What is FFO in finance? Funds from Operations (FFO) is a crucial metric, particularly in real estate and other industries, used to assess a company’s operating performance and financial health. Unlike EBITDA, which can include non-cash items, FFO focuses on cash flow from operations. Understanding its calculation, applications, and limitations is key for investors and analysts seeking a more accurate picture of a company’s profitability.

This comprehensive guide explores the intricacies of FFO, comparing it to other financial metrics like EBITDA and delving into its specific relevance to real estate investment trusts (REITs). We’ll uncover how FFO impacts debt analysis, valuation, and industry comparisons, ultimately empowering you to make informed decisions.

Definition and Meaning

FFO, or Funds from Operations, is a crucial metric for evaluating the operating performance of real estate investment trusts (REITs) and other businesses with significant property holdings. It focuses on cash flow generated from core operations, providing a clearer picture of profitability compared to traditional earnings metrics. Unlike net income, FFO strips out non-cash items and adjustments specific to the industry, offering a more accurate reflection of the underlying operational health.

Key Components of FFO

FFO calculation typically includes net income, depreciation and amortization, and certain other adjustments. These adjustments account for items that don’t directly relate to the ongoing operational performance of the business, allowing for a more reliable evaluation of operational efficiency. The specific components can vary depending on the reporting entity and industry standards. Understanding these components is vital for investors and analysts to assess the true financial health of the business.

Comparison with EBITDA

FFO and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) are both popular metrics for evaluating profitability, but they differ significantly. EBITDA, while broad, excludes non-cash expenses like depreciation and amortization. FFO, on the other hand, is tailored to the specific operational characteristics of businesses with significant property holdings. FFO often provides a more precise measure of the cash flow generated from core operations, while EBITDA is more commonly used for a broader range of industries.

Consequently, investors need to consider the context and specific industry characteristics when choosing between these metrics.

Calculation of FFO

The calculation of FFO involves a step-by-step process, adding back specific non-cash expenses and adjusting for other relevant items. This process provides a more comprehensive view of the company’s operating performance, free from accounting treatments that don’t directly relate to its ongoing operations. The precise formula varies depending on the company and the industry.

FFO Formulas

| Formula | Description |

|---|---|

|

This is a general representation of the formula. The specific adjustments can vary depending on the entity’s accounting practices and industry standards. |

|

This illustrates a more comprehensive formula that includes potential non-cash gains or losses from selling assets, and other operating items relevant to the company’s operations. |

The table above provides a basic framework for understanding the general structure of FFO calculations. The specific components included in the calculation will depend on the reporting entity and the specific requirements of the industry or regulatory bodies.

Applications and Uses

FFO, or Funds from Operations, transcends its definition as a financial metric. It’s a powerful tool for analyzing a company’s performance, particularly in sectors with significant real estate holdings or substantial operating leases. Understanding how FFO is applied in various industries and its significance in investment decisions provides a more comprehensive view of its value.FFO is a key component of financial analysis, especially in sectors with substantial property holdings or extensive operating leases.

It offers a more accurate representation of a company’s operating performance compared to traditional net income. This is crucial for investors seeking a clearer picture of the company’s ability to generate cash from its core business activities.

Industries Where FFO is Commonly Used

FFO is frequently utilized in real estate investment trusts (REITs) and other companies with substantial real estate holdings. This is because FFO reflects the cash flow generated from the operations of these properties. It’s also valuable for companies in the energy sector, which often have complex financial structures involving significant operating leases and asset valuations. Further, companies with substantial lease obligations find FFO insightful in evaluating their operational efficiency and financial health.

FFO in Financial Analysis

FFO is employed in financial analysis to gauge a company’s operating performance and cash flow generation. Analysts use FFO to assess the company’s ability to meet its financial obligations and generate returns for investors. By comparing FFO to other key financial metrics, such as net income, investors gain a deeper understanding of the company’s financial health and potential for future growth.

