Does pet insurance cover cushing disease – Does pet insurance cover Cushing’s disease? This crucial question confronts pet owners facing this costly condition. Understanding the intricacies of pet insurance policies and the specifics of Cushing’s Disease is paramount for navigating this complex financial landscape. We’ll delve into the details, exploring coverage possibilities, potential exclusions, and the factors that influence insurance decisions.

Cushing’s disease, a hormonal disorder, can significantly impact your pet’s health and well-being. Diagnosing and treating it can be expensive, often requiring a comprehensive and prolonged care plan. This discussion will equip you with the knowledge to evaluate your options, making informed decisions about your pet’s healthcare.

Overview of Pet Insurance

Pet insurance provides financial protection for your beloved companion animals. It helps cover unexpected veterinary expenses, such as illnesses and injuries. This coverage can significantly reduce the financial burden of costly treatments, ensuring your pet receives the necessary care without putting a strain on your budget.Pet insurance plans typically function like health insurance for people, but with tailored coverage for animals.

The specifics of what’s covered and what’s excluded are critical considerations when choosing a plan. Different policies offer varying levels of protection, from basic accident and illness coverage to more comprehensive plans that include preventative care.

Common Types of Pet Insurance Plans, Does pet insurance cover cushing disease

Different plans cater to various needs and budgets. Some policies are designed for preventative care, while others prioritize coverage for accidents and illnesses. Basic plans often limit coverage for pre-existing conditions, while comprehensive plans generally provide broader protection. Consider your pet’s age, breed, and potential health risks when selecting a plan.

Typical Exclusions in Pet Insurance Policies

Certain conditions and procedures are typically excluded from pet insurance coverage. Pre-existing conditions, meaning illnesses or injuries present before the policy begins, are often excluded or have limitations on coverage. Routine preventative care, such as vaccinations or dental cleanings, may not be fully covered or may require additional costs. Specific behavioral issues or conditions related to aggression or destructive behavior are often excluded.

Also, some policies exclude coverage for conditions caused by neglect or abuse.

Comparison of Pet Insurance Providers

Choosing the right pet insurance provider depends on your pet’s specific needs and your budget. The following table compares several providers, highlighting their coverage for Cushing’s disease, premiums, and additional benefits. Note that coverage for Cushing’s disease can vary significantly between providers.

| Provider | Coverage for Cushing’s | Premium | Additional Benefits |

|---|---|---|---|

| Example 1 | Generally covers treatment, but with potential limitations based on pre-existing conditions. | $50-$100 per month (depending on deductible and coverage levels) | Wellness visits, prescription medications, and emergency care are often included. |

| Example 2 | Limited coverage for Cushing’s disease, often requiring higher deductibles or co-pays. | $30-$60 per month (depending on deductible and coverage levels) | Accident and illness coverage, but with exclusions for pre-existing conditions. |

| Example 3 | Comprehensive coverage for Cushing’s disease, including diagnostic tests and long-term treatment. | $75-$150 per month (depending on deductible and coverage levels) | Accident and illness coverage, wellness care, and preventative care. |

Understanding Cushing’s Disease in Pets

Cushing’s disease, also known as hyperadrenocorticism, is a common endocrine disorder in dogs and, less frequently, in cats. It’s characterized by an overproduction of cortisol, a steroid hormone crucial for various bodily functions. This excess cortisol disrupts normal metabolic processes, leading to a range of physical and behavioral changes. Understanding the causes, symptoms, and diagnostic processes is crucial for early detection and effective management of this condition.Cushing’s disease stems from a disruption in the hypothalamic-pituitary-adrenal (HPA) axis, the complex system responsible for regulating cortisol production.

Common causes include a benign tumor in the pituitary gland (commonly referred to as pituitary-dependent Cushing’s disease), or less commonly, a tumor in the adrenal glands (adrenal-dependent Cushing’s disease). Factors like genetics, age, and environmental influences may play a role in the development of this disease.

Causes of Cushing’s Disease

Cushing’s disease in pets arises from an imbalance in the body’s hormone regulation. The primary cause is a tumor in either the pituitary gland or the adrenal glands. Pituitary-dependent Cushing’s disease, the most common form, results from a benign tumor in the pituitary gland, which overstimulates the adrenal glands to produce excessive cortisol. Adrenal-dependent Cushing’s disease, on the other hand, is caused by a tumor directly within the adrenal glands themselves, leading to autonomous cortisol production.

