How to cancel dental insurance is often a complex process, fraught with potential pitfalls. This review dissects the intricacies of cancellation, highlighting the steps, considerations, and potential consequences. Understanding the procedures, potential drawbacks, and necessary documentation is crucial before taking the leap.

The following analysis meticulously examines various aspects, including cancellation procedures for different plans, potential financial impacts, and online/phone cancellation methods. It also addresses important considerations like outstanding balances, grace periods, and alternative solutions.

Understanding Cancellation Procedures

Cancelling your dental insurance can seem daunting, but it’s a straightforward process once you understand the steps involved. Knowing how to navigate the cancellation process ensures you’re not left with unexpected costs or hassles down the road. This guide will walk you through the common procedures, whether your plan is employer-sponsored or individual.Dental insurance cancellation procedures vary, but typically involve contacting your insurer directly.

Understanding the specific steps for your plan type is crucial to avoid any potential issues. Different plans have different deadlines and requirements, so meticulous attention to detail is important.

General Overview of the Cancellation Process

The cancellation process for dental insurance plans generally involves notifying the insurer of your intent to cancel coverage. This typically requires submitting a written request, often via mail or online portal. The insurer will then process the request and provide confirmation of the cancellation. The specifics of this process depend heavily on the type of plan.

Methods for Cancelling Dental Insurance

Several ways exist to cancel your dental insurance, each with its own set of requirements. The most common methods include:

- Direct Contact with the Insurer: This is the most common method. You typically contact the insurance company via phone, email, or online portal to initiate the cancellation process. Always maintain records of communication, including dates, times, and names of representatives you spoke with.

- Using Online Portals: Many insurance companies offer online portals for managing your account. These portals often include features for canceling coverage, allowing you to initiate the cancellation process from the comfort of your home.

- Submitting Written Requests: Some insurers require written confirmation of your cancellation request. This often involves filling out a specific form or letter, which you can obtain from the insurer’s website or by contacting their customer service department.

Steps Involved in Cancelling Coverage

The typical steps involved in canceling dental insurance are Artikeld below. Each step is crucial to ensure a smooth and hassle-free cancellation process.

- Confirm Your Eligibility: Ensure you’re eligible for cancellation. Some plans may have specific conditions or deadlines that could prevent immediate cancellation.

- Contact the Insurer: Contact the insurance company using the method Artikeld in your policy or on their website. Gather all necessary details, including your policy number, name, and address.

- Submit the Cancellation Request: Provide the necessary documentation, such as a cancellation form or a written request. Keep a copy of the request for your records.

- Obtain Confirmation: The insurer should provide written confirmation of the cancellation. This confirmation should include the effective date of the cancellation.

- Record Keeping: Maintain copies of all correspondence, including cancellation requests and confirmations.

Cancellation Procedures for Different Plan Types

Cancellation procedures can vary based on whether your plan is employer-sponsored or an individual plan. The specific procedures and required documentation may differ.

| Plan Type | Key Considerations |

|---|---|

| Employer-Sponsored | Cancellation often involves notifying your employer and/or HR department. Your employer’s policies may influence the cancellation process. |

| Individual Plans | The cancellation process is generally more straightforward and handled directly with the insurance company. |

Important Considerations

Remember to review your policy documents carefully for specific cancellation procedures and deadlines. A clear understanding of these details will ensure a smooth cancellation experience.

Important Considerations Before Cancellation: How To Cancel Dental Insurance

Cancelling your dental insurance might seem like a quick fix for your budget, but it’s crucial to weigh the potential consequences. Before you pull the trigger, understanding the implications of this decision is key to making an informed choice. It’s not just about the immediate cost savings; it’s about your long-term oral health and financial well-being.

Potential Consequences of Cancellation

Cancelling dental insurance can lead to significant financial burdens down the road. A lack of coverage can dramatically increase the cost of future dental procedures, including routine cleanings, fillings, and more complex treatments like root canals or crowns. This is especially true for unexpected or emergency dental needs.

