As how to transfer ira to another bank takes center stage, this opening passage beckons readers with melancholic poem style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Embarking on the journey of moving your Individual Retirement Arrangement (IRA) from one financial haven to another can feel like a solemn undertaking, a migration of your future’s seeds. This process, while seemingly straightforward, carries an undercurrent of careful consideration, a dance between caution and necessity. We shall explore the nuances, the quiet steps, and the vital information required to ensure this transition unfolds with grace, safeguarding the precious legacy you have built.

Understanding the Basics of IRA Transfers

Transferring an Individual Retirement Arrangement (IRA) is a strategic move many individuals undertake to consolidate accounts, find better investment options, or improve their overall financial management. This process, while straightforward, requires a clear understanding of the different account types, the motivations behind a transfer, and the procedural nuances. Navigating these elements ensures a smooth transition and helps you leverage your retirement savings effectively.Understanding the foundational aspects of IRA transfers is crucial for making informed decisions.

This includes recognizing the various IRA structures you might be moving from and to, the common triggers that prompt such a decision, and the fundamental differences between the two main transfer methods. A solid grasp of these basics sets the stage for a successful and beneficial IRA relocation.

Types of IRA Accounts Eligible for Transfer

Several types of IRA accounts can be transferred, offering flexibility for individuals managing different retirement savings vehicles. These accounts are designed to provide tax-advantaged growth for retirement.

- Traditional IRA: Contributions may be tax-deductible, and earnings grow tax-deferred. Withdrawals in retirement are taxed as ordinary income.

- Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free.

- Rollover IRA: This is an IRA established to receive funds from a qualified employer-sponsored retirement plan, such as a 401(k), 403(b), or TSP, when you leave that employer.

- SEP IRA (Simplified Employee Pension): Primarily for self-employed individuals and small business owners, allowing for higher contribution limits.

- SIMPLE IRA (Savings Incentive Match Plan for Employees): Another option for small businesses, with employee and employer contribution requirements.

Primary Reasons for Transferring IRAs

Individuals opt to transfer their IRAs for a variety of compelling financial and logistical reasons. These motivations often align with optimizing investment performance, reducing fees, or simplifying account management.

- Consolidation of Accounts: Managing multiple retirement accounts across different institutions can be cumbersome. Consolidating them into a single IRA simplifies tracking, reporting, and overall financial oversight.

- Access to Better Investment Options: Some financial institutions offer a wider array of investment choices, including specific mutual funds, ETFs, or other securities, that may better align with an individual’s risk tolerance and financial goals.

- Lower Fees and Expenses: Different institutions have varying fee structures for account maintenance, trading, and investment management. Transferring to an institution with lower fees can significantly impact long-term returns.

- Improved Customer Service: An individual might seek a financial institution with superior customer support, better online tools, or more personalized advisory services.

- Seeking a Different Investment Strategy: An investor might want to shift from a self-directed approach to a managed portfolio or vice-versa, or align with an advisor who specializes in a particular investment philosophy.

Direct Transfer Versus Rollover: Key Differences

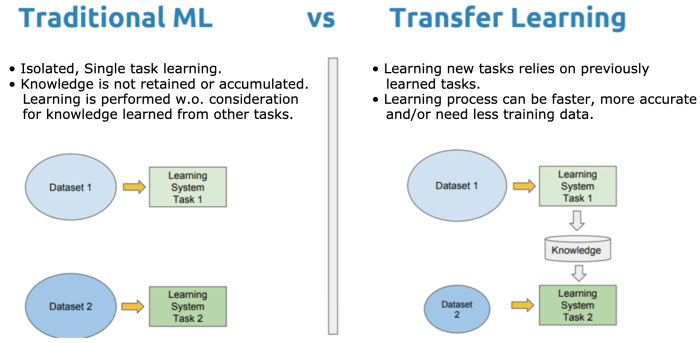

Understanding the distinction between a direct transfer and a rollover is paramount to avoid potential tax penalties and ensure compliance with IRS regulations. Both methods move funds from one IRA to another, but the mechanics and implications differ.A direct transfer, often referred to as a trustee-to-trustee transfer, involves the financial institution holding your current IRA sending the funds directly to the new financial institution that will hold your new IRA.

This method is generally preferred as it completely bypasses your possession of the funds, thus avoiding any risk of inadvertent taxation.A rollover, on the other hand, involves you receiving a distribution from your current IRA, and then you are responsible for depositing those funds into a new IRA within a specified timeframe.

The IRS allows a 60-day window to complete a rollover from one IRA to another. If the funds are not deposited into the new IRA within this period, the distribution may be considered a taxable withdrawal, subject to income tax and a potential 10% early withdrawal penalty if you are under age 59½.

Typical IRA Transfer Process Overview

The process of transferring an IRA typically involves a series of well-defined steps. While the exact sequence may vary slightly depending on the financial institutions involved, the general framework remains consistent.

- Choose Your New IRA Provider: Research and select a financial institution that offers the investment options, services, and fee structure that best suit your needs. Open a new IRA account with this institution.

- Initiate the Transfer: Contact your current IRA custodian (the financial institution where your IRA is currently held) and inform them of your intention to transfer your account. They will likely provide you with a transfer request form.

