As how is a credit union different from a bank takes center stage, this opening passage beckons readers with stimulating spiritual enlightenment style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Delving into the essence of financial stewardship, we embark on a journey to illuminate the profound distinctions between credit unions and traditional banks. This exploration will unveil the foundational principles that guide each institution, from their very ownership structures to their ultimate purpose in serving humanity. Prepare to witness a paradigm shift in your understanding of financial institutions as we uncover the spiritual underpinnings of cooperative versus corporate models.

Fundamental Ownership Structures

:max_bytes(150000):strip_icc()/bank-vs-credit-union-315399_final-7e75d758bc894e5da45e6b4d474e304d.png?w=700)

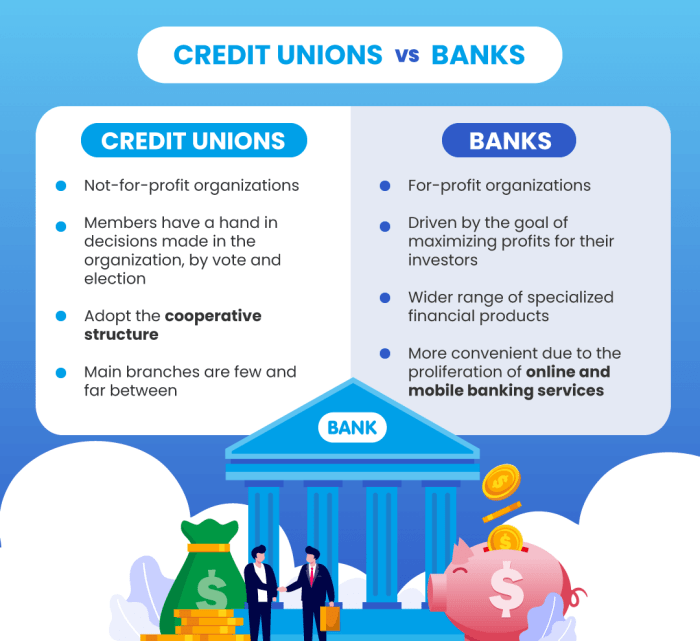

Alright, let’s dive into what really makes a credit union and a bank different under the hood. It all boils down to who’s actually calling the shots and who benefits when things are booming. Think of it like the difference between a tight-knit neighborhood potluck and a fancy corporate gala – both serve food, but the vibe and the ownership are totally different.The core difference is as fundamental as it gets: ownership.

Banks are typically owned by shareholders, people or entities who buy stock in the bank with the primary goal of making a profit. Credit unions, on the other hand, are owned by their members – that’s you, me, and anyone else who has an account there. This isn’t just a technicality; it’s the engine that drives their entire operational philosophy.

Member Ownership vs. Shareholder Ownership

This ownership difference is a total game-changer when it comes to how decisions are made. When a bank is owned by shareholders, the main directive is to maximize profits for those investors. Every decision, from fees to interest rates to the services offered, is filtered through the lens of shareholder return. It’s all about the bottom line, and sometimes that means services that are great for the bank might not be so great for the everyday customer.Credit unions operate on a democratic, member-owned model.

Each member, regardless of how much money they have in their account, usually gets one vote. This means decisions are made with the best interests of the membership at heart. It’s less about squeezing every last penny out of customers and more about providing affordable financial services and building a community. It’s like the difference between a CEO answering to a board of investors versus a community leader answering to the people they serve.

Profit Motive vs. Service Orientation

The profit motive of a bank is pretty straightforward. They’re in the business of making money, and that’s totally legit for a for-profit enterprise. They earn revenue through interest on loans, fees for services, and investments. When a bank does well, the profits typically go to the shareholders.Credit unions, however, are not-for-profit institutions. Any “profit” they make – which they call surplus – is returned to the members.

This can manifest in a few awesome ways:

- Lower interest rates on loans, like car loans or mortgages.

- Higher interest rates on savings accounts and certificates of deposit (CDs).

- Lower fees for services, or sometimes no fees at all.

- Investment back into the credit union through better technology, more branches, or enhanced member services.

