How to edit a bank statement is a path fraught with peril, a whispered temptation in the quiet hours when financial realities feel overwhelming. It’s a question that hovers in the periphery of necessity, a seemingly simple manipulation that unravels into a complex tapestry of ethical quandaries and stark legal repercussions.

This exploration delves into the hypothetical mechanics of altering such documents, examining the technical nuances of digital manipulation and the tell-tale signs that betray an edited truth. We will dissect the sophisticated methods employed by financial institutions to safeguard authenticity and underscore the profound importance of maintaining financial integrity in all dealings, for the echoes of deceit can resonate far beyond the immediate transaction.

Understanding the Nuances of Bank Statement Modification

While the idea of editing a bank statement might cross some minds, it’s crucial to understand that this is a serious matter with significant repercussions. This section delves into why people might consider such actions, the inherent ethical and legal boundaries, and the potential fallout from submitting falsified financial documents.It’s important to acknowledge that individuals might consider altering bank statements for a variety of reasons, often driven by a desire to present a more favorable financial picture than reality.

These motivations can range from seeking loans or mortgages to applying for rental properties or even for personal record-keeping purposes. However, regardless of the perceived necessity, the act of modification itself carries substantial risks.

Reasons for Bank Statement Alteration

Individuals may contemplate modifying bank statements for several common reasons. These often stem from a perceived need to meet specific financial thresholds or to create an illusion of financial stability.

- Loan and Mortgage Applications: A primary driver is often the attempt to qualify for a loan or mortgage by artificially inflating income or reducing apparent expenses. Lenders use bank statements as a key indicator of a borrower’s financial health and repayment capacity.

- Rental Property Applications: Landlords frequently request bank statements to verify a tenant’s ability to afford rent. Applicants might try to show higher balances or consistent income to appear more reliable.

- Visa and Immigration Applications: Some immigration processes require proof of sufficient funds to support oneself or family members. Altered statements could be an attempt to meet these financial requirements.

- Business Funding and Investment: Entrepreneurs seeking investment or business loans might edit statements to showcase stronger cash flow or higher asset levels.

- Personal Financial Management (Misguided Attempts): In rare cases, individuals might attempt to “clean up” their statements for personal reasons, perhaps to avoid confronting financial difficulties, though this is an unhealthy coping mechanism.

Ethical and Legal Implications of Falsifying Financial Documents

The act of falsifying financial documents like bank statements is not a minor transgression; it is a serious ethical breach and, more importantly, a criminal offense. These documents are foundational to trust in financial systems, and their integrity is paramount.

“Falsifying financial documents undermines the integrity of financial systems and is considered a form of fraud.”

The ethical implications are clear: it is dishonest and deceptive. Legally, it falls under the umbrella of fraud, which carries severe penalties. This includes charges related to forgery, misrepresentation, and potentially more serious financial crimes depending on the jurisdiction and the intent behind the falsification. The intent to deceive is a critical component in establishing legal culpability.

Consequences of Submitting Edited Bank Statements

The repercussions of being caught submitting an edited bank statement can be severe and far-reaching, impacting both immediate applications and future financial endeavors. Institutions that rely on these documents have robust verification processes in place.The consequences can be categorized as follows:

- Immediate Application Rejection: The most direct outcome is the instant denial of whatever application the edited statement was submitted for, be it a loan, rental, or visa.

- Damage to Reputation and Trust: Once discovered, an individual’s reputation for honesty and integrity is severely damaged. This can make it extremely difficult to secure financial products or services in the future, as trust is a critical factor.

- Legal Penalties: Depending on the severity and intent, individuals can face criminal charges. This may result in hefty fines, probation, or even imprisonment. For example, in the United States, submitting fraudulent documents to a financial institution can lead to charges under federal laws like the False Statements Act.

- Blacklisting by Institutions: Financial institutions, landlords, and other organizations often maintain internal databases of individuals who have engaged in fraudulent activities. Being blacklisted can mean being permanently barred from doing business with them.

- Impact on Credit Score: While not a direct consequence of the editing itself, any legal proceedings or defaults that arise from the fraudulent attempt can severely damage a person’s credit score, making future financial transactions more expensive and difficult.

