How to merge bank accounts after marriage marks a significant step in a couple’s journey, symbolizing a shared future and a unified financial path. It’s more than just combining numbers; it’s about weaving your financial lives together, creating a tapestry of shared goals and mutual trust.

Embarking on this new chapter together often brings up questions about how to best manage your finances as a team. Understanding the ‘why’ behind merging accounts, exploring the legalities, and choosing the right approach are all crucial for a smooth transition. We’ll delve into the practical steps, effective management strategies, and how to navigate potential bumps in the road, ensuring your financial union is as strong as your marital one.

Understanding the Need to Merge Bank Accounts After Marriage: How To Merge Bank Accounts After Marriage

So, you guys just tied the knot, congrats! Now that you’re officially a team, it’s time to think about your money game. Merging bank accounts isn’t just about convenience; it’s a big step towards building a solid financial future together. Think of it as leveling up your relationship’s economic power!This isn’t about losing your individuality, but rather about creating a unified front for your shared life.

When you combine your finances, you’re essentially saying, “We’re in this together, financially speaking.” It’s a tangible way to show commitment and build trust.

Reasons for Merging Bank Accounts

There are some pretty solid reasons why couples opt for joint accounts after saying “I do.” It’s about making life smoother and boosting your financial goals as a duo.The primary drivers behind merging bank accounts revolve around fostering transparency, simplifying financial management, and cultivating a sense of shared responsibility. It’s a practical move that can lead to significant benefits for both the couple and their collective financial well-being.

Financial Benefits of Joint Accounts

Having joint accounts can seriously streamline your money management and help you hit those financial milestones faster. It’s like having a turbo boost for your savings and budgeting.Here are some of the key financial advantages:

- Simplified Budgeting and Tracking: With all your income and expenses in one place, it’s way easier to create and stick to a budget. No more juggling multiple statements or trying to figure out who paid for what.

- Enhanced Savings Potential: Pooling your money means you can reach savings goals, like a down payment for a house or a dream vacation, much quicker. You can set up automatic transfers from your joint account to dedicated savings or investment accounts.

- Easier Bill Payment: Forget the confusion of who’s responsible for which bill. A joint account ensures all household expenses are covered seamlessly, reducing the risk of late fees or missed payments.

- Emergency Fund Consolidation: Building a robust emergency fund is crucial. Merging accounts allows you to combine your individual emergency savings into a larger, more secure fund for unexpected life events.

- Streamlined Tax Filing: For married couples, having a joint account can simplify the process of tracking shared income and expenses, potentially making tax filing less of a headache.

Emotional and Relationship Benefits of Financial Unification

Beyond the numbers, merging finances can bring a whole new level of connection and trust to your relationship. It’s about building a shared vision and working towards it together.Financial unification can significantly impact the emotional landscape of a marriage by fostering a deeper sense of partnership and mutual respect. It’s a powerful tool for strengthening the bond between partners.Here’s how it can boost your relationship vibes:

- Increased Transparency and Trust: Knowing where your money is going and having open conversations about finances builds a foundation of trust. It eliminates secrets and fosters honesty.

- Shared Goals and Teamwork: When you have a joint account, you’re working towards shared financial goals, whether it’s buying a home, starting a family, or planning for retirement. This sense of teamwork can be incredibly bonding.

- Reduced Financial Stress: Knowing you’re both contributing and have a clear picture of your financial situation can alleviate a lot of stress and potential conflict related to money.

- Sense of Partnership: A joint account signifies a true partnership. It’s a tangible representation of your commitment to building a life together and sharing both the responsibilities and the rewards.

- Improved Communication: Regularly discussing your finances, even if it’s just reviewing your joint statement, encourages open and honest communication about your values, priorities, and future plans.

Consider this scenario: Before merging, Sarah was saving for a new car, and Mark was putting money aside for a gaming PC. After merging, they realized that by combining their savings, they could afford a much nicer family car sooner, and Mark could still get his PC later. This collaborative approach often leads to mutually beneficial outcomes and strengthens their decision-making as a unit.

Legal and Practical Considerations Before Merging

Yo, jadi setelah nyobain jadi suami-istri, udah pasti ada banyak hal baru yang perlu disesuaikan, termasuk urusan duit. Nah, sebelum kalian

- gaspol* gabungin rekening, penting banget nih buat paham dulu seluk-beluknya biar nggak ada drama di kemudian hari. Ibaratnya, ini kayak

- pre-wedding check-up* buat keuangan kalian.

Merging rekening bank itu bukan cuma sekadar nyatuin saldo, tapi ada implikasi hukum dan praktis yang lumayan krusial. Nggak mau kan tiba-tiba ada masalah gara-gara nggakaware* dari awal? Makanya, yuk kita bedah satu-satu biar kalian makin mantap melangkah.