It’s like the credit union is a collective savings and lending club, where everyone pitches in and everyone benefits from the success. Instead of a big corporation getting richer, the money stays within the community of members, making financial life a little easier for everyone involved.

Membership and Accessibility

So, you’re wondering how to get your hands on some financial services, right? Well, when it comes to credit unions versus banks, the way you get in the door is a bit of a plot twist. Think of it like a VIP club versus a public park – both offer services, but who gets to chill there is a whole different ballgame.Credit unions are all about community, and that means they’re not just open to anyone with a pulse and a few bucks.

They have specific criteria, kind of like trying to get backstage passes. Banks, on the other hand, are generally more like an open-door policy, making their services accessible to a much wider audience.

Credit Union Eligibility Requirements

To join the cool kids’ table at a credit union, you gotta meet their membership criteria. This isn’t some random draw; it’s all about who they’re set up to serve. It’s like needing a specific type of ticket to get into a concert.The primary eligibility requirement for joining a credit union is being part of its defined “field of membership.” This means you have a connection to the organization or group that chartered the credit union.

It’s not about having the most money, but about belonging to a certain community.

The Field of Membership Concept

This “field of membership” is the secret sauce that makes credit unions unique. It’s the group of people or organizations that a credit union is legally allowed to serve. Think of it as the exclusive guest list for a private party.

“A credit union’s field of membership defines its community and its core mission.”

This concept ensures that credit unions remain focused on serving their members, rather than just chasing profits from any customer. It’s about building relationships and understanding the financial needs of a specific group.

Common Fields of Membership

Credit unions often define their field of membership based on various common ties. These affiliations can be as straightforward as where you live or work, or as specific as your employer or the organizations you belong to.Here are some typical examples of fields of membership that credit unions use:

- Employer-Based: Many credit unions are formed by employees of a particular company or industry. For instance, a credit union might be for teachers in a specific school district or for employees of a large manufacturing plant.

- Geographic Location: Some credit unions serve anyone who lives, works, worships, or attends school within a specific city, county, or even a defined neighborhood. This makes them a great option for local community members.

- Association or Group Membership: If you’re part of a particular professional organization, alumni association, religious group, or even a labor union, there’s a good chance there’s a credit union specifically for members of that group.

- Family Relationships: Often, if one member of a family is eligible for a credit union, their relatives can also join, extending the membership benefits to the entire household.

Bank Accessibility

Now, let’s talk about banks. Their vibe is generally much more laid-back when it comes to who can use their services. It’s less about who you know and more about whether you have an account.Most banks operate with a much broader accessibility model. As long as you can meet their basic account opening requirements, like providing identification and meeting minimum deposit amounts, you’re usually good to go.

This makes them a go-to for a wide range of consumers, from students to seasoned professionals, without the need for a specific affiliation. They are designed to be available to the general public, making financial services a lot more widespread.

Governance and Control

Alright, let’s dive into the nitty-gritty of how credit unions and banks are run, because when it comes to your money, knowing who’s in charge is kinda a big deal. Think of it like the difference between a democracy and, well, something a little more top-down.

Credit Union Democratic Governance

Credit unions are all about the people – the members! This translates directly into how they’re governed. It’s a grassroots operation, where every member gets a say, like casting a ballot in your favorite reality TV show, but with way more impact on your financial future. This structure ensures that the credit union is always working for its members, not just a select few.

Volunteer Board of Directors

The brain trust of a credit union? That’s the volunteer board of directors. These folks are actual members, just like you, who step up to the plate to guide the credit union’s strategy and ensure it’s staying true to its mission. They’re not getting paid big bucks; they’re doing it because they believe in the credit union movement. It’s like having your most trusted, financially savvy friends making the big calls.

Understanding how a credit union differs from a bank, especially regarding asset protection, is wise. While banks operate for profit, credit unions are member-owned, which can influence how they handle accounts and potential issues like whether can debt collectors seize your bank account. This member-focused approach is a key distinction from traditional banks.

Bank Corporate Board Structure

Now, let’s flip the script to banks. Their boards are typically made up of paid professionals, often with backgrounds in finance, business, and sometimes even politics. While they’re certainly experienced, their primary responsibility is to the shareholders – the folks who own stock in the bank. This can create a different set of priorities compared to a member-owned credit union.