- Loss of Opportunity: Beyond financial applications, the discovery of falsification can lead to the loss of other opportunities, such as employment in certain sectors that require a high degree of trust and financial probity.

Exploring Methods for Editing Bank Statements (Hypothetical Scenarios)

In the realm of digital documents, image manipulation software offers a variety of tools that can be hypothetically used to alter the appearance of a bank statement. These tools, often designed for legitimate graphic design purposes, can be repurposed for more nefarious ends. Understanding their capabilities is crucial for recognizing potential forgeries.The process of editing a digital bank statement image typically involves a series of technical steps, each requiring a degree of skill and attention to detail.

While these methods are purely hypothetical and for educational purposes, they illustrate the technical challenges involved in creating convincing forgeries.

Hypothetical Software Tools for Document Image Manipulation

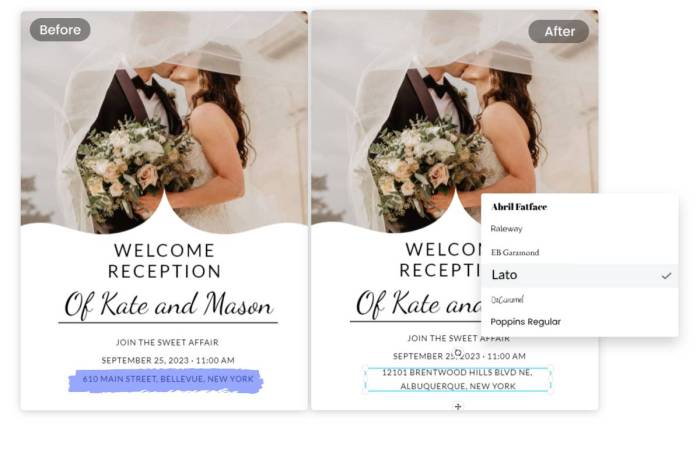

Various software applications, commonly used for graphic design and photo editing, possess the functionalities that could be leveraged to alter document images. These tools allow for precise control over pixels, colors, and text.

- Adobe Photoshop: This industry-standard software provides a comprehensive suite of tools for image editing. Its features, such as the Clone Stamp tool, Healing Brush, and Content-Aware Fill, can be used to remove existing text or numbers and replace them with fabricated ones. Layers and masks allow for non-destructive editing, making alterations harder to detect.

- GIMP (GNU Image Manipulation Program): A powerful, free, and open-source alternative to Photoshop, GIMP offers similar capabilities for pixel-level editing. Its selection tools, brushes, and filters can be employed to modify document content.

- Specialized PDF Editors (e.g., Adobe Acrobat Pro): While primarily designed for managing PDF documents, advanced versions of PDF editors often include features that allow for direct editing of text and images within a PDF. This can be more straightforward than pixel-level manipulation if the original PDF is not secured against editing.

- Online Image Editors: Numerous web-based tools offer basic to intermediate image editing functionalities. While generally less sophisticated than desktop applications, they can still be used for simpler alterations.

Technical Steps in Altering Numerical Data in a Digital Document Image

Modifying numerical data within a digital bank statement image involves carefully replacing existing figures with new ones while maintaining the visual integrity of the document. This requires a meticulous approach to avoid detection.The core technical steps often include:

- Isolation of Target Area: The first step is to precisely select the numerical data that needs to be altered. This might involve using selection tools to create a mask around the specific digits or transaction amount.

- Removal of Original Data: Once isolated, the original numbers are removed. This can be achieved by:

- Using the Clone Stamp or Healing Brush tools to sample pixels from surrounding areas of the statement (e.g., the background paper texture or adjacent text) and paint over the original numbers. The goal is to blend the removal seamlessly.

- If the numbers are on a solid background, a solid color fill might be used to cover them, followed by the recreation of the background texture.

- Replication or Creation of New Data: New numbers are then introduced. This can be done in several ways:

- Font Matching: The most convincing method involves identifying the exact font used for the original numbers and typing the new numbers using that same font, size, and spacing. This requires careful observation and potentially the use of font identification tools.