Account Ownership and Liability Implications

Soal kepemilikan rekening, ini yang palingbasic* tapi sering bikin bingung. Kalau kalian gabungin rekening, secara otomatis rekening itu jadi milik bersama. Artinya, dua-duanya punya hak yang sama buat ngatur dan ngakses dana di dalamnya. Tapi, ini juga berarti kalau ada hutang atau kewajiban finansial yang muncul dari salah satu pihak setelah rekening digabung, pihak lain bisa ikut bertanggung jawab. Misalnya, kalau salah satu punya kartu kredit yang ditagih ke rekening gabungan, atau ada pinjaman yang harus dibayar dari situ, kalian berdua yang nimbrung.

Dalam hukum perbankan, penggabungan rekening seringkali diartikan sebagai pembentukan ‘joint account’ atau rekening bersama. Ini berarti kedua pemilik memiliki hak yang sama atas dana, namun juga berbagi tanggung jawab atas kewajiban yang terkait dengan rekening tersebut.

Bisa juga lho, kalau salah satu pasangan punya riwayat kredit yang kurang baik, ini bisa berdampak pada kemampuan kalian mengajukan pinjaman baru di masa depan kalau rekeningnya sudah digabung. Makanya, penting banget buat jujur-jujuran soal kondisi finansial masing-masing sebelum memutuskan merger.

Required Documentation for Merging Accounts

Setiap bank punya

- rules* sendiri, tapi umumnya ada beberapa dokumen kunci yang wajib kalian siapin biar proses merger lancar jaya. Anggap aja ini kayak

- materi ujian* buat bank biar yakin kalian emang pasangan sah dan mau gabungin rekening.

Bank biasanya butuh bukti identitas yang jelas buat kedua belah pihak. Ini penting buat verifikasi dan keamanan rekening. Selain itu, bukti status pernikahan juga jadi syarat mutlak. Nggak mungkin kan bank ngizinin sembarangan orang gabungin rekening.Untuk mempermudah, ini dia daftar dokumen yang umumnya diminta:

- Kartu Identitas Resmi (KTP/Paspor) untuk kedua pasangan. Pastikan masih berlaku ya!

- Buku Nikah atau Akta Perkawinan yang asli atau salinan yang dilegalisir. Ini bukti paling sahih status pernikahan kalian.

- Formulir Pengajuan Penggabungan Rekening yang disediakan oleh bank. Biasanya bisa diunduh di website bank atau diambil langsung di cabang.

- Dokumen pendukung lain yang mungkin diminta oleh bank, seperti bukti alamat, tergantung kebijakan masing-masing bank.

Bank Procedures for Merging Customer Accounts

Proses merger rekening di bank itu biasanya nggak instan, tapi juga nggak serumit yang dibayangkan kok. Ada tahapan-tahapan yang perlu dilalui biar semuanya

on the track*.

Pertama, kalian biasanya harus datang langsung ke cabang bank tempat salah satu atau kedua rekening berada. Di sana, kalian akan dibantu oleh

customer service* untuk mengisi formulir dan menyerahkan dokumen yang dibutuhkan.

Setelah semua dokumen lengkap dan diverifikasi, bank akan memproses penggabungan rekening. Ini bisa melibatkan penutupan rekening lama dan pembukaan rekening baru yang bersifat gabungan, atau mengubah jenis rekening yang sudah ada menjadi rekening bersama.

Prosesnya kurang lebih begini:

- Kunjungan ke Cabang Bank: Datangi cabang bank terdekat dengan membawa dokumen lengkap.

- Pengisian Formulir: Isi formulir permohonan penggabungan rekening dengan data yang benar.

- Verifikasi Dokumen: Pihak bank akan memeriksa keaslian dan kelengkapan dokumen yang Anda serahkan.

- Proses Internal Bank: Bank akan melakukan proses administrasi untuk menggabungkan atau mengubah status rekening.

- Konfirmasi dan Aktivasi: Setelah proses selesai, Anda akan mendapatkan konfirmasi dan rekening gabungan siap digunakan.

Proses ini bisa memakan waktu beberapa hari kerja, tergantung antrean dan sistem bank. Jadi, sabar sedikit ya!

Checklist of Essential Documents for Merging Accounts

Biar nggak ada yang kelewat dan bikin repot, bikin checklist ini bakal ngebantu banget. Anggap aja ini

- cheat sheet* kalian biar nggak

- nervous* pas di bank.

Siapin semua dokumen ini sebelum berangkat ke bank. Dijamin prosesnya bakal lebih efisien dan kalian bisa langsung fokus ngurusin hal lain.

| Dokumen | Keterangan | Status |

|---|---|---|

| Kartu Identitas (KTP/Paspor) | Untuk kedua pasangan, pastikan berlaku. | [ ] |

| Buku Nikah/Akta Perkawinan | Asli atau salinan legalisir. | [ ] |

| Formulir Pengajuan Penggabungan | Unduh atau ambil di bank. | [ ] |

| Bukti Alamat (jika diminta) | Tagihan listrik/air, dll. | [ ] |

| Surat Keterangan Domisili (jika perlu) | Tergantung kebijakan bank. | [ ] |

Different Approaches to Merging Bank Accounts

Alright, so after you’ve tied the knot, managing your money can get a bit… complicated. Think of it like a playlist for your life together – do you want one epic shared playlist, or do you still want a few solo tracks? Merging bank accounts is kinda like that, and there are a couple of main vibes you can go for.

