |

| Missing Documentation | Essential documents like physician’s orders, treatment records, or evaluations are missing. | Missing documents. | Immediately obtain the missing documentation and resubmit the claim. |

| Incorrect Coding | The treatment codes are not accurate or match the procedures performed. | Original billing documents and supporting records. | Contact the insurance company to clarify the correct coding. If necessary, obtain a corrected bill from your provider. |

| Patient Eligibility | The patient may not meet the coverage criteria for ECT. | Patient’s policy details, coverage information, and medical records. | Contact the insurance company to verify patient eligibility and understand the specific coverage criteria. |

Tips for Navigating Coverage

Yo, fam! Navigating insurance for ECT can be a total vibe killer. It’s like trying to decipher ancient hieroglyphics sometimes. But don’t you worry, we’re breaking down the lowdown to make it easier to handle. This ain’t no game, this is your mental health, so let’s get this straight.Understanding your policy is key to getting the help you need.

It’s like having a secret code to unlocking your benefits. Knowing the specific language used in your policy is crucial. This isn’t your average policy, so listen up.

Effective Communication with Insurance Providers

Communicating effectively with your insurance provider is crucial. They’re the gatekeepers to your benefits, so you gotta know how to talk the talk. Clear and concise communication is key. Avoid jargon and use plain English, like you’re explaining it to your bestie. Providing all necessary information upfront will save you time and headaches.

Think of it like ordering food—the more details you give, the more likely you are to get what you want.

Researching and Comparing Insurance Policies

Don’t just settle for the first policy you see. Researching and comparing different plans is crucial. Think of it like shopping for shoes—you gotta try on a few pairs to find the perfect fit. Look for plans that explicitly cover ECT, and compare the dollar amounts for sessions and the maximum coverage for the whole treatment. Look into the deductibles, co-pays, and coinsurance percentages.

The more you know, the better off you’ll be.

Understanding the Language of Insurance Policies

Insurance policies are often written in a language that’s almost as cryptic as ancient Egyptian. So, you gotta decode it! Look for specific terms related to mental health procedures. Terms like “pre-authorization,” “prior approval,” “maximum lifetime benefit,” and “out-of-network” are crucial. Understanding these terms is essential for making sure your coverage is legit. Ask your provider for clarification if anything is unclear.

Resources for Assistance

Navigating this stuff alone can be a pain in the neck. Luckily, there are resources available to help. Your insurance provider’s customer service line is a great place to start. They can answer your questions and provide guidance. Also, mental health advocates and organizations can be a lifesaver, providing support and info.

You’re not alone in this, so tap into the support systems available to you.

- Insurance Provider’s Customer Service Line: A direct line to your insurance company for answers and clarification.

- Mental Health Advocates/Organizations: Support groups and organizations dedicated to mental health can provide valuable resources and support.

- Your Therapist/Doctor: Your healthcare provider can help you understand your policy and navigate the process.

Closing Notes

So, is ECT covered by insurance? The answer isn’t always straightforward. This guide provides a comprehensive overview of the factors that influence coverage, helping you understand the nuances involved. Remember, you’re not alone in this process. Knowing your rights and the steps to take if a claim is denied is crucial.

Armed with this knowledge, you can navigate the complexities of insurance coverage for ECT with confidence. Always check with your insurance provider for the most up-to-date information.

FAQ Guide: Is Ect Covered By Insurance

Does my insurance cover the cost of ECT?

Unfortunately, there’s no simple yes or no answer. It depends on several factors, including your specific plan, the provider, and the details of your case. You’ll need to check your policy and potentially contact your insurance company directly for clarification.

What if my insurance denies my ECT claim?

Don’t panic! You have the right to appeal a denied claim. Your provider should give you the specific steps to take and the necessary documentation. Be prepared to explain why you need the procedure, and provide any additional medical records or evidence needed.

How long does it usually take to get an answer about ECT coverage from my insurance?

Processing time varies. Some insurance companies may take a few weeks to process your claim, while others may take longer. Keep in touch with your insurance provider and follow up regularly to get an update.

Are there resources to help me understand my insurance coverage for ECT?

Absolutely! Your insurance provider and the mental health professionals involved should provide resources and support. Additionally, there are often independent resources and organizations available to help consumers navigate insurance issues.