- Complete Transfer Forms: Fill out the necessary paperwork provided by your current custodian. This form will typically require details about your existing IRA and the new IRA, including account numbers and the name of the receiving institution. If opting for a direct transfer, you will also need to provide information for the new custodian.

- Fund Movement:

- Direct Transfer: Your current custodian will send the funds directly to your new custodian. You will not take possession of the money.

- Rollover: Your current custodian will issue a check payable to you (or your new IRA custodian, if specified). You must then deposit this check into your new IRA within 60 days.

- Confirmation: Once the transfer is complete, both your old and new custodians should provide confirmation. Review these statements carefully to ensure the correct amount was transferred and that all assets have been accounted for.

Preparing for Your IRA Transfer

Transferring an IRA is a strategic move that requires careful planning and attention to detail. Before you initiate the process, thorough preparation ensures a smooth transition and minimizes the risk of errors or penalties. This involves gathering necessary information, assessing your current investment landscape, and selecting the right financial partner for your retirement savings.Understanding the prerequisites and taking proactive steps will empower you to navigate the transfer process with confidence, ultimately benefiting your long-term financial goals.

Essential Information From Your Current IRA Provider

To facilitate a seamless transfer, you’ll need to obtain specific details from your existing IRA custodian. This information is crucial for both your current provider to process the outgoing transfer request and for your new institution to correctly set up your account. Missing or inaccurate data can lead to delays or complications.The following information is typically required:

- Full legal name and Social Security Number (SSN) of the account holder.

- The exact name of your current IRA provider (e.g., Fidelity, Vanguard, Schwab).

- Your current IRA account number.

- The type of IRA you hold (Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA).

- The full address of your current IRA provider.

- Contact information for your current IRA provider, including a phone number and website.

- Details about any outstanding loans against your IRA, if applicable.

Reviewing Current IRA Investment Holdings

Before initiating a transfer, a comprehensive review of your current IRA’s investment holdings is a critical step. This evaluation serves multiple purposes, from understanding your existing asset allocation to identifying any potential issues that might impact the transfer process or your future investment strategy. A thoughtful review can prevent unwanted surprises and align your investments with your evolving financial objectives.Consider the following aspects during your review:

- Asset Allocation: Analyze the current distribution of your assets across different classes (stocks, bonds, mutual funds, ETFs, etc.). This provides a baseline for comparing with potential new investment options.

- Performance: Assess the historical performance of your current investments. While past performance is not indicative of future results, it can offer insights into their suitability.

- Fees and Expenses: Scrutinize the expense ratios of mutual funds and ETFs, as well as any account maintenance fees charged by your current provider. High fees can erode your returns over time.

- Investment Types: Note the specific investment vehicles you hold. Some older or less common investment types might require special handling during a transfer.

- Tax Implications: Understand the tax implications of any unrealized gains or losses within your current IRA. While a direct trustee-to-trustee transfer generally avoids immediate tax consequences, being aware is prudent.

This review also presents an opportunity to re-evaluate if your current investment strategy still aligns with your risk tolerance, time horizon, and retirement goals.

Choosing a New Bank or Financial Institution for Your IRA

Selecting the right financial institution to hold your transferred IRA is a decision that can significantly impact your retirement savings. The ideal institution should not only offer competitive fees and a wide range of investment options but also provide excellent customer service and user-friendly platforms. Your choice should align with your investment style and long-term financial aspirations.Key factors to consider when choosing a new institution include:

- Investment Options: Ensure the institution offers a diverse selection of investment vehicles, including low-cost index funds, ETFs, and potentially individual stocks and bonds, that match your investment strategy.

- Fees and Costs: Compare account maintenance fees, trading commissions, advisor fees (if applicable), and any other charges. Lower fees translate to higher net returns for your retirement.

- Research and Tools: Evaluate the availability of research reports, market analysis tools, and educational resources. These can be invaluable for making informed investment decisions.

- Customer Service: Consider the accessibility and quality of customer support. Responsive and knowledgeable service can be crucial when you have questions or encounter issues.

- Online Platform and Mobile App: A robust and intuitive online platform and mobile app can simplify account management, trading, and access to information.

- Reputation and Stability: Choose an institution with a strong track record and financial stability.

For example, a younger investor with a high risk tolerance might prioritize access to a broad range of growth-oriented ETFs and low trading fees, while a retiree might seek an institution with robust withdrawal management tools and a wider selection of income-generating investments.

Checklist of Documents Required for Initiating an IRA Transfer

To ensure a smooth and efficient IRA transfer process, it is essential to have all the necessary documentation readily available. Having these documents prepared in advance will prevent delays and potential complications with both your current and prospective IRA providers.The following checklist Artikels the common documents and information you will likely need:

| Document/Information | Description | Notes |

|---|---|---|

| Completed IRA Transfer Request Form | This form is typically provided by the new financial institution you are transferring to. It authorizes them to initiate the transfer from your old account. | Ensure all fields are accurately completed, including your personal information and account details. |

| Proof of Identity | A copy of a government-issued photo ID, such as a driver’s license or passport. | This is a standard Know Your Customer (KYC) requirement. |

| Proof of Address | A recent utility bill, bank statement, or other official document showing your current residential address. | This helps verify your location. |

| Current IRA Account Statement | A recent statement from your current IRA provider. | This statement helps confirm account details and balances. |

| Information from New Institution | Details about the account you are opening at the new institution, including the account number and type. | This is needed for the outgoing transfer to be directed correctly. |

Employer Identification Number (EIN)

|

If transferring a SEP or SIMPLE IRA, you may need your business’s EIN. | This is specific to employer-sponsored retirement plans. |

Always confirm with both your current and prospective IRA providers for any specific document requirements they may have, as these can sometimes vary.