Member Influence on Credit Union Policies

Here’s where the democratic muscle really flexes. Every year, members get to vote on who sits on the board of directors. Think of it as your chance to elect your financial dream team. Plus, major policy decisions often get a nod from the membership. This direct influence means that when you have an idea or a concern, it’s not just falling on deaf ears; it can actually shape how your credit union operates.

It’s a system built on the idea that the collective voice of the members is the most powerful force.

Product and Service Offerings: How Is A Credit Union Different From A Bank

When you’re trying to figure out where to park your hard-earned cash, both banks and credit unions offer a buffet of financial products and services. Think of it like comparing your favorite fast-food joints – they both serve burgers, but the ingredients, the vibe, and the deals can be totally different. While banks often go for the “everything for everyone” approach, credit unions tend to be a bit more dialed-in, focusing on what their members actually need to thrive.This isn’t to say credit unions are slacking; they’ve got the essentials covered and then some.

The real difference often lies in thewhy* behind their offerings. Banks are businesses driven by shareholder profits, so their product development is geared towards maximizing that. Credit unions, on the other hand, are member-owned, so their product strategy is all about giving their members the best bang for their buck, often with a more personal touch.

Financial Product and Service Range

Let’s break down the menu. Banks, being the big players they are, usually boast a massive catalog of financial goodies. They’re like the superstores of the financial world, carrying everything from basic checking and savings accounts to super-complex investment vehicles, international wire transfers, and business loans that could fund a small nation. They’ve got the resources to offer a dizzying array of options, catering to everyone from a student opening their first account to a multinational corporation managing its global finances.Credit unions, while often smaller, are far from being penny-pinchers when it comes to services.

They definitely cover the core financial needs: checking, savings, loans, credit cards, and online banking. Where they might differ is in the sheer breadth and depth of the more niche or high-end offerings. You might not find every single type of exotic investment product or the same level of specialized business banking services at a credit union as you would at a massive national bank.

However, they often excel in areas that directly benefit their membership, like affordable mortgage rates or student loan programs tailored to local educational institutions.

Prioritizing Member Needs

This is where credit unions really shine, like a superhero swooping in to save the day. Because they’re run by and for their members, credit unions are hyper-attuned to what their community actually needs. If a credit union’s members are primarily young families, they might put extra effort into offering competitive car loan rates or robust savings accounts with decent interest.

If their membership is heavily composed of local small business owners, they might focus on providing accessible business checking accounts and flexible loan options. It’s all about serving the crew.Banks, while they do market research, are ultimately trying to appeal to the broadest possible market to maximize profits. This can sometimes mean offering products that are more profitable for the bank, even if they aren’t the absolute best fit for every individual customer.

A credit union’s priority is member well-being, so their product development is less about chasing the next big profit margin and more about empowering their members financially.

Common Loan Products

When it comes to borrowing money, both banks and credit unions offer a pretty standard set of tools. You’ll find these staples at pretty much any financial institution worth its salt:

- Mortgage Loans: The big kahuna for buying a home.

- Auto Loans: For getting that sweet ride you’ve been eyeing.

- Personal Loans: For whatever life throws your way – consolidating debt, unexpected expenses, or that dream vacation.

- Student Loans: To help finance your education and avoid becoming a broke scholar.

- Home Equity Loans/Lines of Credit: Leveraging the value of your home for extra cash.

The key differentiator here, as with other products, often comes down to the interest rates, fees, and the flexibility of the terms. Credit unions frequently aim to offer more competitive rates on loans because they don’t have the same profit margins to hit as banks. They might also be more willing to work with members who have less-than-perfect credit, offering a lifeline where a big bank might just say “no thanks.”

Savings and Checking Accounts

When it comes to everyday banking, the choices are plentiful at both banks and credit unions, though the details can vary.Banks typically offer a wide spectrum of checking accounts, from no-frills basic accounts with minimal features to premium accounts that come with perks like free checks, ATM fee reimbursements, and even relationship benefits if you have other accounts with them.

