What is alternative finance? It’s like, totally the new way to get money, you know? It’s not your grandpa’s bank loans and stock market stuff. This is about new players, new tools, and new ways to make it happen. Think peer-to-peer lending, crowdfunding, and even using your phone to get a loan.

It’s all about bypassing the traditional finance system, and it’s blowing up. It’s a whole new game, fam.

This ain’t your average financial system. Alternative finance is all about finding innovative ways to get capital moving, whether you’re a startup trying to get off the ground or a seasoned entrepreneur looking for extra funding. It’s about connecting people with the resources they need, skipping the red tape and bureaucratic hurdles that traditional finance often throws at you.

It’s all about speed, efficiency, and getting things done.

Defining Alternative Finance

Alternative finance, a burgeoning sector in the global economy, represents a departure from traditional financial institutions and models. It leverages innovative technologies and approaches to access capital and investment opportunities, often bypassing the established financial intermediaries. This shift is driven by a need for more agile and accessible financial solutions, especially for businesses and individuals who might be excluded from traditional financial markets.

Alternative Finance Definition

Alternative finance encompasses a wide range of financial services and instruments that are not part of the conventional banking system. These methods prioritize direct lending, peer-to-peer (P2P) platforms, and crowdfunding. Key characteristics include: a focus on speed and efficiency; a diverse range of participants; and a tendency to be more accessible than traditional finance, particularly for underserved communities.

The methods employed frequently leverage technology to facilitate transactions and reduce reliance on intermediaries.

Alternative Finance vs. Traditional Finance

Traditional finance is typically characterized by large, established institutions like banks and investment firms, relying on extensive regulatory frameworks and procedures. Alternative finance, conversely, is often more agile and less regulated, although this does not imply a lack of risk management. This distinction is crucial, as it impacts the speed of transactions, accessibility to capital, and the risk profiles of the instruments involved.

The speed and efficiency of alternative finance can be attractive to businesses needing quick capital, but the lack of regulatory oversight presents potential risks for investors.

Forms and Types of Alternative Finance

Alternative finance manifests in various forms, including:

- Peer-to-peer (P2P) lending: This method connects borrowers directly with lenders, bypassing traditional financial intermediaries. Platforms facilitate these transactions, often using technology to assess creditworthiness and manage risk. Examples include platforms for personal loans, small business loans, and even real estate investments.

- Crowdfunding: This method raises capital from a large number of individuals, typically through online platforms. Different models exist, such as donation-based crowdfunding, reward-based crowdfunding, and equity crowdfunding. It enables individuals and small businesses to access funding for various projects and ventures.

- Venture capital and private equity: These involve investments in private companies, often at earlier stages of development. Investors seek high potential returns but also accept higher risk compared to publicly traded investments. The process often involves specialized due diligence and investment committees.

- Asset-backed lending: This involves lending secured by specific assets, like real estate or equipment. The asset value acts as collateral, reducing risk for lenders. The process often requires specialized valuation and appraisal.

Comparison of Traditional and Alternative Finance

The table below highlights key differences between traditional and alternative finance.

| Categories | Traditional Finance | Alternative Finance |

|---|---|---|

| Features | Established institutions, extensive regulations, slow processing, high barriers to entry for individuals, emphasis on credit history | Direct lending, speed, accessibility, technological dependence, variable regulatory oversight, diverse participants |

| Examples | Bank loans, mortgages, bonds, investment funds, traditional insurance | P2P lending platforms, crowdfunding campaigns, venture capital, asset-backed loans |

Key Players and Actors

The realm of alternative finance is a vibrant ecosystem, teeming with diverse participants each playing a crucial role in its functioning. From intrepid investors seeking novel opportunities to resourceful borrowers seeking capital, the interplay of these actors drives the dynamism of this evolving financial landscape. This intricate web of relationships underpins the innovation and efficiency of alternative finance, propelling its growth and shaping its future.

Key Participants in Alternative Finance

The success of alternative finance hinges on the intricate interactions among various participants. Investors, lenders, and borrowers are fundamental to this system, each fulfilling distinct functions that contribute to the overall ecosystem. Their roles are often interconnected, creating a dynamic exchange that fuels the flow of capital and facilitates innovative financial solutions.