In some rare instances, the cause might be iatrogenic, meaning it’s a result of long-term steroid medication use.

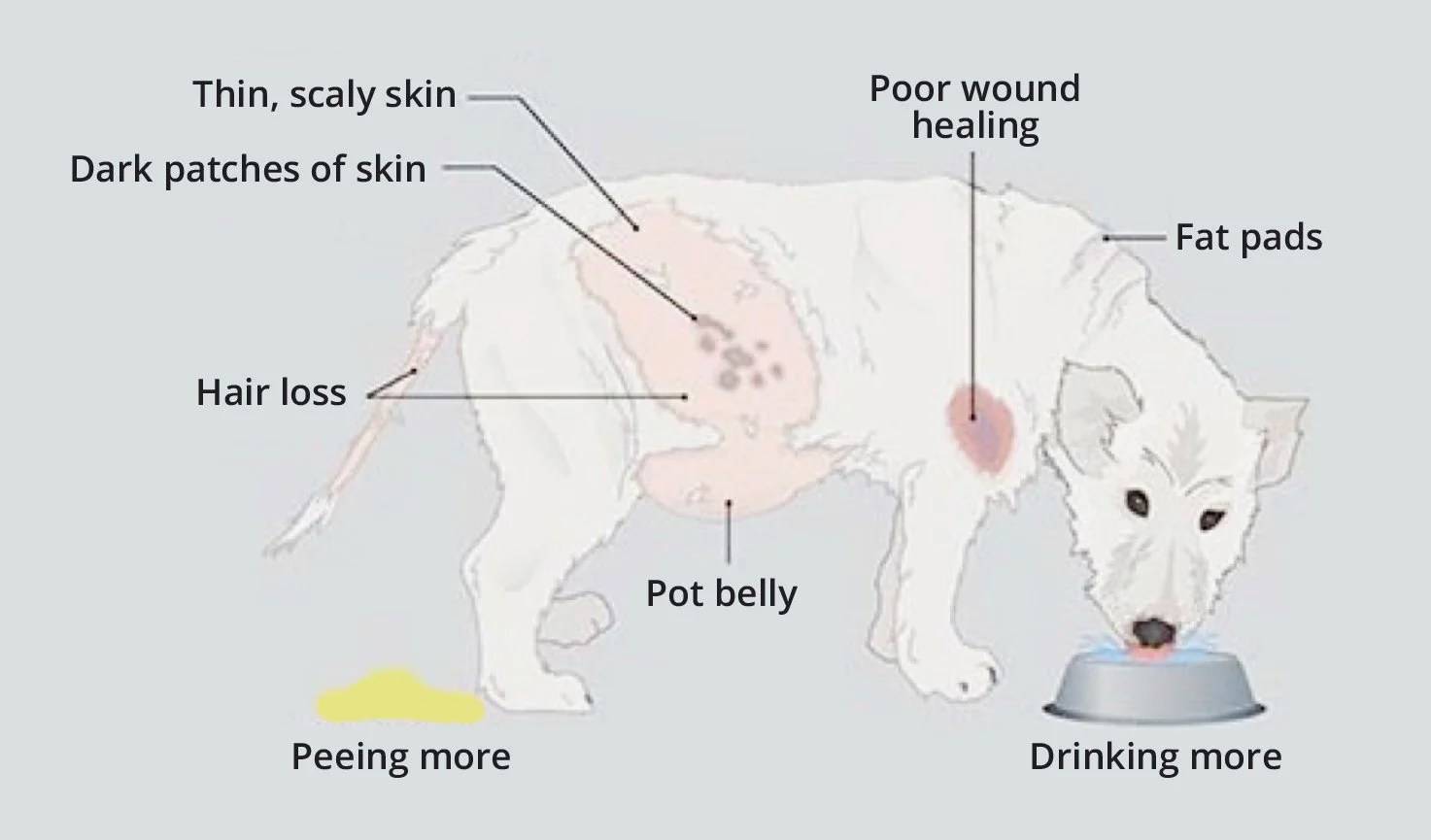

Symptoms of Cushing’s Disease

Recognizing the symptoms is vital for early diagnosis. Common signs include increased thirst and urination, weight gain with muscle loss, thinning of the skin, and hair loss. Other symptoms may include panting, increased appetite, and behavioral changes, such as lethargy or aggression. It’s important to note that symptoms can vary depending on the severity of the disease and the individual pet.