Benefits of Using FFO for Investment Decisions

FFO offers investors a more accurate portrayal of a company’s ability to generate cash from its operations. This is particularly beneficial in industries where operating leases are substantial or property valuations are significant. By using FFO, investors can make more informed decisions, evaluating the true profitability and financial stability of the company. This allows for a more precise assessment of future growth potential and financial risk.

Application of FFO to Assess a Company’s Financial Health

FFO assists in evaluating a company’s financial health by providing a clearer picture of its operating cash flow. By focusing on the cash generated from operations, investors can assess the company’s ability to pay its debts, fund future investments, and distribute profits. Comparing FFO to other key financial indicators like net income and debt levels provides a comprehensive view of the company’s financial strength and potential risks.

Examples of Companies Utilizing FFO

| Company | Industry | Reason for FFO Use |

|---|---|---|

| Simon Property Group (SPG) | Real Estate Investment Trust (REIT) | Significant real estate portfolio; FFO reflects cash flow from properties. |

| Brookfield Asset Management (BAM) | Real Estate Investment Trust (REIT) | Diversified portfolio, including significant real estate holdings; FFO aids in evaluating operating performance. |

| ExxonMobil (XOM) | Energy | Complex financial structure; FFO provides a clearer picture of operating performance, including operating leases. |

| Crown Castle International (CCI) | Telecommunications Infrastructure | Large-scale infrastructure assets; FFO aids in evaluating cash flow generation and financial health. |

Advantages and Disadvantages

FFO, or Funds from Operations, is a crucial metric for evaluating companies, particularly those in real estate and other industries with significant depreciation or amortization. Understanding its strengths and weaknesses is vital for investors and analysts to form a complete picture of a company’s financial health. It offers a unique perspective on profitability, but like any metric, it has limitations.Evaluating a company’s financial performance requires a multifaceted approach.

A thorough understanding of FFO, alongside other metrics, can provide a more comprehensive view, helping to make informed investment decisions. Analyzing the advantages and disadvantages of FFO allows for a critical assessment of its usefulness in different contexts.

Advantages of Using FFO in Evaluating Companies

FFO’s primary advantage lies in its focus on cash flow generated from operations. Unlike net income, which can be affected by non-cash items like depreciation and amortization, FFO strips away these non-cash expenses, offering a clearer picture of a company’s operational cash flow. This focus on cash flow makes FFO more relevant for evaluating companies with substantial property, plant, and equipment.

This metric also provides a consistent method for comparing companies across industries with varying capital structures.

Limitations of FFO as a Financial Metric

FFO, despite its strengths, has limitations. It doesn’t account for the true cost of capital or the impact of financing decisions. Also, it might not fully reflect the company’s overall financial health if other factors, like debt levels, are not considered alongside FFO. In addition, FFO’s focus on operational cash flow may obscure the company’s ability to generate profits beyond its core operations.

Comparison of FFO versus Other Metrics

| Metric | Advantages | Disadvantages |

|---|---|---|

| FFO | Focuses on operational cash flow, consistent comparisons across industries with significant property, plant, and equipment. | Doesn’t account for financing costs or overall financial health, might not fully reflect profits beyond core operations. |

| Net Income | Reflects the overall profitability of the company. | Can be affected by non-cash items like depreciation and amortization, potentially obscuring operational cash flow. |

| Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) | Focuses on operating performance before financing costs. | Doesn’t account for capital expenditures, potentially providing a skewed view of profitability in industries with significant capital expenditures. |

Potential Pitfalls When Relying Solely on FFO

Relying solely on FFO can lead to a narrow perspective on a company’s financial health. Analysts should consider other metrics, such as net income, cash flow from operations, and debt levels, to gain a complete picture. Furthermore, companies can manipulate FFO by using different accounting methods. Lastly, FFO’s usefulness can vary greatly depending on the specific industry.

It is critical to evaluate the industry context before solely relying on FFO.