It’s all about finding what feels right for your new dynamic as a married couple.This section breaks down the two main strategies: going all-in with a fully merged setup or keeping some things separate with a partially merged approach. We’ll dive into what each looks like, the pros and cons, and when each might be your best bet.

Fully Merged Bank Accounts

This is where you basically combine everything. All your individual checking accounts, savings accounts, maybe even those old emergency funds – they all become one big pot. It’s like you’re creating a joint venture for your finances, where every dollar earned and spent is visible to both partners. This approach fosters transparency and can simplify budgeting and financial planning as a team.The fully merged strategy involves transferring all existing funds from individual accounts into newly opened joint accounts.

This means closing out old personal accounts and consolidating everything under both of your names. For example, if Person A had a checking account with Rp 5.000.000 and Person B had one with Rp 3.000.000, both would be moved into a new joint checking account. Similarly, any personal savings accounts would be merged into a joint savings account.

Scenarios Favoring Fully Merged Accounts

This approach is often a solid choice for couples who:

- Prioritize maximum transparency and shared financial goals.

- Are looking to simplify their financial management and reduce the number of accounts to track.

- Have a strong foundation of trust and open communication about money.

- Are actively working towards shared financial objectives like buying a house, paying off debt together, or saving for retirement.

A real-life example would be a couple in their late twenties, both earning a steady income, who are planning to buy their first home within the next three years. They decide to fully merge their accounts to aggressively save for a down payment, track their combined spending habits to identify areas for savings, and ensure they’re both equally invested in the financial goal.

Partially Merged Bank Accounts

On the flip side, the partially merged approach is all about finding a balance. You might combine some accounts, like your main checking and savings for shared bills and everyday expenses, but keep others separate. This could include individual accounts for personal spending money, hobbies, or even separate emergency funds. It’s about having a shared financial life while still maintaining a degree of personal financial autonomy.This strategy involves identifying specific accounts to be merged for joint use, while others remain individual.

For instance, a couple might open a joint checking account for household expenses like rent, utilities, and groceries, funded by contributions from each partner. However, they might each keep their own personal checking account for discretionary spending, like personal hobbies or gifts for each other, to maintain a sense of independence.

Scenarios Favoring Partially Merged Accounts

This approach can be a great fit for couples who:

- Value individual financial freedom and personal spending autonomy.

- Have significantly different spending habits or financial priorities that might cause friction if fully merged.

- Want to maintain separate accounts for specific goals or past financial commitments.

- Are still navigating their financial compatibility and prefer a more gradual merging process.

Consider a couple where one partner is a saver and the other is a spender, or where one has significant student loan debt from before the marriage that they prefer to manage separately. They might opt for a partially merged system. They could have a joint account for shared bills and savings for a family vacation, but each maintains a separate account for their personal discretionary spending, allowing them to manage their individual habits without directly impacting the other’s finances.

This can prevent potential arguments and maintain a sense of personal control.

Step-by-Step Guide to Merging Bank Accounts

Alright, so you’ve decided to make it official and merge those bank accounts. It’s like leveling up in a game, but with actual money. This section is your walkthrough, your cheat sheet to making this transition smoother than a fresh beat drop. We’re gonna break down the whole process, from prepping your finances to the final confetti drop.This ain’t rocket science, but it does require some planning and communication.

Think of it as a collab project between you and your partner, where the end goal is a unified financial front. We’ll cover the essential groundwork, how to chat with your banks, and the actual moves to make.

Initial Preparation Steps

Before you even think about hitting up the bank, there’s some homework to do. This is where you get your financial ducks in a row, ensuring you know exactly what you’re dealing with. It’s all about clarity and making sure no one’s left in the dark.Here’s what you and your partner should do first:

- Inventory Current Accounts: Make a list of all existing bank accounts, savings accounts, investment accounts, and credit cards each of you holds. Note down the bank, account type, current balance, and any associated fees or interest rates. This gives you a clear picture of your combined financial landscape.

- Review Account Statements: Go through the last few months of statements for each account. This helps identify any recurring transactions, direct debits, or automatic payments that need to be managed. It’s also a good time to spot any unexpected charges or unusual activity.

- Discuss Financial Goals: Before merging, have an open and honest conversation about your shared financial goals. Are you saving for a house, a big trip, or just building an emergency fund? Aligning on these goals will help you decide on the best structure for your merged accounts.

- Check for Joint vs. Individual Account Holders: Understand who is currently listed as the primary or secondary holder on each account. This will impact how you can proceed with closing or transferring ownership.

- Assess Credit Scores: While not directly part of merging accounts, it’s wise to check your individual credit scores. Merging finances can sometimes impact credit utilization and history, so being aware of your current standing is beneficial.

Contacting Financial Institutions

Once you’ve got your ducks in a row, it’s time to get the official word from your banks. Each institution has its own way of doing things, so you need to be proactive and ask the right questions. This is where you get the nitty-gritty details specific to your accounts.When you reach out to your banks, here are the key points to cover:

- Inquire about Joint Account Options: Ask about the process for opening a new joint account or converting an existing individual account into a joint one.