Investors

Investors in alternative finance are often drawn to the potential for higher returns, but also the possibility of supporting ventures with social or environmental impact. They often evaluate opportunities through alternative metrics and criteria, recognizing that the traditional financial benchmarks may not always align with the potential of these ventures. Examples include venture capital firms, angel investors, and high-net-worth individuals.

They often engage with platforms facilitating investment in peer-to-peer lending, crowdfunding, and other innovative financing models.

Lenders

Lenders in alternative finance provide capital to borrowers who may not qualify for traditional financing options. This includes individuals, small businesses, and entrepreneurs, who often find alternative lending platforms to be a crucial source of funding. They often utilize data analytics and risk assessment methods to evaluate the creditworthiness of borrowers, tailoring lending terms to individual needs. Platforms such as peer-to-peer lending platforms and online marketplaces for small business loans are key examples of how alternative lending operates.

Borrowers

Borrowers in alternative finance are a diverse group, encompassing individuals, small businesses, and entrepreneurs who seek financing for various purposes. They often benefit from alternative finance solutions, accessing capital that might otherwise be inaccessible through traditional channels. This group includes individuals needing personal loans, small businesses seeking growth capital, and entrepreneurs launching innovative ventures. Examples include freelancers needing short-term loans or small business owners seeking working capital.

Alternative Finance Platforms and Businesses

Several successful alternative finance platforms and businesses have emerged, demonstrating the viability and potential of this sector. These platforms often leverage technology to streamline processes, reduce costs, and enhance access to capital. Examples include platforms facilitating peer-to-peer lending, online marketplaces for small business loans, and innovative crowdfunding platforms.

Table of Alternative Finance Actors

| Actor Type | Function | Examples |

|---|---|---|

| Investors | Provide capital to ventures deemed promising, often seeking higher returns or impact investment opportunities. | Venture capital firms, angel investors, high-net-worth individuals, institutional investors |

| Lenders | Provide financing to borrowers who might not qualify for traditional loans, often leveraging data analytics for risk assessment. | Peer-to-peer lending platforms, online marketplaces for small business loans, crowdfunding platforms. |

| Borrowers | Seek financing for various needs, ranging from personal loans to business capital. | Individuals, small businesses, entrepreneurs, startups |

Funding Mechanisms: What Is Alternative Finance

Alternative finance thrives on diverse funding mechanisms, deviating from traditional banking models. These mechanisms cater to specific needs and circumstances, enabling businesses and individuals to access capital outside conventional channels. This flexibility is crucial in fostering innovation and entrepreneurship, particularly in sectors where traditional financing might be limited or unavailable.The variety of funding mechanisms employed in alternative finance is a testament to the dynamic nature of the industry.

Each method offers unique advantages and disadvantages, impacting the financial health and trajectory of the projects or ventures it supports. Understanding these mechanisms is essential for navigating the complexities of this evolving landscape.

Equity Financing

Equity financing involves exchanging ownership stakes in a company or project for capital. Investors, known as equity providers, receive a share of the profits (and potential losses) in exchange for their investment. This approach is particularly attractive for ventures seeking long-term support and partners with shared vision.Different types of equity financing exist, such as venture capital, angel investing, and crowdfunding.

Venture capital firms invest in early-stage companies with high growth potential, while angel investors typically provide seed funding to startups. Crowdfunding platforms allow a multitude of individuals to contribute small amounts of capital to support a project.

Debt Financing

Debt financing involves borrowing money from lenders with an obligation to repay the principal plus interest. This approach allows businesses to access capital without diluting ownership. Debt financing mechanisms are often structured with different repayment terms, interest rates, and collateral requirements, which cater to diverse needs and risk profiles.Peer-to-peer lending platforms and alternative lending institutions facilitate debt financing.

These platforms connect borrowers directly with investors, enabling faster access to capital. These platforms often specialize in specific sectors, recognizing their unique needs and risks.

Grants and Subsidies

Government grants and subsidies provide financial support to specific projects or initiatives. These are often geared toward fostering social impact, environmental sustainability, or technological advancements. Applications and selection criteria for grants and subsidies are often rigorous, requiring a demonstrable social or environmental impact.These funding mechanisms offer significant advantages to organizations pursuing impactful initiatives, and they are prevalent in sectors such as renewable energy, sustainable agriculture, and affordable housing.