Executing a Direct IRA Transfer (Trustee-to-Trustee)

Transitioning your IRA funds to a new institution can be a seamless process when opting for a direct transfer, also known as a trustee-to-trustee transfer. This method ensures your money never touches your hands, thereby avoiding potential tax implications and penalties. It’s the most recommended approach for IRA rollovers.In a direct IRA transfer, your existing custodian (the trustee of your current IRA) directly sends the funds to your new custodian (the trustee of your new IRA).

This eliminates the risk of inadvertently missing the 60-day rollover deadline that applies to indirect transfers, where you receive a check. The process is designed to be straightforward, but understanding each step and potential pitfalls is crucial for a smooth experience.

Initiating a Direct Transfer with Your Current Custodian

The initial step in a direct IRA transfer involves formally notifying your current IRA custodian of your intention to move your funds. This typically requires completing a specific form provided by your custodian.The process generally involves the following actions:

- Locate and complete the “IRA Transfer of Assets” or “Trustee-to-Trustee Transfer Request” form from your current custodian’s website or by contacting their customer service.

- Fill out the form accurately, providing your personal information, account number, and the details of your new financial institution, including their name, address, and specific routing and account information for IRA transfers.

- Specify the exact amount or all assets you wish to transfer. For in-kind transfers (moving specific investments like stocks or mutual funds), you will need to list these assets.

- Sign and submit the completed form according to your current custodian’s instructions, which may include mailing, faxing, or secure online submission.

The Role of the New Financial Institution in Facilitating a Direct Transfer

Your new financial institution plays a pivotal role in receiving and processing the transferred IRA assets. They act as the destination for your funds and are responsible for setting up your new IRA account.Key responsibilities of the new institution include:

- Providing you with the necessary account and routing information to complete the transfer request form for your old custodian. This includes their official name, address, and any specific codes required for electronic or wire transfers of retirement funds.

- Establishing your new IRA account and ensuring it is ready to receive the incoming funds or assets.

- Confirming receipt of the transferred assets and notifying you once the funds are settled in your new account.

- If you are transferring investments in-kind, the new institution will also be responsible for accepting and holding those specific assets within your new IRA.

Common Pitfalls to Avoid During a Direct Transfer and How to Prevent Them

While direct transfers are designed to be secure, certain common errors can cause delays or complications. Being aware of these potential issues and taking proactive steps can ensure a smooth transition.Here are common pitfalls and their prevention strategies:

- Incomplete or Incorrect Information: Errors in account numbers, custodian names, or routing details on the transfer form are frequent causes of delays.

- Prevention: Double-check all information on the transfer form against official documentation from both your old and new custodians. Obtain the correct details directly from your new institution.

- Transferring Retirement Funds to a Non-Retirement Account: Sending IRA funds to a standard brokerage or savings account at the new institution can lead to tax implications.

- Prevention: Explicitly state that the transfer is for an IRA account at the new institution and ensure the new custodian confirms receipt into the correct IRA type (e.g., Traditional IRA, Roth IRA).

- Failure to Specify “Direct Transfer” or “Trustee-to-Trustee”: Ambiguity in the request can sometimes lead to the custodian interpreting it as an indirect transfer.

- Prevention: Always use the terms “direct transfer” or “trustee-to-trustee transfer” on your request form and confirm this is how the transfer will be processed.

- Delays in Processing by the Old Custodian: Some custodians may take longer than others to process transfer requests.

- Prevention: Follow up with your old custodian if you haven’t seen movement within a reasonable timeframe (e.g., 5-10 business days). Keep a record of when you submitted the request.

- Misunderstanding In-Kind Transfers: If you are transferring specific investments, ensure both custodians can handle the specific assets.

- Prevention: Confirm with your new custodian that they accept the specific types of investments you hold (e.g., certain mutual funds, ETFs, individual stocks). Coordinate with both custodians regarding the mechanics of the in-kind transfer.

Sample Communication Template to Send to Your Current IRA Custodian

This template can be adapted for your specific situation when initiating a direct IRA transfer. Remember to replace bracketed information with your personal details.

[Your Name][Your Address][Your Phone Number][Your Email Address][Date][Current IRA Custodian Name][Current IRA Custodian Address]Subject: Trustee-to-Trustee IRA Transfer Request – Account Number: [Your Current IRA Account Number]Dear [Current IRA Custodian Name] Representative,I am writing to formally request a trustee-to-trustee transfer of funds from my [Type of IRA, e.g., Traditional IRA] account, number [Your Current IRA Account Number], to a new IRA account at [New Financial Institution Name].Please process this transfer as a direct trustee-to-trustee transfer. The funds should be sent directly to:[New Financial Institution Name][New Financial Institution Address][New Financial Institution Routing Number for IRA Transfers][New Financial Institution Account Number for IRA Transfers][Any other required account identifiers for the new IRA]I wish to transfer the full balance of my account, totaling approximately $[Approximate Account Balance] as of [Date].