Implications on Current Treatments and Balances

If you’re currently undergoing dental treatment, canceling your insurance might impact your ability to afford the ongoing costs. Some plans may offer coverage for treatments already in progress, but others might not. Carefully review your policy’s cancellation provisions to understand the financial responsibilities you’ll inherit if you discontinue your coverage.

Financial Implications of Cancellation

The financial impact of canceling dental insurance can be substantial. Consider the cost of routine checkups, cleanings, and preventive care, which are often covered by insurance. Without coverage, these routine expenses can quickly add up. For example, a routine cleaning might cost $100-$200 without insurance but be covered entirely by your plan. Imagine how quickly that small cost can become a significant expense without insurance.

Importance of Understanding Cancellation Policy and Terms

Thoroughly reviewing your insurance plan’s cancellation policy is essential. This document Artikels the specific conditions and procedures for canceling your coverage. It’s crucial to understand any penalties or limitations that might apply. Some policies might have waiting periods before coverage ceases or may require a specific notice period. Failure to adhere to these terms could result in unexpected fees or financial obligations.

Pros and Cons of Cancelling Dental Insurance

| Pros | Cons |

|---|---|

| Potentially lower monthly premiums. | Increased risk of incurring significant dental costs in the future. |

| Increased disposable income. | Difficulty affording necessary dental procedures without coverage. |

| Greater control over your budget. | Potential for significant financial burden during emergencies or complex procedures. |

| Flexibility in choosing providers. | Reduced access to quality dental care due to cost constraints. |

This table provides a simplified comparison, and individual circumstances can greatly affect the overall outcome. The specific pros and cons will vary based on your individual dental needs, existing insurance policy, and financial situation.

Documents and Information Needed

Cancelling your dental insurance requires meticulous attention to detail and proper documentation. This section details the critical paperwork needed for a smooth and efficient cancellation process. Understanding the required forms and ensuring their accuracy is key to avoiding delays or complications. Having everything prepared beforehand saves you time and stress.

Required Documents Overview

To initiate the cancellation process, you’ll need to gather specific documents from your dental insurance provider. These documents verify your identity, insurance coverage, and the request for cancellation. The exact requirements may vary depending on the insurance company, so it’s crucial to check with them directly for the most up-to-date information. Failing to provide necessary documents may result in the cancellation request being delayed or denied.

Insurance Policy Documents

Your insurance policy is the cornerstone of your cancellation request. It contains essential details about your coverage, including policy number, effective dates, and specific cancellation procedures. Be sure to have the entire policy document handy, not just a summary.

Identification Documents

Verifying your identity is critical. Providing valid government-issued photo identification is necessary. This could include a driver’s license, passport, or state-issued ID card. The format and specific requirements for ID documentation vary by jurisdiction. Ensure the ID is current and reflects your legal name as it appears on your insurance policy.

Proof of Address

Proof of your current address is often required. This helps the insurance company verify your location and ensure correspondence reaches you correctly. Utility bills, bank statements, or a recent lease agreement are typical examples of acceptable proof of address. Ensure the date on the document is recent.

Cancellation Request Form

Most insurance providers have a specific form for canceling coverage. This form typically Artikels the steps for cancellation, deadlines, and required information. You’ll need to complete this form accurately and completely. Carefully review the form’s instructions to ensure compliance.

Unleashing the shackles of unnecessary dental insurance requires meticulous planning, a process fraught with potential pitfalls. Navigating the complexities of cancellation procedures demands careful attention to detail, and understanding the financial implications is crucial. Knowing how much prescription glasses cost without insurance, a crucial consideration for those seeking to streamline their healthcare budget, will profoundly impact your financial freedom.

How much is prescription glasses without insurance can significantly influence the decision to cancel dental coverage. Ultimately, the decision to cancel dental insurance hinges on a thorough assessment of your individual needs and circumstances.