Their savings accounts also range from simple passbook savings to high-yield options, though the “high-yield” part can sometimes be a bit of a stretch compared to what other institutions might offer.Credit unions also provide a solid foundation of checking and savings accounts. You’ll find standard checking accounts, often with low or no monthly fees and sometimes even earning a little interest.

Their savings accounts, often called “share accounts” because you’re buying a share in the credit union, are usually straightforward and provide a safe place to stash your cash. The real draw for credit unions here is often the competitive interest rates they can offer on both checking and savings, especially compared to the average bank. They might also have fewer and lower fees, making your money work harder for you.

“It’s not about how much you have, but how much you save and how wisely you invest it.”

A wise financial guru, probably.

Fee Structures and Interest Rates

Alright, let’s dive into the nitty-gritty of where your hard-earned cash goes and how much it earns. When we talk about credit unions versus banks, especially concerning fees and interest rates, it’s like comparing a local lemonade stand to a massive fast-food chain. One’s all about community and keeping things fair, the other’s focused on maximizing profits for shareholders. This fundamental difference plays a HUGE role in your wallet.Credit unions, being non-profit outfits, don’t have shareholders breathing down their necks demanding sky-high profits.

Their mission is to serve their members, which means they can often pass on savings in the form of lower fees and better interest rates. Banks, on the other hand, are for-profit businesses. Their primary goal is to generate returns for their investors, and that often means squeezing a bit more out of their customers through fees and by paying less on deposits.

It’s the classic “people helping people” versus “profit-driven” dynamic.

Fee Structures for Common Banking Services

Let’s break down the typical fees you might encounter. Think of it like checking the price tag on your favorite sneakers versus a generic brand. Banks often have a more extensive and sometimes higher list of fees for everyday services. Credit unions, aiming to keep costs down for their members, tend to have fewer fees, and when they do charge, they’re often significantly lower.Here’s a look at what you might see:

- Monthly Maintenance Fees: Many checking and savings accounts at traditional banks come with a monthly fee unless you meet certain balance requirements or direct deposit thresholds. Credit unions are far more likely to offer free checking and savings accounts with no minimum balance required.

- ATM Fees: If you use an ATM outside your bank’s network, you’re almost guaranteed to pay a fee, sometimes two (one from the ATM owner, one from your bank). Credit unions often have larger ATM networks or participate in shared branching networks, meaning you can use thousands of ATMs nationwide without paying a fee.

- Overdraft Fees: These can be brutal at banks, often costing $30-$35 per overdraft. While credit unions also have overdraft fees, they are frequently lower, and some offer more flexible overdraft protection options that are less punitive.

- Wire Transfer Fees: Sending money electronically can also rack up costs at banks, with both domestic and international transfers incurring fees. Credit unions generally have more competitive rates for wire transfers.

- Account Closing Fees: While less common, some banks might charge a fee if you close an account shortly after opening it. This is rarely seen with credit unions.

Interest Rates on Loans and Savings

This is where the “non-profit” versus “for-profit” distinction really shines. For credit unions, lower operating costs and a member-first approach mean they can often offer more bang for your buck.When it comes to saving your money, credit unions typically offer higher Annual Percentage Yields (APYs) on savings accounts, money market accounts, and certificates of deposit (CDs) compared to what you’d find at most large banks.

This means your money grows faster.On the flip side, when you need to borrow money, credit unions generally offer lower Annual Percentage Rates (APRs) on loans, including auto loans, personal loans, and mortgages. This translates to saving money on interest payments over the life of the loan.

Credit unions are designed to return profits to their members through better rates and lower fees, while banks are designed to return profits to their shareholders.

Hypothetical Scenario: Auto Loan Savings

Let’s imagine you’re looking to buy a sweet new ride, say a $30,000 car, and you need a loan for 60 months. Scenario A: The Big BankYou secure an auto loan from a large national bank with an APR of 7.5%.Using a loan calculator, your estimated monthly payment would be around $584.28.Over the life of the loan (60 months), your total interest paid would be approximately $5,016.80.