- Using Existing Numbers from the Document: Sometimes, an editor might “lift” numbers from other parts of the same document (if available and of the correct font) and paste them into the desired location, then adjust them.

- Creating Numbers from Scratch: In less sophisticated edits, numbers might be drawn using brushes, but this often leads to inconsistencies in texture and shape.

- Color and Lighting Matching: The new numbers must precisely match the color, shade, and even the subtle lighting or shadows of the surrounding text and the document’s background. Any discrepancy here is a significant red flag.

- Texturing and Blending: The final step involves ensuring the new numbers appear to be part of the original document. This might involve adding subtle paper texture, slight imperfections, or ensuring the ink effect is consistent with the rest of the statement.

Visual Cues Indicating Digital Alteration of a Bank Statement

Detecting a digitally altered bank statement often relies on spotting inconsistencies that betray the manipulation. These anomalies, even if subtle, can be telltale signs.Several visual cues can suggest that a bank statement has been digitally altered:

- Inconsistent Font or Text Size: A common giveaway is a change in the font style, weight, or size of the numbers compared to the surrounding text. For instance, if the bank’s standard font is serif and the altered numbers are sans-serif, or if the numbers appear slightly larger or smaller than other figures in the same line.

- Pixelation or Jagged Edges: When text or numbers are extensively manipulated, especially if they are not perfectly blended, they might exhibit pixelation or jagged edges, particularly when viewed at a high zoom level. This is often a result of copying and pasting or using imprecise editing tools.

- Unnatural Shading or Lighting: If the numbers appear to have a different level of brightness, contrast, or shadow compared to the rest of the document, it suggests they have been added or altered. For example, numbers that are perfectly flat without any subtle shadow cast by the original print.

- Color Mismatch: Even a slight difference in the color of the ink or toner used for the altered numbers can be a strong indicator. The original print might have a specific shade of black or blue, while the altered numbers have a slightly different hue.

- Alignment and Spacing Anomalies: Numbers that are not perfectly aligned with the baseline of the text, or have irregular spacing between them, can point to manual insertion. Bank statements are typically printed with precise alignment.

- Texture Discrepancies: The texture of the paper or the ink itself might not match. For example, if the original statement has a faint paper grain, and the added numbers appear too smooth or too rough, it suggests manipulation.

- Absence of Natural Imperfections: Genuine printed documents often have minor imperfections, such as slight ink bleeds or paper creases. A perfectly clean and uniform alteration might, paradoxically, look less authentic.

- Metadata Inconsistencies (if applicable): While not strictly a visual cue, if the digital file itself is examined, metadata might reveal information about when and how the file was created or modified, which could indicate tampering.

Identifying Indicators of Tampered Bank Statements

Spotting alterations on a bank statement is crucial, whether you’re reviewing your own finances or scrutinizing one for official purposes. Genuine statements are meticulously generated by financial institutions and often contain specific security features that are challenging to replicate. Learning to identify these subtle (and sometimes not-so-subtle) discrepancies can save you from potential fraud or misrepresentation.Examining a bank statement for signs of tampering requires a keen eye for detail.

While sophisticated forgers might create convincing documents, there are common giveaways that can expose an edited statement. These often involve inconsistencies in formatting, data, or the absence of standard security elements.

Common Discrepancies in Edited Statements

When reviewing a bank statement for potential edits, several types of inconsistencies are common. These range from simple formatting errors to more complex data manipulation. It’s essential to cross-reference information and look for anything that seems out of place or doesn’t align with typical banking practices.

- Inconsistent Font and Formatting: Look for variations in font styles, sizes, or spacing within the document. Genuine statements usually maintain a uniform appearance.

- Mismatched Transaction Dates or Descriptions: Dates that don’t follow a chronological order or descriptions that seem generic or unrelated to typical account activity can be red flags.

- Unusual Transaction Amounts: Round numbers or amounts that don’t align with expected spending patterns might indicate manipulation.

- Missing or Altered Bank Logos and Watermarks: Official bank logos and security watermarks are often present. Their absence, distortion, or poor quality can signal a fake.

- Discrepancies in Account Balances: The opening balance, closing balance, and running totals should all reconcile perfectly. Any mathematical errors or inconsistencies in these figures are highly suspect.