[If transferring specific assets in-kind, add: I also wish to transfer the following specific assets in-kind: (List assets here)].Please find attached the completed “IRA Transfer of Assets” form [or specify the name of the form you are using]. I have also included a voided check from my new account for verification purposes, if required.Kindly confirm receipt of this request and provide an estimated timeline for the completion of the transfer.

Please notify me once the transfer has been successfully processed.Thank you for your prompt attention to this matter.Sincerely,[Your Signature][Your Typed Name]

Executing an IRA Rollover (Indirect Transfer)

While direct trustee-to-trustee transfers are often the most straightforward method for moving IRA funds, an indirect rollover presents an alternative, albeit one that requires meticulous attention to detail and adherence to strict IRS guidelines. This method involves you, the account holder, taking temporary possession of the funds before depositing them into a new IRA. Understanding the nuances of this process is crucial to avoid unexpected tax liabilities and potential penalties.An indirect IRA rollover, also known as a 60-day rollover, allows you to withdraw funds from your current IRA and then deposit them into a new IRA within a specific timeframe.

The key distinction from a direct transfer is that the money passes through your hands, triggering different rules and responsibilities. Navigating this process successfully hinges on understanding the critical 60-day window and the tax implications associated with it.

The 60-Day Rule for Indirect Rollovers

The 60-day rule is the cornerstone of an indirect IRA rollover. It dictates that you must deposit the withdrawn funds into a new, eligible retirement account within 60 days of the date you receive the distribution from your old IRA. Failure to meet this deadline can have significant financial repercussions, as the IRS may treat the distribution as a taxable withdrawal, subject to ordinary income tax and a potential 10% early withdrawal penalty if you are under age 59½.

The 60-day clock starts ticking the moment the funds are considered distributed to you, not when you deposit them into the new account.

It’s important to note that the IRS generally limits individuals to one indirect IRA rollover per 12-month period. This rule applies across all of your IRAs, including Traditional IRAs, SEP IRAs, and SIMPLE IRAs. This limitation is designed to prevent individuals from repeatedly accessing their retirement funds without incurring taxes and penalties. However, direct trustee-to-trustee transfers are not subject to this 12-month limitation.

Tax Implications of Withdrawing Funds for an Indirect Rollover

When you initiate an indirect rollover, the distribution from your original IRA is typically subject to mandatory federal income tax withholding. For most distributions, this withholding rate is 20%. This means that if you withdraw $10,000, only $8,000 will be directly available to you, with $2,000 withheld by the financial institution. This withholding is an advance payment of taxes, and it’s crucial to understand that you are responsible for depositing the full amount of the distribution (including the withheld portion) into your new IRA to avoid it being treated as a taxable withdrawal.If you are unable to deposit the full amount within 60 days, the portion not deposited will be considered a taxable distribution.

If you are under age 59½, you may also be subject to a 10% early withdrawal penalty on this taxable amount. To avoid this penalty and the tax liability, you would need to cover the 20% withheld amount from your own personal funds when making the deposit into your new IRA. For example, if you received $10,000 and $2,000 was withheld, you would need to deposit $10,000 into your new IRA within 60 days.

This means you would contribute $8,000 from the distribution and $2,000 from your other savings.

Tracking Funds During an Indirect Rollover

Meticulous record-keeping is paramount when executing an indirect IRA rollover. The 60-day deadline is absolute, and any misstep can lead to unintended tax consequences. To ensure compliance and avoid missing the deadline, it is advisable to implement a robust tracking system.Here’s a method for tracking your funds:

- Document the Distribution Date: Immediately note the exact date you receive the distribution notice or the funds are made available to you. This is the official start of your 60-day window.

- Record the Withdrawal Amount: Keep a clear record of the gross amount withdrawn and any amounts withheld for taxes.

- Monitor the Deposit Timeline: Set up calendar reminders well in advance of the 60-day deadline. Aim to deposit the funds into your new IRA at least a few days before the deadline to account for any processing delays.

- Obtain Proof of Deposit: Secure confirmation from the receiving institution that the funds have been deposited into your new IRA. This documentation is vital.

- Keep All Statements: Retain all statements from both the distributing and receiving financial institutions, as well as any communication related to the rollover.

Reporting an IRA Rollover to the IRS

Properly reporting your IRA rollover to the IRS is a critical step in the process. Even though the funds are intended to be tax-deferred, the IRS requires notification of the distribution and the subsequent rollover. This reporting is primarily done on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., and IRS Form 5498, IRA Contribution Information.When you receive a distribution from your IRA, the financial institution that held the account is required to send you and the IRS a Form 1099-R.

This form will detail the amount of the distribution and any taxes withheld. You will use this form to report the distribution on your federal income tax return.For the rollover itself, you will typically report it on IRS Form 1040, U.S. Individual Income Tax Return, by indicating that the distribution was rolled over. The specific line item for this can vary slightly by tax year, but it generally involves showing the distribution and then subtracting the rolled-over amount to demonstrate that it was not a taxable event.Furthermore, the financial institution where you establish your new IRA will send you and the IRS Form 5498.

This form reports the contributions made to your IRA for the year, including rollover contributions. It is important to note that Form 5498 is typically issued in May of the following year, as it includes contributions made up to the tax filing deadline.