- Understand Account Closure Procedures: For accounts you plan to close, ask about the steps involved, including any required forms, notice periods, or documentation.

- Clarify Fund Transfer Methods: Find out the easiest and most secure ways to transfer funds between accounts, especially if you’re moving money between different banks.

- Ask about Fees and Charges: Be sure to ask if there are any fees associated with account merging, transfers, or closing accounts.

- Confirm Identity Verification Requirements: Banks will need to verify your identities. Understand what documents you’ll need to bring or provide.

It’s a good idea to take notes during these conversations or even ask if they can send you an email summary of the information.

Organizing Fund Transfers and Account Closures, How to merge bank accounts after marriage

This is the action phase. You’ve got the intel, now it’s time to execute. This involves carefully moving your money and tidying up the old accounts. Doing this in a systematic way prevents confusion and ensures all your funds end up in the right place.Here’s a recommended sequence of actions:

- Designate a Primary Bank: Decide which bank will be your main financial hub moving forward. This simplifies things and reduces the number of institutions you need to manage.

- Open New Joint Account (if applicable): If you’re opening a brand new joint account, do this first. This will be the destination for your merged funds.

- Transfer Funds from Individual Accounts: Systematically transfer the balances from your individual accounts into the new joint account or one of your existing accounts that you’ll keep. Prioritize accounts with higher balances or those that are easier to transfer from.

- Update Automatic Payments and Direct Debits: Once your new joint account is set up and funded, start updating all your recurring payments and direct debits to draw from the new account. This includes subscriptions, utility bills, loan payments, and any other automatic transactions.

- Close Individual Accounts: After all funds have been transferred and all automatic payments have been updated, proceed with closing your individual accounts. Ensure you have confirmation of closure from the bank.

- Consolidate Savings and Investments: If you have separate savings accounts or investment portfolios, discuss with your financial advisor or the bank about consolidating them into joint options if that aligns with your goals.

Sample Timeline for Account Merging

Putting a timeline on this process helps manage expectations and keeps things on track. While every couple’s situation is unique, this sample timeline provides a general framework to aim for. It’s about breaking down a bigger task into manageable chunks.Here’s a possible timeline, assuming a relatively straightforward merging process:

Week 1: Preparation & Initial Contact

- Day 1-3: Inventory accounts, review statements, discuss goals.

- Day 4-7: Contact primary bank to inquire about joint account options and procedures.

Week 2: Bank Procedures & Fund Transfers

- Day 8-10: Open new joint account (if needed).

- Day 11-14: Begin transferring funds from individual accounts to the joint account.

Week 3: Updating Payments & Account Closures

- Day 15-18: Start updating automatic payments and direct debits.

- Day 19-21: Contact other banks to initiate closure of individual accounts.

Week 4: Finalizing & Review

- Day 22-25: Ensure all individual accounts are officially closed and confirm with banks.

- Day 26-28: Review the new joint account to ensure all funds are present and automatic payments are functioning correctly.

This timeline is a guide; some steps might take longer depending on bank processing times or your personal schedule. The key is consistent communication and action.

Managing Joint Bank Accounts Effectively

Alright, so you’ve officially merged your bank accounts – congrats! This is where the real magic (and maybe a little bit of juggling) happens. It’s not just about slapping your names on one account; it’s about building a solid financial partnership. Think of it like a band: everyone has their instrument, but you gotta play in sync to make killer music.

This section is all about making sure your joint account is your financial power-up, not a source of drama.Merging accounts is a big step, and making it work smoothly requires some intentional effort. It’s about creating transparency, shared goals, and a system that feels fair to both of you. We’ll dive into how to keep things chill and productive, so your finances become a team win.

Shared Budget Strategies

Setting up a shared budget is like drawing the blueprint for your financial future together. It’s the foundation that helps you see where your money is going, what you’re saving for, and how you’re going to get there without any awkward “who spent what?” moments. A well-defined budget is key to avoiding financial stress and making sure you’re both on the same page about your spending habits and long-term goals.Here are some solid strategies to get your shared budget game strong:

- Zero-Based Budgeting: Every dollar has a job. You assign every single dollar of your combined income to a specific category – savings, bills, fun money, etc. This ensures you’re being super intentional with your cash and not letting anything slip through the cracks.

- Percentage-Based Budgeting: This is a bit more flexible. You decide on percentages for different categories (e.g., 50% for needs, 30% for wants, 20% for savings). This can be a good starting point if you’re new to budgeting or want a less rigid approach.

- Envelope System (Digital or Physical): For variable expenses like groceries or entertainment, allocate a set amount. Once the money in that “envelope” is gone, spending in that category stops for the month. This is a visual and tangible way to control spending.

- Regular Budget Reviews: Schedule weekly or bi-weekly check-ins to review your spending against the budget. This isn’t about judgment, but about understanding and adjusting as needed. Life happens, and your budget should be able to adapt.