Table of Required Documents

| Document Type | Description | Example |

|---|---|---|

| Insurance Policy | Complete policy document. | Contains details like policy number, coverage, and cancellation procedures. |

| Photo ID | Valid government-issued photo ID. | Driver’s license, passport, or state-issued ID card. |

| Proof of Address | Recent document verifying current address. | Utility bill, bank statement, or lease agreement. |

| Cancellation Request Form | Form provided by the insurance company for cancellation requests. | Contains specific instructions and fields for cancellation information. |

Cancelling Coverage Online and by Phone

Canceling your dental insurance can feel like navigating a maze, but it doesn’t have to be. Understanding the process, whether you choose to do it online or over the phone, empowers you to make the right decision for your needs. Knowing the ins and outs of both methods will help you save time and potentially avoid headaches.This section dives deep into the practical aspects of canceling your dental insurance, offering a clear roadmap for both online and phone-based cancellations.

We’ll highlight the advantages and disadvantages of each approach, guiding you toward the best course of action for your situation.

Online Cancellation Procedures

Online cancellation is often the faster and more convenient option. However, not all providers offer this feature, and the process can vary significantly.

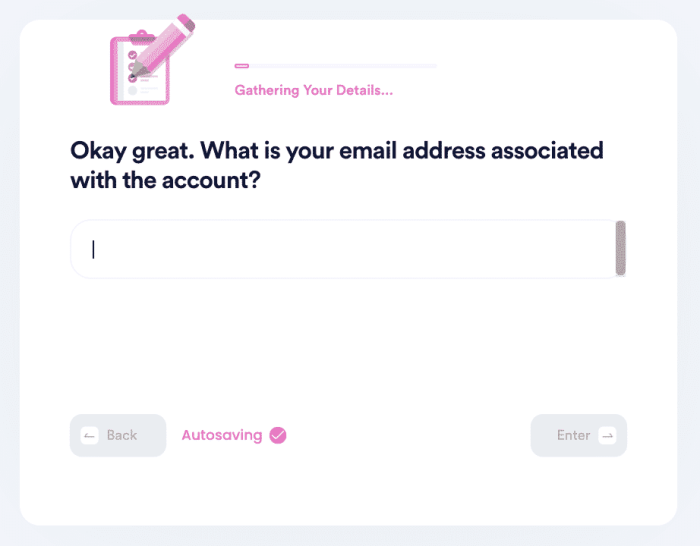

- Account Access and Portal Navigation: Most dental insurance providers have secure online portals for managing your account. Look for a section specifically labeled “Account Management,” “Cancel Coverage,” or a similar designation. Accessing your account often requires a username and password, which you should have readily available. Navigating the portal efficiently is key to a smooth cancellation process.

- Specific Cancellation Procedures: Once inside the portal, you’ll need to locate the cancellation section. This could be within your account details, under a dedicated “Coverage” or “Policies” section. Follow the on-screen instructions, providing the necessary information requested. This might include confirmation numbers, policy details, or other specifics.

- Important Considerations: Be sure to read all terms and conditions related to cancellation. Often, there are deadlines for cancellation or potential penalties for canceling before a specific period. Understanding these terms ensures a straightforward and problem-free experience. Also, keep a record of the cancellation date and time for your records.

Phone Cancellation Procedures

Canceling by phone can be helpful if you prefer speaking with a representative. This method often offers personalized support, but it may involve waiting on hold or dealing with a large call volume.

- Finding the Right Contact Information: Identify the appropriate phone number for your dental insurance provider. Look for a dedicated customer service or cancellation line, if available, to expedite the process.

- Preparing for the Call: Gather all necessary documents, including your policy number, date of birth, and any other relevant information that the representative might request. Having these details readily available will make the process smoother and more efficient. Having your account number and any relevant documentation at the ready is critical.

- Following the Steps: The representative will guide you through the cancellation process. Actively listen to their instructions and ask clarifying questions if needed. Be prepared to provide the necessary information accurately and completely. Take detailed notes, including confirmation numbers or reference codes.

- Confirmation and Documentation: Request a confirmation number or written confirmation of your cancellation. This serves as proof that your cancellation request was successfully processed. Keep a record of the confirmation number for future reference and to track the cancellation’s progress.

Online vs. Phone Cancellation: Pros and Cons

- Online Cancellation:

- Pros: Convenience, speed, usually available 24/7. No need to wait on hold.

- Cons: Not all providers offer online cancellation, potential technical issues, lack of immediate human support.