Observing these changes and consulting a veterinarian is crucial for prompt intervention.

Types of Cushing’s Disease

Cushing’s disease presents in two primary forms: pituitary-dependent and adrenal-dependent. Pituitary-dependent Cushing’s disease is the more common type, arising from a tumor in the pituitary gland. This tumor triggers excessive cortisol production in the adrenal glands. Adrenal-dependent Cushing’s disease results from a tumor directly within the adrenal glands themselves, leading to autonomous cortisol production. Differentiating between these types is critical for appropriate treatment strategies.

Pet insurance for Cushing’s disease is a bit tricky, right? It really depends on the specific policy, but it’s often not a guaranteed cover. Similar to how does homeowners insurance cover rotted windows , it’s not always a straightforward yes or no. Ultimately, you’ll probably need to check your policy details to see if it’s covered.

Diagnostic Tests for Cushing’s Disease

Accurate diagnosis relies on a series of diagnostic tests. These tests help differentiate Cushing’s disease from other conditions that exhibit similar symptoms. The goal is to confirm the presence of elevated cortisol levels and identify the underlying cause.

| Test | Description | Purpose |

|---|---|---|

| Urinalysis | Examination of urine for abnormalities such as protein, glucose, and specific gravity. | Provides initial clues regarding the pet’s overall health and potential kidney issues. |

| Complete Blood Count (CBC) | Evaluates red and white blood cell counts, platelet levels, and other blood components. | Helps identify infections or other underlying conditions. |

| Serum Cortisol Measurement | Measures the level of cortisol in the blood. | Provides a baseline cortisol level and is often the first step in diagnosing Cushing’s disease. |

| Low-Dose Dexamethasone Suppression Test (LDDS) | Administering a low dose of dexamethasone and measuring cortisol levels before and after. | Identifies whether the adrenal glands respond normally to cortisol-regulating hormones. |

| High-Dose Dexamethasone Suppression Test (HDDS) | Administering a high dose of dexamethasone and measuring cortisol levels before and after. | Further evaluates the cause of the disease by determining whether the cortisol levels are suppressed appropriately. |

| Adrenal Imaging (e.g., ultrasound, CT scan) | Visualizing the adrenal glands for any abnormalities. | Helps identify adrenal tumors in cases where pituitary tumors are ruled out. |

Long-Term Implications of Cushing’s Disease

Left untreated, Cushing’s disease can lead to several significant complications. These include increased risk of infections, secondary diabetes, and cardiovascular issues. The overall quality of life for affected pets can be significantly impacted. Prognosis and treatment options vary based on the severity of the disease and the type of Cushing’s disease present.

Pet Insurance Coverage for Cushing’s Disease

Pet insurance can provide financial assistance for managing Cushing’s disease in pets, but coverage varies significantly between policies. Understanding the specifics of your policy is crucial to anticipate potential costs and plan accordingly. Coverage often hinges on factors like the policy’s terms, pre-existing conditions, and the specific treatments required.Comprehensive pet insurance policies can offer substantial support for the long-term care and treatment of Cushing’s disease, a chronic condition.

However, potential exclusions and limitations should be carefully reviewed to avoid unexpected out-of-pocket expenses.

Common Scenarios of Coverage

Pet insurance may cover Cushing’s disease treatment in various situations, such as routine checkups, diagnostic tests, and medication costs. A proactive approach to managing the disease often involves regular monitoring and adjustments to treatment plans. These adjustments may involve different medications or dosages. Policies may also cover hospitalization costs if the pet requires specialized care.

Pre-existing Conditions and Coverage

Pre-existing conditions can significantly impact coverage for Cushing’s disease. Policies typically define pre-existing conditions as those diagnosed before the insurance policy begins. If Cushing’s disease is diagnosed before the policy’s inception, coverage may be limited or excluded entirely. The policy’s specific wording regarding pre-existing conditions should be reviewed thoroughly to avoid surprises during treatment.