Scenario B: The Credit UnionYou go to your local credit union, which offers you an auto loan with an APR of 5.5% for the same $30,000 over 60 months.Your estimated monthly payment would be around $566.05.Over the life of the loan, your total interest paid would be approximately $3,963.00. The Bottom Line:In this hypothetical, by choosing the credit union, you would save approximately $1,053.80 in interest over the five years of your loan.

That’s extra cash you can use for, well, anything else! Maybe some sweet custom rims for that new car, or a killer vacation. It’s a tangible example of how a slightly better interest rate can make a significant difference.

Regulatory Framework and Insurance

Alright, let’s talk about the grown-ups in charge and how your cash is protected. When it comes to credit unions and banks, the government plays a big role in making sure everything is on the up and up. Think of it like the referees in a championship game – they’re there to keep things fair and square, especially when it comes to your hard-earned dough.The financial world can seem like a labyrinth, but understanding the regulatory bodies and insurance coverage is key to feeling secure.

These systems are designed to be your safety net, ensuring that even if the unthinkable happens, your money is still safe and sound.

Federal Regulator for Credit Unions

In the United States, the main federal agency keeping an eye on most credit unions is the National Credit Union Administration, or NCUA. This agency is all about making sure credit unions are run properly, are financially sound, and are looking out for their members. They’re like the ultimate compliance officers for the credit union world, setting the rules and making sure everyone plays by them.

NCUA Deposit Insurance

When you stash your cash in a federally insured credit union, your deposits are protected by the National Credit Union Administration. This protection is pretty sweet; it’s similar to the FDIC for banks. The NCUA guarantees that if a credit union goes belly-up, your money is covered up to a certain amount per depositor, per insured credit union, for each account ownership category.

The NCUA insures deposits at federal credit unions and most state-chartered credit unions up to $250,000 per individual depositor.

This insurance is a huge deal for consumers. It means you don’t have to sweat it if a credit union hits hard times. Your savings are safe, allowing you to focus on your financial goals without that nagging worry in the back of your mind.

FDIC Deposit Insurance for Banks

For banks, the deposit insurance big kahuna is the Federal Deposit Insurance Corporation, or FDIC. Just like the NCUA, the FDIC steps in to protect depositors if an insured bank fails. The coverage limits are generally the same: up to $250,000 per depositor, per insured bank, for each account ownership category. So, whether you’re rocking with a credit union or a bank, your deposits are typically covered to the same extent.

Implications for Consumer Protection

The presence of both the NCUA and the FDIC as federal regulators and insurers is a major win for consumers. It means that regardless of whether you choose a credit union or a bank, your deposits are safeguarded by robust federal insurance programs. This parity in coverage ensures a level playing field for consumer confidence, allowing you to make financial decisions based on services and convenience rather than being swayed by perceived differences in safety.

These agencies act as guardians of your financial well-being, building trust and stability in the financial system.

Community Focus and Impact

While banks are often national or even global players, credit unions are typically all about that local love. Think of it like this: a bank might be a blockbuster movie, seen everywhere. A credit union? It’s more like your favorite indie film, deeply rooted in its hometown vibe. This local connection means they’re not just in the business of money; they’re in the business of making their neighborhoods thrive.Credit unions often have a “people helping people” mantra, which isn’t just some cheesy slogan.

It’s a guiding principle that shapes how they operate. Instead of chasing shareholder profits like a hungry celebrity agent, they funnel their earnings back into services that benefit their members and the community at large. This can translate into better rates, lower fees, and investments in local initiatives that truly make a difference.

Reinvesting Profits Locally

Unlike traditional banks that might send profits to corporate headquarters or offshore accounts, credit unions are designed to keep that cash flowing within the community. This reinvestment strategy is a core part of their DNA, making them a powerful engine for local economic growth and support.Here’s how that reinvestment typically shakes out:

- Local Lending: A significant portion of profits is used to offer more competitive loan rates for mortgages, auto loans, and small business loans, keeping more money circulating within the local economy.

- Community Development Projects: Credit unions often sponsor or invest in local projects, such as affordable housing initiatives, community centers, or educational programs, directly enhancing the quality of life for residents.