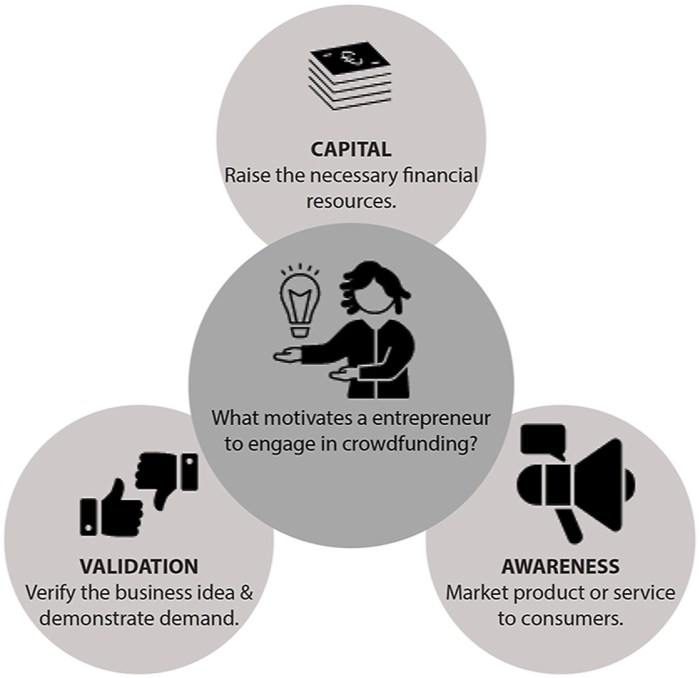

Crowdfunding

Crowdfunding is a method where a project or venture seeks capital from a large number of individuals through online platforms. This can include various types, such as reward-based crowdfunding, equity crowdfunding, and donation-based crowdfunding. Each model offers a different investment structure and return profile for participants.Crowdfunding platforms streamline the process of raising capital by connecting entrepreneurs with a broad pool of potential investors.

It is increasingly popular for startups and creative projects, allowing individuals to participate in the success of innovative ventures.

Table: Comparison of Funding Mechanisms

| Mechanism Type | Advantages | Disadvantages |

|---|---|---|

| Equity Financing | Long-term support, shared vision | Dilution of ownership, potential for loss |

| Debt Financing | Preservation of ownership, flexible repayment terms | Repayment obligations, potential for default |

| Grants and Subsidies | Significant financial support, focus on social/environmental impact | Rigorous application process, limited availability |

| Crowdfunding | Broad access to capital, community involvement | Potential for slow capital accumulation, platform fees |

Investment Strategies in Alternative Finance

Alternative finance offers a diverse array of investment strategies, departing from traditional methods. These strategies often target specific sectors or asset classes, providing opportunities for potentially higher returns but also bearing increased risk. Understanding these strategies is crucial for navigating the complexities of this dynamic financial landscape.

Different Investment Strategies

Various investment strategies are employed in alternative finance, each with unique characteristics. These strategies often leverage the expertise of specialized fund managers and often involve a more active role in the investment process. A key consideration is the alignment of the investment strategy with the investor’s risk tolerance and financial goals.

- Private Equity Investments: These investments focus on privately held companies, offering the potential for substantial returns but with significant operational and financial due diligence. Private equity strategies often include buyouts, growth equity, and venture capital investments. Success hinges on identifying promising companies with strong growth potential, and understanding the complexities of managing and exiting investments. Examples include leveraged buyouts of established businesses and investments in startups with high growth potential.

- Real Estate Investments: These strategies encompass various real estate assets, such as commercial properties, residential developments, or farmland. The value proposition lies in the potential for capital appreciation and rental income. Strategies may involve property development, value-add investments, or opportunistic acquisitions. Risks include market fluctuations, tenant vacancies, and unpredictable economic conditions. For example, a real estate investment trust (REIT) might acquire a portfolio of retail spaces, targeting rental income and appreciation.