>Accurate reporting on your tax return is essential to confirm the rollover transaction and avoid any potential misinterpretation by the IRS as a taxable withdrawal.

Considerations When Choosing a New IRA Provider: How To Transfer Ira To Another Bank

Selecting the right IRA provider is a critical step in ensuring your retirement savings are managed effectively and efficiently. This decision impacts not only the potential growth of your investments through available options but also the costs you incur and the support you receive. A thorough evaluation of potential custodians will help you align your choice with your financial goals and preferences.The landscape of IRA providers is diverse, ranging from large brokerage firms to smaller financial institutions, each offering a unique set of services and fee structures.

Understanding these differences is paramount to making an informed decision that benefits your long-term financial well-being.

Typical Fees Associated with IRA Providers

Fees can significantly erode your investment returns over time. It is essential to understand the various types of fees that IRA providers may charge and to compare them across different institutions. This proactive approach helps in maximizing your net gains.Common fees include:

- Annual Maintenance Fees: Charged by some custodians simply for holding an IRA account. These can be flat fees or a percentage of your account balance.

- Account Transfer Fees: Fees charged when moving your IRA to a different institution. This is particularly relevant if you are executing an indirect rollover.

- Investment Fees: These are often embedded within the investment products themselves, such as expense ratios for mutual funds and ETFs. Some providers may also charge trading commissions for buying or selling securities.

- Advisory Fees: If you opt for a managed account or advice from the provider, there will likely be an advisory fee, typically a percentage of assets under management.

- Inactivity Fees: Some providers may charge a fee if your account remains inactive for a certain period.

When comparing fees, look beyond the headline numbers. A provider with slightly higher stated fees might offer superior investment options or customer service that justifies the cost. Always request a comprehensive fee schedule.

Range of Investment Options

The investment options available through an IRA provider dictate the potential for growth and diversification of your retirement portfolio. Different institutions cater to varying investment styles and risk tolerances.Financial institutions typically offer a spectrum of investment vehicles:

- Stocks: Individual company shares.

- Bonds: Fixed-income securities issued by governments or corporations.

- Mutual Funds: Pooled investments managed by a professional fund manager, offering diversification across various assets.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but trade on exchanges like individual stocks.

- Certificates of Deposit (CDs): Time deposits with a fixed interest rate.

- Money Market Funds: Low-risk, low-return investments focused on short-term debt instruments.

- Alternative Investments: Some providers may offer access to less traditional assets like real estate investment trusts (REITs) or commodities, though these are less common.

A provider with a broad selection of low-cost index funds and ETFs can be advantageous for investors seeking diversification and passive growth strategies. Conversely, active traders might prefer platforms offering a wide array of individual securities and sophisticated trading tools.

Customer Service Quality and Support

The quality of customer service and support can significantly influence your experience as an IRA holder. Responsive and knowledgeable assistance is crucial, especially when dealing with complex transactions or seeking investment guidance.Factors to consider regarding customer service include:

- Availability: Are customer service representatives available during standard business hours, extended hours, or 24/7?

- Channels of Communication: Can you reach them via phone, email, live chat, or secure messaging?

- Expertise: Do the representatives possess sufficient knowledge to answer your IRA-specific questions and provide helpful guidance?

- Problem Resolution: How efficiently and effectively are issues or inquiries typically resolved?

- Educational Resources: Does the provider offer webinars, articles, or tools to help you understand your investments and retirement planning?

Online reviews and ratings from existing customers can offer valuable insights into a provider’s customer service performance. A provider that invests in robust customer support demonstrates a commitment to its clients’ satisfaction and financial success.

Questions to Ask Potential New IRA Custodians

To ensure you are making the most informed decision, prepare a list of pertinent questions to ask prospective IRA custodians. These questions will help you gather the necessary information to compare providers objectively and select the one that best aligns with your financial needs.Here is a set of essential questions to ask:

- What are all the fees associated with holding an IRA account with your institution, including annual maintenance, transfer, and any other potential charges?

- What types of investment options are available within your IRA accounts, and are there any limitations on trading specific securities or funds?

- What is the average response time for customer service inquiries via phone and email?

- Do you offer any educational resources or financial planning tools for IRA holders?

- What is your process for handling IRA transfers and rollovers, and are there any specific forms or procedures I need to follow?

- Are there any minimum balance requirements for opening or maintaining an IRA account?

- Do you offer self-directed IRA options for alternative investments, and what are the associated fees and restrictions?

- What is your policy on account inactivity, and are there any fees associated with it?

By systematically asking these questions and thoroughly documenting the answers, you can create a clear comparison matrix that highlights the strengths and weaknesses of each potential IRA provider. This structured approach empowers you to make a confident decision about where to entrust your retirement savings.

Potential Challenges and Solutions in IRA Transfers

Navigating the transfer of your Individual Retirement Account (IRA) can be a straightforward process, but like any financial transaction, potential roadblocks can emerge. Understanding these common challenges and knowing how to address them proactively will ensure a smoother transition for your retirement savings. This section will equip you with the knowledge to identify and overcome hurdles, keeping your financial future on track.While the goal is a seamless transfer, errors can occur due to miscommunication, incomplete information, or procedural oversights.

These issues can lead to delays, incorrect account balances, or even unintended tax implications. The key to managing these situations lies in vigilance, clear communication, and prompt action.