- Support for Local Non-profits: They frequently partner with and donate to local charities and non-profit organizations, helping them fulfill their missions and serve vulnerable populations.

- Financial Literacy Programs: Many credit unions offer free financial education workshops and resources to members and the wider community, empowering individuals to make smarter financial decisions.

Community Engagement Strategies

When it comes to getting involved, credit unions and banks often approach it from different angles, driven by their fundamental structures and goals. It’s less about a corporate PR stunt and more about genuine participation.A typical bank’s community engagement might look like this:

- Sponsorship of large-scale, high-visibility events (e.g., major sports teams, national conferences).

- Donations to national charities or foundations, often with a focus on broad impact.

- Corporate social responsibility initiatives that might be centrally managed and less locally tailored.

In contrast, a credit union’s engagement is usually more hands-on and community-centric:

- Local Event Sponsorship: Sponsoring Little League teams, school fundraisers, local festivals, and community fairs – the stuff that’s part of everyday life.

- Volunteerism: Encouraging and facilitating employee volunteer hours at local food banks, shelters, and community clean-up events.

- Partnerships with Local Organizations: Collaborating with local schools on financial literacy, working with small business development centers, and supporting local chambers of commerce.

- Direct Member Benefits: The “profits” are often returned directly to members through better rates and fewer fees, which is a tangible form of community support by strengthening the financial well-being of its members.

The “People Helping People” Philosophy

This isn’t just a catchy tagline; it’s the heart and soul of the credit union movement. It signifies a deep-seated commitment to the financial well-being of individuals and communities, prioritizing human needs over pure profit maximization.This philosophy translates into a tangible difference in how credit unions operate:

“The credit union difference is rooted in a cooperative spirit, where members are owners, and the primary goal is to serve their financial needs and contribute to their collective prosperity.”

This means credit unions are more likely to go the extra mile for their members, offering personalized service and understanding the unique challenges and opportunities within their local areas. They see their members not just as customers, but as fellow community members who are all in this together. This collaborative approach fosters trust and loyalty, creating a financial institution that truly works for the people it serves.

Technology and Innovation

Alright, let’s dive into the digital playground where banks and credit unions are duking it out – technology! In today’s world, your bank or credit union’s tech game is just as important as their interest rates. It’s all about making your financial life smoother than a perfectly dropped beat.Think of it like this: both banks and credit unions are upgrading their tech arsenals, but sometimes one is rocking the latest gear while the other is still rocking a flip phone.

It’s a constant race to offer you the slickest, most convenient ways to manage your money, from your couch to the coffee shop.

Technological Advancements Offered

Both banks and credit unions are investing heavily in tech to keep up with customer demands and stay competitive. This means you’ll find a range of digital tools designed to make banking easier and more accessible.Here’s a breakdown of the typical tech advancements you’ll see:

- Online Banking Platforms: Robust websites that allow you to check balances, transfer funds, pay bills, and even apply for loans without stepping foot in a branch.

- Mobile Banking Apps: Dedicated smartphone applications for on-the-go banking, featuring mobile check deposit, card controls, and real-time transaction alerts.

- Digital Wallets and Contactless Payments: Integration with services like Apple Pay, Google Pay, and Samsung Pay for secure and quick transactions.

- Personal Finance Management (PFM) Tools: Features within apps or online portals that help you track spending, create budgets, and visualize your financial health.

- Secure Messaging and Customer Support: In-app or online chat features for quick and secure communication with customer service representatives.

- Biometric Authentication: Fingerprint or facial recognition for logging into your accounts, adding an extra layer of security.

Mobile Banking App Features Comparison, How is a credit union different from a bank

Mobile banking apps are where the rubber really meets the road for many users. They’re your primary connection to your money when you’re not near a computer. While both types of institutions offer apps, the sophistication and breadth of features can vary.Banks, especially the big national players, often have highly polished and feature-rich mobile apps. Think of them as the blockbuster movies of the app world – lots of bells and whistles, a smooth user interface, and integrations with a wide array of services.