Tracking Shared and Individual Spending

Keeping tabs on where your money goes is crucial, especially with a joint account. It’s not about policing each other, but about having a clear picture of your collective financial health and respecting individual autonomy. This helps you identify patterns, find areas to save, and ensure that personal spending remains within agreed-upon limits.Here are some effective methods for tracking your expenses:

- Budgeting Apps: Tools like Mint, YNAB (You Need A Budget), or PocketGuard can link to your joint bank account and automatically categorize transactions. They provide visual reports and insights into your spending habits.

- Spreadsheets: For the DIY folks, a shared Google Sheet or Excel file can be a powerful tool. You can customize it to track specific categories, set up formulas for analysis, and easily share updates.

- Bank Statement Analysis: Regularly going through your joint bank statements together is a fundamental practice. This allows you to identify all transactions, question any discrepancies, and understand your spending trends over time.

- Designated “Fun Money” or “Pocket Money”: Allocate a certain amount of money each month for each spouse to spend as they please, no questions asked. This can be transferred to separate personal accounts or managed within the joint account with a clear understanding. This helps maintain a sense of individual financial freedom.

Financial Communication Best Practices

Open and honest communication about money is non-negotiable for a healthy financial partnership. It’s about creating a safe space to discuss your dreams, fears, and plans without judgment. Regular, proactive conversations prevent small financial issues from snowballing into major conflicts.Here are some best practices for keeping the financial communication flowing:

- Schedule Regular “Money Dates”: Set aside dedicated time, maybe once a week or every two weeks, specifically to talk about finances. Treat it like any other important appointment – no distractions.

- Be Transparent and Honest: Share all financial information, including debts, assets, income, and spending habits. Hiding financial details erodes trust.

- Listen Actively and Empathetically: When your partner is talking about their financial concerns or ideas, really listen. Try to understand their perspective, even if it differs from yours.

- Focus on Shared Goals: Frame conversations around your common objectives, like saving for a down payment, a vacation, or retirement. This reinforces that you’re a team working towards mutual success.

- Use “I” Statements: When discussing sensitive topics, use phrases like “I feel concerned when…” instead of “You always…” This reduces defensiveness and promotes understanding.

Resolving Financial Disagreements

It’s inevitable that you’ll have different ideas about money sometimes. The key isn’t to avoid disagreements, but to have a constructive framework for resolving them. This means approaching conflicts as opportunities to learn more about each other’s financial values and to find solutions that work for both of you.Here’s a framework for navigating financial disagreements:

- Identify the Core Issue: What is the actual disagreement about? Is it about spending priorities, saving urgency, or a specific purchase? Get to the root of the problem.

- Acknowledge Each Other’s Perspectives: Even if you don’t agree, acknowledge that your partner’s viewpoint is valid to them. Phrases like “I understand why you feel that way” can go a long way.

- Seek Compromise: Most financial disagreements can be resolved through compromise. Look for solutions where both partners get some of what they want or need. For example, if one wants to save aggressively and the other wants to spend on a hobby, you might agree to a savings goal with a specific allowance for the hobby.

- Refer to Your Budget and Goals: Use your established budget and shared financial goals as objective criteria. Does a particular spending decision align with your long-term plans?

- Take a Break if Needed: If emotions are running high, it’s okay to pause the discussion and revisit it when you’re both calmer and can think more clearly.

- Consider Professional Help: If you consistently struggle to resolve financial disagreements, a financial advisor or couples counselor can provide neutral guidance and tools to help you navigate these issues.

Potential Challenges and How to Address Them

Merging bank accounts, while often a positive step for couples, isn’t always smooth sailing. It’s common for newlyweds to bump into a few financial speed bumps. Recognizing these potential issues beforehand is key to navigating them like seasoned pros and keeping your relationship (and your finances) on track.Think of merging accounts as a team sport. Just like in any team, different players have different strengths and play styles.

In this case, those styles translate to spending habits and financial aspirations. When these styles clash, it can lead to friction. The good news is, with a little understanding and some smart strategies, you can turn potential conflicts into collaborative wins.

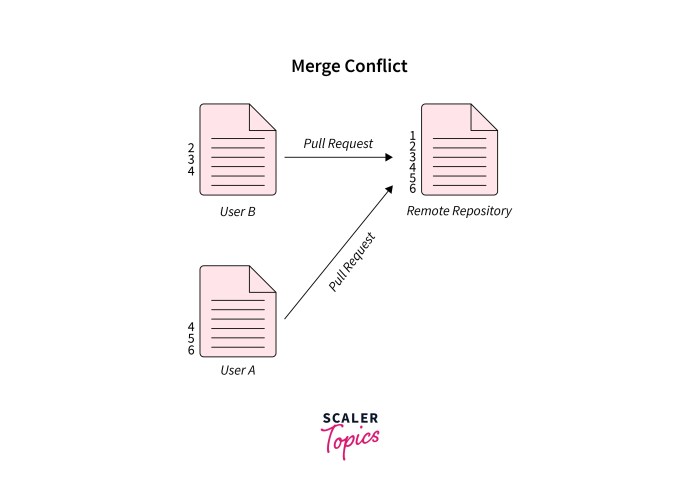

Differing Spending Habits and Financial Goals

It’s super common for partners to have distinct ways of handling money. One might be a saver, always thinking about the future, while the other is more of a spender, enjoying the present. These differences, if not discussed, can become a major source of tension when money is pooled. For example, if one partner is saving for a down payment on a house and the other prefers spontaneous weekend getaways, disagreements are bound to arise.To tackle this, honesty and compromise are your best friends.