- Inconsistent Paper Quality or Printing: Genuine statements are typically printed on specific types of paper with high-quality printing. Differences in paper texture, color, or print clarity can be indicators.

- Absence of Security Features: Many banks incorporate microprinting, security threads, or holographic elements that are difficult to counterfeit.

Verifying Bank Statement Authenticity Through Official Channels

The most reliable way to confirm the legitimacy of a bank statement is to bypass the document itself and go directly to the source: your bank. Official channels are designed to provide accurate and verified information, making them the gold standard for authentication.

- Online Banking Portal: Log in to your official online banking account. Most banks provide access to historical statements, allowing you to download a verified copy and compare it with the one you have.

- Mobile Banking App: Similar to online portals, mobile banking apps often offer statement access and download features.

- Contacting the Bank Directly: Call the customer service number on the back of your bank card or the official number listed on the bank’s website. You can request them to verify the details of a specific statement or transaction.

- Visiting a Branch: Present the statement at a local bank branch and ask a representative to verify its authenticity. They can access your account history and confirm the details.

- Requesting a Certified Copy: For official purposes, you can request a certified copy of your bank statement directly from the bank. This usually involves a fee but provides a legally recognized verification.

Security Features on Genuine Bank Statements

Financial institutions employ a variety of sophisticated security features on their bank statements to prevent fraud and ensure authenticity. These features are designed to be difficult for unauthorized individuals to replicate, acting as a strong deterrent against tampering.

- Microprinting: This involves printing extremely small text, often too small to be seen with the naked eye, which appears as a solid line to the casual observer. When magnified, the text becomes legible.

- Security Watermarks: These are patterns or images embedded within the paper that are visible when held up to light. They are usually specific to the bank’s branding or security protocols.

- Holograms: Some statements may feature holographic elements that change appearance when tilted or viewed from different angles, making them very hard to counterfeit.

- Security Threads: These are threads woven into the paper, often with visible or hidden text, similar to those found in currency.

- UV-Reactive Inks: Certain elements on the statement may only be visible under ultraviolet (UV) light, appearing as distinct colors or patterns.

- Unique Paper Stock: Banks often use specialized paper with specific textures, weights, and security fibers that are not readily available to the public.

- Perforations: Some statements, particularly older formats or those designed for specific mailing systems, may have specific perforation patterns that are difficult to replicate accurately.

Illustrative Examples of Editing Techniques (For Educational Purposes Only)

This section delves into practical, albeit hypothetical, examples of how bank statements might be altered. Understanding these techniques is crucial for recognizing potential fraud and appreciating the sophistication required for such manipulations. It’s important to reiterate that these examples are purely for educational purposes and should not be used to engage in any illegal activities.The digital age has presented new avenues for document alteration.

While physical documents once required more hands-on forgery, digital formats offer a different set of challenges and opportunities for manipulation.

Hypothetical Procedure for Altering a Transaction Amount in a PDF

This step-by-step hypothetical procedure Artikels the technical process of changing a transaction amount within a PDF bank statement. This process typically involves specialized software and a careful approach to maintain the document’s integrity.

Unraveling the secrets of how to edit a bank statement often leads one down intriguing paths, even to questions like can you transfer money from credit card to bank account , a curious financial maneuver. Understanding such transactions is key before one even contemplates the delicate art of how to edit a bank statement, a practice requiring utmost discretion.

- Open the PDF in Editing Software: The first step is to open the PDF file using a robust PDF editor that supports text editing, such as Adobe Acrobat Pro or other advanced PDF manipulation tools.

- Locate the Target Transaction: Navigate through the statement to find the specific transaction line item that needs modification. This involves carefully scanning the transaction details, dates, and amounts.

- Select the Amount Field: Using the editing tools within the PDF software, precisely select the numerical characters representing the transaction amount. This often involves clicking and dragging to highlight the text.

- Delete the Original Amount: Once selected, delete the existing numerical characters. This must be done cleanly to avoid leaving any residual marks or formatting inconsistencies.

- Input the New Amount: Carefully type in the desired new transaction amount. It is critical to match the original font, size, and color as closely as possible to avoid detection. This might involve using the eyedropper tool to sample the original font’s characteristics.