- Phone Cancellation:

- Pros: Personalized support, ability to clarify questions immediately, direct interaction with a representative.

- Cons: Potentially longer wait times, need to be available during business hours, potential for miscommunication.

Step-by-Step Phone Cancellation Guide

- Gather Your Information: Ensure you have your policy number, account number, and any relevant identification details readily available.

- Contact the Provider: Call the customer service or cancellation line, as appropriate.

- State Your Intent: Clearly inform the representative that you wish to cancel your dental insurance coverage.

- Provide Necessary Details: Answer any questions the representative asks accurately and completely.

- Confirm Cancellation: Request a confirmation number or written confirmation of your cancellation request.

- Follow Up: Keep a copy of any confirmation documents for your records.

Grace Periods and Notice Requirements

Cancelling your dental insurance isn’t as simple as just clicking a button. There are often grace periods and specific notice requirements you need to meet to ensure a smooth transition. Understanding these nuances can save you from potential penalties or issues down the line. Knowing these details empowers you to make informed decisions about your coverage.Grace periods and notice requirements vary significantly depending on your insurance provider and the specific plan you hold.

These procedures are put in place to allow both the insurance company and the insured a reasonable timeframe to process the cancellation and ensure appropriate handling of any outstanding claims or benefits. Failure to adhere to these guidelines can lead to complications and delays in the cancellation process.

Grace Periods Associated with Cancellation

Grace periods, if applicable, are timeframes after your cancellation request is submitted during which you’re still covered for services. These periods are crucial to understand as they impact the timing of your last coverage. They can vary considerably. A grace period isn’t guaranteed for all dental insurance plans. For some, the coverage continues until the end of the policy period, regardless of when the cancellation request is submitted.

Notice Requirements for Cancellation

Notice requirements dictate the specific timeframes and methods you need to communicate your cancellation request to the insurance company. This usually involves written notification and adherence to specific deadlines. Failure to meet these requirements might result in the continuation of your coverage or a delay in the cancellation process.

Implications of Not Adhering to Notice Requirements

Failure to follow the required notice periods can have various implications. The most common is the continuation of your coverage beyond your intended cancellation date. You might also face penalties or fees, and it could make resolving any outstanding claims more difficult. In some cases, your insurance company might not process the cancellation request at all, which means you remain covered, which could be a positive or negative outcome depending on your situation.

Examples of Grace Periods and Notice Requirements

Examples of grace periods and notice requirements are diverse, depending on the insurance provider. Some plans might offer a 30-day grace period, while others may require a 60-day notice period. These terms and conditions are explicitly stated in your policy documents. Review your policy carefully to understand your specific plan’s stipulations.

Table Comparing Grace Periods for Different Plans

| Insurance Provider | Plan Type | Grace Period (Days) | Notice Period (Days) |

|---|---|---|---|

| ABC Dental Insurance | Basic | 30 | 30 |

| XYZ Dental Insurance | Premium | 60 | 60 |

| PQR Dental Insurance | Silver | 0 | 45 |

Note: This table is for illustrative purposes only. Actual grace periods and notice requirements may vary. Always refer to your specific policy documents for accurate information.

Handling Outstanding Balances and Claims

Cancelling your dental insurance isn’t a simple on/off switch. You need to understand the ramifications, especially regarding any outstanding balances or pending claims. This section dives into the nitty-gritty of how these are handled during the cancellation process, providing clarity and empowering you to navigate the process effectively.

Outstanding Balance Resolution Procedures

Insurance companies have established protocols for handling outstanding balances and claims during cancellation. These procedures ensure a fair resolution for both the policyholder and the insurance provider. Failure to follow these procedures can lead to complications and delays in receiving reimbursements or settling outstanding amounts.

Submitting Final Claims

To ensure your final claims are processed correctly, meticulously gather all required documentation. This might include receipts, x-rays, and any other supporting materials. Clearly label the documents to facilitate quick processing by the insurance company. Following the insurance provider’s specific claim submission guidelines is crucial to avoid rejection.