Start by having open and honest conversations about your individual spending habits and what makes you feel financially secure. It’s not about judging each other, but understanding. Then, work together to create a shared budget that accommodates both your needs and desires. This might involve setting aside a certain amount for individual “fun money” that each partner can spend guilt-free, while also allocating funds towards shared goals.A great way to visualize this is through a shared spreadsheet or a budgeting app.

You can categorize expenses, track spending, and see where your money is going as a team.

| Habit/Goal | Potential Conflict | Strategy |

|---|---|---|

| Aggressive Saver vs. Spender | Disagreements over budget allocation, feeling restricted. | Establish a joint “fun money” allowance for each partner. Create a clear savings plan with defined milestones. |

| Short-term vs. Long-term Goals | Prioritizing immediate gratification over future security. | Identify shared long-term goals (e.g., retirement, travel) and break them down into manageable steps. |

| Impulse Buying vs. Planned Purchases | Unforeseen expenses derailing financial plans. | Implement a “cooling-off” period for significant purchases. Use a shared wish list for desired items. |

Maintaining Financial Independence with Joint Accounts

Even with merged accounts, it’s important for both partners to feel like they still have a degree of financial autonomy. This doesn’t mean hiding money, but rather having a personal space for discretionary spending without needing to justify every purchase. This can boost individual confidence and reduce feelings of being overly controlled.One effective approach is to allocate a set amount of personal spending money to each partner from the joint account each month.

This “allowance” can be used for whatever they wish, whether it’s a new gadget, a coffee with friends, or a personal hobby, without needing to consult the other. This creates a sense of personal freedom within the shared financial structure.Another strategy is to maintain separate savings accounts for personal goals or emergencies that are outside of the main joint account.

This allows for individual pursuits or a safety net that is solely under one’s control.

Open Communication in Overcoming Financial Hurdles

Financial discussions can sometimes feel awkward or even confrontational, but they are absolutely vital for a healthy marriage. When couples avoid talking about money, misunderstandings fester, and resentment can build. Creating a safe space where both partners feel heard and respected is paramount.Regular financial check-ins, perhaps weekly or bi-weekly, can prevent small issues from snowballing. These meetings shouldn’t be about blame, but about collaboration.

Use these sessions to review your budget, discuss upcoming expenses, and adjust your financial plan as needed. It’s also a great time to celebrate financial wins, like hitting a savings goal.

“Financial harmony in marriage is built on transparency, empathy, and a shared vision.”

Consider using a neutral facilitator or a financial advisor if you find it difficult to communicate effectively about money. Sometimes, an outside perspective can help bridge gaps and provide objective advice. Remember, the goal is to be a united front, tackling financial challenges as a team rather than as adversaries.

Choosing the Right Bank for Joint Accounts

Alright, so you’ve decided to merge your finances, which is a big step! But before you just pick the first bank you see, let’s talk about picking theright* bank. This ain’t just about where your money chills; it’s about making life easier, saving some dough, and keeping things smooth. Think of it like choosing your ride-or-die squad for your cash – gotta be reliable, have all the features you need, and not be a total buzzkill with fees.Picking the right bank is more than just a formality; it’s a strategic move to optimize your financial journey as a couple.

The features, account types, and services offered by a bank can significantly impact your ability to manage money efficiently, earn interest, and access your funds conveniently. It’s about finding a financial partner that aligns with your shared goals and lifestyle.

Features to Look For in a Bank

When you’re scouting for a bank to host your joint accounts, you wanna zero in on the stuff that actually matters for day-to-day money management and future planning. We’re talking about features that make your lives easier, not more complicated.Here are the key features to keep an eye out for:

- Robust Online and Mobile Banking: This is non-negotiable in 2024, fam. You need an app and website that’s intuitive, lets you see both your balances at a glance, easily transfer funds between your personal and joint accounts, pay bills, and deposit checks remotely. Look for real-time transaction updates and secure login options.

- ATM Network and Fee Structure: How many ATMs are conveniently located for both of you? Are there fees for using out-of-network ATMs? Some banks offer fee reimbursements, which can be a lifesaver if you’re on the go.

- Customer Service Accessibility: When you have a question or an issue, you don’t want to be stuck on hold for an eternity. Check if they offer multiple ways to get in touch – phone, chat, in-person branches – and what their typical response times are.

- Integration with Other Financial Tools: Does the bank play nice with budgeting apps like Mint or YNAB? Can you easily link your joint account to investment platforms or other financial services you might use?

- Security Measures: Beyond basic online security, look for features like multi-factor authentication, fraud monitoring, and deposit insurance (FDIC in the US, for example) to protect your funds.

Types of Joint Accounts

Financial institutions offer a few flavors of joint accounts, and knowing the difference helps you pick the one that fits your needs best. It’s not a one-size-fits-all situation, so let’s break down the common types.Financial institutions provide various structures for joint accounts, each with its own implications for ownership and access. Understanding these distinctions is crucial for selecting the most suitable arrangement for your marital finances.