- Adjust Spacing and Alignment: After entering the new amount, meticulously adjust the spacing and alignment to ensure it seamlessly integrates with the surrounding text and the table structure of the statement. Any misalignment can be a red flag.

- Review and Refine: Zoom in on the altered section to scrutinize the changes. Look for any discrepancies in font, color, size, or spacing. Make minor adjustments as needed to achieve a natural appearance.

- Save the Edited PDF: Save the modified PDF file. It is often advisable to save it under a new file name to preserve the original document.

Visual Elements Forensic Document Examiners Assess for Authenticity

Forensic document examiners employ a rigorous methodology to identify alterations. Their examination focuses on a range of visual cues that can indicate tampering.

When assessing the authenticity of a bank statement, forensic document examiners meticulously scrutinize various visual elements. These elements, when examined under magnification and specific lighting conditions, can reveal subtle inconsistencies indicative of manipulation.

- Ink Characteristics: Examiners analyze the type of ink used, looking for variations in color, sheen, and drying patterns that might suggest different writing instruments or applications.

- Typeface and Font Consistency: They check for uniformity in font style, size, and spacing across the document. Inconsistencies can point to text being added or altered.

- Alignment and Spacing: The precise alignment of text within lines and the spacing between characters and words are examined. Deviations from standard formatting can be tell-tale signs.

- Paper Texture and Watermarks: The texture of the paper, its thickness, and the presence or absence of watermarks are assessed to ensure they are consistent with genuine bank statements from the issuing institution.

- Impressions and Indentations: Subtle indentations from previous pages or writing on a pad can be detected using specialized lighting, revealing if text was added or removed.

- Erasure Marks: Even subtle signs of erasure, such as scuffing or thinning of the paper, can be visible under specific lighting and magnification.

- Staple or Punch Holes: The condition and placement of staple or punch holes can indicate if pages have been removed or reordered.

- Printing Quality: The clarity and consistency of printed elements, such as logos, borders, and text, are examined for any signs of poor quality or inconsistency that might suggest a reprint or alteration.

Comparative Overview of Alteration Difficulty: Printed vs. Digitally Generated Statements, How to edit a bank statement

The ease with which a bank statement can be altered depends significantly on its origin: whether it was printed from a physical ledger or generated digitally.

| Statement Type | Alteration Difficulty | Reasons for Difficulty |

|---|---|---|

| Printed (from physical ledger) | High | These statements are often carbon copies or imprints from physical books. Altering them would require meticulous erasure and redrawing or overwriting, which is very difficult to do without leaving visible traces. The texture of the paper and the nature of the printing method make sophisticated forgery challenging. |

| Digitally Generated (PDF, image files) | Moderate to High | While digitally generated statements, particularly PDFs, can be edited with specialized software, the difficulty lies in achieving a seamless alteration. Forensic analysis can often detect inconsistencies in metadata, font embedding, pixelation, and layering. However, for a less sophisticated observer, subtle digital edits might be harder to spot than physical alterations. The risk of detection increases with the level of forensic scrutiny applied. |

The Role of Financial Institutions in Detecting Forgery: How To Edit A Bank Statement

Financial institutions are on the front lines of preventing financial fraud, and detecting tampered bank statements is a crucial part of their security measures. They employ a multi-layered approach, combining advanced technology with stringent protocols to safeguard their operations and protect their clients. This vigilance is essential to maintain trust and the integrity of financial transactions.Banks and other financial bodies have sophisticated systems in place to identify any discrepancies or alterations in submitted documents.

These systems are continuously updated to counter evolving forgery techniques. When a statement raises a red flag, a specific set of procedures is initiated to thoroughly investigate the matter.

Technologies Employed by Banks for Fraud Detection

Financial institutions utilize a range of cutting-edge technologies to scrutinize documents for signs of manipulation. These tools are designed to detect subtle anomalies that might escape the human eye, ensuring a high level of accuracy in fraud detection.

- Optical Character Recognition (OCR) and Intelligent Character Recognition (ICR): These technologies are used to read and interpret text from scanned documents. Banks use them to compare the extracted text against original data or to identify inconsistencies in font types, sizes, or spacing that might indicate manual alteration.