Options for Resolving Outstanding Balances

Several options exist for resolving outstanding balances. If you have an outstanding balance, the insurance company might offer a payment plan. You can also negotiate a settlement, although this depends on the specific circumstances. In some cases, you may need to submit additional information or documentation to substantiate the claim and ensure proper payment.

Insurance Company Practices

| Insurance Company | Outstanding Balance Handling |

|---|---|

| Acme Dental Insurance | Offers a 30-day grace period for submitting final claims. Outstanding balances are typically settled within 45 days of cancellation. |

| Universal Dental Insurance | Provides a payment plan option for outstanding balances. Final claims must be submitted within 14 days of cancellation. |

| Healthy Smiles Insurance | Handles outstanding balances on a case-by-case basis, offering payment plans for eligible claims. Final claims are processed within 60 days of cancellation. |

These are just examples, and procedures can vary significantly between insurance providers. Always refer to your specific policy details for accurate information.

Flowchart for Handling Outstanding Claims

This flowchart Artikels the general steps involved in handling outstanding claims during cancellation. Understanding these steps will help you stay organized and ensure a smooth resolution.

Note: This is a general flowchart; specific steps and timelines may vary by insurance company. Always consult your policy document for precise details.

Alternatives to Canceling Coverage

Cancelling dental insurance might seem like the only option when faced with unexpected expenses or lifestyle changes. But there are often better ways to manage your coverage and keep the benefits. Consider these alternatives before taking the drastic step of cancellation. It’s frequently more cost-effective and advantageous to adjust your current plan than to terminate it completely.

Changing Plans

Switching to a different dental plan can significantly impact your out-of-pocket costs and coverage. A different plan might offer better benefits, lower premiums, or more favorable network options. Researching available plans within your current insurance provider or exploring other providers is a smart first step. Compare the coverage details, including annual maximums, co-pays, and deductibles, to make an informed decision.

Look for plans that align with your current needs and anticipated future dental care requirements.

Adjusting Coverage

Adjusting your coverage level can be a valuable strategy for cost optimization. Some plans allow you to reduce the extent of benefits, such as opting for a lower annual maximum or a less comprehensive coverage level. A reduced benefit plan might save you money on premiums while still providing essential coverage. You’ll need to evaluate whether the reduced coverage meets your specific dental needs and financial capacity.

Steps Involved in Modifying Coverage, How to cancel dental insurance

Modifying your dental insurance coverage typically involves contacting your insurance provider directly. This usually involves completing a form or request for modification, explaining your reasons for changing your coverage, and submitting the necessary documentation. Review the provider’s specific procedures and deadlines to ensure you comply with all requirements. Don’t hesitate to ask for clarification or assistance from your insurance provider if needed.

Examples of Alternatives to Cancellation

- Switching to a high-deductible plan: This option might save you money on premiums, but you’ll need to prepare for higher out-of-pocket expenses for dental procedures until you meet your deductible.

- Choosing a plan with a lower annual maximum: This can lower your monthly premiums, but it might limit the total amount your insurance will cover in a year. Be sure to carefully consider the potential financial implications.

- Adding a supplemental plan: This can be beneficial for covering additional dental procedures that aren’t fully covered by your existing plan. Supplemental plans can provide a more comprehensive coverage level for a specific procedure or service.

Comparison Chart of Alternatives

| Alternative | Description | Potential Benefits | Potential Drawbacks |

|---|---|---|---|

| Change Plan | Switching to a different plan offered by the same or another provider. | Better coverage, lower premiums, preferred network access. | Potential for increased out-of-pocket costs if not carefully researched. |

| Adjust Coverage | Reducing the extent of benefits, like lower annual maximums. | Lower monthly premiums, potentially better affordability. | Limited coverage, potential for higher out-of-pocket expenses. |

| Supplemental Plan | Adding a supplemental plan to complement your existing coverage. | Enhanced coverage for specific procedures. | Increased premiums, potential overlap with existing coverage. |

Maintaining Records After Cancellation

Keeping track of your dental insurance records after cancellation might seem like a minor detail, but it can save you headaches down the road. Proper record-keeping ensures you’re aware of any outstanding claims or obligations, and it helps if you need to reinstate coverage in the future. It also protects you from potential issues with billing and ensures your financial records are in order.Understanding the importance of maintaining records is crucial for managing your financial well-being and avoiding future complications.