- Joint Checking Accounts: This is the most common type. Both partners have equal access to deposit, withdraw, and manage funds. All transactions are visible to both account holders. It’s great for day-to-day expenses like bills, groceries, and shared spending.

- Joint Savings Accounts: Similar to joint checking, but designed for saving money. This is ideal for shared financial goals like a down payment on a house, a vacation fund, or an emergency fund. Interest earned is typically shared.

- Joint Money Market Accounts: These often offer higher interest rates than regular savings accounts and may come with check-writing privileges or debit card access, albeit with some limitations on the number of transactions per month. They’re a good middle ground for saving and maintaining some liquidity.

- Joint Certificates of Deposit (CDs): For funds you won’t need for a specific period, joint CDs can offer fixed, often higher, interest rates. Both partners are listed on the CD, and early withdrawal penalties apply if funds are accessed before maturity.

Evaluating Bank Fees, Interest Rates, and Online Banking

These three factors are the bedrock of your banking experience. Get them wrong, and you could be losing money without even realizing it. It’s like choosing a cheap outfit that falls apart after one wash – not a good look for your finances.When choosing a bank, a thorough evaluation of its fee structure, interest rates, and online banking capabilities is paramount.

These elements directly impact the growth of your savings, the cost of managing your money, and the overall convenience of your banking activities.

Bank Fees

Fees are the silent killers of your savings. Some banks are notorious for nickel-and-diming customers. You need to be aware of what you’re signing up for.Here’s a breakdown of common fees to scrutinize:

- Monthly Maintenance Fees: Can you waive this by meeting a minimum balance or setting up direct deposit?

- Overdraft Fees: How much are they, and what are the policies? Some banks offer overdraft protection linked to a savings account, which can be cheaper.

- ATM Fees: As mentioned before, check fees for using out-of-network ATMs and any foreign transaction fees.

- Wire Transfer Fees: If you anticipate needing to send or receive wire transfers, know the cost.

- Account Closure Fees: Less common, but worth checking if you plan to switch banks later.

Interest Rates

For savings accounts, money market accounts, and CDs, the interest rate is key. Even a small difference can add up over time.

The magic of compound interest means that a slightly higher APY can significantly boost your savings over the years. Don’t leave money on the table!

Compare the Annual Percentage Yield (APY) offered by different banks for their savings and money market products. For CDs, look at the fixed rates for the terms you’re considering.

Online Banking Services

This is where convenience meets functionality. A clunky online banking platform can turn simple tasks into a headache.Consider these aspects of their online and mobile services:

- User Interface (UI) and User Experience (UX): Is it easy to navigate? Can you find what you need quickly?

- Mobile Check Deposit Limits: Are there daily or monthly limits that might be too low for you?

- Bill Pay Features: Does it allow for recurring payments, e-bills, and payment reminders?

- Alerts and Notifications: Can you set up custom alerts for low balances, large transactions, or due dates?

- Account Aggregation: Some banks allow you to link external accounts, giving you a holistic view of your finances.

Questions to Ask Potential Banks

Walking into a bank or calling them without a game plan is like going to an exam without studying. Arm yourself with these questions to get the straight dope on their joint account offerings.To ensure you make an informed decision, prepare a list of targeted questions to ask potential banks. This proactive approach will help you compare offerings and identify the best fit for your joint financial needs.Here’s a cheat sheet of questions to ask:

- What are the minimum balance requirements for opening and maintaining a joint checking/savings account, and what are the consequences of falling below them?

- Are there any monthly service fees associated with your joint accounts, and what are the conditions for waiving these fees?

- What is the current Annual Percentage Yield (APY) for your joint savings and money market accounts?

- What are the fees for using ATMs outside of your network, and do you offer any ATM fee reimbursement programs?

- Can you explain your overdraft policies and fees, including options for overdraft protection?

- What are the security features of your online and mobile banking platforms, and how do you protect customer data?

- What are the daily and monthly limits for mobile check deposits?

- How many transactions are allowed per month on your joint money market accounts before fees are incurred?

- What is the process for adding or removing an authorized user from a joint account?

- Do you offer any perks or rewards programs for joint account holders, such as higher interest rates or cashback incentives?

- What is the process for dispute resolution or reporting fraudulent activity on a joint account?

- Can you provide a fee schedule for all potential charges related to joint accounts?

Specific Scenarios and Their Merging Solutions

Alright, so merging bank accounts ain’t always a one-size-fits-all situation, especially when you’re tying the knot and bringing your own financial baggage (or lack thereof) into the mix. Think of it like combining playlists; you gotta figure out what bops and what needs to be retired. This section breaks down some common pre-marriage account setups and how to make ’em work for your new joint life.Navigating these scenarios requires a solid chat about your financial vibes and what makes you both feel secure.

It’s not just about the numbers, but about building trust and a shared vision for your future money moves.