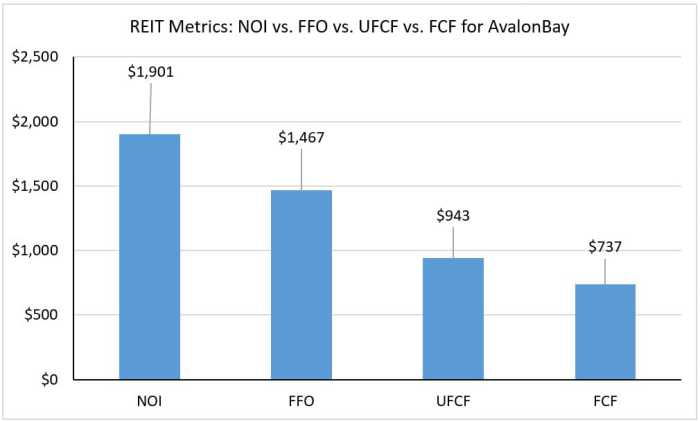

FFO and Real Estate Investment Trusts (REITs)

FFO, or Funds from Operations, is a crucial metric for evaluating the financial health of Real Estate Investment Trusts (REITs). REITs, unlike traditional companies, are obligated to distribute a substantial portion of their income to shareholders. Understanding FFO is paramount for investors seeking to assess the true operating performance of these unique entities.REITs are companies that own and manage income-producing real estate.

They generate revenue through rent, lease payments, and other property-related income streams. Because of their specific structure and regulatory requirements, FFO offers a more accurate picture of their operating performance than traditional metrics like net income.

Specific Relevance of FFO to REITs

FFO is specifically relevant to REITs due to the unique characteristics of their business model and regulatory framework. REITs are required by law to distribute a significant portion of their taxable income to shareholders. This distribution is a key factor in their valuation and investment appeal. FFO, by excluding items like depreciation and amortization, provides a clearer view of the core operating income generated from the properties, enabling investors to gauge the sustainability of the REIT’s cash flows.

FFO Calculation for REITs

FFO is calculated by adding back non-cash expenses, such as depreciation and amortization, to net income. It also typically includes other income items like gains or losses from sales of properties. This process provides a more realistic representation of the cash flow generated by the core real estate operations. A key formula for calculating FFO is:

Net Income + Depreciation & Amortization + Other Non-Cash Expenses + Other Income = FFO

Why FFO is Crucial for REIT Investors

FFO is a crucial metric for REIT investors because it reflects the core operating performance of the real estate holdings. It isolates the cash flow generated from the properties, which is a critical aspect of REIT investment. Unlike traditional income statements that can be distorted by non-cash expenses, FFO offers a more reliable measure of the REIT’s ability to generate cash.

This metric allows investors to better assess the sustainability of the income stream and the potential for future returns.

Comparison of FFO Calculations for REITs versus Other Companies

The calculation of FFO for REITs differs from that of other types of companies. Traditional companies often use net income as the primary measure of financial performance. However, REITs, due to their unique structure and regulatory requirements, must use FFO to provide a more accurate picture of their core operating performance. REIT FFO focuses on the cash generated from the real estate portfolio, while other companies may have other components, such as revenue from sales or manufacturing.

This distinct approach reflects the inherent nature of the real estate investment industry.

Typical FFO Components for a REIT

| Component | Description |

|---|---|

| Net Income | The profit or loss from the REIT’s operations after deducting all expenses. |

| Depreciation and Amortization | Non-cash expenses reflecting the decrease in value of assets over time. Added back to net income. |

| Real Estate Taxes | Taxes directly related to the ownership and operation of the properties. |

| Interest Expense | Interest paid on debt obligations. |

| Other Non-Cash Expenses | Any other non-cash expenses specific to REIT operations. |

| Other Income | Any additional income sources related to the REIT’s real estate portfolio. |

This table illustrates the typical components involved in calculating FFO for a REIT. Understanding these components is essential for investors to properly assess the REIT’s financial performance.