It’s not just about keeping paperwork; it’s about proactively safeguarding your interests and ensuring a smooth transition after canceling your coverage.

Importance of Maintaining Records

Maintaining accurate records after canceling your dental insurance is critical for several reasons. It ensures that you have all the necessary information if you decide to reinstate your coverage or if there are any disputes or queries related to your previous coverage. This thorough documentation will help prevent misunderstandings and potentially save you time and money in the long run.

Documents to Keep and Retention Period

Thorough record-keeping involves knowing exactly what documents to retain and for how long. This isn’t just about collecting papers; it’s about strategic organization to access crucial information quickly.

- Policy Documents: Keep your original policy documents, including the certificate of insurance, summary of benefits, and any riders or endorsements. These documents detail your coverage specifics, benefits, and limitations. Retaining these documents ensures you have a complete picture of your previous coverage and is essential for understanding your financial obligations. Retain these documents indefinitely.

- Claims and Payment Records: Carefully save all submitted claims, receipts, and payment confirmations. These records document the progress of your claims, the amount paid, and the amounts owed. This information will be invaluable if you need to resolve any issues related to outstanding claims or payments. Retain these documents for at least 3 years or according to your state’s statute of limitations.

- Correspondence with Insurance Provider: All letters, emails, and other communication you receive from the insurance company should be saved. These documents can help clarify any misunderstandings or provide evidence of interactions you had with the insurance company about your cancellation or claims. Retain these documents for at least 3 years or according to your state’s statute of limitations. If the communication is about a dispute or a claim, it’s wise to keep it indefinitely.

Examples of Important Records

Here are some concrete examples of records to keep, demonstrating the practical application of the general guidelines:

- Original policy documents: These are essential for understanding your coverage details.

- Claims submission forms: Proof of your submitted claims.

- Payment receipts: Evidence of payments made.

- Correspondence about cancellation: All emails, letters, and other communication about the cancellation process.

Secure Storage of Documents

Storing these documents securely is just as crucial as keeping them. Think about how you’d retrieve this information if you needed it.

- Physical Storage: If you’re storing documents physically, use a fireproof and waterproof safe or a file cabinet in a secure location. A binder or folder is useful for organizing documents chronologically.

- Digital Storage: If you’re storing documents digitally, create backups of your files and use strong passwords to protect your data. Consider using cloud storage services with robust security features.

Checklist for Maintaining Records

This checklist provides a streamlined approach to ensuring you’ve captured all necessary documents:

| Document Category | Specific Documents | Retention Period |

|---|---|---|

| Policy Documents | Policy Certificate, Summary of Benefits, Riders | Indefinite |

| Claims and Payments | Claim Forms, Receipts, Payment Confirmation | 3 years or statute of limitations |

| Correspondence | Emails, Letters, Notices | 3 years or statute of limitations |

Final Summary

In conclusion, canceling dental insurance requires careful consideration and meticulous adherence to the insurer’s policy. This review provides a comprehensive guide, yet individual circumstances may necessitate further consultation. The complexities of handling outstanding balances, understanding grace periods, and exploring alternatives are vital components of a successful cancellation. Ultimately, thorough preparation and proactive communication are paramount.

Quick FAQs

What are the typical steps involved in canceling employer-sponsored dental insurance?

Contacting your employer’s HR department is the first step. They will provide specific instructions, potentially requiring a completed form and adherence to their internal deadlines.

What if I have outstanding dental bills when canceling?

The insurer’s policy dictates how outstanding balances are handled. It’s crucial to understand the procedures for submitting final claims and resolving outstanding balances before canceling.

Can I cancel my dental insurance online?

Some dental insurance providers offer online cancellation options. Access to your online account, usually through a portal, is typically required, along with adhering to any specific online cancellation procedures.

What documents do I need to cancel my dental insurance?

Specific documents vary by provider. Typically, your policy documents, proof of identity, and any relevant claim information will be needed.