- Infrastructure Investments: These investments focus on projects like roads, bridges, and energy grids, providing long-term income streams and positive social impact. Strategies may involve the construction, operation, or financing of infrastructure assets. The returns are often stable, but the upfront investment and regulatory hurdles can be substantial. Examples include investments in renewable energy projects or upgrading public transportation systems.

- Venture Capital Investments: These investments focus on early-stage companies, often with high growth potential, but also significant risk. Venture capital firms often provide not just capital but also guidance and mentorship to the companies they invest in. The rewards can be substantial, but the likelihood of failure is high. For example, a venture capital fund might invest in a tech startup with innovative software, anticipating exponential growth.

- Hedge Fund Investments: These strategies leverage sophisticated investment techniques to generate high returns, often through complex trading strategies, such as arbitrage or short selling. They can offer superior returns but are associated with considerable complexity and often require significant capital. These strategies are typically only suitable for experienced investors. Examples include investments in derivatives or short selling of undervalued stocks.

Investment Strategy Risks and Rewards

Understanding the potential risks and rewards of each strategy is essential. While alternative finance offers the potential for higher returns, it also carries greater risk than traditional investments. Careful due diligence and a well-defined investment strategy are paramount to mitigate these risks.

| Strategy Type | Description | Associated Risks |

|---|---|---|

| Private Equity | Investments in privately held companies | Operational risks, financial risks, exit strategy challenges |

| Real Estate | Investments in real estate assets | Market fluctuations, tenant vacancies, economic downturns |

| Infrastructure | Investments in infrastructure projects | Regulatory hurdles, construction delays, long investment cycles |

| Venture Capital | Investments in early-stage companies | High failure rates, illiquidity, operational challenges |

| Hedge Funds | Investments employing sophisticated trading strategies | Complexity, illiquidity, potential for large losses |

Regulatory Landscape

The regulatory landscape surrounding alternative finance in the Maluku archipelago is a complex tapestry woven from national and local regulations, with implications that ripple across various financing mechanisms. Navigating this framework requires a nuanced understanding of both the opportunities and the challenges it presents for entrepreneurs and investors. The evolving nature of alternative finance demands a dynamic approach to compliance, fostering innovation while ensuring responsible practices.

Regulatory Environment Overview

The regulatory environment for alternative finance in Indonesia, encompassing the Maluku region, is characterized by a blend of national and regional regulations. These regulations aim to balance the need for innovation and financial inclusion with the imperative of maintaining financial stability and consumer protection. While providing a foundation, this framework often necessitates adaptation to specific alternative finance products and services.

The lack of specific regulations tailored to certain alternative finance models can create uncertainty for both participants and regulators. This complex environment highlights the need for continuous dialogue and collaboration between regulators, industry stakeholders, and policymakers.

Challenges and Opportunities

Several challenges arise within the current regulatory framework for alternative finance in the Maluku region. The lack of clear guidelines for specific alternative finance instruments, such as peer-to-peer lending platforms or crowdfunding campaigns, often leads to uncertainty and compliance complexities. Moreover, the digital nature of many alternative finance platforms can present challenges in enforcing regulations and ensuring consumer protection.

Despite these challenges, opportunities abound. A robust regulatory framework can foster trust and attract more investment, both from local and international sources. This, in turn, could stimulate economic growth and support entrepreneurship in the region. Clearer guidelines can help legitimize alternative finance, providing a safer and more transparent environment for participants.

Specific Regulations and Guidelines

The regulatory landscape surrounding alternative finance is multifaceted, encompassing various forms of financing. Regulations governing money lending, capital markets, and digital financial services often influence alternative finance activities. The implementation of these regulations varies based on the specific instrument or platform, impacting the accessibility and feasibility of different alternative finance models. For example, regulations pertaining to debt collection and dispute resolution play a crucial role in safeguarding the interests of both lenders and borrowers.