Common Errors During the IRA Transfer Process

Mistakes can happen at various stages of an IRA transfer, impacting its accuracy and timeliness. Being aware of these potential pitfalls allows for preemptive measures and quicker resolution if they arise.

- Incorrect Account Information: This is a frequent issue, involving transposed account numbers, misspelled names, or incorrect Social Security numbers. Such errors can halt the transfer or lead to funds being sent to the wrong destination.

- Missing or Incomplete Forms: Both the sending and receiving institutions require specific documentation. If forms are not filled out entirely or are missing required signatures, the transfer will be stalled until these omissions are rectified.

- Misunderstanding Transfer Types: Confusing a direct trustee-to-trustee transfer with an indirect rollover can lead to significant tax penalties. In an indirect rollover, the individual receives the funds, and if not reinvested within 60 days, it’s considered a taxable distribution.

- Failure to Notify the Current Provider: Sometimes, individuals initiate the transfer with the new institution without formally notifying their current IRA custodian to release the funds, causing delays.

- Incorrect Beneficiary Designations: While not directly a transfer error, ensuring beneficiary information is correctly transferred or updated with the new provider is crucial for estate planning.

Resolving Issues with Incomplete or Incorrect Transfers

When an IRA transfer doesn’t go as planned, a systematic approach is necessary to correct the errors and ensure your funds are secure and properly accounted for. Prompt and clear communication with all parties involved is paramount.If you discover that funds have been sent to the wrong account or that the amount is incorrect, the first step is to contact both the sending and receiving financial institutions immediately.

Document the date and time of your call, the name of the representative you spoke with, and a summary of the conversation. Most institutions have dedicated departments to handle transfer discrepancies. They will investigate the issue, which may involve tracing the funds or correcting account details. If the error was due to incorrect information provided by you, be prepared to resubmit the necessary documentation promptly.

For issues arising from the institutions’ errors, they should bear the responsibility for rectifying the situation without further cost or penalty to you.

Handling Extended Transfer Timelines

Occasionally, unforeseen circumstances or institutional processing times can extend the duration of an IRA transfer beyond the typical timeframe. While frustrating, patience and consistent follow-up are key.

“Extended timelines for IRA transfers are often a result of internal processing backlogs or the need for additional verification, rather than intentional delays.”

If your transfer is taking longer than expected, reach out to your new IRA provider for an update. They can often inquire with the outgoing custodian on your behalf. If the delay persists, consider escalating the issue within both institutions. Keep a log of all communications, including dates, times, and the names of individuals you speak with. If the delay is causing you to approach the 60-day deadline for an indirect rollover (if applicable), inform the receiving institution of this situation to explore any grace periods or alternative solutions they might offer.

In rare cases, if significant delays are causing potential financial harm, consulting with a financial advisor or tax professional might be beneficial.

The Importance of Detailed Record-Keeping

Maintaining meticulous records throughout the IRA transfer process is not merely good practice; it’s a critical safeguard against potential disputes and ensures accountability. Every document, communication, and confirmation plays a vital role in validating the transaction.A comprehensive record-keeping system should include:

- Copies of all submitted forms: Keep a digital or physical copy of every application, authorization, or transfer request you submit to both your old and new IRA providers.

- Correspondence logs: Note down dates, times, names of representatives, and summaries of phone calls. Save all email communications.

- Confirmation statements: Once the transfer is complete, you should receive confirmation from both institutions. Retain these statements as proof of the transaction’s successful completion and the final balances.

- Tracking numbers or reference IDs: If any part of the transfer process involves specific tracking numbers or reference IDs, record them.

This detailed documentation serves as your evidence if any discrepancies arise, helping to quickly identify where an error may have occurred and facilitating a faster resolution. It also provides a clear audit trail for tax purposes.

Understanding the Tax and Legal Aspects

Navigating an IRA transfer requires a firm grasp of the associated tax and legal implications. While designed to be a seamless process, errors can lead to unintended tax liabilities and penalties. Understanding these nuances ensures your retirement savings remain protected and compliant with IRS regulations. This section will clarify the tax consequences, the impact on Required Minimum Distributions (RMDs), potential early withdrawal penalties, and the legal safeguards for your IRA funds.

Tax Consequences of Improper IRA Handling

Improperly handling an IRA transfer can trigger significant tax consequences, primarily due to the IRS viewing unauthorized distributions as taxable income. When you withdraw funds from an IRA without initiating a proper transfer or rollover, the IRS considers it a taxable event. This means the withdrawn amount will be added to your gross income for the year, subject to your ordinary income tax rate.

Furthermore, if you are under age 59½, an additional 10% federal tax penalty for early withdrawal will likely apply to the distribution. This dual taxation—income tax and an early withdrawal penalty—can substantially diminish your retirement nest egg. For instance, withdrawing $50,000 from your IRA at age 50 without a proper rollover could result in income tax on the $50,000 and a $5,000 early withdrawal penalty, in addition to any state taxes.

Required Minimum Distributions (RMDs) and Transfers

Required Minimum Distributions (RMDs) are mandatory withdrawals that individuals must take from their retirement accounts, including Traditional IRAs and Roth IRAs (after the owner’s death), once they reach a certain age, currently 73. The rules surrounding RMDs are critical to understand during an IRA transfer. A direct trustee-to-trustee transfer is generally not considered a distribution, meaning it does not satisfy your RMD for the year.