FFO and Debt Analysis

Understanding a company’s ability to service its debt is crucial for assessing its financial health. Free Cash Flow (FCF) is often used for this, but FFO provides a more accurate picture for companies with significant non-cash expenses, like depreciation and amortization, often found in real estate and other industries. FFO allows for a more nuanced and accurate assessment of the company’s capacity to cover its debt obligations, moving beyond just reported net income.FFO’s role in debt analysis extends beyond a simple calculation.

It acts as a key indicator of a company’s ongoing operating performance and its ability to generate cash flow from its core operations. This, in turn, directly influences its ability to meet financial commitments and maintain financial stability. This section delves into how FFO affects debt servicing capacity, and how it is used to assess and evaluate a company’s financial health and solvency.

Impact of FFO on Debt Servicing Capacity

FFO, by excluding non-cash expenses, provides a more realistic picture of a company’s ability to generate cash flow from its core operations. This improved cash flow visibility is crucial for evaluating its capacity to meet debt obligations. A higher FFO relative to debt levels generally indicates a stronger ability to service that debt. Conversely, a low FFO relative to debt suggests potential strain on the company’s ability to meet its debt obligations.

Using FFO to Assess Debt Obligations

FFO serves as a crucial metric in evaluating a company’s ability to meet its debt obligations. By focusing on operating cash flow, FFO offers a more accurate reflection of a company’s ability to generate cash flow from core business activities compared to net income, which can be affected by non-cash items. This allows investors and analysts to gauge a company’s financial strength and its capacity to repay debt.

Analyzing Debt-to-FFO Ratios

A key method for analyzing a company’s debt servicing capacity is to calculate its debt-to-FFO ratio. This ratio compares the company’s total debt to its FFO. A lower ratio generally indicates a healthier financial position, suggesting a greater capacity to meet debt obligations.

Debt-to-FFO Ratio = Total Debt / FFO

A company with a debt-to-FFO ratio of 2.5, for example, might be considered riskier than one with a ratio of 1.0. Analyzing this ratio over time provides valuable insights into a company’s financial health and its progress in managing its debt. Historical data and industry benchmarks can further contextualize the ratio. For instance, if a company’s ratio has consistently increased, it could indicate a growing debt burden and potentially higher financial risk.

FFO and Overall Financial Health

FFO is an integral component in evaluating a company’s overall financial health and stability. It provides a clear picture of the company’s ability to generate cash flow from its core operations, which directly affects its capacity to manage debt and other financial obligations. Companies with consistently high FFO levels, coupled with prudent debt management, generally exhibit better financial health and stability.

FFO and Company Solvency

FFO is a critical factor in evaluating a company’s solvency. Solvency refers to a company’s ability to meet its long-term financial obligations. A high FFO-to-debt ratio suggests a strong ability to service debt and indicates higher solvency. Conversely, a low ratio indicates potential solvency issues. This assessment of solvency is valuable for both investors and creditors.

They can use this analysis to make informed decisions about investing in or lending to the company.

FFO and Valuation: What Is Ffo In Finance

FFO, or Funds from Operations, is a crucial metric for evaluating the financial health and intrinsic value of real estate investment trusts (REITs) and other similar companies. Its focus on cash flow from operations, rather than accounting profits, provides a more accurate picture of a company’s ability to generate returns. This focus on operational cash flow makes FFO a valuable tool for investors seeking to understand the true economic performance of these entities.FFO’s significance in valuation stems from its direct correlation with a company’s ability to generate cash.

By analyzing FFO, investors can better assess a company’s long-term viability and potential for future earnings. This, in turn, allows for more informed decisions about investment strategies.

FFO in Company Valuation

FFO plays a pivotal role in determining a company’s intrinsic value, particularly for REITs and other similar companies. It is a key component in various valuation methodologies, particularly in discounted cash flow (DCF) analysis. This focus on cash flow distinguishes FFO from other profitability measures.