- Digital Watermarking and Holograms: Legitimate bank statements often contain security features like watermarks or holograms that are difficult to replicate. Advanced scanners and software can detect the presence and authenticity of these features.

- Database Cross-referencing: Submitted statements are often cross-referenced with internal bank records and, where permissible, with external databases to verify transaction details, account balances, and customer information.

- AI and Machine Learning Algorithms: Increasingly, banks are deploying artificial intelligence and machine learning to analyze patterns in transaction data and document characteristics. These algorithms can identify unusual deviations from a customer’s typical spending habits or flag documents with statistical anomalies indicative of forgery.

- Forensic Software: Specialized forensic software can analyze digital documents for metadata, hidden layers, or evidence of image manipulation, such as pixel inconsistencies or color shifts.

Protocols for Handling Suspicious Statements

When a financial institution suspects a bank statement has been tampered with, a structured set of protocols is activated to ensure a thorough and consistent response. These protocols are designed to minimize risk and gather all necessary information for a potential investigation.

- Initial Flagging and Review: The system or a trained analyst identifies potential anomalies in the statement. This might include inconsistencies in dates, amounts, transaction descriptions, or formatting.

- Internal Verification: The flagged statement is sent for a more detailed internal review. This often involves comparing it against the bank’s own digital records for the same period, if the statement was provided by a third party and not directly from the bank itself.

- Contacting the Customer: In some cases, the bank may contact the account holder directly to verify specific transactions or the authenticity of the document presented.

- Escalation to Fraud Department: If suspicions are confirmed or remain high after initial checks, the case is escalated to the bank’s dedicated fraud detection or security department.

- Legal and Regulatory Compliance: The fraud department follows established legal and regulatory guidelines for handling suspected fraud, which may involve reporting to authorities.

Verification Processes by Lenders and Financial Bodies

Beyond banks themselves, lenders and other financial bodies rely heavily on accurate bank statements for critical decisions, such as loan approvals or investment assessments. They implement their own verification processes to ensure the legitimacy of these documents.

The integrity of financial documentation is paramount for responsible lending and investment.

Lenders typically engage in the following verification steps:

- Direct Bank Confirmation: For significant loan applications, lenders may request authorization from the applicant to directly contact the applicant’s bank to confirm account details and transaction history. This is a highly reliable method as it bypasses the need for the applicant to provide the statement themselves.

- Third-Party Verification Services: Specialized services exist that can independently verify the authenticity of bank statements by cross-referencing them with data from financial institutions, provided the applicant grants permission.

- Review of Transaction Patterns: Lenders analyze the presented statements for consistent and logical transaction patterns. Unusual spikes in deposits or withdrawals, or inconsistencies in the timing and nature of transactions, can raise suspicion.

- Comparison with Other Submitted Documents: Bank statements are usually submitted alongside other financial documents, such as pay stubs, tax returns, and credit reports. Lenders compare the information across all documents to identify discrepancies. For instance, if a bank statement shows a large, unexplained deposit that doesn’t align with the applicant’s declared income sources, it would be a cause for concern.

- Scrutiny of Formatting and Appearance: Experienced loan officers are trained to spot subtle signs of tampering, such as inconsistent fonts, misaligned text, unusual paper texture, or missing security features, even on seemingly well-crafted forgeries.

Ethical Considerations and Responsible Information Handling

When we talk about editing bank statements, even in hypothetical scenarios, it’s crucial to pause and consider the ethical implications. Financial integrity forms the bedrock of trust in both our personal lives and professional endeavors. This means being honest and transparent in all financial dealings, whether it’s managing personal accounts or presenting financial documents for business purposes. Upholding this integrity isn’t just about following rules; it’s about building and maintaining a reputation for reliability and trustworthiness.Engaging in deceptive financial practices, such as altering official documents like bank statements, carries significant risks.

These actions can have far-reaching consequences that extend beyond immediate legal penalties. The erosion of trust, the damage to personal and professional relationships, and the potential for severe financial repercussions are all part of the landscape of misconduct. It’s vital to understand that even seemingly minor alterations can be detected and can lead to serious trouble.