Credit unions, while catching up fast, might sometimes have apps that are more streamlined, focusing on core banking functions, but they are increasingly offering comparable features.Here’s a look at what you might find:

| Feature | Typical Bank App | Typical Credit Union App |

|---|---|---|

| Mobile Check Deposit | Standard, often with high limits. | Standard, limits may vary. |

| Bill Pay | Comprehensive, often with e-bill options. | Comprehensive, usually with e-bill options. |

| Account Transfers | Seamless internal and external transfers. | Seamless internal and external transfers. |

| Card Controls (Freeze/Unfreeze) | Common, with granular controls. | Increasingly common, with good control options. |

| Budgeting Tools | Often integrated, sometimes quite advanced. | Available, but may be less sophisticated than large banks. |

| Biometric Login | Widely available. | Widely available. |

| Real-time Alerts | Highly customizable. | Customizable, focusing on key transactions. |

Adoption Rates of New Financial Technologies

When it comes to jumping on the latest fintech trends, big banks often have the advantage due to their massive resources and dedicated R&D departments. They can afford to experiment and roll out cutting-edge technologies to a huge customer base. Think of them as the early adopters who can afford to test drive every new gadget that hits the market.Credit unions, while often agile and responsive to member needs, might have a slightly more measured approach.

Their adoption rates can be influenced by the size of the credit union and the collective investment capacity of their membership. However, many credit unions are partnering with fintech companies or pooling resources to bring innovative solutions to their members, proving they aren’t afraid to innovate. They’re like the savvy tech enthusiasts who wait for the best reviews but then quickly adopt game-changing tech.

Online Banking Feature User Experience Comparison

The user experience (UX) of online banking platforms can be a major differentiator. Banks, especially those with dedicated UX teams and extensive user testing, often offer highly intuitive and visually appealing interfaces. These platforms are designed to be user-friendly, guiding you through complex tasks with ease. Imagine navigating a well-designed website that feels like second nature.Credit unions are also prioritizing UX, and many have invested in modernizing their online platforms to rival the big banks.

The experience can sometimes feel a bit more straightforward and less flashy, focusing on functionality and clarity. For some users, this simplicity is a plus, offering a no-nonsense approach to managing their finances. Others might find it less engaging than the feature-packed interfaces offered by larger institutions. It’s like comparing a sleek, minimalist smartwatch to a robust, multi-functional digital watch – both tell time, but the feel and presentation differ.

Last Recap

As we conclude this illuminating exploration, the tapestry of differences between credit unions and banks unfurls, revealing a spectrum of purpose and philosophy. The insights gained transcend mere financial transactions, touching upon the very spirit of service and community. By understanding these distinctions, we are empowered to align our financial choices with our deepest values, fostering a path towards greater abundance and collective well-being.

FAQ Overview

What is a credit union’s primary mission?

A credit union’s primary mission is to serve its members, operating on a not-for-profit basis with a focus on providing financial services that benefit the membership rather than generating profits for external shareholders.

Who owns a credit union?

A credit union is owned by its members, who are also its customers. Each member typically has one vote, regardless of how much money they have deposited.

Are credit unions federally insured?

Yes, deposits at federally insured credit unions are protected by the National Credit Union Administration (NCUA) up to at least $250,000 per depositor, per insured credit union, for each account ownership category.

Can anyone join a credit union?

No, to join a credit union, you must meet specific eligibility requirements, often based on your employer, geographic location, or affiliation with a particular group or organization. This is known as the “field of membership.”

Do credit unions offer the same products as banks?

Credit unions offer a wide range of financial products and services similar to banks, including checking and savings accounts, loans, mortgages, and credit cards. However, their offerings may be tailored to the specific needs of their membership.

How are credit union boards of directors chosen?

Credit union boards of directors are typically composed of volunteers elected by the members. This democratic structure ensures that the board represents the interests of the membership.

What does “non-profit” status mean for a credit union?

As not-for-profit organizations, credit unions return any earnings back to their members in the form of lower loan rates, higher savings rates, and fewer fees, rather than distributing profits to shareholders.

How does a credit union’s community focus differ from a bank’s?

Credit unions often have a stronger local community focus, with profits reinvested directly into the community they serve through local initiatives and member benefits, embodying a “people helping people” philosophy.