Covered Expenses

Pet insurance typically covers a range of expenses related to Cushing’s disease treatment. This includes the cost of diagnostic tests, such as blood tests, urine analysis, and imaging studies. Medication costs, including prescription drugs and supplements, are often covered. It’s also important to understand that the cost of veterinary visits, including office visits and specialist consultations, is frequently covered.

Policy Comparison

Different pet insurance policies adopt various approaches to covering Cushing’s disease treatment. Some policies might offer a higher reimbursement percentage for diagnostic tests, while others may have lower limits on medication costs. Some plans may provide broader coverage for various treatments and procedures, whereas others may have specific exclusions. Compare policies carefully to find the best fit for your pet’s needs.

Carefully review the fine print of each policy to understand the specific terms and conditions.

Coverage Limits

| Policy | Covered Treatments | Coverage Limits | Exclusions |

|---|---|---|---|

| Policy A | Diagnostic tests (blood work, urinalysis), medication, routine vet visits | $5,000 per claim, $10,000 annual maximum | Excludes pre-existing conditions, surgery for advanced stages |

| Policy B | All treatments including diagnostics, medications, and specialist consults | $10,000 per claim, $20,000 annual maximum | Excludes treatments deemed experimental, alternative therapies not recommended by a vet |

| Policy C | Diagnostics, medication, and hospitalization (up to 10 days) | $8,000 per claim, $15,000 annual maximum | Excludes long-term care facilities, non-covered medical procedures |

Note: Coverage limits and exclusions can vary greatly. Always review the specific policy details to understand the extent of your pet’s coverage.

Factors Influencing Coverage Decisions: Does Pet Insurance Cover Cushing Disease

Pet insurance policies, while designed to offer financial protection, aren’t a guaranteed safety net for all veterinary expenses. Various factors play a significant role in determining whether and how much coverage an insurer will provide for conditions like Cushing’s disease. These factors are crucial for pet owners to understand to make informed decisions about their insurance choices.

Severity of Cushing’s Disease

The severity of Cushing’s disease significantly impacts coverage decisions. Insurers typically assess the condition based on its stage and the associated symptoms. Mild cases might receive full coverage for treatment, while more advanced stages might lead to limitations or exclusions. For example, a pet with early-stage Cushing’s experiencing mild symptoms, such as increased thirst and urination, might have full coverage for diagnostic tests and medication.

However, a pet with severe Cushing’s, exhibiting debilitating symptoms like muscle weakness and organ damage, could have limited coverage or outright denial for extensive treatments. Insurance companies often prioritize cost-effectiveness and sustainability, so coverage is typically tailored to the predicted treatment costs and long-term prognosis.

Pet’s Age and Breed

Age and breed also influence coverage decisions. Younger animals with Cushing’s often have a better prognosis and are more likely to receive full coverage. Older pets with pre-existing conditions or other health concerns might encounter limitations or denial due to increased risk factors. Similarly, some breeds are predisposed to certain health issues, including Cushing’s. If a pet’s breed carries a higher risk of developing Cushing’s, insurers might impose higher premiums or restrict coverage based on the inherent risk factors associated with that breed.

For instance, a young, healthy Labrador Retriever with a diagnosis of Cushing’s disease might receive more generous coverage compared to an older, mixed-breed dog with pre-existing conditions.

Situations Where Coverage Might Be Denied or Limited

Several situations can lead to coverage denial or limitation for Cushing’s disease treatment. Pre-existing conditions are a common reason. If the pet already showed signs of Cushing’s before the insurance policy was purchased, the insurer might deny coverage or significantly limit it. A history of similar conditions, or if the diagnosis falls outside the policy’s scope of coverage, can lead to limited coverage or denial.

Unnecessary or experimental treatments not recommended by a veterinarian might also be excluded from coverage. Furthermore, if the pet’s symptoms worsen due to negligence or failure to adhere to the veterinarian’s treatment plan, the insurer may deny coverage for related expenses. Lastly, if the treatment exceeds a predetermined coverage limit or the pet’s prognosis is poor, the insurer may limit coverage or deny further claims.