When considering how to transfer an IRA to another bank, it’s natural to wonder about managing your finances comprehensively. This leads to the question, can i have multiple bank accounts ? Absolutely, and having various accounts doesn’t complicate the process of a direct IRA rollover to your chosen institution, ensuring a smooth transition.

If you have an RMD due, you must still take it from your original IRA before or after the transfer, or from the new IRA after the transfer is complete. Failing to take your RMD by the deadline can result in a steep 25% penalty on the amount that should have been withdrawn, though this penalty can sometimes be waived by the IRS if you can demonstrate reasonable cause.

An indirect rollover, where you receive the funds directly, requires you to deposit the money into the new IRA within 60 days. If this rollover is completed correctly, it will not be treated as a distribution for RMD purposes. However, if the 60-day deadline is missed, the funds may be considered a taxable distribution, potentially impacting your RMD status and triggering penalties.

Penalties for Early Withdrawal in Rollovers, How to transfer ira to another bank

The 60-day rule is paramount when executing an indirect IRA rollover. If you withdraw funds from your IRA with the intention of rolling them over into another IRA, you have precisely 60 days from the date of withdrawal to deposit the entire amount into the new qualified retirement account. Missing this deadline, even by a single day, means the withdrawn funds are treated as a taxable distribution.

This triggers immediate income tax on the amount withdrawn and, if you are under age 59½, the 10% federal penalty for early withdrawal. For example, if you withdraw $30,000 from your IRA on July 1st with the intent to roll it over, and you fail to deposit it into a new IRA by August 30th, the IRS will consider that $30,000 a taxable event.

If you are 50 years old, you could face income tax on $30,000 plus an additional $3,000 penalty. This highlights the importance of meticulous planning and prompt action when undertaking an indirect rollover. Direct trustee-to-trustee transfers circumvent this 60-day rule entirely, as the funds never leave the control of a qualified custodian.

Legal Protections for IRA Funds During Transfer

Your IRA funds are subject to specific legal protections designed to safeguard your retirement savings. When you initiate a transfer, these protections generally remain intact, provided the process is executed correctly. The Employee Retirement Income Security Act of 1974 (ERISA) and other federal and state laws govern retirement accounts, offering various safeguards against creditors and other claims. In most cases, IRA assets are protected from creditors, bankruptcy proceedings, and legal judgments, though there are exceptions, particularly for debts incurred before the IRA was established or for certain types of marital property settlements.

During a transfer, especially a direct trustee-to-trustee transfer, the funds are continuously held by qualified financial institutions, maintaining their protected status. The legal framework ensures that the transfer process itself does not diminish these protections, as long as it adheres to IRS regulations and involves legitimate, qualified financial institutions.

Post-Transfer Actions and Management

Completing an IRA transfer is a significant step towards consolidating your retirement savings and potentially optimizing your investment strategy. However, the process doesn’t end once the funds have arrived at your new institution. Proactive post-transfer actions are crucial for ensuring your retirement accounts continue to serve your long-term financial goals effectively. This section Artikels the essential steps to take after your IRA has been successfully transferred, from updating beneficiaries to managing your investments and staying informed about your account’s performance.Effectively managing your IRA after a transfer involves several key administrative and strategic tasks.

These actions ensure your account is set up correctly with your new provider, aligned with your financial objectives, and easy to monitor. By addressing these points promptly, you can maximize the benefits of your new IRA provider and maintain control over your retirement planning.

Setting Up New Beneficiaries

Establishing or updating your IRA beneficiaries is a critical post-transfer task. Beneficiaries are the individuals or entities designated to receive the assets in your IRA upon your passing. Failing to update beneficiaries after a transfer can lead to complications and unintended distribution of your assets, potentially overriding your wishes. This process ensures your assets are distributed according to your estate plan.The process for designating beneficiaries typically involves the following steps:

- Obtain the necessary beneficiary designation form from your new IRA provider. This is usually available on their website or by contacting customer service.

- Complete the form accurately, providing the full legal names, Social Security numbers, and contact information for each primary and contingent beneficiary.

- Specify the percentage of the IRA assets each beneficiary will receive.

- Review the form carefully to ensure all information is correct and your intentions are clearly stated.

- Submit the completed form to your new IRA provider as instructed. It is advisable to keep a copy for your records.

It is also important to review your beneficiary designations periodically, especially after significant life events such as marriage, divorce, the birth of a child, or the death of a beneficiary.

Rebalancing Your Investment Portfolio

After transferring your IRA, it is an opportune moment to re-evaluate and potentially rebalance your investment portfolio. Market fluctuations and changes in your personal circumstances may have shifted your asset allocation away from your target. Rebalancing ensures your portfolio remains aligned with your risk tolerance and long-term financial goals.The rebalancing process involves several key considerations:

- Review Your Investment Objectives and Risk Tolerance: Reassess your retirement timeline, your capacity for risk, and your overall financial goals. This assessment will guide your asset allocation strategy.

- Analyze Your Current Asset Allocation: Examine the current distribution of your investments across different asset classes (e.g., stocks, bonds, mutual funds, ETFs).