Regulatory Landscape Table, What is alternative finance

| Type of Alternative Finance | Relevant Regulations | Implications |

|---|---|---|

| Peer-to-peer lending platforms | Banking Law, Consumer Protection Law, Fintech Regulations | Platforms must adhere to lending limits, KYC/AML requirements, and consumer protection standards. Non-compliance can lead to sanctions and reputational damage. |

| Crowdfunding campaigns | Capital Markets Law, Securities Law, Consumer Protection Law | Platforms need to comply with disclosure requirements and investor protection regulations. Failure to comply can result in legal action and market exclusion. |

| Equity crowdfunding | Capital Markets Law, Securities Law, Investment regulations | Companies raising capital must comply with disclosure rules and regulations related to the offering of securities. |

| Invoice financing | Commercial Law, Tax Regulations | Platforms need to comply with regulations on factoring, payment processing, and tax reporting. Understanding the intricacies of these regulations is crucial for compliance. |

Technological Advancements

The digital revolution has profoundly reshaped the landscape of alternative finance, driving innovation and efficiency across various facets of the industry. Technological advancements have empowered new actors, streamlined processes, and opened up previously inaccessible investment opportunities. From blockchain-based platforms to AI-driven risk assessments, technology continues to play a pivotal role in shaping the future of alternative finance.Technological innovations have fundamentally transformed the way alternative finance operates.

These advancements facilitate faster transactions, enhanced security, and increased access to capital for underserved communities. This evolution is characterized by the development of user-friendly platforms, the integration of sophisticated algorithms, and the utilization of emerging technologies to automate complex financial processes.

Role of Technology in Transaction Facilitation

Technological platforms are revolutionizing the speed and efficiency of transactions in alternative finance. Digital platforms enable instantaneous fund transfers, streamlined KYC (Know Your Customer) processes, and the automation of loan disbursement. This technological evolution is particularly beneficial in markets where traditional financial infrastructure is underdeveloped or inaccessible. By removing geographic and logistical barriers, technology fosters inclusivity and accelerates capital flow.

The integration of mobile technology allows for remote access to financial services, extending access to underserved populations.

Key Technological Innovations Driving Alternative Finance

A plethora of technological innovations are reshaping the alternative finance ecosystem. These innovations include but are not limited to blockchain, artificial intelligence, big data analytics, and distributed ledger technology. These advancements have facilitated the creation of new financial products and services, fostering greater transparency, security, and efficiency in the industry.

List of Technological Advancements Impacting Alternative Finance

- Blockchain Technology: Blockchain, a decentralized and immutable ledger, enhances transparency and security in alternative finance. It enables secure and verifiable record-keeping for transactions, reducing fraud risks and increasing trust. Cryptocurrency platforms are a prominent example of blockchain’s application, offering alternative avenues for investment and financing.

- Artificial Intelligence (AI): AI algorithms are increasingly used for risk assessment, fraud detection, and personalized investment strategies. AI-powered platforms analyze vast datasets to identify patterns and predict market trends, enhancing decision-making in alternative finance. This includes automated due diligence processes, allowing for faster and more efficient evaluation of investment opportunities.

- Big Data Analytics: Alternative finance increasingly leverages big data to identify investment opportunities, assess risk, and personalize financial products. Data analysis provides insights into market trends, investor behavior, and economic indicators, enabling better informed investment decisions. Platforms utilizing data analytics can identify underserved markets and tailor products accordingly.

- Cloud Computing: Cloud-based platforms offer scalable and cost-effective solutions for storing and managing large volumes of data associated with alternative finance transactions. This enhances efficiency, reduces operational costs, and enables greater flexibility for businesses to adapt to changing market conditions.

- Mobile Technology: Mobile applications provide accessible financial services to underserved populations, enabling them to participate in alternative finance markets. Mobile wallets and peer-to-peer lending platforms are examples of mobile technology’s role in expanding access to financial products and services, particularly in remote areas.

Impact and Trends

The rise of alternative finance in Maluku, like throughout the archipelago, presents a fascinating interplay of traditional and modern financial systems. This innovative approach to capital flows is transforming access to credit and investment opportunities, while simultaneously challenging established norms and creating new avenues for economic growth. It’s a dynamic landscape ripe with potential, but also with inherent complexities that demand careful consideration.

Impact on Traditional Financial Systems

Alternative finance is not simply an add-on to existing financial structures. It presents a fundamental shift, influencing traditional banking and lending practices. Disintermediation is a key aspect of this transformation, with alternative platforms directly connecting borrowers and lenders, bypassing the traditional intermediary role of banks. This can lead to faster transaction times and potentially lower costs for borrowers, but also to a decline in traditional banking’s market share.