Importance of Financial Integrity

Financial integrity is paramount because it underpins the stability and fairness of our economic systems. In personal finance, it means managing money responsibly, paying bills on time, and being truthful about one’s financial situation when seeking loans or credit. Professionally, it involves accurate record-keeping, honest reporting of income and expenses, and transparent dealings with clients, investors, and regulatory bodies. A commitment to financial integrity fosters confidence and allows for smoother transactions and collaborations.

Risks of Deceptive Financial Practices

The allure of financial gain through deception is often short-lived and comes with a hefty price. The risks associated with manipulating financial documents are multifaceted and can manifest in several ways:

- Legal Ramifications: Altering bank statements can be considered fraud or forgery, leading to criminal charges, hefty fines, and imprisonment. The severity of these penalties often depends on the jurisdiction and the intent behind the alteration.

- Financial Penalties: Beyond legal fines, individuals or businesses caught in deceptive practices may face significant financial penalties from regulatory bodies, civil lawsuits, and the loss of future financial opportunities.

- Reputational Damage: A tarnished reputation is incredibly difficult to repair. Once trust is broken, it can be nearly impossible to regain, impacting future employment prospects, business partnerships, and personal relationships.

- Loss of Access to Financial Services: Financial institutions and lenders maintain records of individuals and businesses with a history of financial misconduct. This can result in being blacklisted, making it extremely difficult to open new accounts, secure loans, or obtain credit in the future.

Long-Term Impact on Credibility

The long-term impact of financial misconduct on an individual’s credibility can be devastating and enduring. Once a reputation for dishonesty is established, it becomes a permanent mark that can follow a person throughout their life. This impacts not only their financial standing but also their social and professional interactions.

“Integrity is doing the right thing, even when no one is watching.”C.S. Lewis

This quote succinctly captures the essence of ethical behavior. In the context of financial dealings, it means adhering to honest practices regardless of whether one believes they are being scrutinized. The long-term consequences of compromising this principle can include:

- Difficulty in Securing Employment: Employers often conduct background checks, and any history of financial fraud or deception can be a significant red flag, leading to rejection for job opportunities.

- Strained Personal Relationships: Deceptive financial practices can damage trust with family members, friends, and partners, leading to strained or broken relationships.

- Limited Business Opportunities: For entrepreneurs and business owners, a lack of financial integrity can deter potential investors, partners, and customers, hindering business growth and sustainability.

- Psychological Toll: Living with the constant fear of being discovered and the burden of a dishonest reputation can take a significant psychological toll, leading to stress, anxiety, and a diminished sense of self-worth.

Last Word

Ultimately, the question of how to edit a bank statement leads not to a solution, but to a stark realization of the inherent risks and severe consequences. The allure of a quick fix is a mirage, obscuring the solid ground of honesty and legitimate financial practice. Understanding the intricate security measures, the legal ramifications, and the indelible impact on one’s credibility is paramount.

True financial stability is built on transparency and trust, not on the fragile foundation of altered realities.

Frequently Asked Questions

What are the primary reasons someone might consider editing a bank statement?

Individuals might consider editing a bank statement to meet loan or rental application requirements, to present a more favorable financial picture to a potential lender, or in some unfortunate cases, to conceal financial mismanagement or illicit transactions.

What are the legal penalties for submitting a falsified bank statement?

Submitting a falsified bank statement can lead to serious legal consequences, including charges of fraud, forgery, and perjury, which can result in hefty fines, probation, and imprisonment.

Can editing a bank statement be detected even with sophisticated software?

Yes, even with sophisticated software, edited bank statements can often be detected. Forensic document examiners utilize advanced techniques to identify inconsistencies in fonts, alignment, digital signatures, and printing characteristics that are difficult to perfectly replicate.

What are the common security features found on genuine bank statements?

Genuine bank statements often feature microprinting, watermarks, unique paper textures, holographic elements, and embedded security threads that are challenging to reproduce accurately on counterfeit documents.

How do banks typically verify the authenticity of a submitted bank statement?

Banks often verify statements by directly contacting the issuing financial institution to confirm the account details, transaction history, and balances presented. They may also use specialized software to analyze the document’s digital properties.