Role of FFO in Determining Intrinsic Value

FFO directly reflects the cash generated by a company’s core operations. This characteristic makes it a powerful tool for assessing a company’s ability to generate returns for its investors. Analysts utilize FFO to estimate future cash flows, which are then discounted to their present value to determine intrinsic value.

FFO in Discounted Cash Flow Analysis

A common method for using FFO in DCF analysis involves projecting future FFO figures. These projections are based on various factors, including market trends, economic forecasts, and the company’s operational performance. A key aspect is the selection of an appropriate discount rate, which reflects the risk associated with the investment. A common formula for this is:

Present Value = FFOt / (1 + r) t

Where:

- FFO t represents the FFO in period t.

- r represents the discount rate.

- t represents the period number.

Summing the present values of all projected future FFOs yields the estimated intrinsic value of the company.

Comparison with Other Valuation Methods

FFO-based valuation methods are contrasted with other techniques such as price-to-earnings (P/E) ratios, price-to-book (P/B) ratios, and comparable company analysis. These other methods offer alternative perspectives on a company’s value, but often rely on accounting figures that may not reflect the true economic performance of the entity, particularly for REITs.

Comparison Table: FFO-Based Valuation vs. Other Techniques

| Valuation Method | Key Considerations | Strengths | Weaknesses |

|---|---|---|---|

| FFO-based Valuation | Focuses on cash flow from operations, crucial for REITs | Provides a more accurate picture of a company’s operational performance, especially important in industries with high capital expenditures | Requires accurate forecasting, selection of a proper discount rate, and potentially more complex calculations |

| P/E Ratio | Compares a company’s stock price to its earnings per share | Simple to calculate and understand | Doesn’t account for capital expenditures or other operational factors, potentially misrepresenting value for REITs |

| P/B Ratio | Compares a company’s stock price to its book value | Provides a perspective on the asset backing of a company | Doesn’t fully account for market value or future earnings potential |

| Comparable Company Analysis | Compares a company to similar publicly traded companies | Provides insights into market valuation | Reliance on comparables can be subjective and may not fully capture unique characteristics of a specific company |

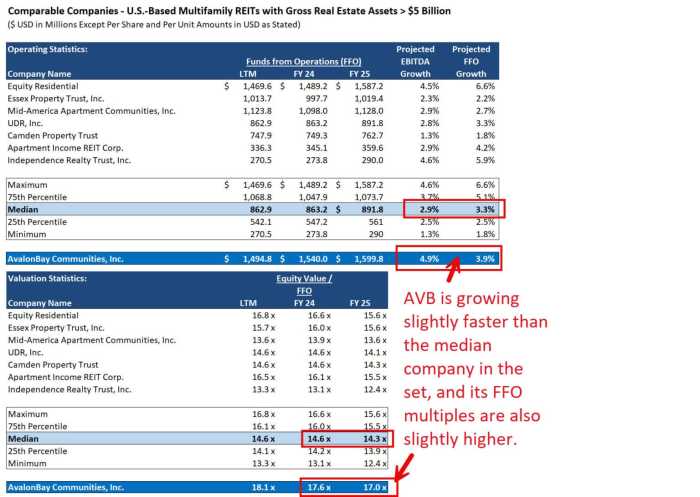

FFO and Industry Comparisons

FFO, or Funds from Operations, provides a crucial lens through which to compare companies within the same industry. It strips away the complexities of accounting methods, offering a more direct measure of a company’s operating performance. This allows for a standardized evaluation, enabling investors and analysts to identify relative strengths and weaknesses.Understanding how FFO is used to compare companies across different sectors, and how trends are identified, is vital for making informed investment decisions.

Industry-specific nuances in FFO calculation and interpretation, combined with a thorough understanding of benchmarking, allow for strategic analysis.

FFO Comparison Methodologies

Comparing companies within a sector using FFO involves several key steps. First, ensure that the companies being compared are using a consistent FFO calculation method. Second, analyze the FFO figures in conjunction with key financial metrics specific to the industry. For example, in the retail sector, revenue growth and inventory turnover rates are vital considerations. Third, consider the impact of unusual or one-time events that may skew the FFO figures.