Impact of Underwriting Process

The insurer’s underwriting process significantly impacts coverage decisions. During this process, insurers evaluate the pet’s health history, including any pre-existing conditions. They also consider factors like the pet’s age, breed, and lifestyle. The underwriting process ensures that the insurer is making informed decisions about the risk they are taking on when insuring a particular pet. A thorough review of the pet’s health records and a discussion with the veterinarian are crucial aspects of the underwriting process.

A detailed health evaluation from a veterinarian, which accurately reflects the pet’s condition and prognosis, often becomes a key factor in determining the extent of coverage offered. Ultimately, the thoroughness and accuracy of the underwriting process significantly influence the decisions made regarding coverage.

Coverage Examples and Scenarios

Pet insurance coverage for Cushing’s disease varies significantly depending on the specific policy and the insurer. Factors such as pre-existing conditions, the extent of treatment required, and the insurer’s interpretation of the disease’s classification all play a crucial role in determining the extent of reimbursement. This section presents illustrative case studies highlighting both covered and non-covered scenarios.Understanding the nuances of these cases can help pet owners make informed decisions about their insurance choices.

It also underscores the importance of reviewing policy documents carefully to anticipate potential limitations and proactively address potential disputes.

Case Study 1: Covered Cushing’s Treatment

A golden retriever named Max was diagnosed with Cushing’s disease. His owner, Sarah, had a comprehensive pet insurance policy that covered pre-existing conditions after a waiting period. The policy included coverage for diagnostic testing, medication, and ongoing monitoring. The insurance company covered 80% of the costs associated with the initial diagnosis, medication, and follow-up visits over a six-month period.

The remaining 20% was covered by Sarah. Max’s treatment plan involved administering medication daily, and regular check-ups to monitor the disease progression. The insurance company fully reimbursed for the vet visits and medication. This successful claim highlights a scenario where a comprehensive policy with pre-existing condition coverage can significantly assist pet owners in managing the financial burden of Cushing’s disease.

Case Study 2: Non-Covered Cushing’s Treatment

Another case involves a terrier named Lucy, who was diagnosed with Cushing’s disease. Her insurance policy excluded coverage for pre-existing conditions. Lucy’s policy was considered a “basic” plan, focusing primarily on accident coverage. While the policy covered routine checkups and vaccinations, it did not cover the expenses related to Cushing’s disease. Treatment for Lucy’s Cushing’s disease was not covered by her insurance.

This case emphasizes the critical importance of understanding policy exclusions and the necessity of comprehensive coverage for conditions like Cushing’s disease.

Filing a Claim for Cushing’s Disease Treatment

Filing a claim for Cushing’s disease treatment involves a specific process. Understanding these steps is crucial for a smooth claim resolution.

- Gather Necessary Documents: Collect all veterinary records, including diagnostic reports, treatment plans, and bills. This includes records of blood work, urine tests, X-rays, and other relevant medical documentation.

- Review Policy Details: Carefully examine your pet insurance policy to understand the specific coverage terms for Cushing’s disease, pre-existing conditions, and any exclusions. Identify the necessary documentation and the required procedures for filing a claim.

- Submit the Claim: Follow the claim submission procedures Artikeld in your policy. This often involves completing claim forms, uploading required documents, and providing supporting information. Contact your insurance provider directly to clarify any questions or concerns about the claim process. Submit the claim form with all necessary documents, including veterinary bills, receipts, and medical records.

- Obtain Approval: Your insurer will review your claim to determine eligibility and coverage. They may request additional information or clarification. Expect a response regarding the claim status. Be prepared to answer any questions and provide further documentation as needed.

- Receive Payment: If your claim is approved, you will receive reimbursement according to your policy terms. Review the payment amount and ensure it aligns with the policy’s percentage of coverage. If there are any discrepancies, contact your insurer promptly to resolve the issue.

Understanding the Claims Process

A step-by-step guide to the claim process can significantly ease the burden of navigating insurance paperwork. A well-defined process will streamline the claim process.

- Verification: The insurer verifies the claim details, including the diagnosis, treatment, and supporting documents. They may request clarification on specific points related to the diagnosis or treatment.