- Determine Your Target Asset Allocation: Based on your objectives and risk tolerance, establish a desired mix of asset classes. For example, a younger investor might have a higher allocation to stocks, while someone nearing retirement might prefer a more conservative mix with a higher allocation to bonds.

- Adjust Holdings to Align with Targets: If your current allocation deviates significantly from your target, you will need to make adjustments. This typically involves selling assets that have grown to represent a larger portion of your portfolio than desired and buying assets that have shrunk.

- Consider Transaction Costs and Tax Implications: Be mindful of any trading fees or potential capital gains taxes associated with buying and selling investments, especially if your IRA is not a Roth IRA.

For instance, if your portfolio was intended to be 60% stocks and 40% bonds, but due to market performance, it has become 70% stocks and 30% bonds, rebalancing would involve selling some stocks and using the proceeds to buy bonds to return to the 60/40 target.

Best Practices for Ongoing IRA Management

Effective ongoing management of your IRA at a new institution is vital for sustained retirement savings growth and security. This involves establishing consistent habits and staying informed about your account’s status and the investment options available.To ensure optimal ongoing management, consider the following best practices:

- Regularly Review Account Statements: Make it a habit to review your monthly or quarterly statements to track performance, verify transactions, and identify any discrepancies.

- Stay Informed About Investment Performance: Monitor how your investments are performing relative to their benchmarks and your expectations. Understand the factors influencing their performance.

- Periodically Rebalance Your Portfolio: As mentioned earlier, rebalancing should not be a one-time event. Aim to rebalance your portfolio at least annually or when significant market shifts occur.

- Understand Fees and Expenses: Familiarize yourself with all fees associated with your IRA, including administrative fees, investment management fees, and any transaction costs. Compare these with industry averages.

- Utilize Educational Resources: Take advantage of the educational materials, webinars, and financial planning tools provided by your new IRA provider.

- Consult with a Financial Advisor: If you have complex financial situations or are unsure about investment decisions, consider consulting with a qualified financial advisor.

- Stay Updated on Tax Law Changes: Keep abreast of any changes in IRA contribution limits, withdrawal rules, or tax regulations that could affect your retirement savings.

Proactive engagement with your IRA ensures it remains a powerful tool for achieving your retirement goals.

Accessing Statements and Tracking Performance

Understanding how to access and interpret your IRA statements and performance reports from your new provider is fundamental to effective management. Most financial institutions offer robust online portals and mobile applications that provide real-time account information.Here’s a breakdown of how to access and utilize these resources:

- Online Account Access: Log in to your new IRA provider’s website. You should find a dedicated section for your account, typically labeled “My Accounts,” “Portfolio,” or “Statements.”

- Statement Retrieval: Within your online account, look for options to view or download your statements. These are usually available in PDF format and are typically issued monthly or quarterly. Statements will detail your account balance, contributions, withdrawals, investment holdings, and transaction history.

- Performance Tracking Tools: Many providers offer tools that allow you to track the performance of your overall portfolio and individual investments. These tools often provide charts and graphs illustrating growth over various time periods (e.g., year-to-date, 1-year, 5-year).

- Understanding Performance Metrics: Familiarize yourself with key performance indicators such as total return, annualized return, and comparison to relevant market benchmarks (e.g., S&P 500 for equity investments).

- Mobile App Functionality: If your provider has a mobile app, explore its features. Many apps allow you to view account balances, track performance, and even make certain transactions on the go.

- Customer Support: If you encounter any difficulties accessing statements or understanding performance data, do not hesitate to contact your new IRA provider’s customer support. They can guide you through the process and answer specific questions.

For example, when reviewing a statement, you might see a section detailing the gains or losses of your mutual fund holdings. A performance tracking tool might then present this data visually, showing how your fund has performed against its stated benchmark over the past year, allowing you to assess whether it’s meeting expectations.

Wrap-Up

Thus, the path of moving your IRA concludes, leaving behind a sense of quiet accomplishment. The careful steps taken, the choices made, and the understanding gained now form the foundation for your future’s continued growth. May this transition bring peace of mind, knowing your retirement dreams are now settled in a new, welcoming embrace, ready to face the dawn.

FAQs

Can I transfer an IRA to a different type of retirement account?

Generally, you can transfer an IRA to another IRA, but transferring directly to a different type of account like a 401(k) is not typically possible without specific rollover provisions or potential tax implications.

What happens to my investments during an IRA transfer?

During a direct trustee-to-trustee transfer, your investments are usually moved in kind, meaning they remain the same. In a rollover, you withdraw the funds, and then you must reinvest them in the new IRA, which may require selling and repurchasing assets.

Is there a limit to how often I can transfer my IRA?

The IRS limits IRA rollovers (indirect transfers) to once every 12 months per individual, regardless of the number of IRAs you own. Direct transfers, however, do not have this 12-month limitation.

What if my new bank offers different investment options than my old one?

This is a key consideration. You will need to review the investment choices at the new institution and decide if they align with your financial goals and risk tolerance. You may need to sell existing holdings before the transfer if they are not available at the new provider.

How long does an IRA transfer typically take?

Direct trustee-to-trustee transfers are generally faster, often taking a few days to a couple of weeks. Indirect rollovers can take longer due to the time it takes to withdraw funds and then deposit them into the new account, with the 60-day deadline looming.