Identifying FFO Trends Across Industries

Tracking FFO trends across industries requires a multi-faceted approach. Analyzing industry-specific data, such as regulatory changes, technological advancements, and market conditions, can provide valuable context for understanding FFO variations. A comprehensive understanding of the industry’s competitive landscape, including pricing strategies and customer demographics, is also crucial. Furthermore, evaluating FFO relative to industry averages helps to identify outlier performance and potential investment opportunities.

Industry-Specific Nuances in FFO Calculation and Interpretation, What is ffo in finance

Different industries have unique accounting practices and operating structures, which can impact FFO calculations. For instance, the real estate industry often includes depreciation and amortization expenses in FFO, while the technology sector may have more significant research and development costs. Therefore, careful consideration of these industry-specific factors is crucial for accurate interpretation. Analysts must adjust for these nuances to ensure a fair comparison across different sectors.

FFO Across Different Sectors: A Comparative Table

The following table provides a snapshot of how FFO can vary across different sectors. Keep in mind that these are just examples and actual figures will differ based on specific company performance.

Understanding Funds from Operations (FFO) in finance is key, especially when considering substantial investments like a yacht. FFO, a crucial metric for evaluating a company’s performance, often reflects the cash flow available for such ventures. Knowing how to finance a yacht here involves navigating various financial instruments, and FFO can be a critical factor in determining eligibility and repayment plans.

Ultimately, grasping FFO remains essential for making sound financial decisions.

| Sector | Typical FFO Characteristics | Key Considerations |

|---|---|---|

| Retail | Strong revenue growth and consistent operating margins are often indicators of healthy FFO. | Inventory management, competition, and economic conditions influence FFO. |

| Real Estate | Stable FFO streams, driven by rental income and property values. | Capital expenditures and lease terms are important considerations. |

| Technology | FFO may be less prominent, as R&D and other intangible assets might dominate financial statements. | Revenue growth, profitability, and market share are critical factors. |

| Energy | Fluctuating FFO due to price volatility of raw materials. | Production volumes and energy prices directly affect FFO. |

FFO for Benchmarking and Strategic Analysis

Using FFO for benchmarking involves comparing a company’s FFO to the average FFO of its competitors within the same industry. This helps to identify strengths, weaknesses, and areas for improvement. A company consistently exceeding industry averages in FFO could signal superior operational efficiency or market positioning. Conversely, a company lagging behind its peers might warrant further investigation into potential issues or strategic adjustments.

This process of benchmarking provides a valuable framework for strategic analysis. It allows for a proactive approach to identifying opportunities and mitigating risks, enhancing long-term financial performance.

Closing Notes

In conclusion, FFO provides a valuable lens through which to evaluate a company’s operating performance, especially in sectors like real estate. While FFO offers advantages in assessing cash flow and debt servicing capacity, it’s crucial to understand its limitations and consider it alongside other metrics for a complete picture. By grasping the nuances of FFO calculation, applications, and industry-specific considerations, you’ll be better equipped to navigate the complexities of financial analysis and make more informed investment choices.

Top FAQs

What is the primary difference between FFO and EBITDA?

FFO focuses on cash flow from operations, while EBITDA includes non-cash items. This makes FFO a potentially more reliable indicator of a company’s current ability to generate cash.

How is FFO calculated for REITs?

REIT FFO calculations often include items like rental income, gains from sales of properties, and other real estate-related income. Specific components may vary based on the REIT’s structure and operations.

What are some potential pitfalls of relying solely on FFO?

FFO doesn’t account for all expenses or capital expenditures. Using it in isolation can lead to an incomplete view of a company’s financial position.

How can I use FFO to compare companies within the same industry?

FFO can help benchmark performance by comparing the cash flow-generating ability of different companies in the same industry. However, you should account for industry-specific factors.