The rise of peer-to-peer lending platforms, for example, has demonstrably reduced reliance on conventional banks for certain types of loans.

Emerging Trends and Developments

Several key trends are shaping the alternative finance landscape. The increasing adoption of technology, particularly mobile-based financial services, is revolutionizing access to credit and financial services in remote areas. This is particularly relevant in Maluku, where mobile penetration is high and traditional banking infrastructure can be limited. Another significant trend is the growing emphasis on social impact investing, with alternative finance platforms seeking to fund ventures that contribute to environmental and social good.

This reflects a global shift toward responsible investing and aligns with Maluku’s emphasis on sustainable development.

Potential Future Directions and Opportunities

Alternative finance in Maluku offers substantial potential for future growth and development. One key area is fostering greater integration between traditional and alternative financial systems. This could involve collaborations between banks and fintech platforms, creating hybrid models that leverage the strengths of both. Another area for exploration is developing tailored solutions for specific sectors within Maluku’s economy, such as agriculture and small-scale businesses.

For example, micro-lending platforms tailored to the needs of local farmers could significantly boost agricultural productivity.

Growth in Specific Regions or Sectors

The adoption of alternative finance in Maluku, like in other Indonesian regions, is closely tied to the availability of technology and the specific needs of the local population. In coastal communities, for example, alternative financing can play a critical role in supporting fishing and maritime businesses, bridging the gap between capital requirements and available resources. Similarly, in rural areas, mobile-based lending platforms can provide crucial access to credit for small farmers and entrepreneurs.

This localized approach, responding to specific community needs, will be crucial for sustainable growth.

Summary of Impact and Trends

| Area of Impact | Trend | Examples |

|---|---|---|

| Traditional Financial Systems | Disintermediation, reduced reliance on traditional banks | Peer-to-peer lending platforms, mobile-based lending |

| Emerging Trends | Increased technology adoption, social impact investing | Mobile money solutions, investment in sustainable agriculture |

| Future Directions | Integration of traditional and alternative systems, tailored solutions for specific sectors | Hybrid models combining banks and fintech, micro-lending for farmers |

| Regional/Sector Growth | Localized solutions addressing specific community needs | Mobile-based lending for coastal fishing communities, agricultural financing |

Case Studies in Alternative Finance

Alternative finance, a vibrant tapestry woven from diverse funding mechanisms and investment strategies, has proven its worth in numerous sectors. These initiatives, often responding to traditional finance’s limitations, offer unique solutions and unlock opportunities for businesses and individuals previously underserved. This section presents compelling case studies that showcase the practical applications and impact of alternative finance models.Successful alternative finance initiatives demonstrate a deep understanding of the specific needs and challenges within their respective industries.

They are characterized by adaptability, innovation, and a commitment to finding solutions that address gaps in traditional financing avenues.

Alternative finance is shaking up traditional lending models, often relying on data-driven insights and innovative platforms. Understanding benchmarks in finance, like the S&P 500 for stocks or LIBOR for loans, is crucial for evaluating alternative investments. For instance, how do these benchmarks impact the valuation of assets in a peer-to-peer lending platform? Knowing the benchmarks for different alternative financial products allows for informed comparisons and risk assessments, ultimately fostering a more robust and transparent alternative finance landscape.

what is a benchmark in finance This crucial aspect is essential for investors seeking alternative ways to grow their portfolios.

Successful Alternative Finance Initiatives

These examples highlight the varied applications of alternative finance models, showcasing their adaptability across different sectors.

- Crowdfunding for Sustainable Agriculture: A notable example involves a platform connecting smallholder farmers in rural areas with investors seeking impact investments. The platform facilitated the raising of capital for sustainable farming practices, including improved irrigation systems and climate-resilient crops. This addressed the problem of limited access to capital for farmers while simultaneously generating returns for investors interested in environmentally conscious projects.

The platform’s success stemmed from a clear value proposition, meticulous due diligence processes for both farmers and investors, and robust communication strategies. The outcomes included increased agricultural yields, improved livelihoods for farmers, and positive environmental impact through reduced carbon footprint and water conservation.