- Eligibility Assessment: The insurer determines if the claim falls under the coverage Artikeld in your policy. This step may involve evaluating pre-existing conditions, exclusions, and the type of treatment provided.

- Coverage Determination: The insurer decides the percentage of the claim that will be covered based on the policy terms and the specific treatments required.

- Reimbursement: The insurer will process the reimbursement according to the approved amount and the payment method Artikeld in your policy.

- Follow-up: If any questions or issues arise, promptly contact your insurer to ensure a smooth resolution. Maintaining open communication can help avoid delays and ensure a positive outcome.

Alternatives and Additional Considerations

Beyond pet insurance, various options exist for managing Cushing’s disease in pets. Understanding these alternatives alongside insurance coverage empowers pet owners to make informed decisions based on their individual circumstances and financial capabilities. These alternatives may be used independently or in conjunction with insurance benefits.Alternative treatments, while not always covered by insurance, can significantly impact a pet’s quality of life and overall well-being.

These treatments often focus on managing the symptoms and slowing the progression of the disease.

Alternative Treatments for Cushing’s Disease

Several treatments can manage Cushing’s disease, each with its own set of advantages and disadvantages. These may be used in conjunction with or instead of insurance-covered treatments. Medication, such as mitotane, is frequently prescribed to help control the overproduction of cortisol. However, this medication may come with potential side effects and requires ongoing monitoring by a veterinarian.

Other treatments, including surgery and radiation therapy, are occasionally considered, depending on the specific case and the pet’s overall health. Lifestyle modifications, such as dietary adjustments and exercise routines, can also play a crucial role in managing the disease and its associated symptoms.

Comparison of Financial Options

The following table contrasts pet insurance coverage with other financial options for managing Cushing’s disease in pets. Note that costs and benefits can vary significantly based on individual circumstances.

| Option | Cost | Benefits | Drawbacks |

|---|---|---|---|

| Pet Insurance | Premiums vary by plan and pet. | Potentially covers a portion of diagnostic and treatment costs, including medication. | Coverage varies significantly between policies; some conditions may not be covered or have limitations. Deductibles and co-pays can add to the out-of-pocket expense. |

| Out-of-Pocket Payments | Full cost of diagnosis and treatment is borne by the owner. | Direct control over treatment choices. | Can be very expensive, especially for long-term conditions like Cushing’s disease. Financial strain can be substantial. |

| Veterinary Financing Options | Loans or payment plans can spread the cost of care. | Makes expensive treatments more accessible. | Interest rates and terms may vary; can create additional financial obligations. |

| Fundraising/Donations | Contributions from friends, family, and community members. | Can significantly reduce financial burden. | May not cover all costs; relies on external support. |

| Prescription Drug Discounts | Savings on prescription medication. | Reduces the cost of essential medication. | May not be available for all medications or in all locations. |

Role of Veterinary Specialists in Cushing’s Treatment

Veterinary specialists, such as endocrinologists, play a crucial role in diagnosing and managing Cushing’s disease. Their expertise allows for accurate diagnosis, tailored treatment plans, and ongoing monitoring of the pet’s response to therapy. A specialist’s involvement can lead to a more effective and comprehensive management approach. They often have advanced knowledge in managing complex endocrine disorders. For instance, a specialist can fine-tune treatment dosages to maximize efficacy while minimizing side effects.

Potential Costs of Cushing’s Treatment Outside Insurance Coverage

The cost of treating Cushing’s disease outside insurance coverage can vary significantly depending on several factors. These include the specific treatment plan, the duration of treatment, and the pet’s overall health. Diagnostic tests, such as blood work and imaging, can be costly. Furthermore, medication, especially long-term medications like mitotane, can accumulate significant expense. Consider, for example, a pet needing regular blood work and medication adjustments.

This can quickly escalate costs. Regular veterinary visits and follow-up care are essential for monitoring the pet’s condition and adjusting the treatment plan as needed. These costs can add up quickly, especially if the pet requires specialized care or extended treatment periods.

Illustrative Case Studies

Case studies provide real-world examples of how pet insurance policies function when a pet is diagnosed with Cushing’s disease. These examples highlight the variety of potential outcomes and the factors that influence coverage decisions. Understanding these cases allows pet owners to anticipate the potential financial implications and make informed decisions about their pet’s care.