Pre-Marriage Account Structures and Merging Options

Before you even think about hitting that “merge” button, it’s super important to map out what your individual financial landscapes look like. This table lays out some typical pre-marriage account setups and the different ways you can blend them, along with the key things to keep in mind.

| Pre-Marriage Structure | Merging Strategy 1 | Merging Strategy 2 | Considerations |

|---|---|---|---|

| Two separate checking, two separate savings | Combine checking into one joint, keep savings separate initially | Combine all into one joint checking and one joint savings | Budgeting habits, shared financial goals |

| One joint checking, one separate | Merge separate into joint, then review | Maintain separate for personal discretionary funds | Level of financial transparency |

| Multiple credit cards, various loans | Consolidate debts into joint loans where feasible | Discuss individual responsibility for pre-marriage debts | Credit score impact, liability |

Merging Accounts with Significant Debt

When one partner comes into the marriage with a noticeable amount of debt, merging accounts needs a bit more finesse and a whole lot of open communication. It’s not about judgment; it’s about creating a unified front to tackle it. The first step is full transparency – lay all the debt cards on the table, so to speak. This includes understanding the types of debt (credit cards, student loans, car loans), interest rates, and repayment schedules.One approach is to create a joint savings account where both partners contribute regularly, with a portion specifically earmarked for debt repayment.

This shows commitment from both sides. Another strategy involves consolidating high-interest debts into a single joint loan with a potentially lower interest rate, which can streamline payments and save money over time. However, it’s crucial to discuss who will be primarily responsible for managing these joint debts and how payments will be allocated from your combined income. For debts that are purely personal and pre-marriage, you might agree to keep those separate, with the individual partner continuing to manage their repayment, but this should still be a discussed and agreed-upon strategy.

Merging Investment Portfolios and Retirement Funds

Merging investment portfolios and retirement funds after marriage is a whole different ballgame than just combining checking accounts. This often involves strategic planning to maximize benefits and align with your long-term financial goals as a couple. For 401(k)s and similar employer-sponsored retirement plans, you typically can’t directly merge them into a single account while both partners are still employed by different companies.

However, you can often roll over individual retirement accounts (IRAs) into a joint IRA or choose one spouse’s IRA to consolidate both contributions.

When merging retirement funds, always consult with a financial advisor to understand the tax implications and ensure you’re making the most advantageous decisions for your combined future.

For taxable investment accounts, you can open joint brokerage accounts and transfer assets into them. This simplifies management and provides a clearer picture of your combined investment growth. It’s also a good time to review your asset allocation as a couple. Are you both comfortable with the same level of risk? Do your investment goals align?

For instance, if one partner has a conservative investment style and the other is more aggressive, finding a middle ground or creating separate investment strategies within a joint framework might be necessary. Remember, the goal is to create a unified investment strategy that supports your shared aspirations, whether that’s early retirement, buying property, or funding future education.

So, you’re tying the knot and wondering how to merge bank accounts? It’s kinda like figuring out if a business even needs its own separate funds, you know, like asking does a business need a business bank account ? Once you nail that down, merging your personal accounts after marriage becomes way less of a headache, keeping your finances smooth.

Last Word

.webp?w=700)

As you navigate the exciting terrain of married life, merging your bank accounts is a powerful way to build a foundation of shared dreams and financial synergy. By understanding the benefits, preparing diligently, and choosing a strategy that resonates with your unique partnership, you can transform this process into a positive and empowering experience. Remember, open communication and a shared vision are your most valuable assets as you embark on this journey of financial unity, paving the way for a future filled with shared prosperity and peace of mind.

Q&A

Can we keep separate accounts even after merging?

Absolutely! Many couples opt for a “partially merged” approach. This could involve having a joint account for shared expenses like bills and groceries, while each partner maintains a separate account for personal spending or individual savings goals. This offers a blend of shared financial transparency and personal autonomy.

What happens to our individual debts when we merge accounts?

Merging bank accounts doesn’t automatically merge individual debts. Pre-marriage debts typically remain the responsibility of the individual who incurred them. However, couples often discuss how to manage these debts together, perhaps by consolidating them into joint loans if it makes financial sense or by creating a plan for repayment from shared funds.

How long does the process of merging bank accounts usually take?

The timeline can vary significantly depending on the banks involved and the complexity of your existing accounts. Generally, the initial preparation and contact with banks might take a few days to a week. The actual transfer of funds and closing of old accounts could be completed within a few days to a couple of weeks, but it’s wise to allocate a month to ensure everything is settled smoothly.

What if one of us has a much higher income than the other? How does that affect merging?

This is a common scenario and doesn’t prevent merging. Couples can agree on contribution levels to the joint account based on income, or they might decide to pool all income into a joint account and then allocate personal spending allowances. The key is open communication and agreement on how funds will be managed to ensure fairness and meet shared goals.

Will merging accounts affect our individual credit scores?

Opening a joint account generally doesn’t negatively impact your individual credit scores. However, if you later decide to take out joint loans or credit cards, your creditworthiness will be linked. It’s important to manage joint credit responsibly, as poor management can affect both partners’ credit. Closing individual accounts as part of the merge usually has a minimal impact unless they are very old, established accounts.