- Peer-to-Peer Lending for Micro-Businesses: A platform enabling direct lending between individuals and small businesses in emerging markets effectively circumvented traditional lending constraints. The platform utilized technology to assess creditworthiness, facilitated secure transactions, and provided transparent information to both lenders and borrowers. This addressed the problem of insufficient capital access for micro-businesses and created a sustainable lending ecosystem. The platform’s success resulted from robust credit risk assessment models, secure transaction infrastructure, and effective outreach strategies within the target communities.

Outcomes included increased business growth, improved access to capital for entrepreneurs, and a demonstrable increase in economic activity.

Alternative Finance Models in Various Industries

Alternative finance models have proven to be particularly impactful in sectors facing unique challenges.

- Real Estate Financing: A platform that facilitates the lending of capital to real estate projects using blockchain technology offered significant advantages in terms of speed, transparency, and security. This addressed the problem of slow and cumbersome processes in traditional real estate financing. The platform’s success resulted from its ability to streamline the entire process through digitization, which reduced paperwork and delays.

The outcomes included faster project development, reduced transaction costs, and improved investor confidence.

- Renewable Energy Projects: A platform connecting investors with renewable energy projects allowed for the financing of projects that would otherwise be inaccessible. This addressed the problem of limited capital availability for projects with long gestation periods and high upfront costs. The platform’s success resulted from a rigorous screening process for projects, clear investment guidelines, and effective investor outreach. Outcomes included a demonstrable increase in renewable energy generation, a reduction in reliance on fossil fuels, and a positive environmental impact.

Lessons Learned from Successful Case Studies

Analyzing successful alternative finance initiatives reveals key lessons applicable to similar endeavors.

- Adaptability and Innovation: Successful initiatives demonstrated the importance of adapting to specific market needs and developing innovative solutions to address existing challenges. Adaptability is a cornerstone of success in this dynamic sector.

- Robust Risk Management: Effective risk management plays a crucial role in mitigating potential losses and ensuring the sustainability of the platform. Thorough risk assessments and appropriate security measures are vital.

- Clear Communication and Transparency: Open and transparent communication with investors and borrowers is paramount. Building trust and fostering a sense of shared responsibility is essential for long-term success.

Detailed Case Studies (Problem, Solution, and Outcomes)

Case Study 1: Crowdfunding for Sustainable Agriculture

Problem: Limited access to capital for smallholder farmers in rural areas, hindering the adoption of sustainable agricultural practices.

Solution: A crowdfunding platform connecting farmers with investors seeking impact investments. The platform provided farmers with access to capital for sustainable farming practices and provided investors with opportunities for socially responsible investments.

Outcomes: Increased agricultural yields, improved livelihoods for farmers, and a positive environmental impact.

Case Study 2: Peer-to-Peer Lending for Micro-Businesses

Problem: Insufficient capital access for micro-businesses in emerging markets, leading to limited growth opportunities.

Solution: A peer-to-peer lending platform enabling direct lending between individuals and small businesses. The platform streamlined the process through technology, facilitating secure transactions and transparent information exchange.

Outcomes: Increased business growth, improved access to capital for entrepreneurs, and a demonstrable increase in economic activity.

Final Review

So, alternative finance is basically a game-changer. It’s giving people and businesses more options, more flexibility, and more control over their financial future. It’s like, totally changing the rules of the game, and it’s gonna keep changing them. It’s the future of finance, and it’s here to stay. Get on board or get left behind.

Word.

Common Queries

What’s the difference between alternative and traditional finance?

Traditional finance is, like, slow and rigid. Alternative finance is fast, flexible, and it’s all about connecting people directly. Think online platforms vs. brick-and-mortar banks.

What are some examples of alternative finance?

Peer-to-peer lending, crowdfunding, and online investment platforms. Basically, any financial service that bypasses traditional institutions.

Is alternative finance risky?

It can be, but it also has the potential for high returns. It’s all about doing your research and understanding the risks involved.

What about regulation?

The regulatory landscape is still developing, so it’s important to stay informed about the rules and guidelines.