Case Study 1: Fluffy the Beagle

Fluffy, a 7-year-old Beagle, was diagnosed with Cushing’s disease. Her symptoms included excessive thirst, urination, and appetite. The veterinarian recommended a treatment plan consisting of daily medication, regular blood tests to monitor hormone levels, and follow-up appointments.

Treatment Plan and Costs

- Initial Diagnosis and Consultation: $500

- Diagnostic Tests (bloodwork, urine analysis): $250

- Prescription Medication (monthly): $150

- Follow-up Appointments (every 3 months): $100 per visit

- Additional bloodwork and tests (during treatment): $200 every 3 months

The estimated total cost for the first year of treatment was approximately $1,600. This estimate includes the initial diagnosis, medications, and the required follow-up care.

Impact of Pet Insurance

Fluffy’s owner had pet insurance with a $500 deductible and 80% reimbursement for covered treatments. The insurance covered the medication, blood tests, and follow-up appointments. The deductible was met in the first year of treatment.

- Insurance Reimbursement (first year): $1,280

- Net Cost to Owner (first year): $320

This example demonstrates how pet insurance significantly reduced the financial burden of treating Cushing’s disease.

Insurance Claim Handling

The insurance company processed Fluffy’s claims quickly and efficiently, typically within 30 days. They followed their established claim procedures and provided detailed explanations of covered and non-covered expenses. The claims process was relatively straightforward, with no significant issues reported.

Case Study 2: Sparky the Pomeranian

Sparky, a 5-year-old Pomeranian, developed Cushing’s disease. Symptoms included hair loss, increased appetite, and lethargy. The veterinarian recommended a different treatment approach compared to Fluffy. The plan focused on managing the disease’s progression through a combination of medication and dietary adjustments.

Treatment Plan and Costs

- Initial Diagnosis and Consultation: $400

- Diagnostic Tests (bloodwork, urine analysis): $300

- Prescription Medication (monthly): $200

- Dietary Management Plan: $50 monthly

- Follow-up Appointments (every 2 months): $150 per visit

The estimated total cost for the first year of treatment was approximately $2,450. This estimate includes the initial diagnosis, medications, dietary adjustments, and the required follow-up care.

Impact of Pet Insurance

Sparky’s insurance policy had a $1,000 deductible and a 75% reimbursement rate. The insurance covered the majority of the treatment costs.

- Insurance Reimbursement (first year): $1,837.50

- Net Cost to Owner (first year): $612.50

Insurance Claim Handling

Sparky’s claims were handled with minimal delays. The insurance company’s claims department communicated clearly and responded to any questions promptly. The claim process was efficient and straightforward, ensuring the owner had access to necessary care.

Final Review

.jpg?format=1500w?w=700)

In conclusion, navigating pet insurance coverage for Cushing’s disease requires careful consideration of policy specifics, pre-existing condition clauses, and the severity of the disease. By understanding the factors influencing coverage decisions, you can make informed choices about your pet’s care. Remember, seeking professional veterinary guidance and consulting with insurance providers are crucial steps in securing the best possible outcome for your beloved companion.

Questions and Answers

Can pet insurance cover the initial diagnosis costs for Cushing’s disease?

Diagnosis costs, such as blood tests and imaging, may or may not be covered, depending on the specific policy and whether the tests are deemed necessary for the overall treatment plan.

How does the age of my pet affect Cushing’s disease insurance coverage?

A pet’s age can impact coverage decisions. Policies often have age restrictions or consider age when evaluating the risk associated with treating a pre-existing condition. Policies may offer different coverage tiers based on the pet’s age.

What are some alternative financial options for Cushing’s disease treatment besides pet insurance?

Alternative financial options include veterinary fundraising, seeking financial assistance programs from local animal shelters or charities, and exploring payment plans with veterinary clinics. These avenues can provide support in managing the financial burden of Cushing’s disease treatment.

What are the common exclusions in pet insurance policies?

Common exclusions often include pre-existing conditions, routine wellness care, and certain types of hereditary diseases. Carefully review your policy’s exclusions to understand what’s not covered.